This version of the form is not currently in use and is provided for reference only. Download this version of

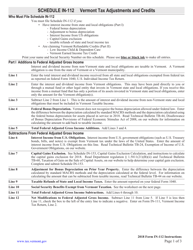

Instructions for Schedule IN-112

for the current year.

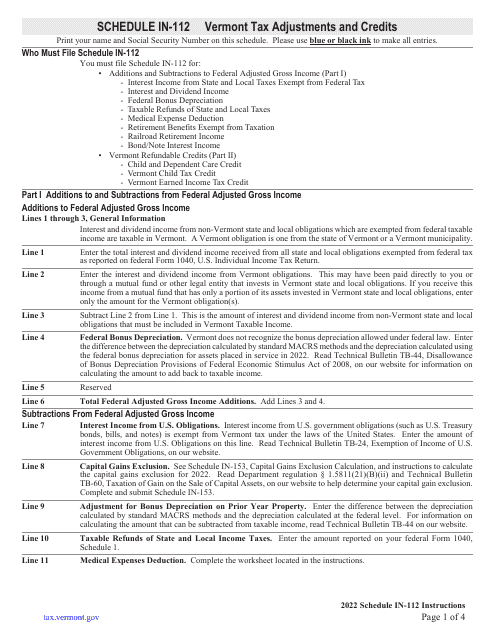

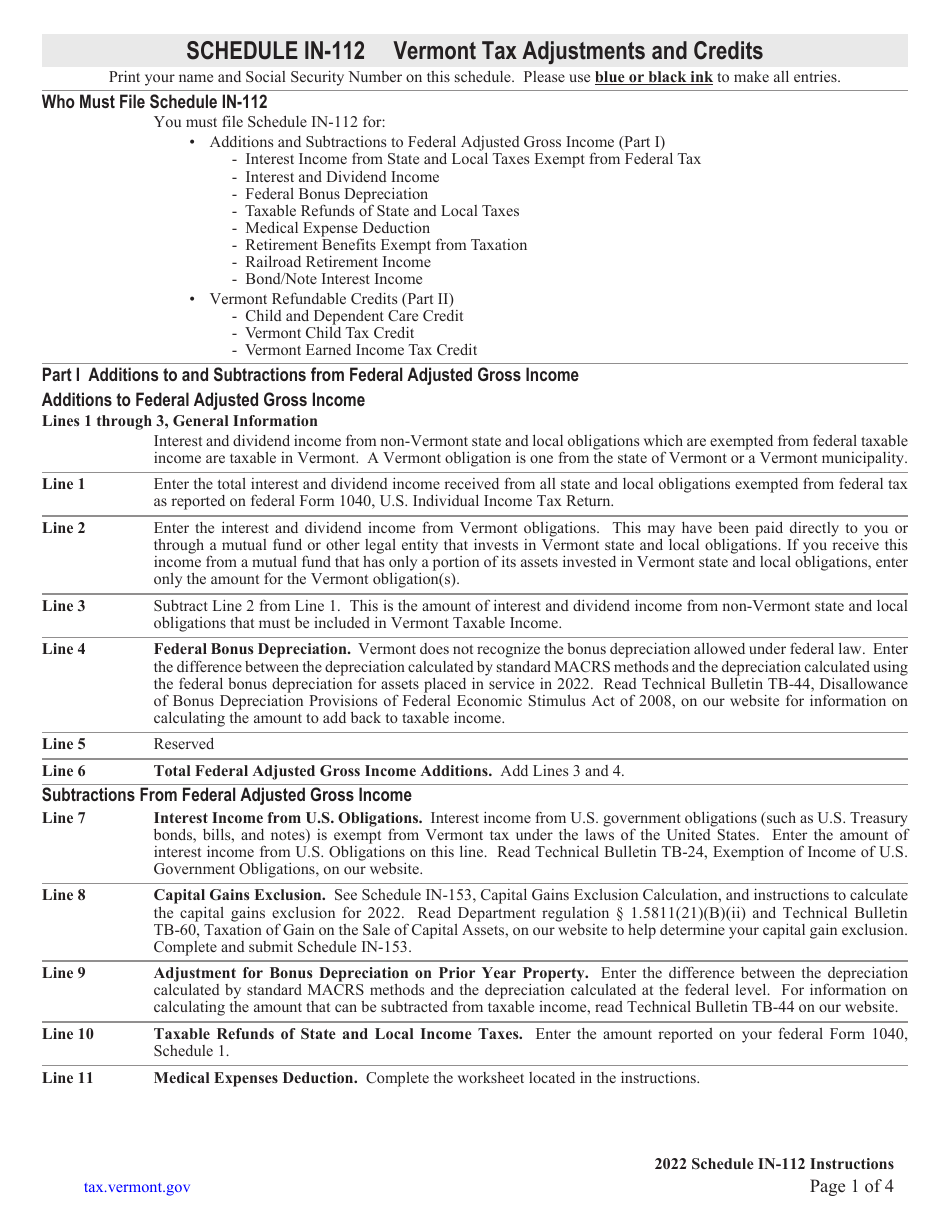

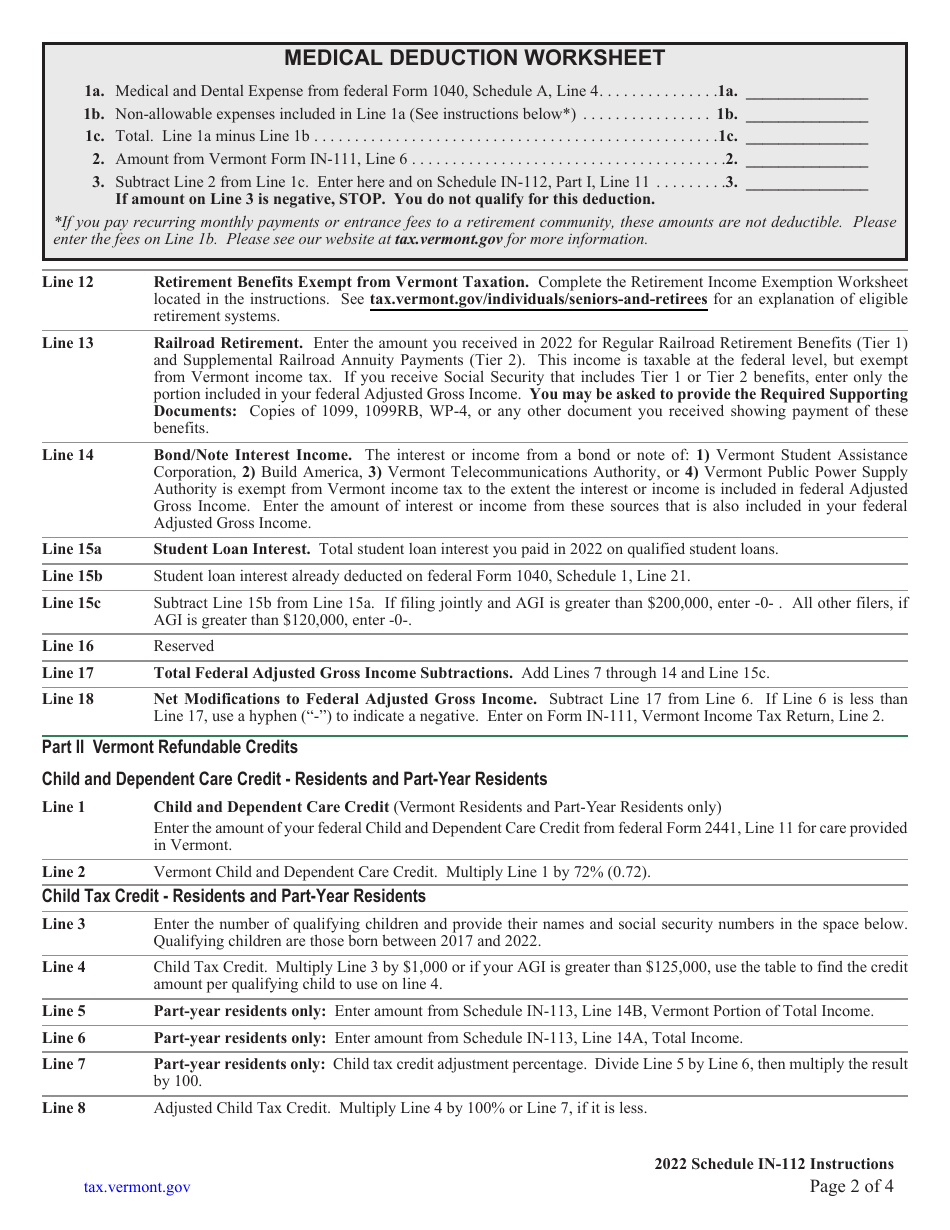

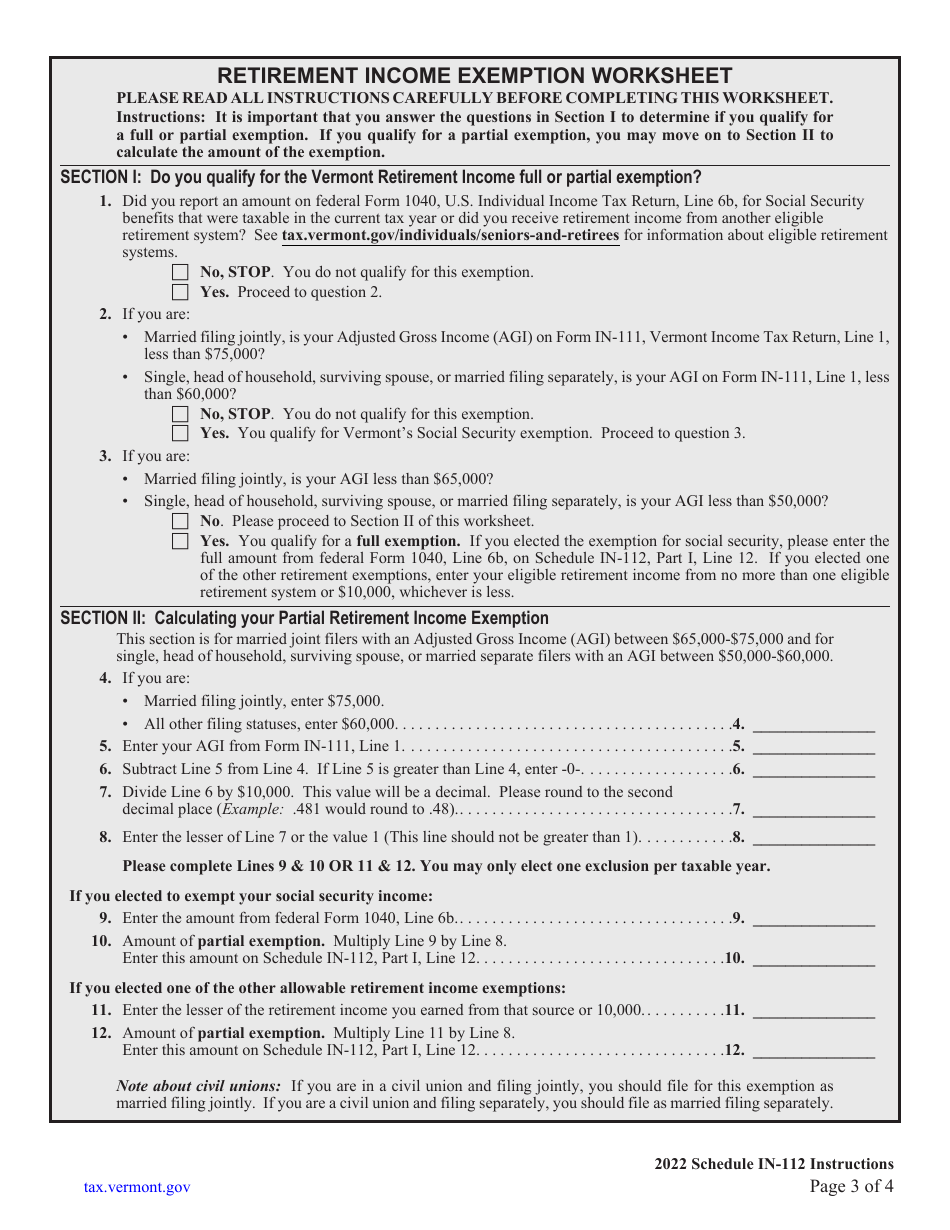

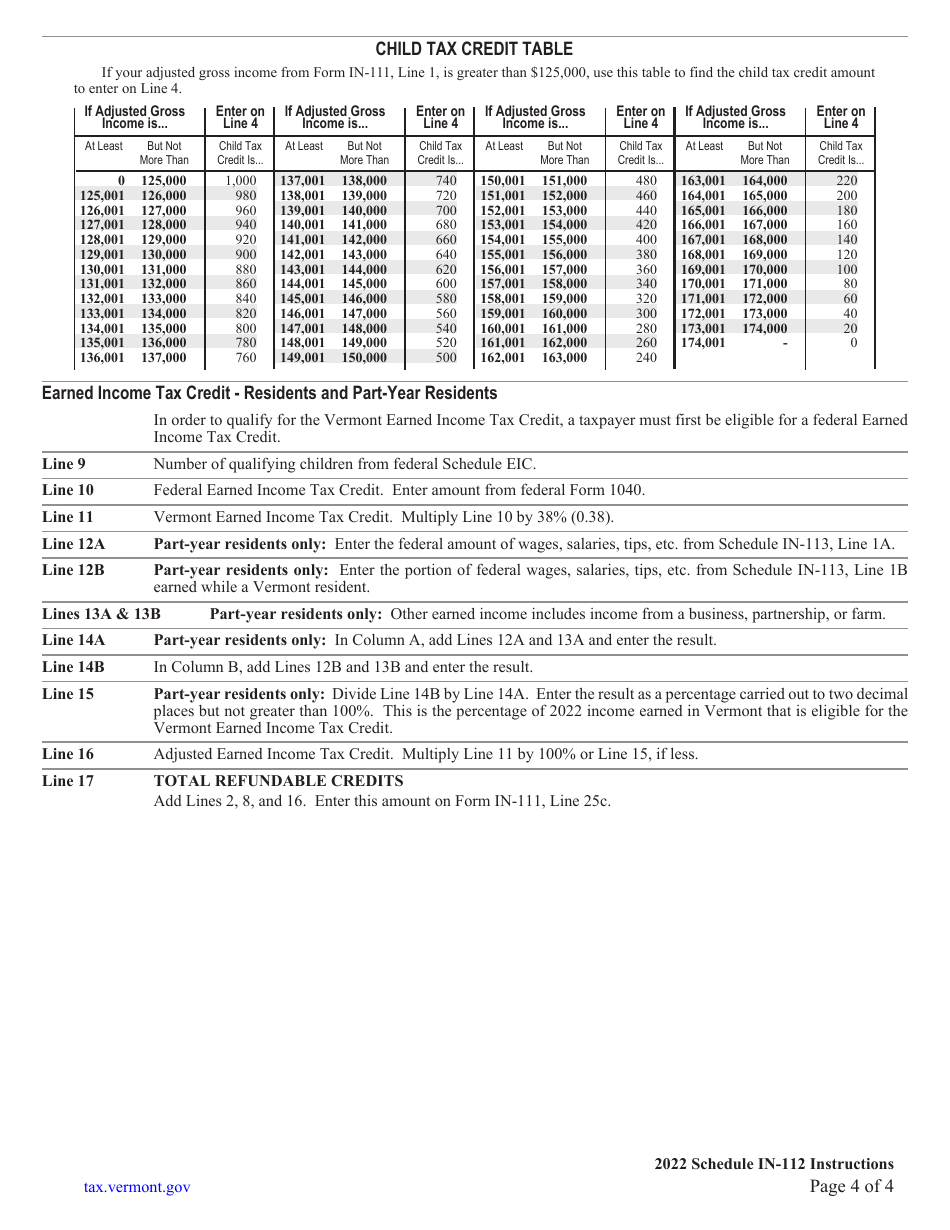

Instructions for Schedule IN-112 Vermont Tax Adjustments and Credits - Vermont

This document contains official instructions for Schedule IN-112 , Vermont Tax Adjustments and Credits - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule IN-112?

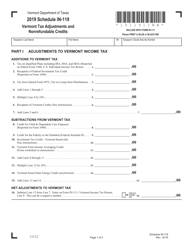

A: Schedule IN-112 is a form used in Vermont to report tax adjustments and credits.

Q: Who needs to file Schedule IN-112?

A: Residents of Vermont who want to claim tax adjustments or credits on their state income tax return.

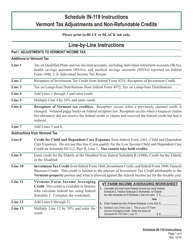

Q: What kind of tax adjustments can be reported on Schedule IN-112?

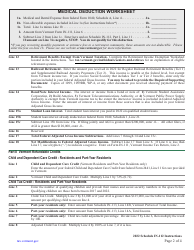

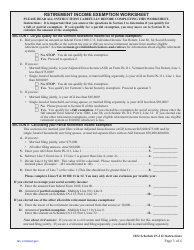

A: Examples of tax adjustments include business deductions, capital gains adjustments, and certain retirement income adjustments.

Q: What types of tax credits can be claimed on Schedule IN-112?

A: Examples of tax credits include the Vermont Earned Income Tax Credit, the Property Tax Adjustment Credit, and the Child and Dependent Care Credit.

Q: Is Schedule IN-112 required to be filed with every tax return?

A: No, you only need to file Schedule IN-112 if you have tax adjustments or credits to report.

Q: When is the deadline to file Schedule IN-112?

A: The deadline to file Schedule IN-112 is the same as the deadline to file your Vermont state income tax return, which is typically April 15th.

Q: Can Schedule IN-112 be filed electronically?

A: Yes, you can file Schedule IN-112 electronically using Vermont's e-file system.

Q: What should I do if I need help filling out Schedule IN-112?

A: You can refer to the instructions provided with the form, or seek assistance from a tax professional or the Vermont Department of Taxes.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.