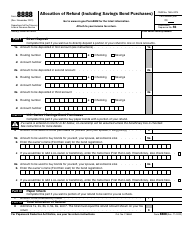

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1045

for the current year.

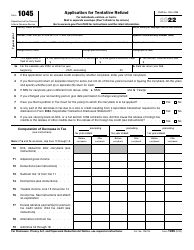

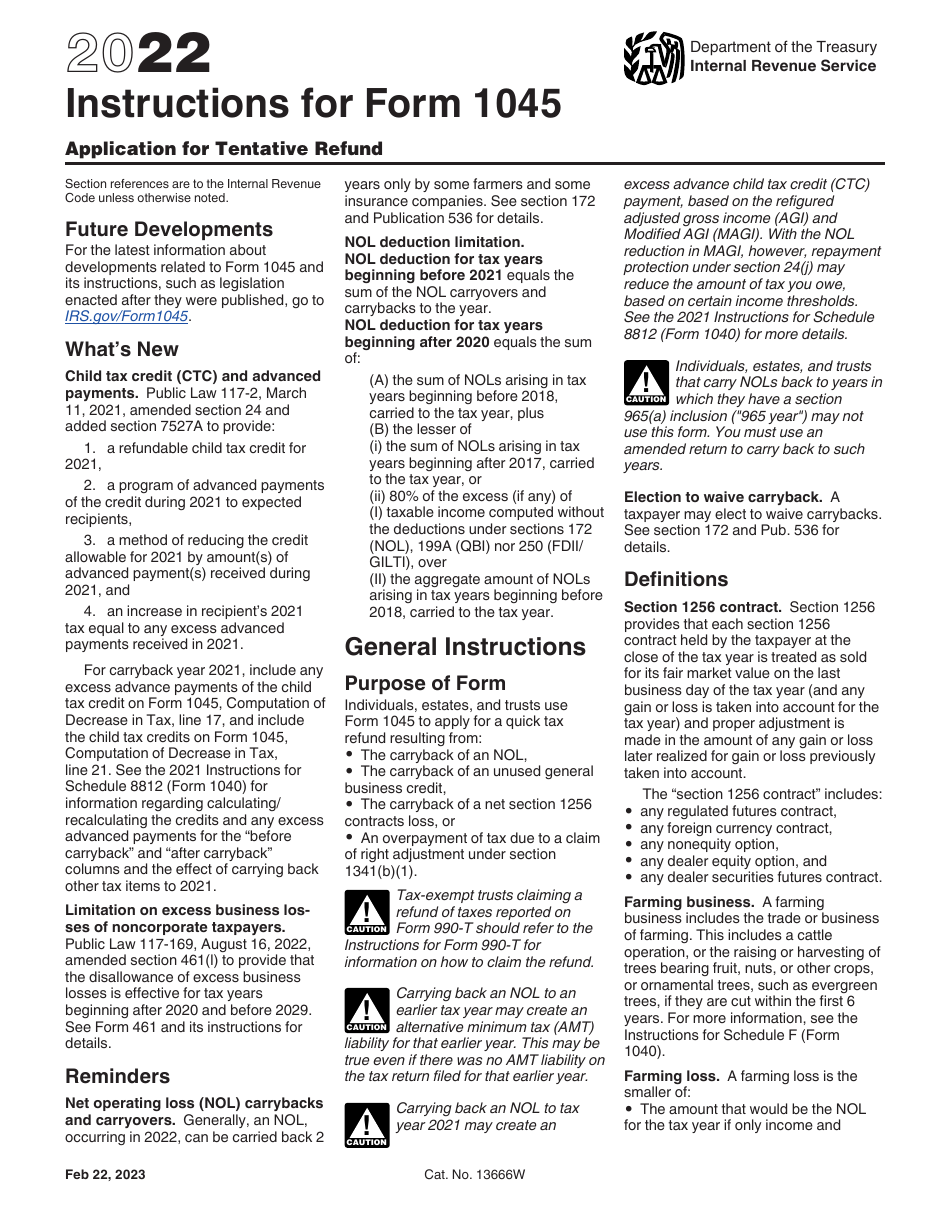

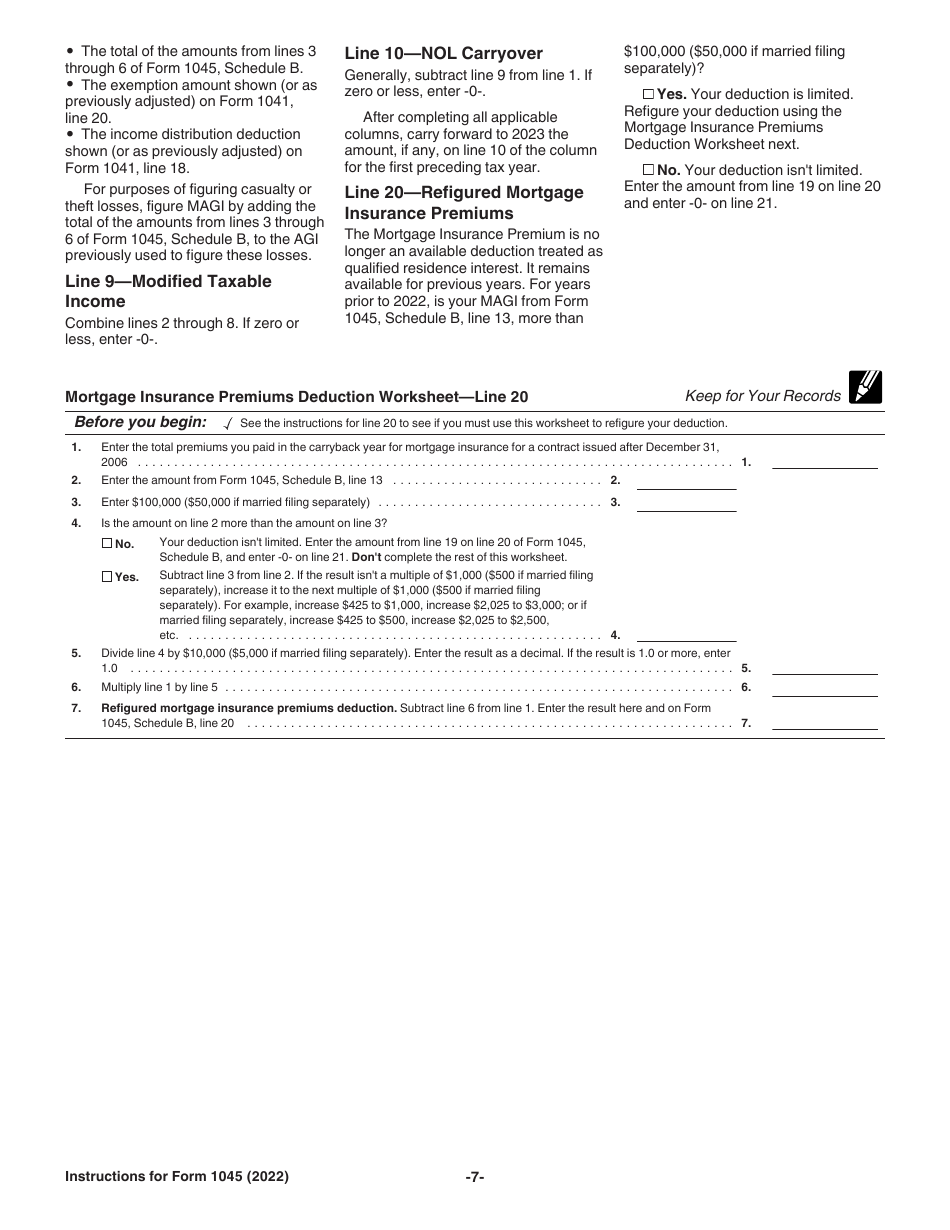

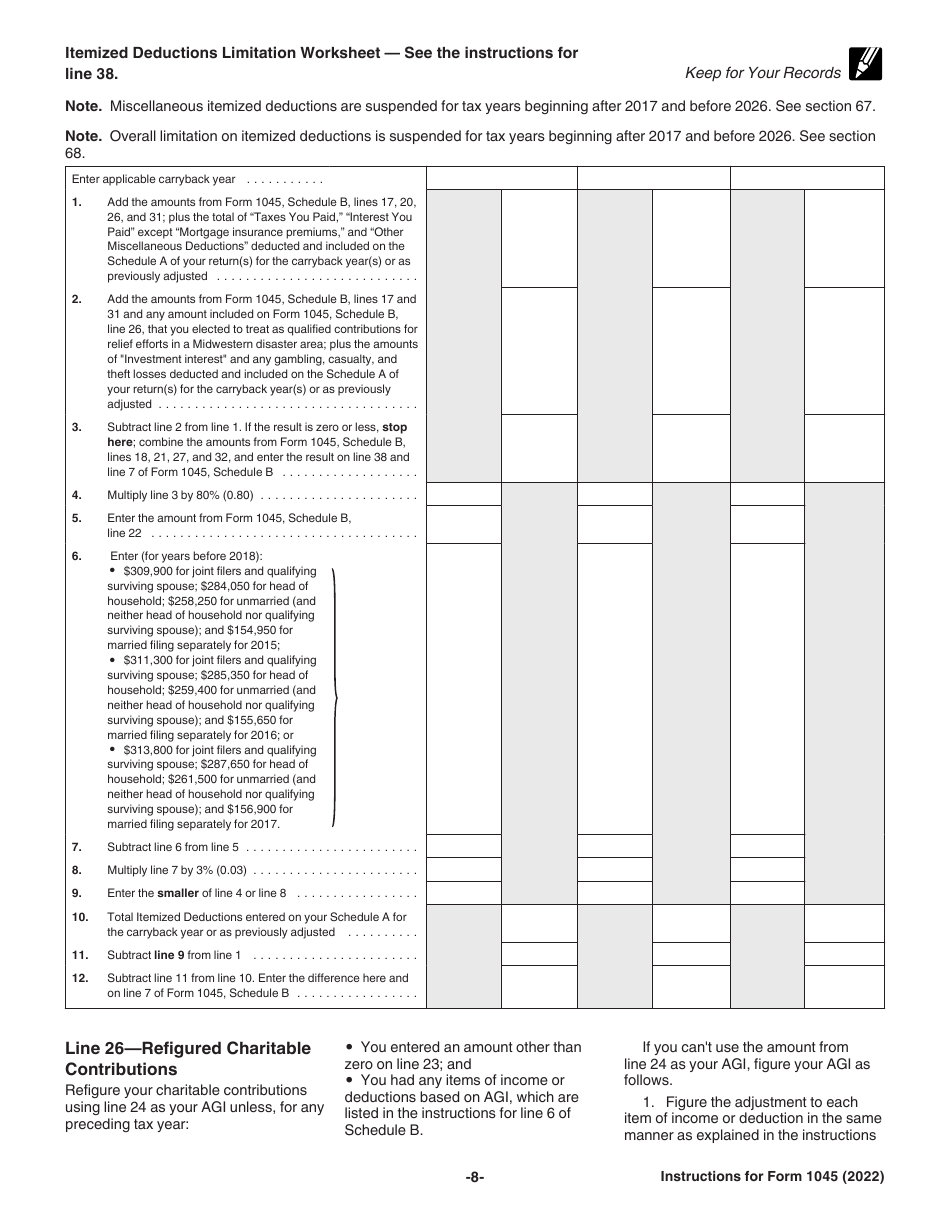

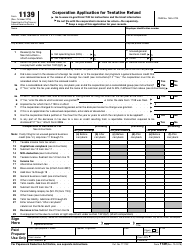

Instructions for IRS Form 1045 Application for Tentative Refund

This document contains official instructions for IRS Form 1045 , Application for Tentative Refund - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1045 is available for download through this link.

FAQ

Q: What is IRS Form 1045?

A: IRS Form 1045 is the Application for Tentative Refund.

Q: What is the purpose of IRS Form 1045?

A: The purpose of IRS Form 1045 is to apply for a tentative refund of certain taxes.

Q: Who should use IRS Form 1045?

A: Individuals, estates, and trusts who want to claim a refund for certain taxes should use IRS Form 1045.

Q: What types of taxes can be claimed on IRS Form 1045?

A: IRS Form 1045 can be used to claim a refund for net operating loss carrybacks, general business credits, or certain other tax credits.

Q: Is there a deadline to file IRS Form 1045?

A: Yes, IRS Form 1045 should be filed within one year of the end of the tax year in which the loss, credit, or deduction is generated.

Q: Are there any fees to file IRS Form 1045?

A: No, there are no fees to file IRS Form 1045.

Q: Can IRS Form 1045 be filed electronically?

A: Yes, IRS Form 1045 can be filed electronically through the IRS e-file system.

Q: What supporting documentation is required with IRS Form 1045?

A: Supporting documentation, such as tax returns, schedules, and worksheets, should be attached to IRS Form 1045 when filing.

Q: How long does it take to process IRS Form 1045?

A: The processing time for IRS Form 1045 varies, but it typically takes around 6 to 8 weeks.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.