This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 943-X

for the current year.

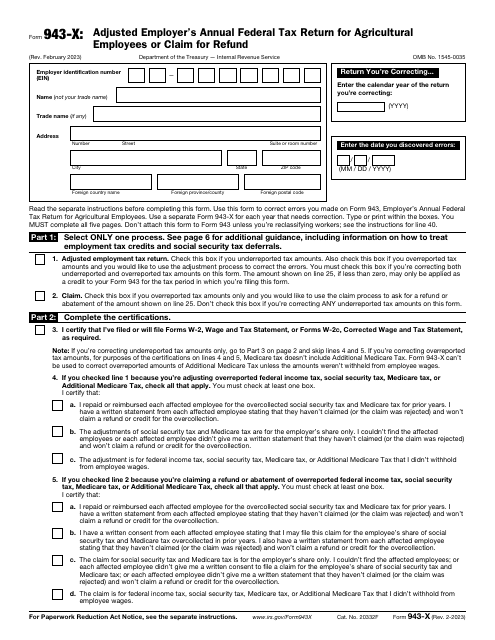

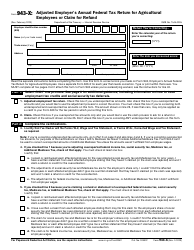

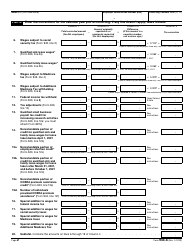

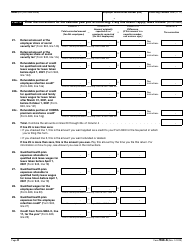

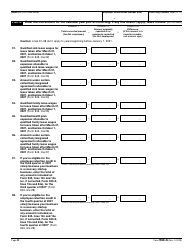

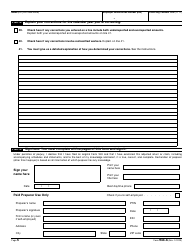

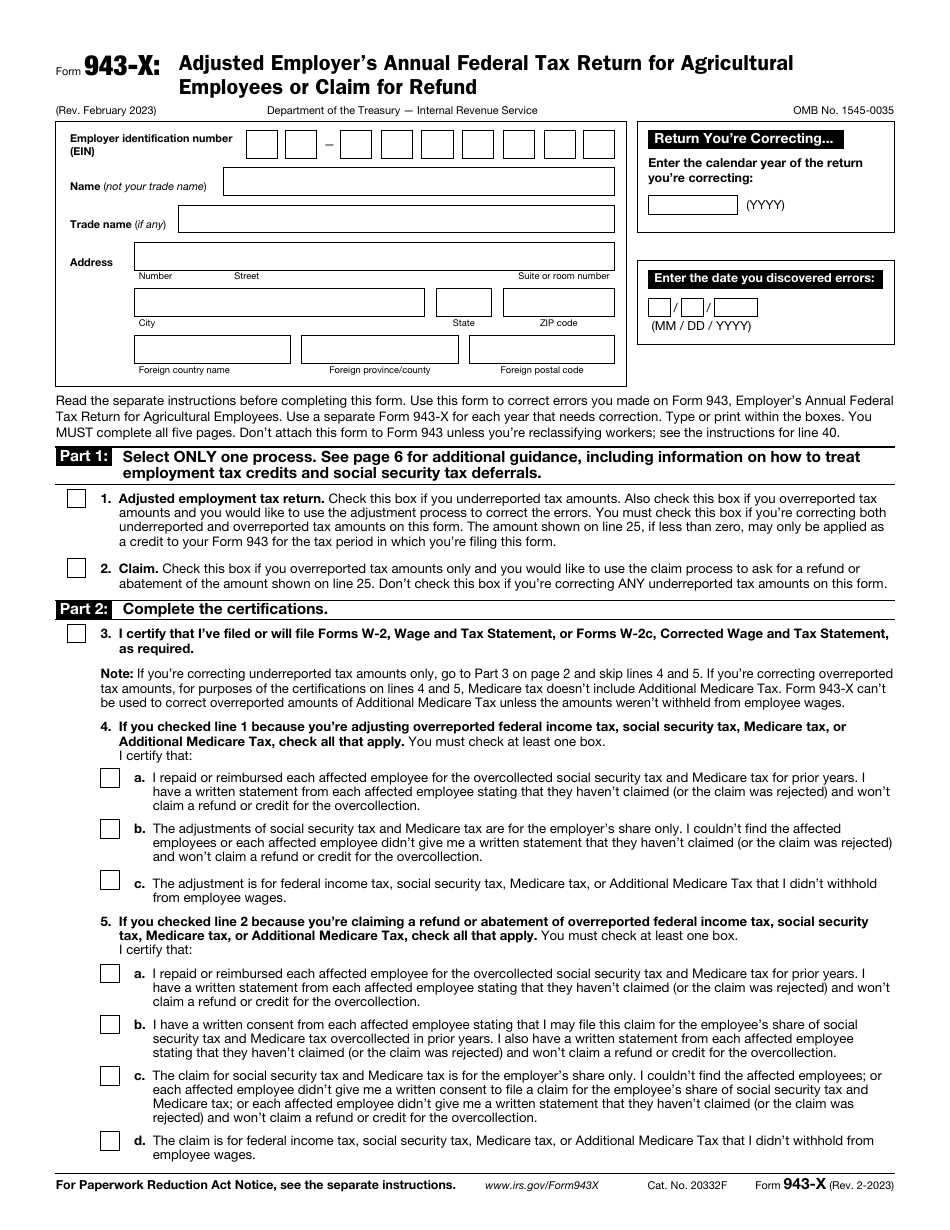

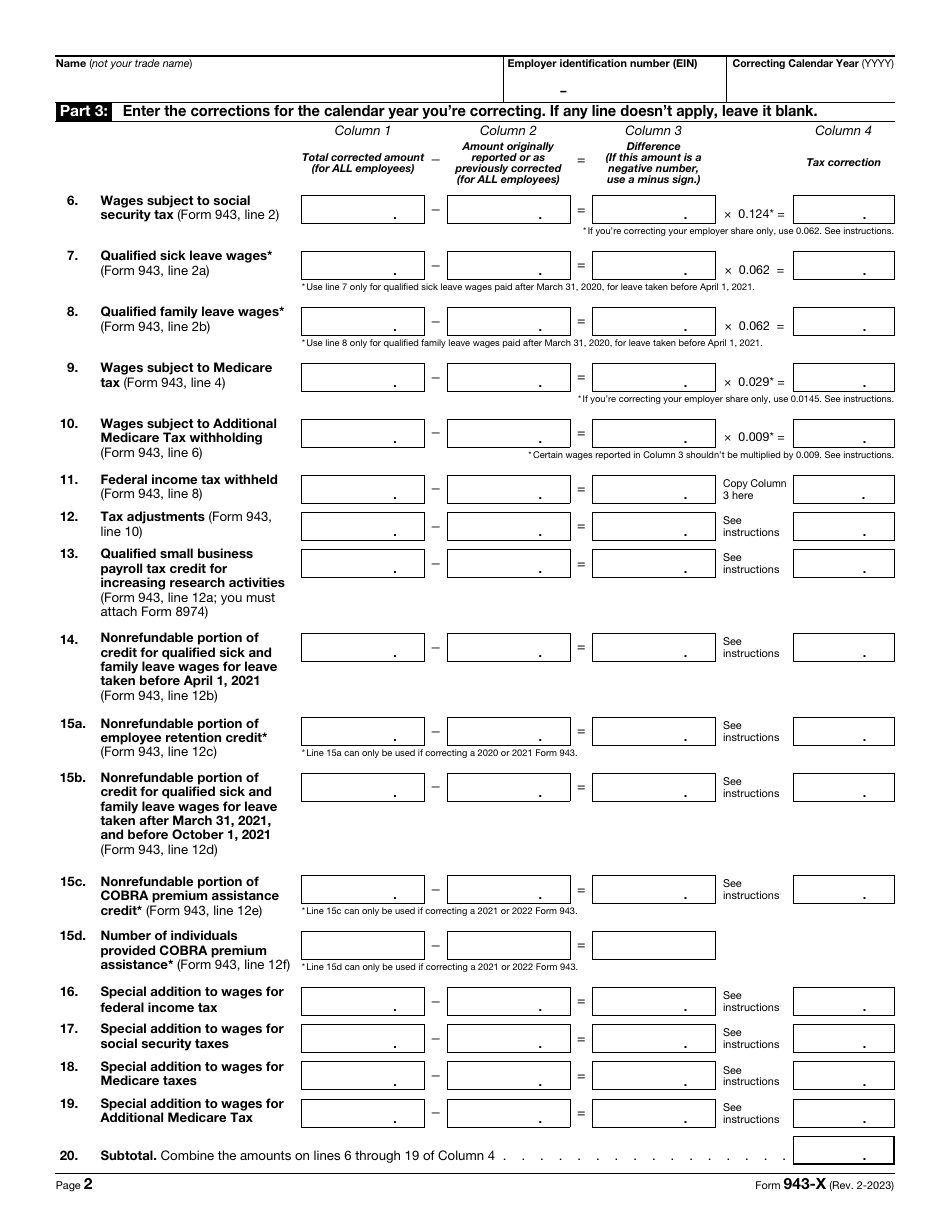

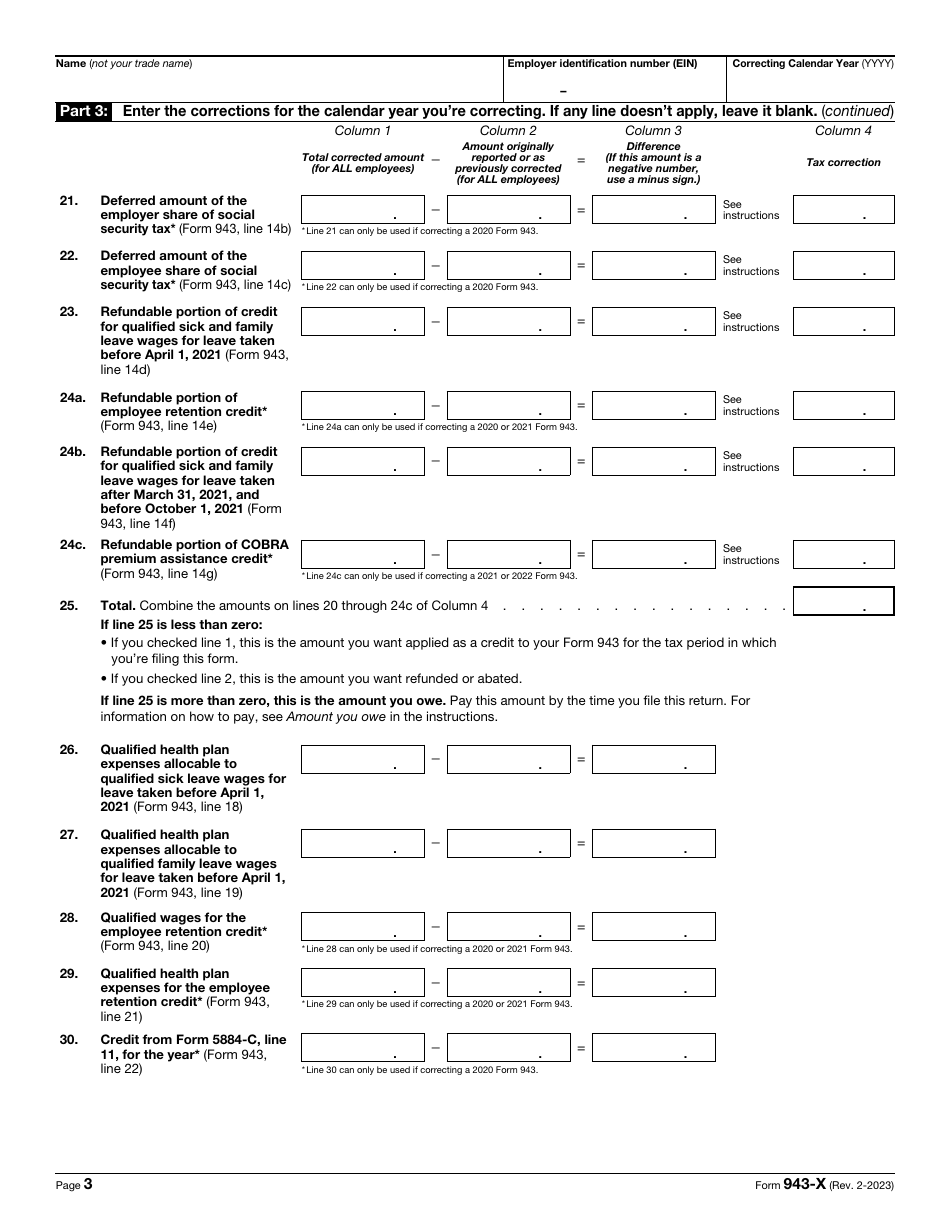

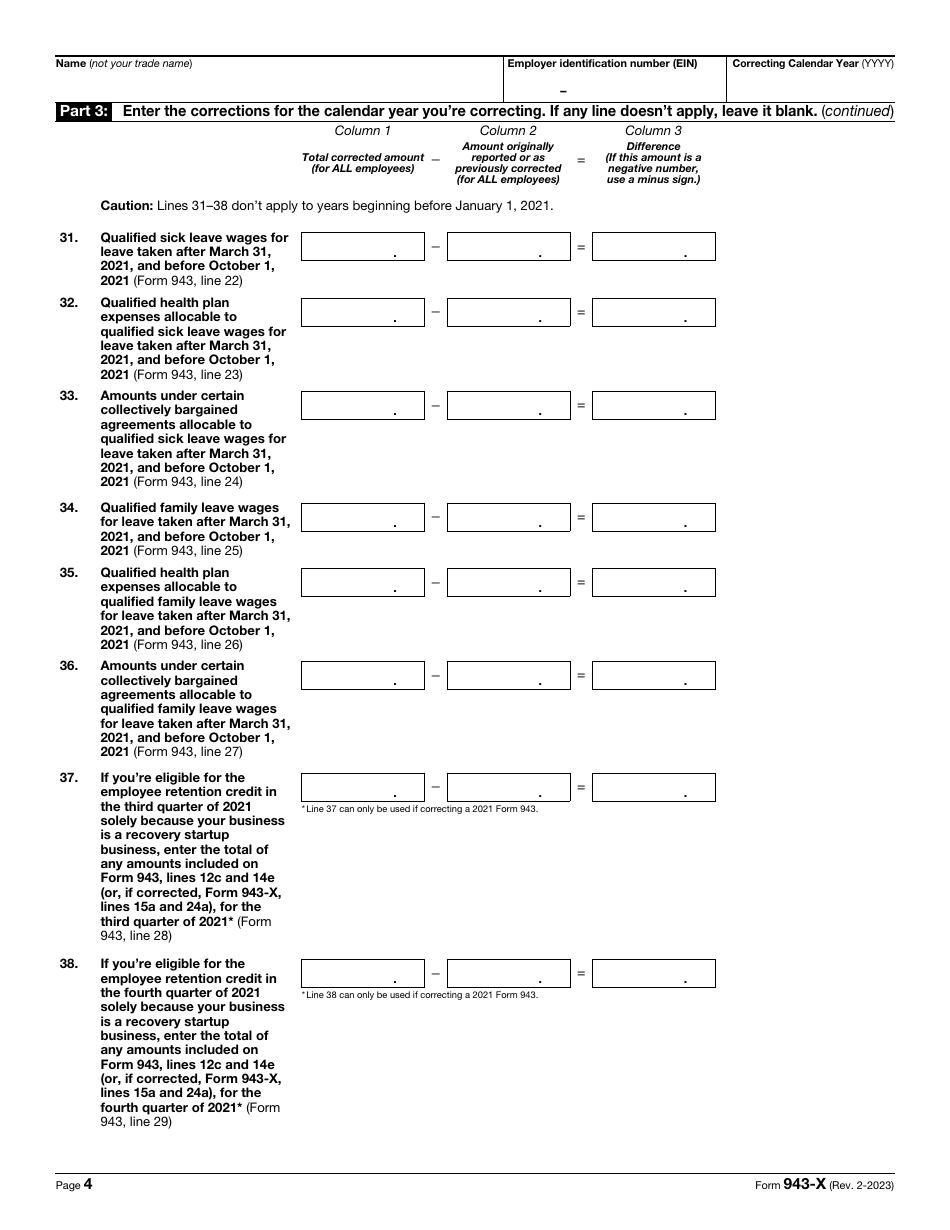

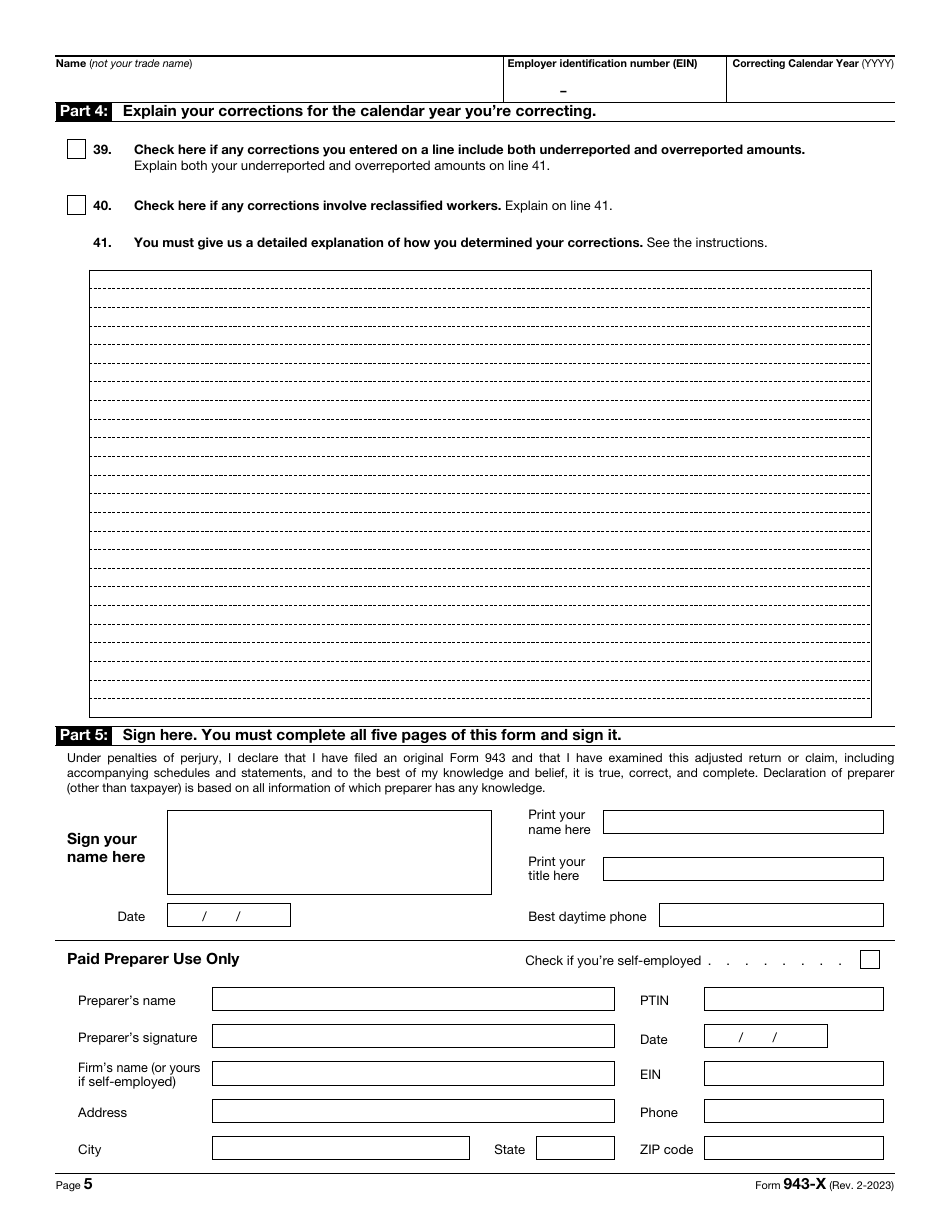

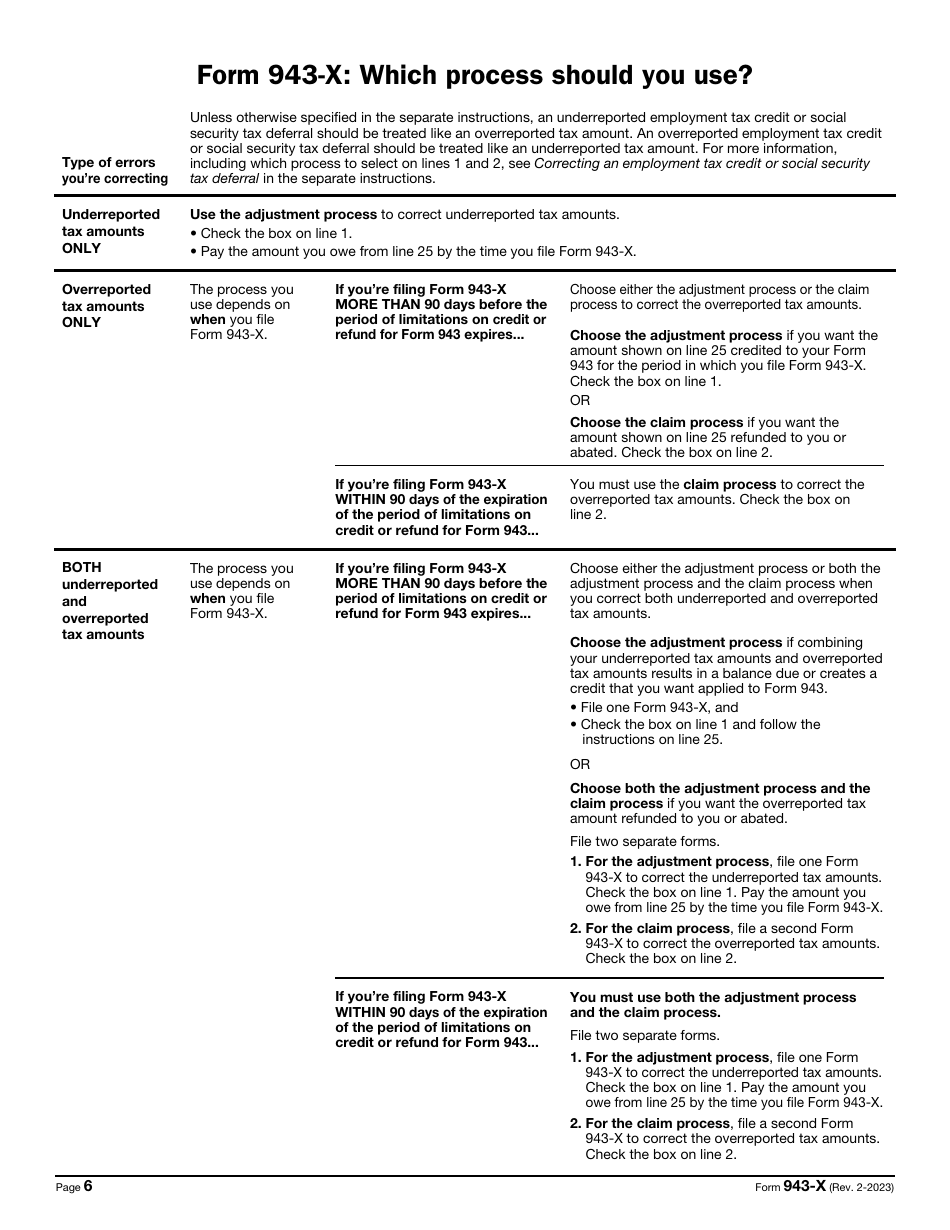

IRS Form 943-X Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund

What Is IRS Form 943-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2023. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 943-X?

A: IRS Form 943-X is the Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund.

Q: Who needs to file IRS Form 943-X?

A: Employers who have made errors or need to make adjustments to their previous filings of IRS Form 943, the Employer's Annual Federal Tax Return for Agricultural Employees, may need to file Form 943-X.

Q: What is the purpose of IRS Form 943-X?

A: The purpose of IRS Form 943-X is to correct errors or make adjustments to the employer's previous filings of Form 943 for agricultural employees, or to claim a refund.

Q: When should IRS Form 943-X be filed?

A: IRS Form 943-X should be filed as soon as possible after the discovery of errors or need for adjustments on the previous filings of Form 943.

Q: How do I file IRS Form 943-X?

A: To file IRS Form 943-X, you need to complete the form with the correct information, attach any supporting documentation, and mail it to the appropriate IRS address provided in the instructions.

Q: Can I file IRS Form 943-X electronically?

A: No, IRS Form 943-X cannot be filed electronically. It must be filed by mail.

Q: Are there any fees for filing IRS Form 943-X?

A: No, there are no fees for filing IRS Form 943-X.

Q: What should I do if I made an error on my previously filed Form 943?

A: If you made an error on your previously filed Form 943, you should file IRS Form 943-X to correct the error.

Q: How long does it take to process IRS Form 943-X?

A: The processing time for IRS Form 943-X can vary, but it usually takes several weeks to several months for the IRS to process and respond to the form.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 943-X through the link below or browse more documents in our library of IRS Forms.