This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-L

for the current year.

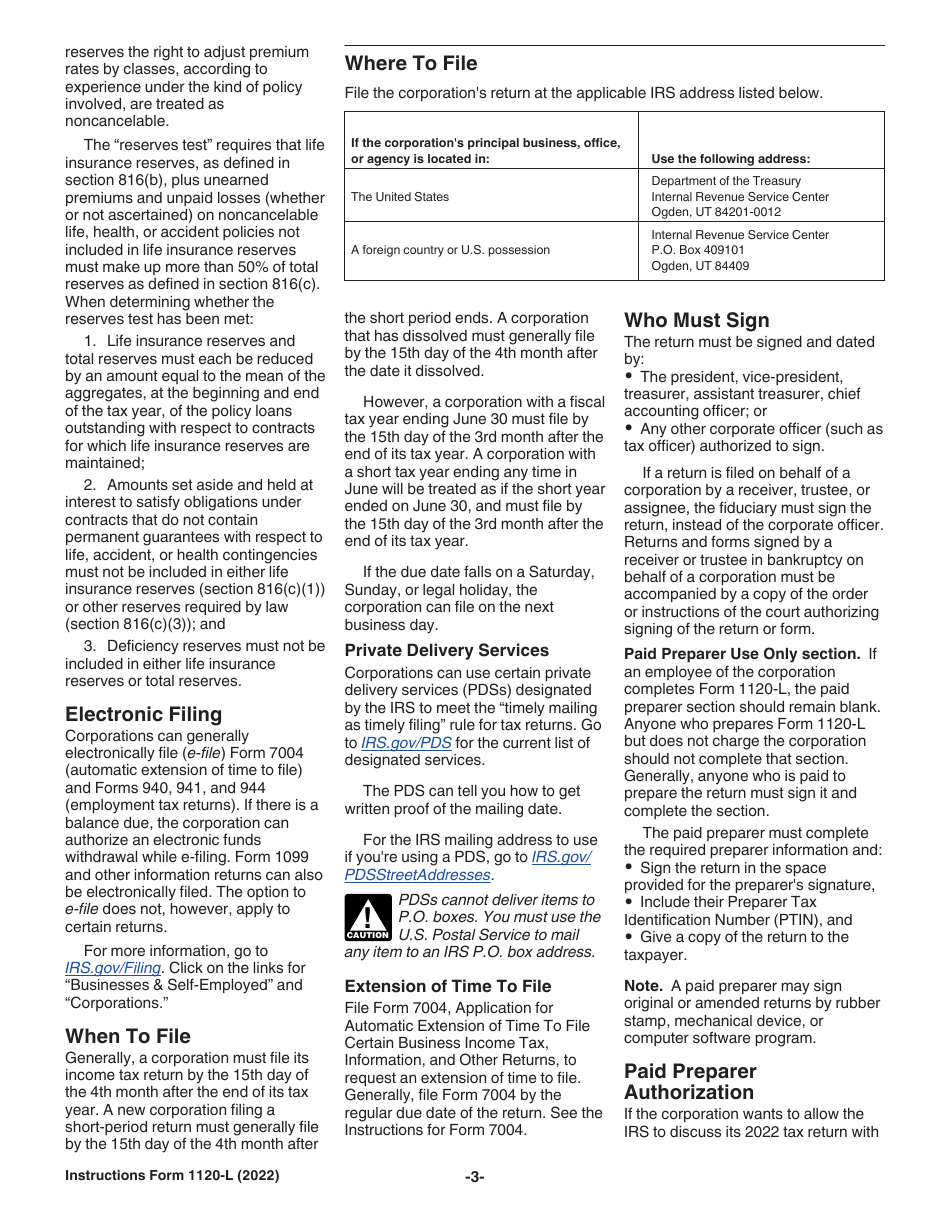

Instructions for IRS Form 1120-L U.S. Life Insurance Company Income Tax Return

This document contains official instructions for IRS Form 1120-L , U.S. Life Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-L is available for download through this link.

FAQ

Q: What is IRS Form 1120-L?

A: IRS Form 1120-L is the U.S. Life Insurance Company Income Tax Return.

Q: Who needs to file IRS Form 1120-L?

A: U.S. life insurance companies need to file IRS Form 1120-L.

Q: What is the purpose of filing IRS Form 1120-L?

A: The purpose of filing IRS Form 1120-L is to report the income, deductions, and tax liability of U.S. life insurance companies.

Q: When is the deadline to file IRS Form 1120-L?

A: The deadline to file IRS Form 1120-L is usually March 15th.

Q: Can the deadline to file IRS Form 1120-L be extended?

A: Yes, the deadline to file IRS Form 1120-L can be extended by filing Form 7004.

Q: What are some common schedules and forms related to IRS Form 1120-L?

A: Some common schedules and forms related to IRS Form 1120-L include Schedule M-2, Schedule L, and Form 1120-RIC.

Instruction Details:

- This 25-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.