This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990-T

for the current year.

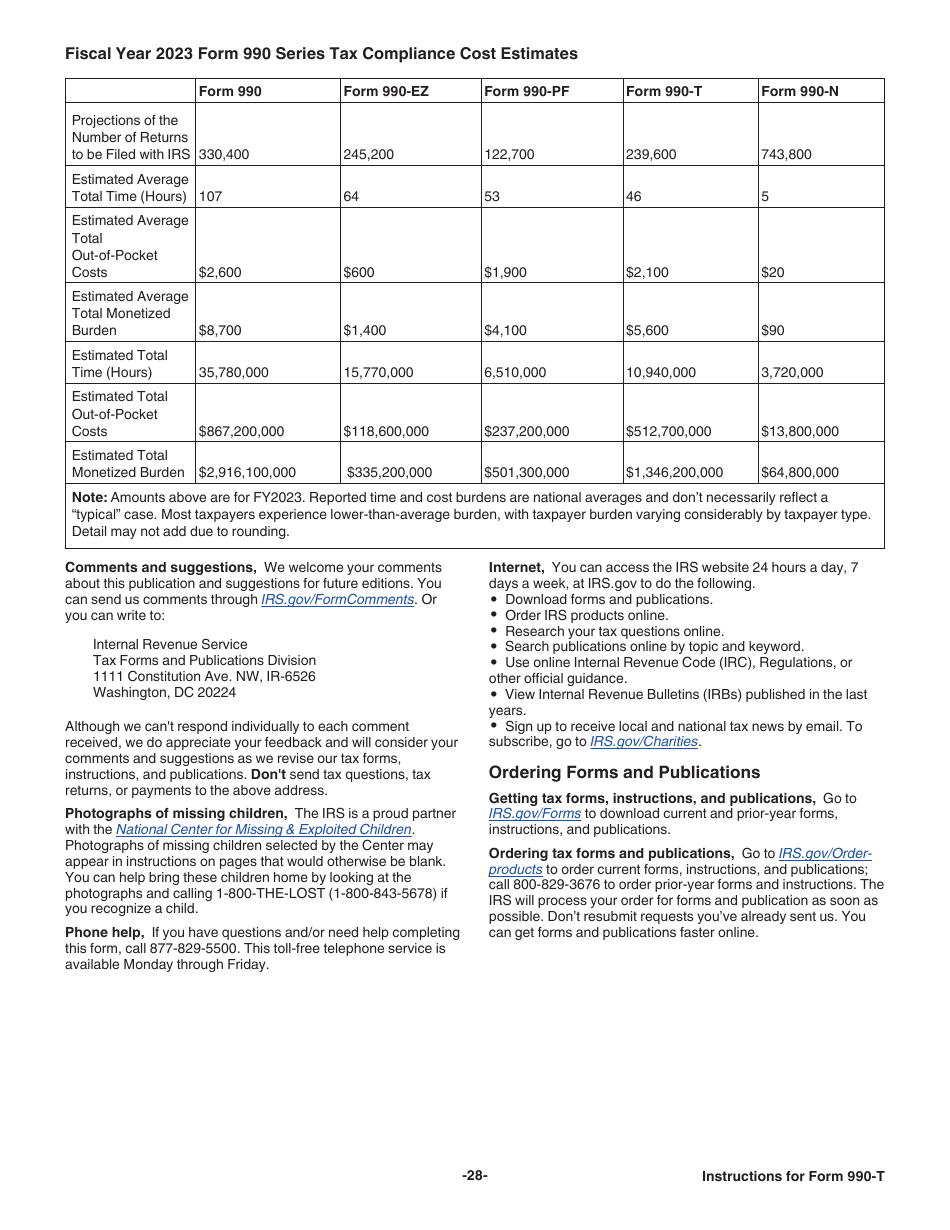

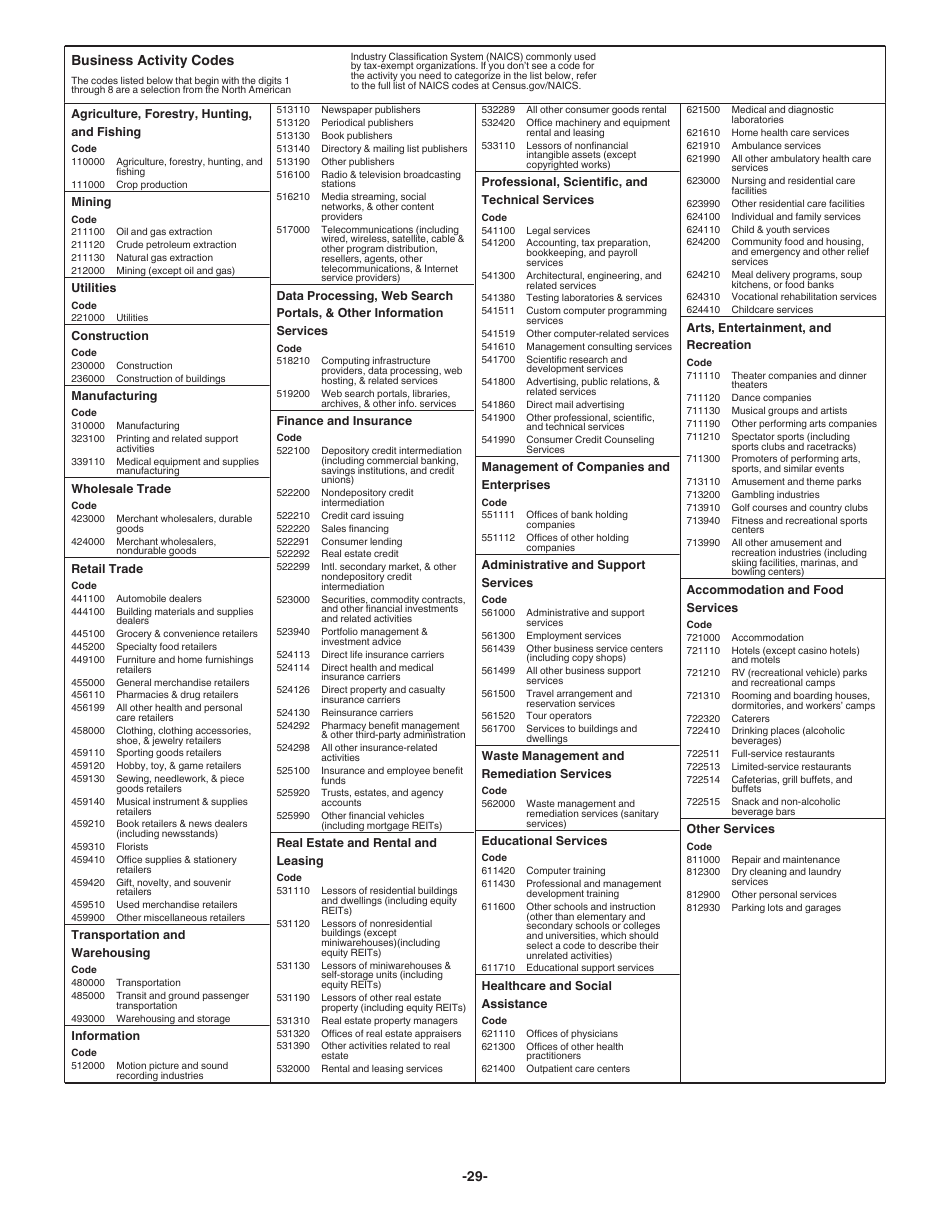

Instructions for IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

This document contains official instructions for IRS Form 990-T , Exempt Organization Proxy Tax Under Section 6033(E)) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990-T is available for download through this link.

FAQ

Q: What is IRS Form 990-T?

A: IRS Form 990-T is a tax return form for exempt organizations to report business income.

Q: Who needs to file IRS Form 990-T?

A: Exempt organizations that have unrelated business income over $1,000 need to file IRS Form 990-T.

Q: What is unrelated business income?

A: Unrelated business income is income earned by an exempt organization from a trade or business that is not substantially related to its tax-exempt purpose.

Q: What is the purpose of filing IRS Form 990-T?

A: The purpose of filing IRS Form 990-T is to report and pay taxes on unrelated business income.

Q: Are there any exceptions to filing IRS Form 990-T?

A: Yes, some exempt organizations are exempt from filing IRS Form 990-T, such as certain religious organizations and governmental entities.

Q: What is proxy tax under Section 6033(E)?

A: Proxy tax under Section 6033(E) refers to the tax imposed on certain lobbying and political expenditures of exempt organizations.

Q: Is proxy tax applicable to all exempt organizations?

A: No, proxy tax is only applicable to certain exempt organizations that engage in lobbying activities or make political expenditures.

Q: Do I need to file IRS Form 990-T if I only have investment income?

A: No, investment income is generally not considered unrelated business income, so you would not need to file IRS Form 990-T for investment income.

Q: When is the deadline for filing IRS Form 990-T?

A: The deadline for filing IRS Form 990-T is generally the 15th day of the 5th month after the end of the organization's fiscal year.

Instruction Details:

- This 36-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.