This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1045

for the current year.

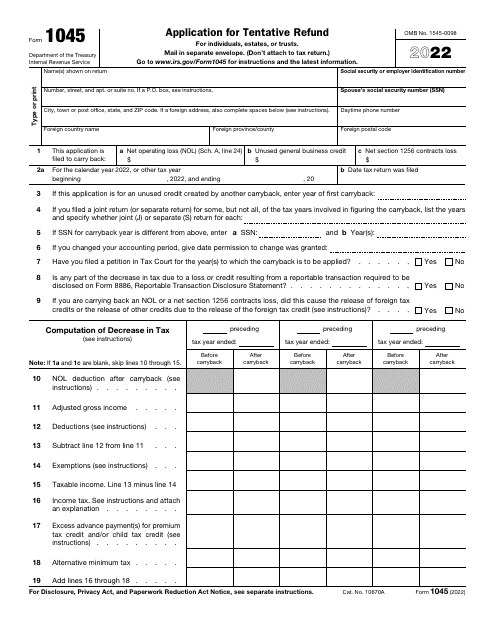

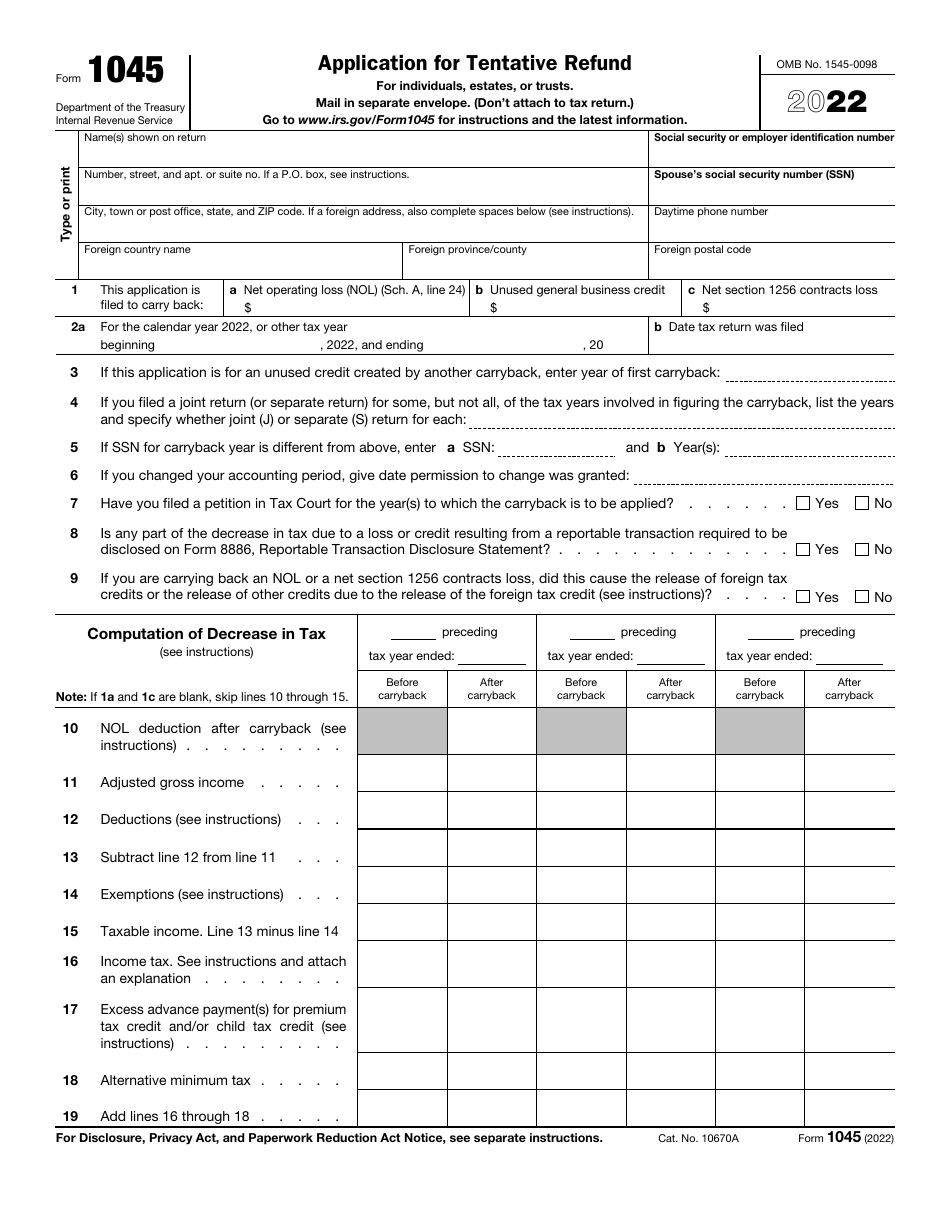

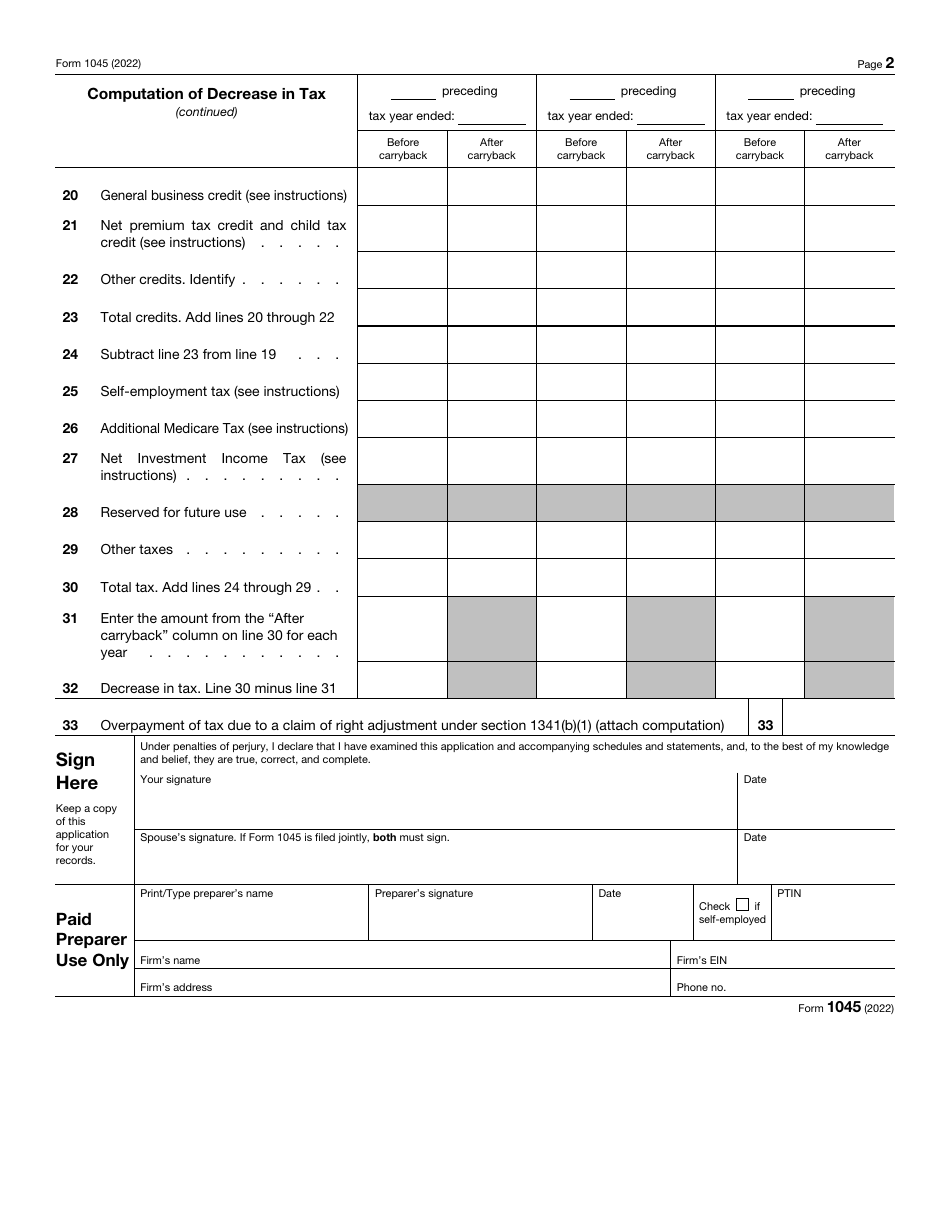

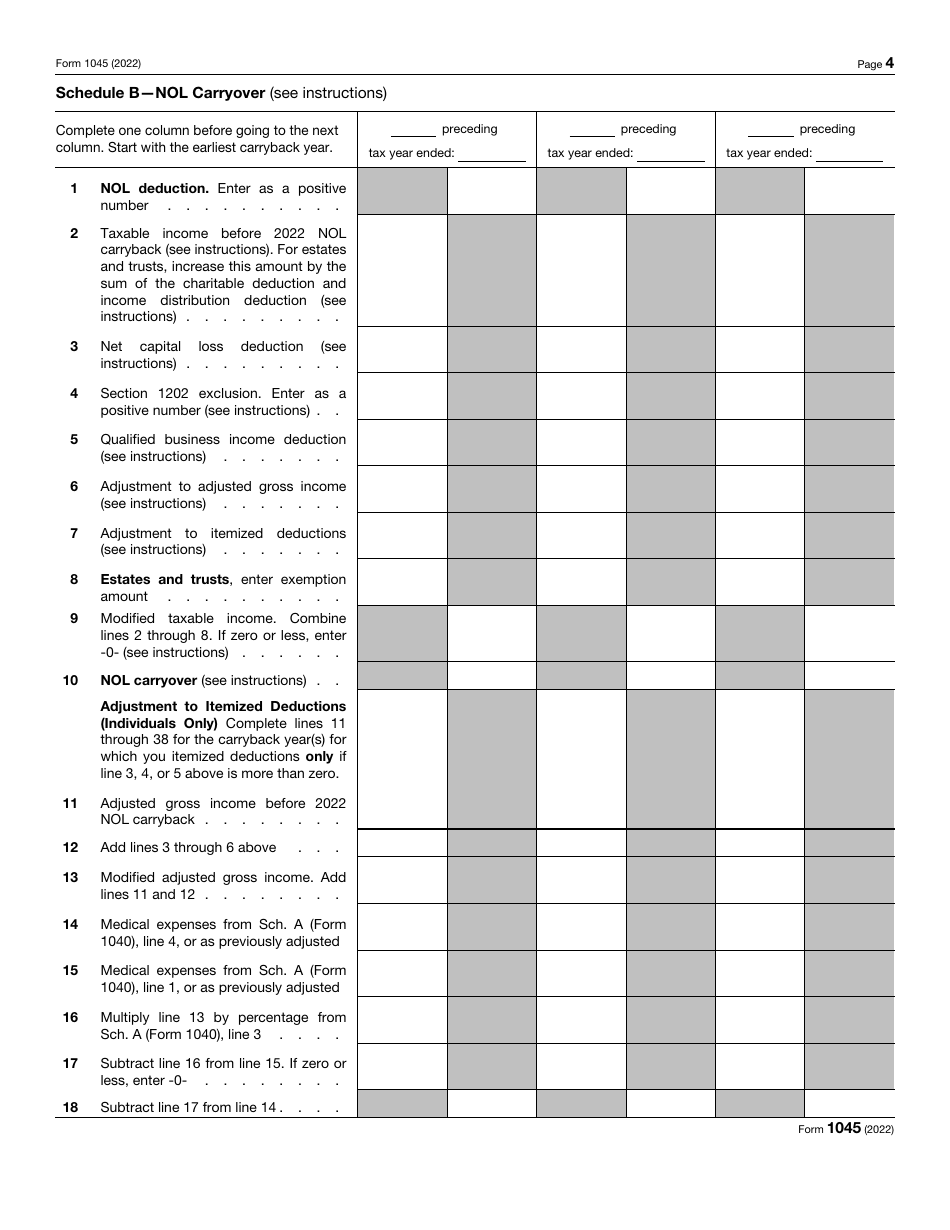

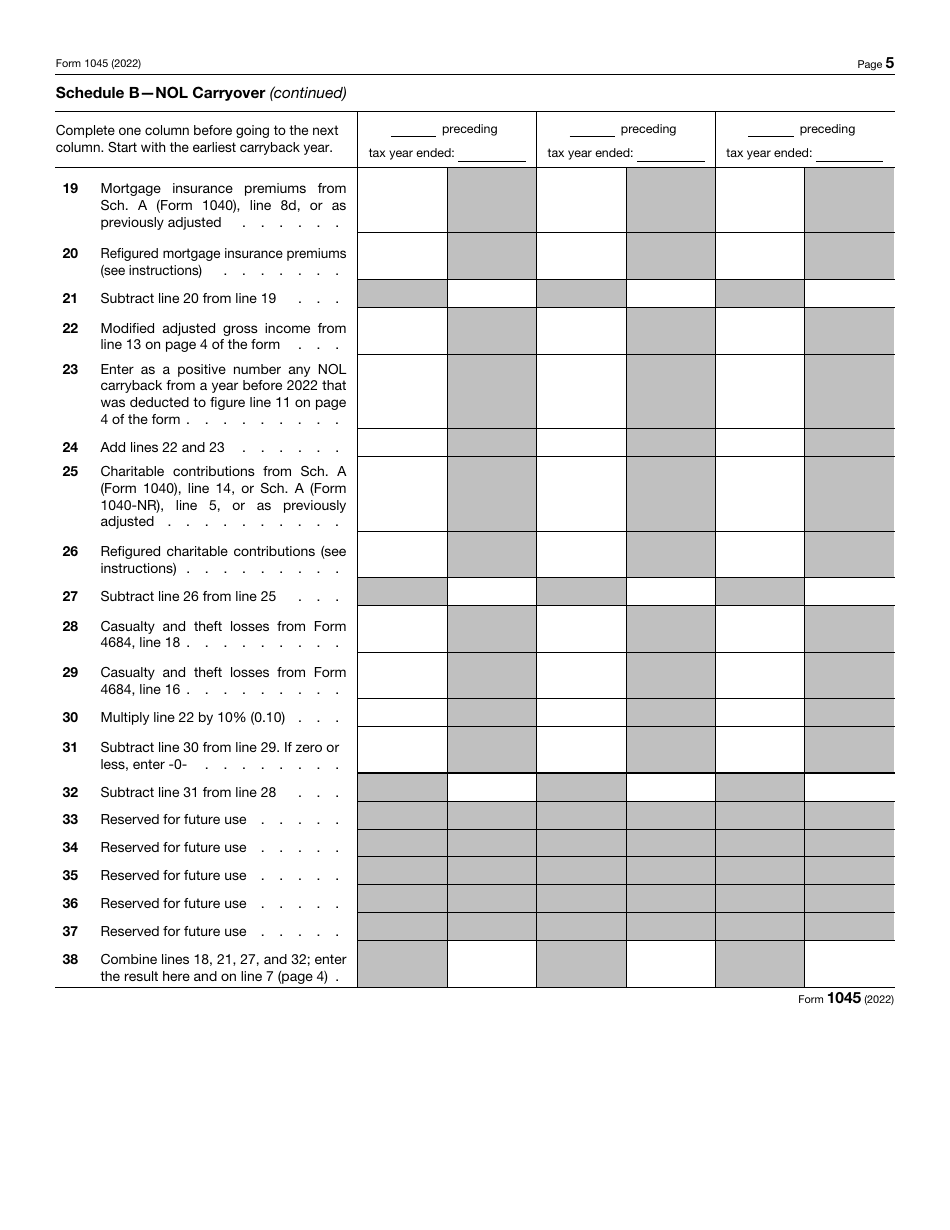

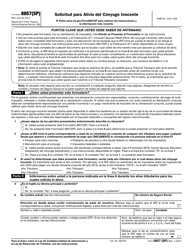

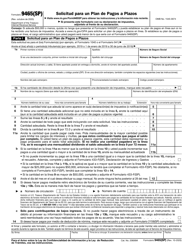

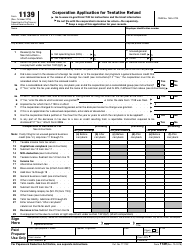

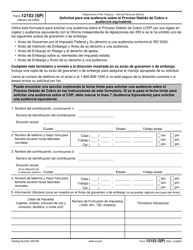

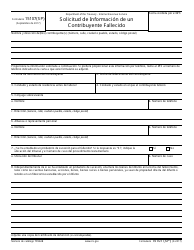

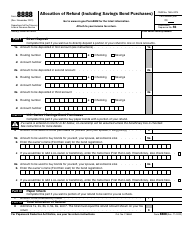

IRS Form 1045 Application for Tentative Refund

What Is IRS Form 1045?

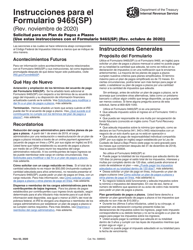

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1045?

A: Form 1045 is an application for a tentative refund.

Q: Who can file Form 1045?

A: Individuals, estates, and trusts can file Form 1045.

Q: What is a tentative refund?

A: A tentative refund is a refund that is claimed before the taxpayer's final tax liability is determined.

Q: What information is required on Form 1045?

A: Form 1045 requires information about the taxpayer's income, deductions, and credits.

Q: When should I file Form 1045?

A: Form 1045 should be filed within one year of the end of the tax year in which the loss or credit occurred.

Q: Can I electronically file Form 1045?

A: Yes, Form 1045 can be electronically filed using tax preparation software or through a tax professional.

Q: How long does it take to process Form 1045?

A: The processing time for Form 1045 can vary, but it generally takes several weeks.

Q: What should I do if my Form 1045 is rejected?

A: If your Form 1045 is rejected, you should review the rejection notice for the reason and correct any errors before resubmitting the form.

Q: What if I need help completing Form 1045?

A: If you need help completing Form 1045, you can consult the instructions provided by the IRS or seek assistance from a tax professional.

Form Details:

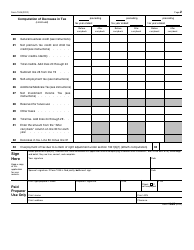

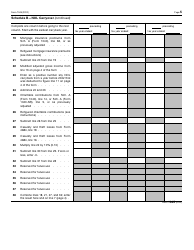

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1045 through the link below or browse more documents in our library of IRS Forms.