This version of the form is not currently in use and is provided for reference only. Download this version of

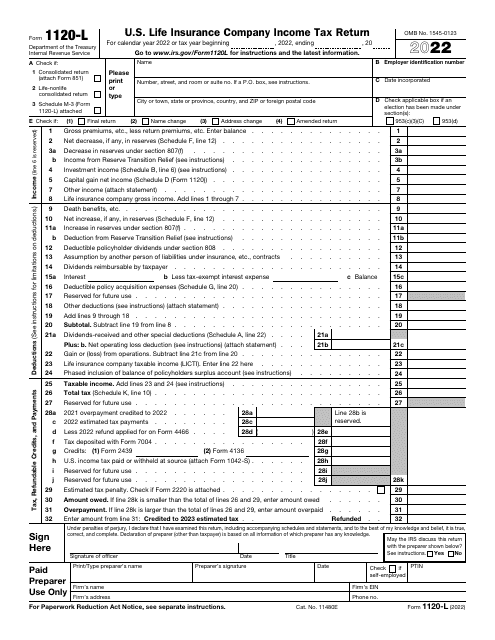

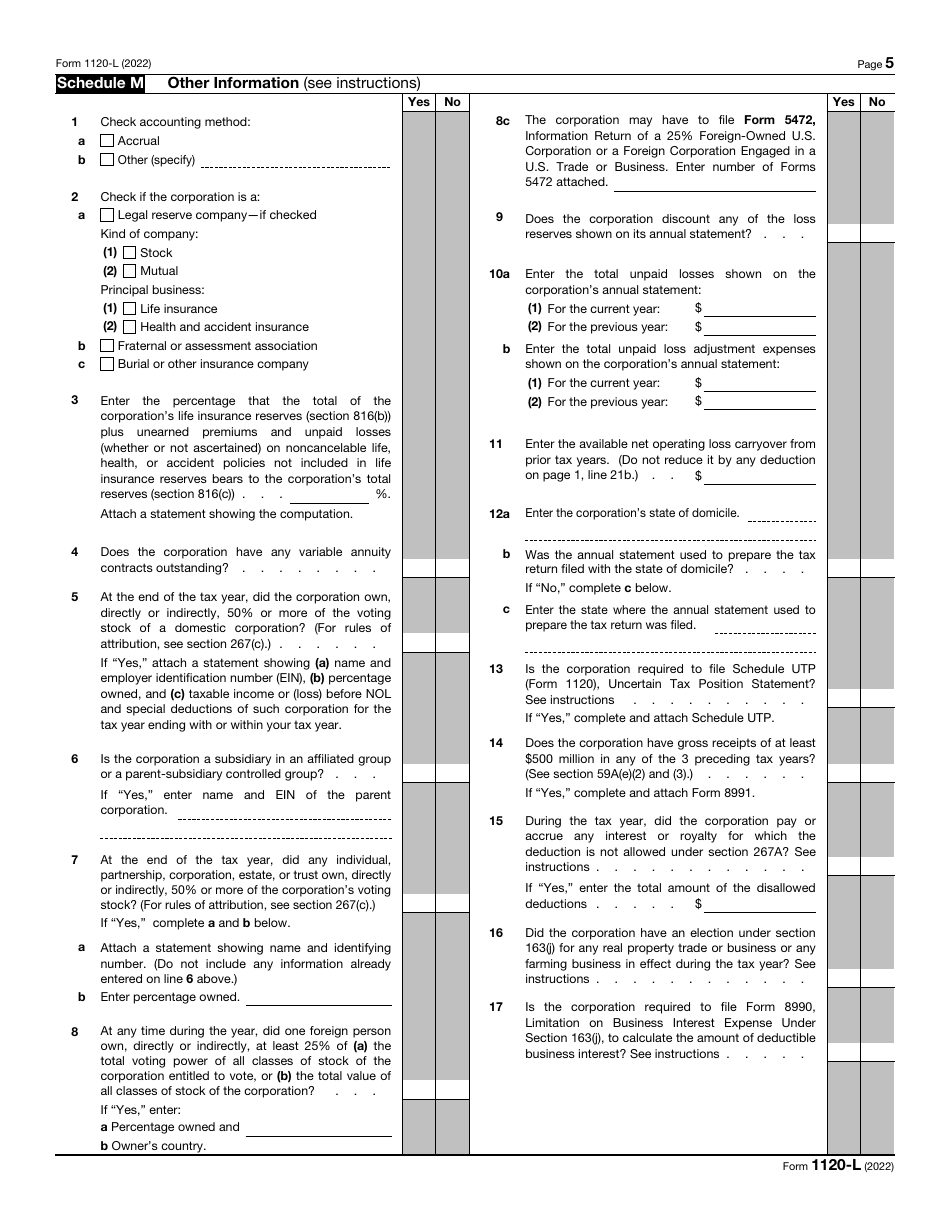

IRS Form 1120-L

for the current year.

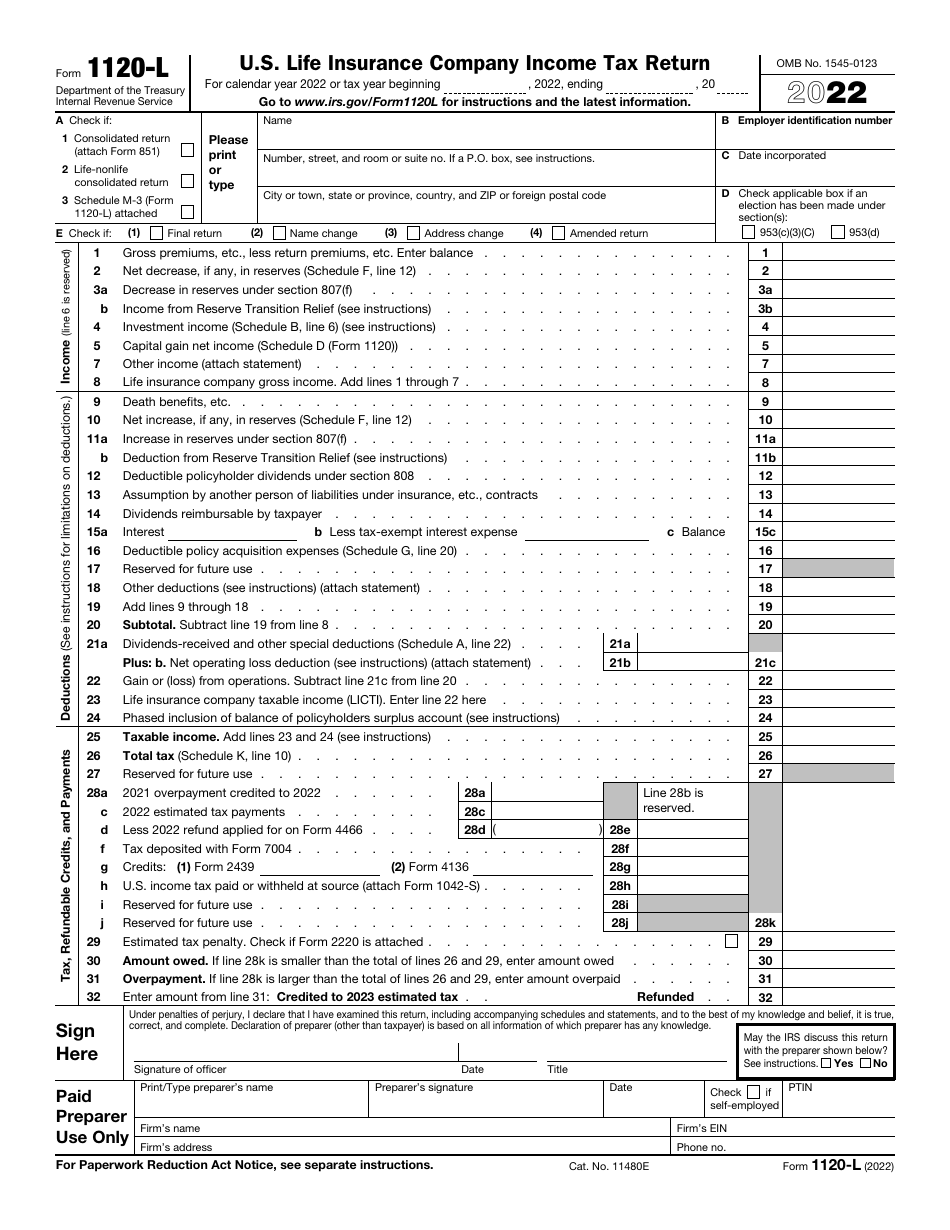

IRS Form 1120-L U.S. Life Insurance Company Income Tax Return

What Is IRS Form 1120-L?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-L?

A: IRS Form 1120-L is the U.S. Life Insurance Company Income Tax Return.

Q: Who needs to file IRS Form 1120-L?

A: U.S. life insurance companies need to file IRS Form 1120-L.

Q: What is the purpose of IRS Form 1120-L?

A: The purpose of IRS Form 1120-L is to report income, deductions, and tax liability for U.S. life insurance companies.

Q: When is the deadline to file IRS Form 1120-L?

A: The deadline to file IRS Form 1120-L is the 15th day of the 3rd month following the end of the tax year.

Form Details:

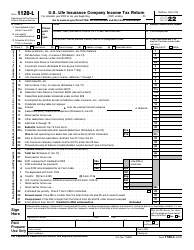

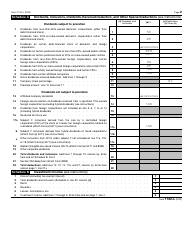

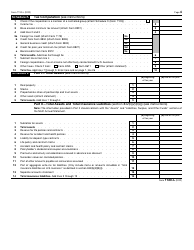

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-L through the link below or browse more documents in our library of IRS Forms.