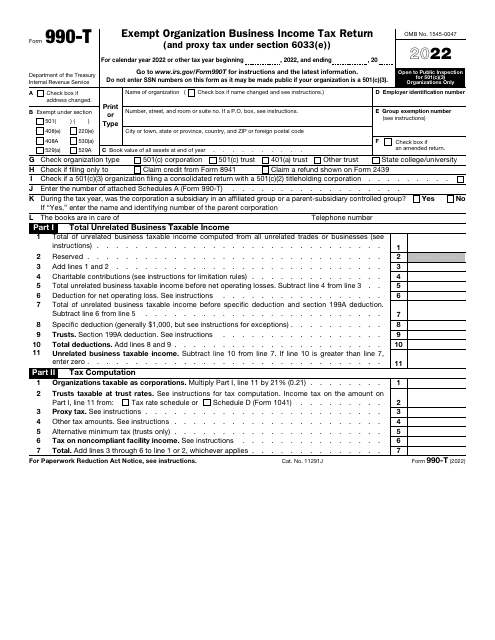

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-T

for the current year.

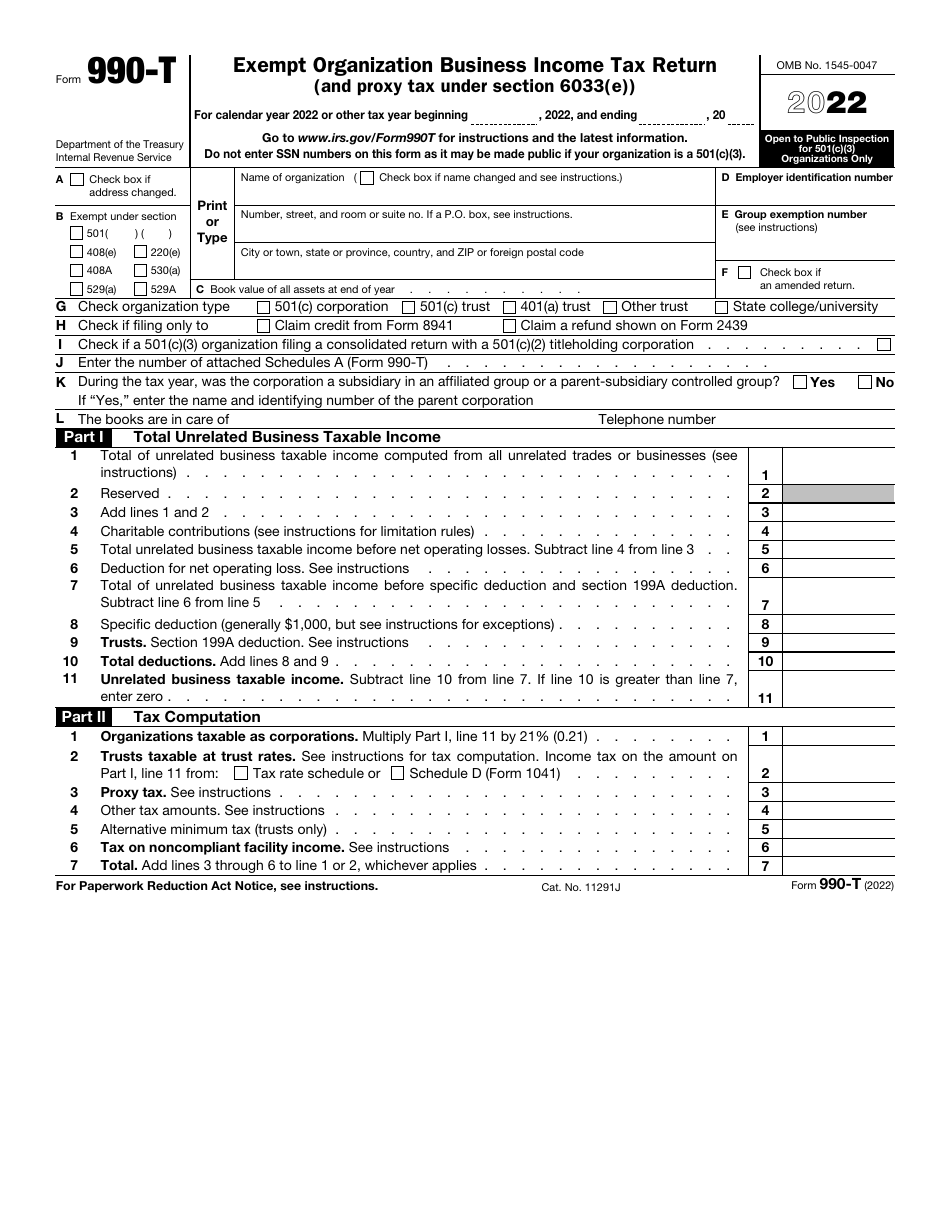

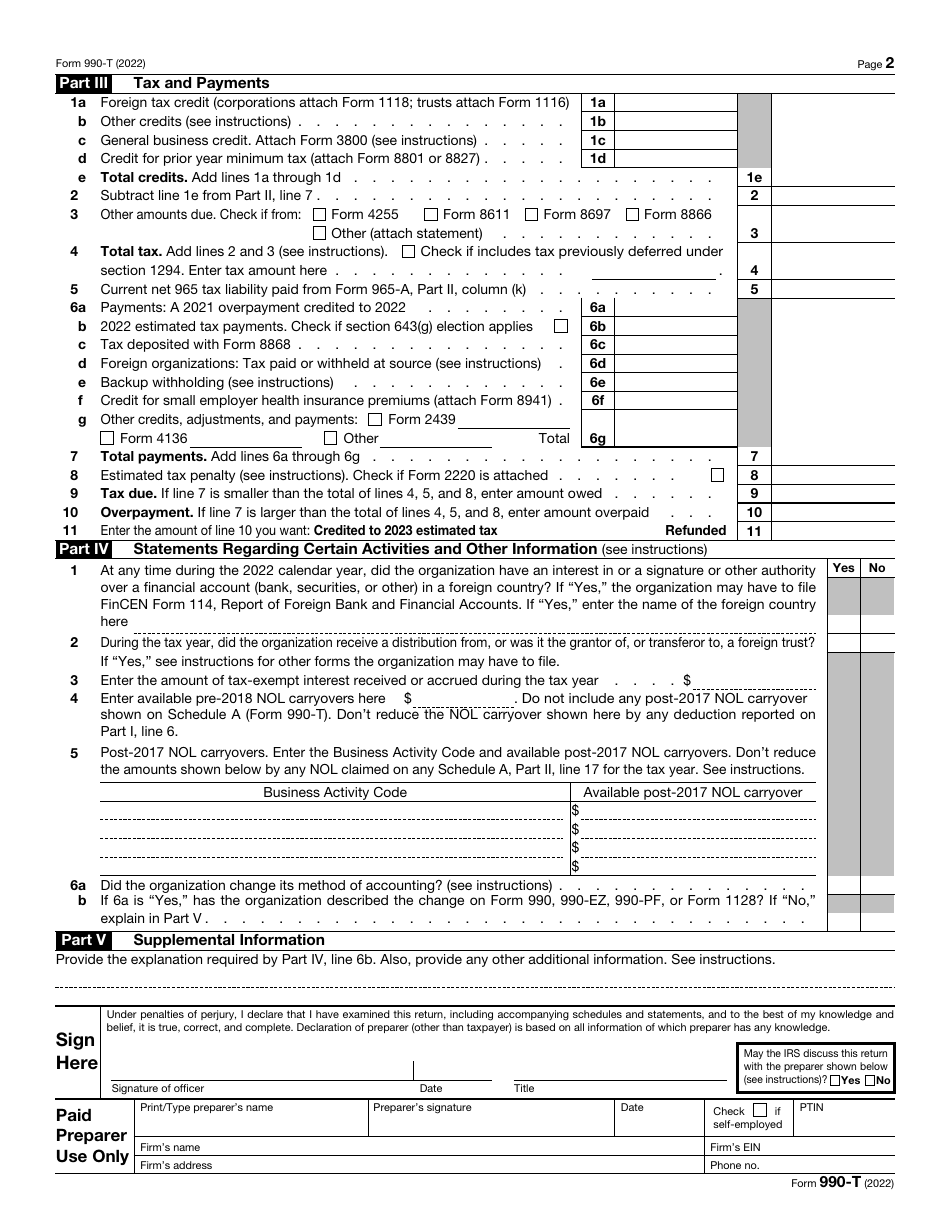

IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

What Is IRS Form 990-T?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990-T?

A: IRS Form 990-T is a tax return form for exempt organizations to report business income and pay taxes on it.

Q: Who needs to file IRS Form 990-T?

A: Exempt organizations that generate business income of $1,000 or more in a tax year must file IRS Form 990-T.

Q: What is the purpose of filing IRS Form 990-T?

A: The purpose of filing IRS Form 990-T is for exempt organizations to report and pay taxes on their business income.

Q: When is IRS Form 990-T due?

A: IRS Form 990-T is due by the 15th day of the 5th month after the end of the organization's tax year.

Q: What is proxy tax under Section 6033(E)?

A: Proxy tax under Section 6033(E) refers to the tax imposed on certain organizations that don't file required information returns or file incomplete or incorrect returns.

Q: Do all exempt organizations need to pay proxy tax?

A: No, only certain exempt organizations that fail to file the required information returns or file incomplete or incorrect returns are subject to proxy tax.

Q: What is the penalty for not filing IRS Form 990-T?

A: The penalty for not filing IRS Form 990-T or filing it late is $20 per day, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-T through the link below or browse more documents in our library of IRS Forms.