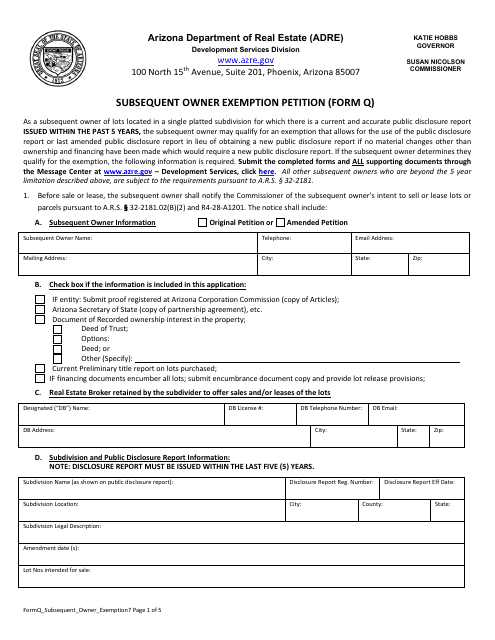

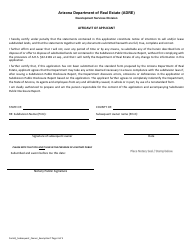

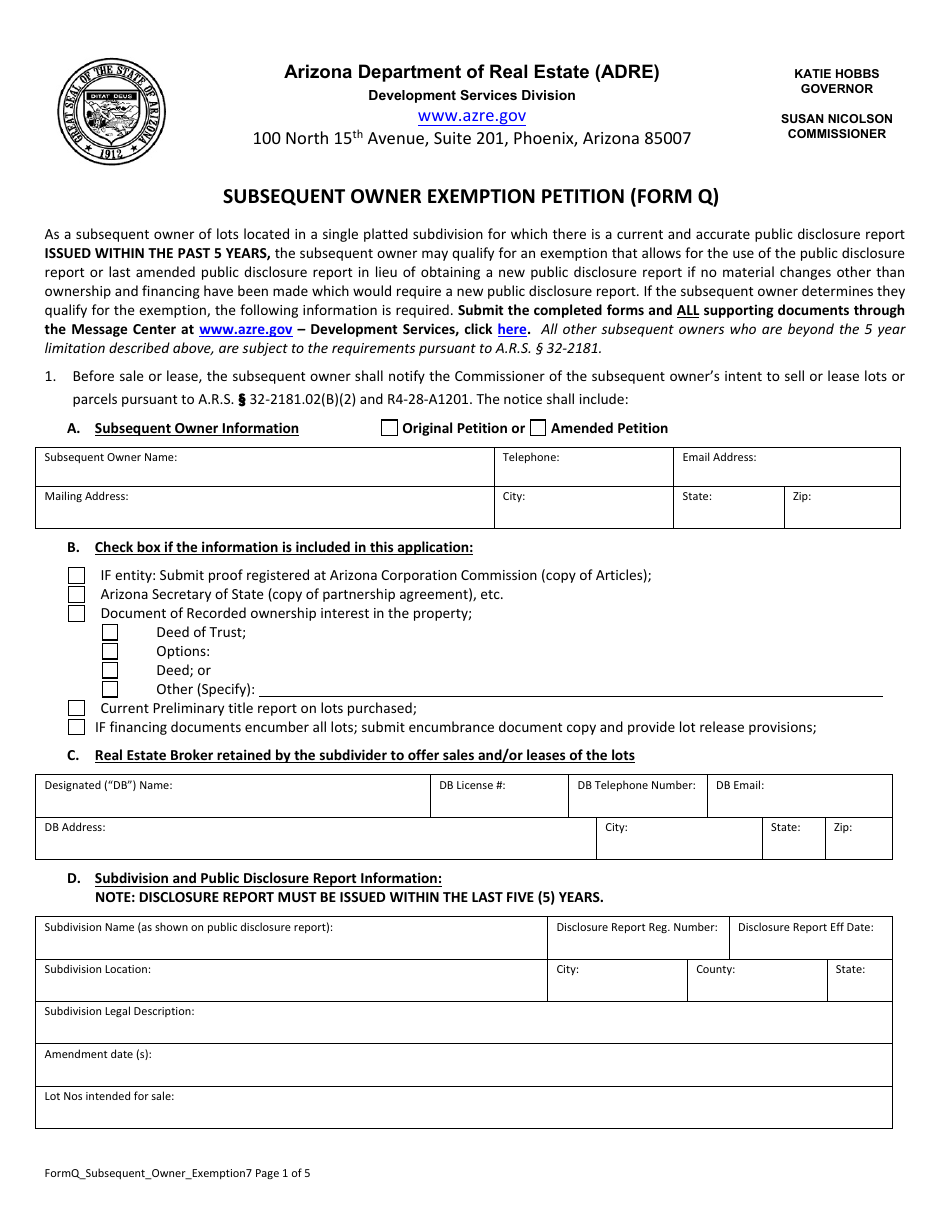

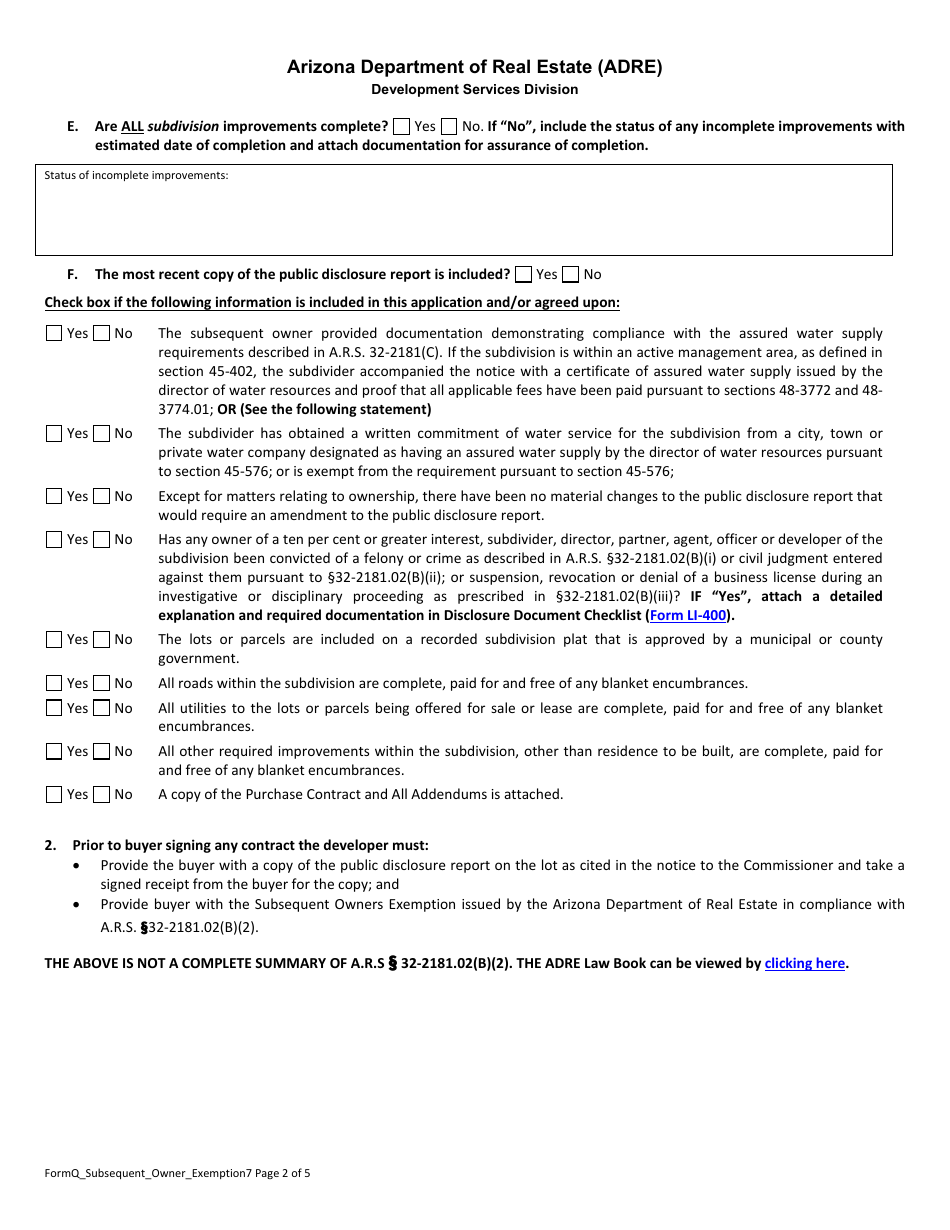

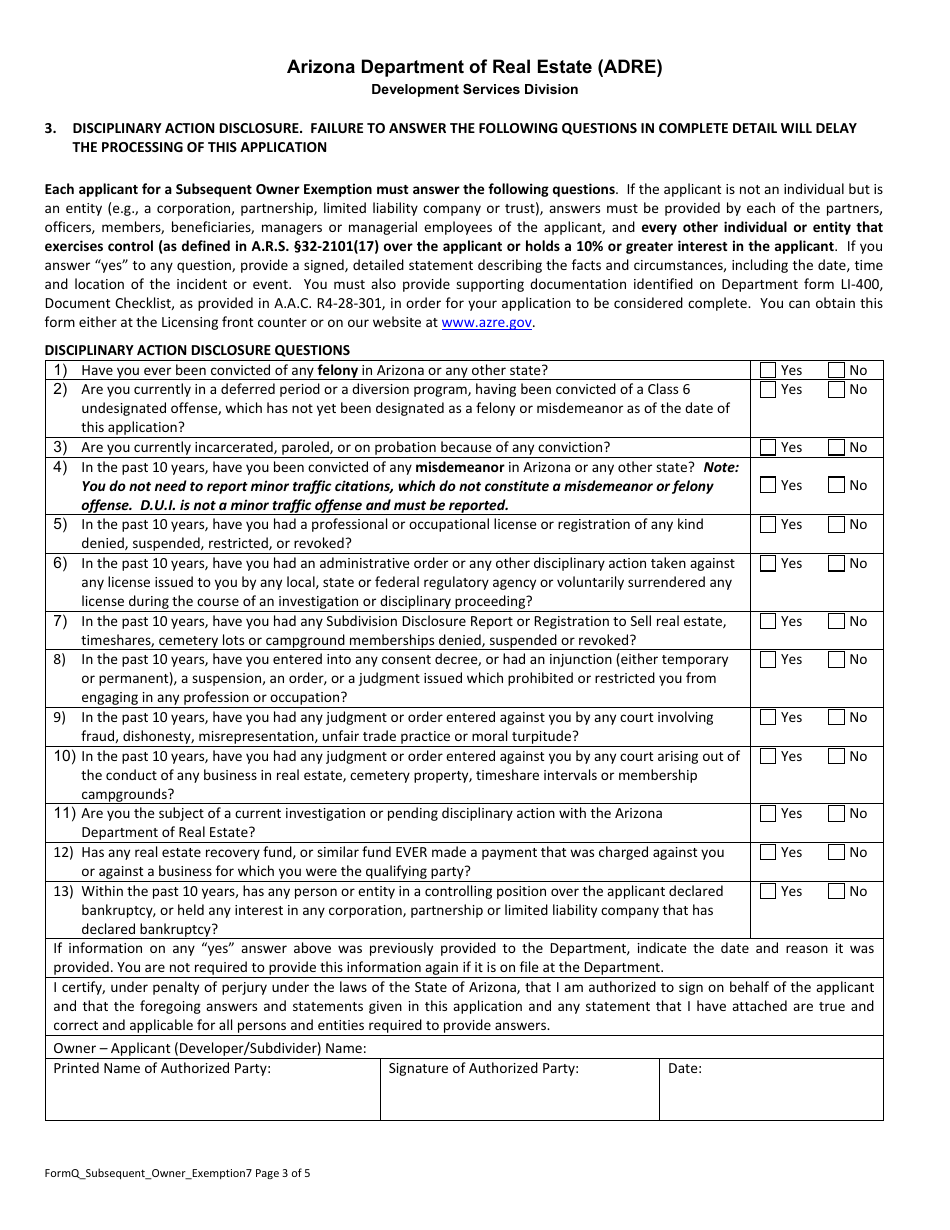

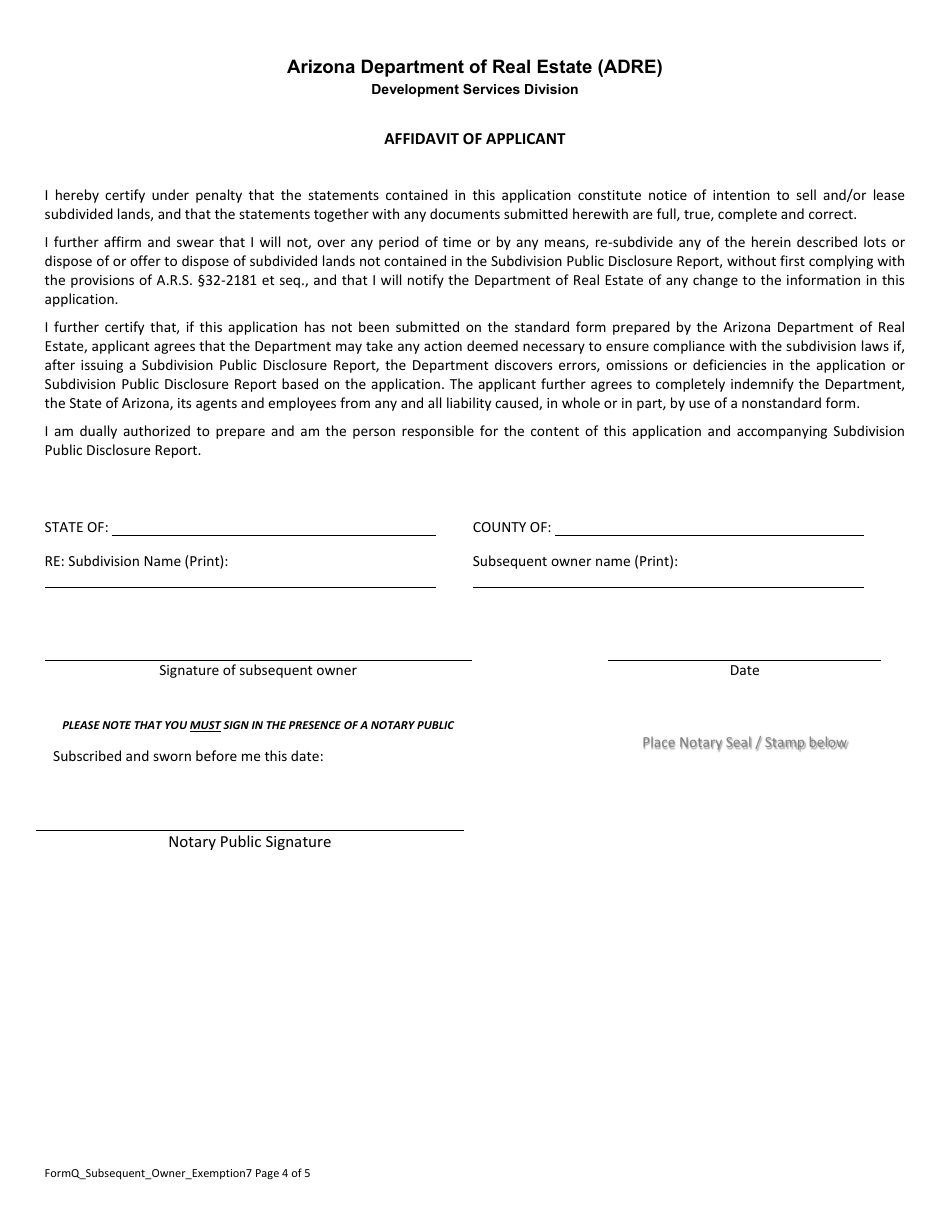

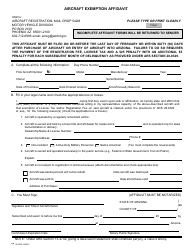

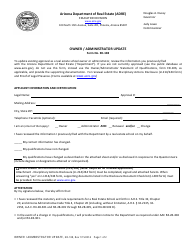

Form Q Subsequent Owner Exemption Petition - Arizona

What Is Form Q?

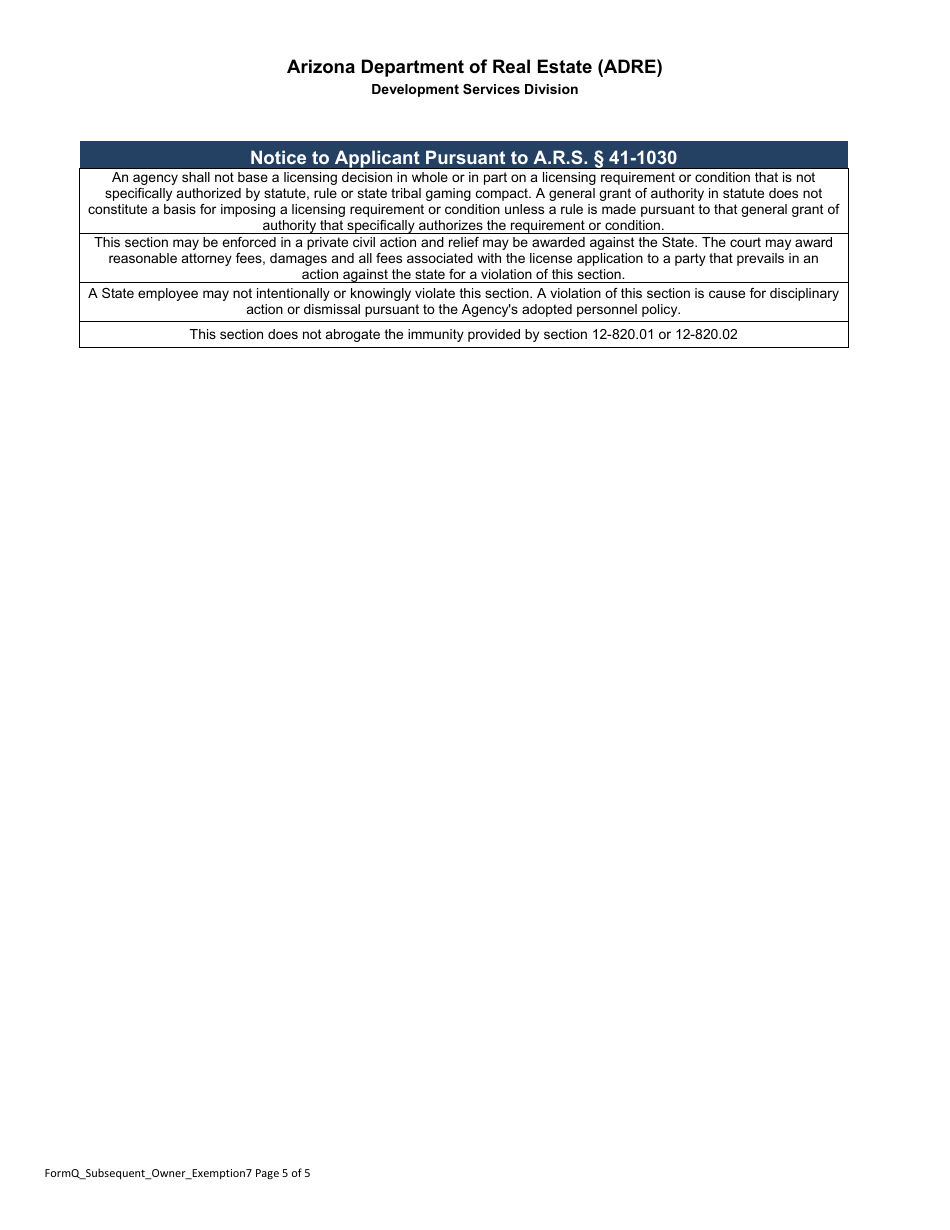

This is a legal form that was released by the Arizona Department of Real Estate - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form Q Subsequent Owner Exemption Petition?

A: Form Q Subsequent Owner Exemption Petition is a document used in Arizona to claim an exemption from property taxes for subsequent owners.

Q: Who can use the Form Q Subsequent Owner Exemption Petition?

A: Any subsequent owner of a property in Arizona can use the Form Q Subsequent Owner Exemption Petition.

Q: What does the Form Q Subsequent Owner Exemption Petition exempt?

A: The Form Q Subsequent Owner Exemption Petition exempts the property from certain property taxes.

Q: How can I obtain a Form Q Subsequent Owner Exemption Petition?

A: You can obtain a Form Q Subsequent Owner Exemption Petition from the county assessor's office in Arizona.

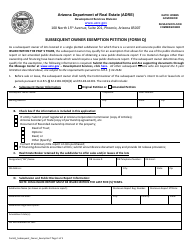

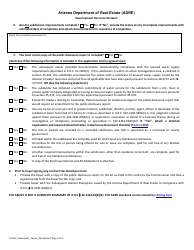

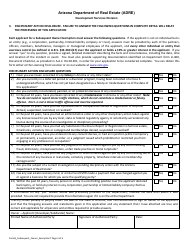

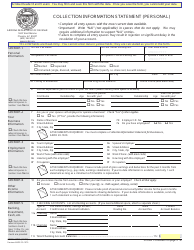

Q: What information is required on the Form Q Subsequent Owner Exemption Petition?

A: The Form Q Subsequent Owner Exemption Petition requires information about the property, the owner, and the reason for the exemption request.

Form Details:

- The latest edition provided by the Arizona Department of Real Estate;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form Q by clicking the link below or browse more documents and templates provided by the Arizona Department of Real Estate.