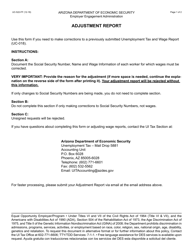

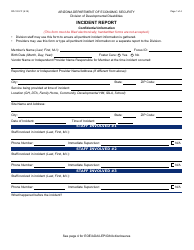

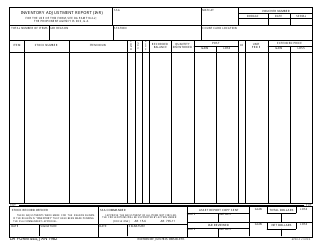

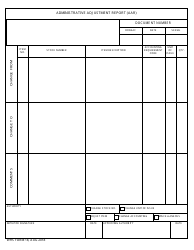

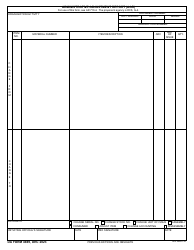

Form UC-522-FF Adjustment Report - Arizona

What Is Form UC-522-FF?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UC-522-FF?

A: Form UC-522-FF is the Adjustment Report used in Arizona for reporting changes in unemployment insurance wages or taxes.

Q: Who needs to file Form UC-522-FF?

A: Employers in Arizona who need to report adjustments to their unemployment insurance wages or taxes.

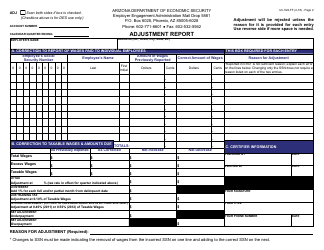

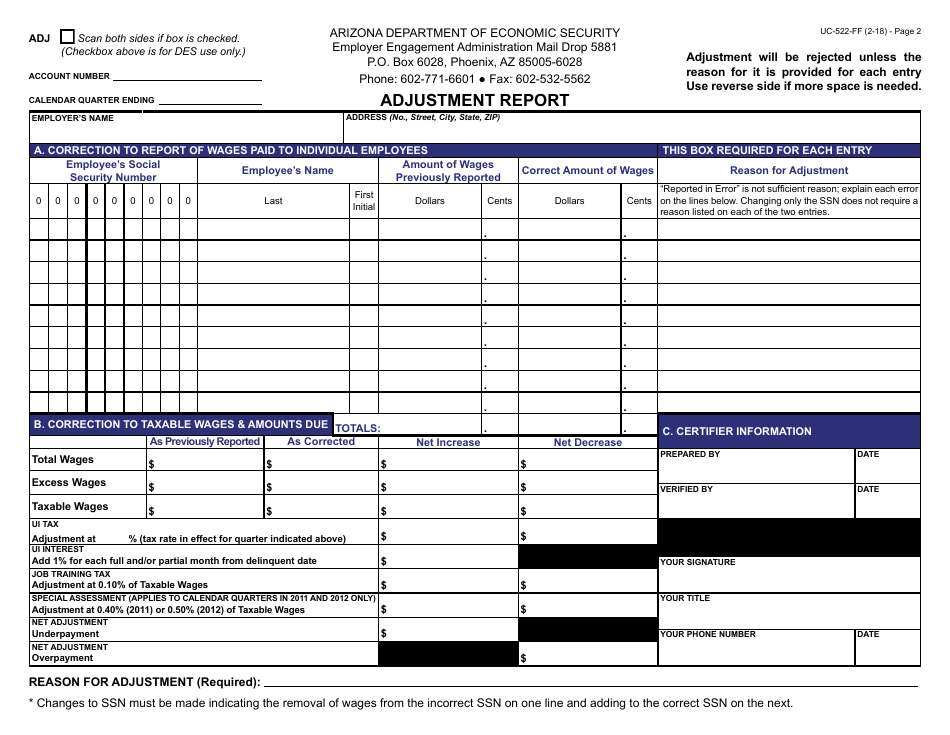

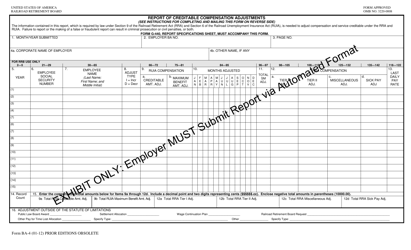

Q: What types of adjustments can be reported on Form UC-522-FF?

A: Form UC-522-FF can be used to report corrections to previously reported wages, changes in tax rates, and other adjustments related to unemployment insurance.

Q: How often do employers need to file Form UC-522-FF?

A: Form UC-522-FF should be filed within 30 days of the adjustment or as directed by the Arizona Department of Economic Security.

Q: Is there a fee for filing Form UC-522-FF?

A: No, there is no fee for filing Form UC-522-FF.

Q: What happens after filing Form UC-522-FF?

A: After filing Form UC-522-FF, the Arizona Department of Economic Security will process the adjustment and make any necessary changes to the employer's unemployment insurance account.

Q: Are there any penalties for not filing Form UC-522-FF?

A: Yes, failure to file Form UC-522-FF or filing it late may result in penalties and interest charges.

Q: Can I amend a previously filed Form UC-522-FF?

A: Yes, if you need to make additional adjustments after filing Form UC-522-FF, you can file an amended form to report the changes.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UC-522-FF by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.