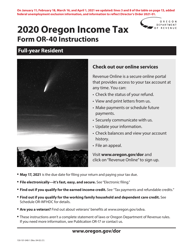

Instructions for Form OR-ESTIMATE, 150-101-026 Oregon Estimated Income Tax Instructions - Oregon

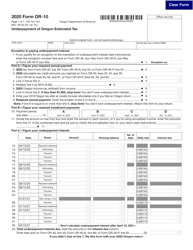

This document contains official instructions for Form OR-ESTIMATE , and Form 150-101-026 . Both forms are released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form OR-ESTIMATE?

A: Form OR-ESTIMATE is the Oregon Estimated Income Tax form.

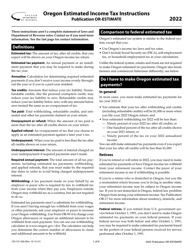

Q: Who needs to file Form OR-ESTIMATE?

A: Individuals who expect to owe Oregon income tax and meet certain criteria need to file Form OR-ESTIMATE.

Q: What is the purpose of Form OR-ESTIMATE?

A: The purpose of Form OR-ESTIMATE is to report estimated income tax payments to the state of Oregon.

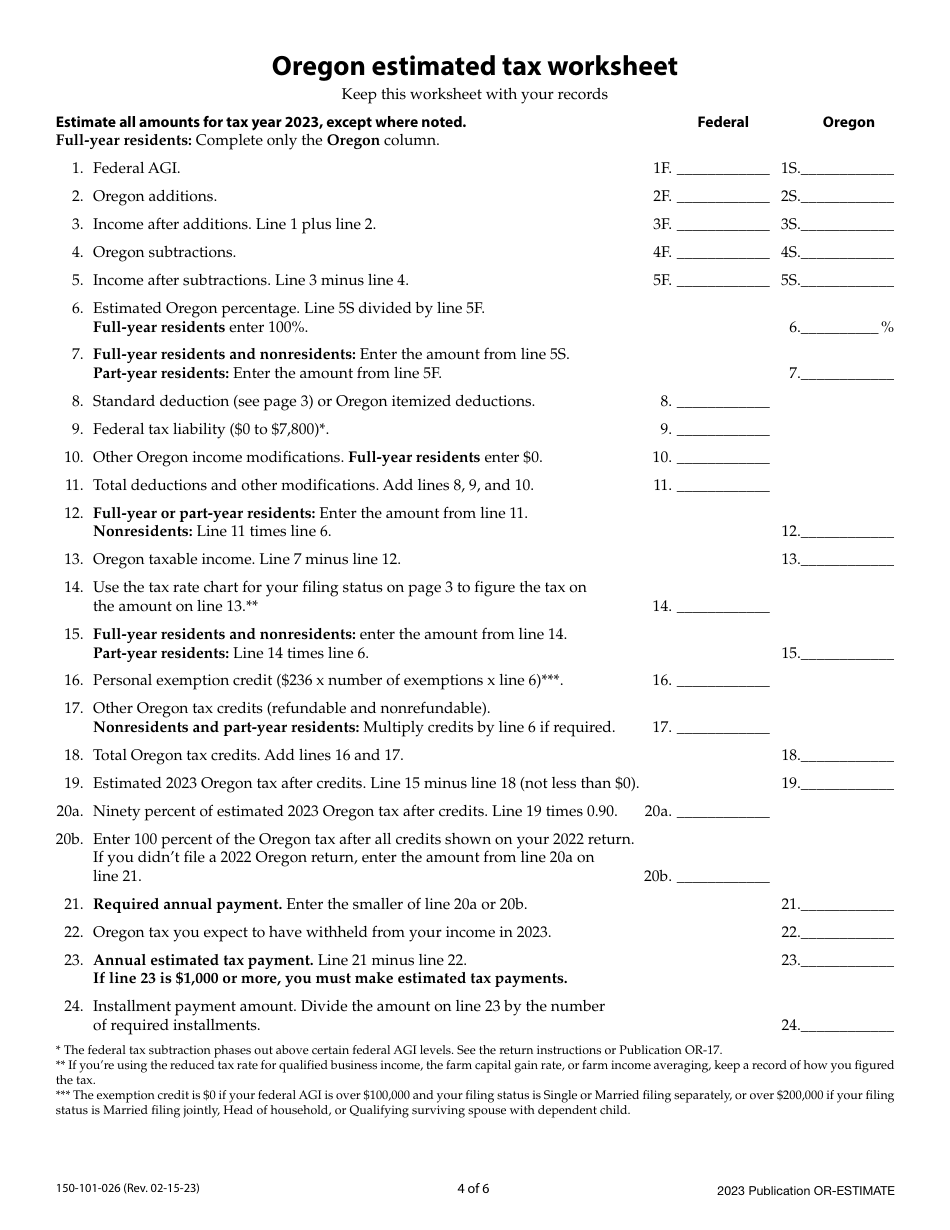

Q: How do I complete Form OR-ESTIMATE?

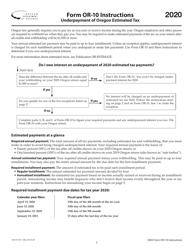

A: Refer to the instructions provided with Form OR-ESTIMATE for guidance on how to complete the form.

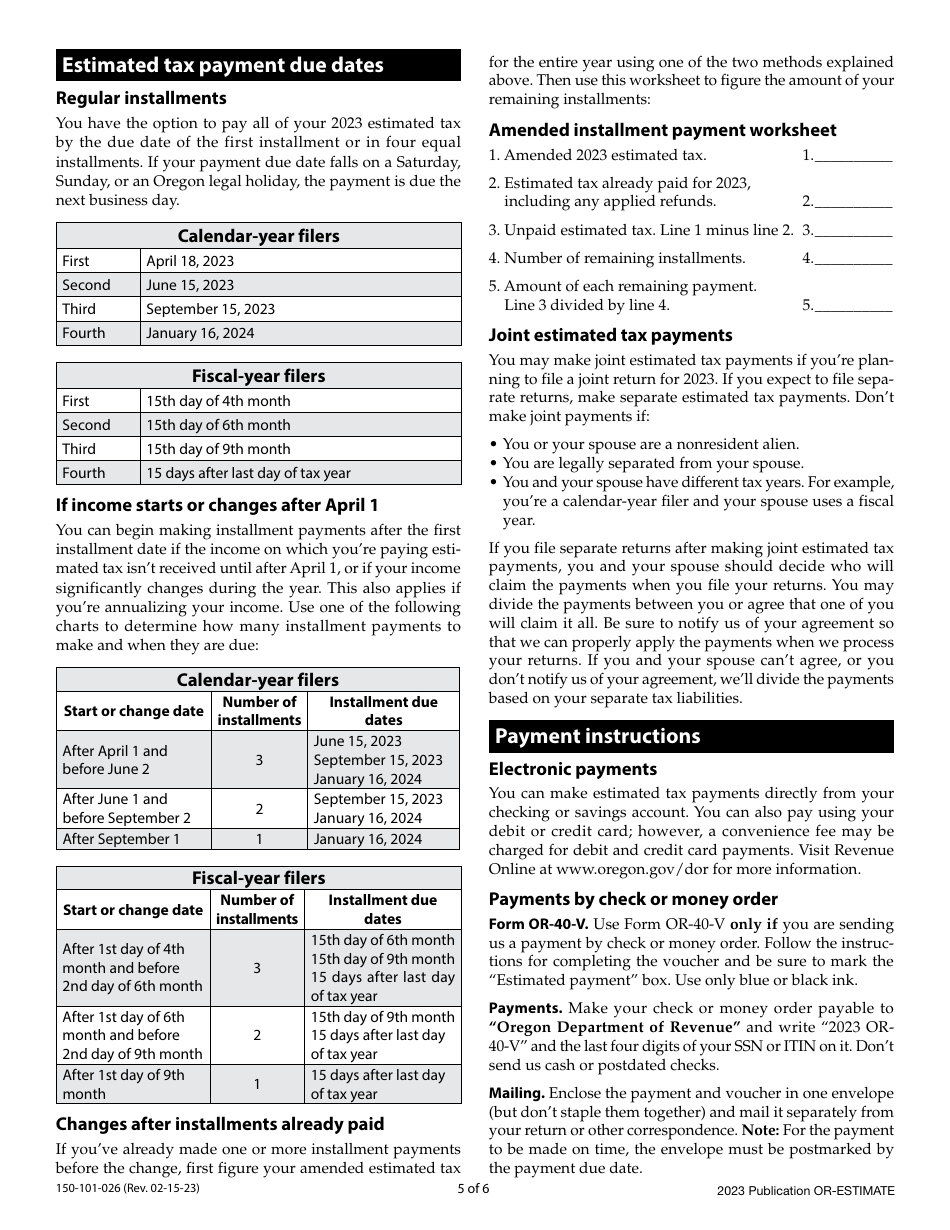

Q: When is Form OR-ESTIMATE due?

A: Form OR-ESTIMATE is generally due on April 15th of the tax year, or on the same day as your federal income tax return if you file on a different date.

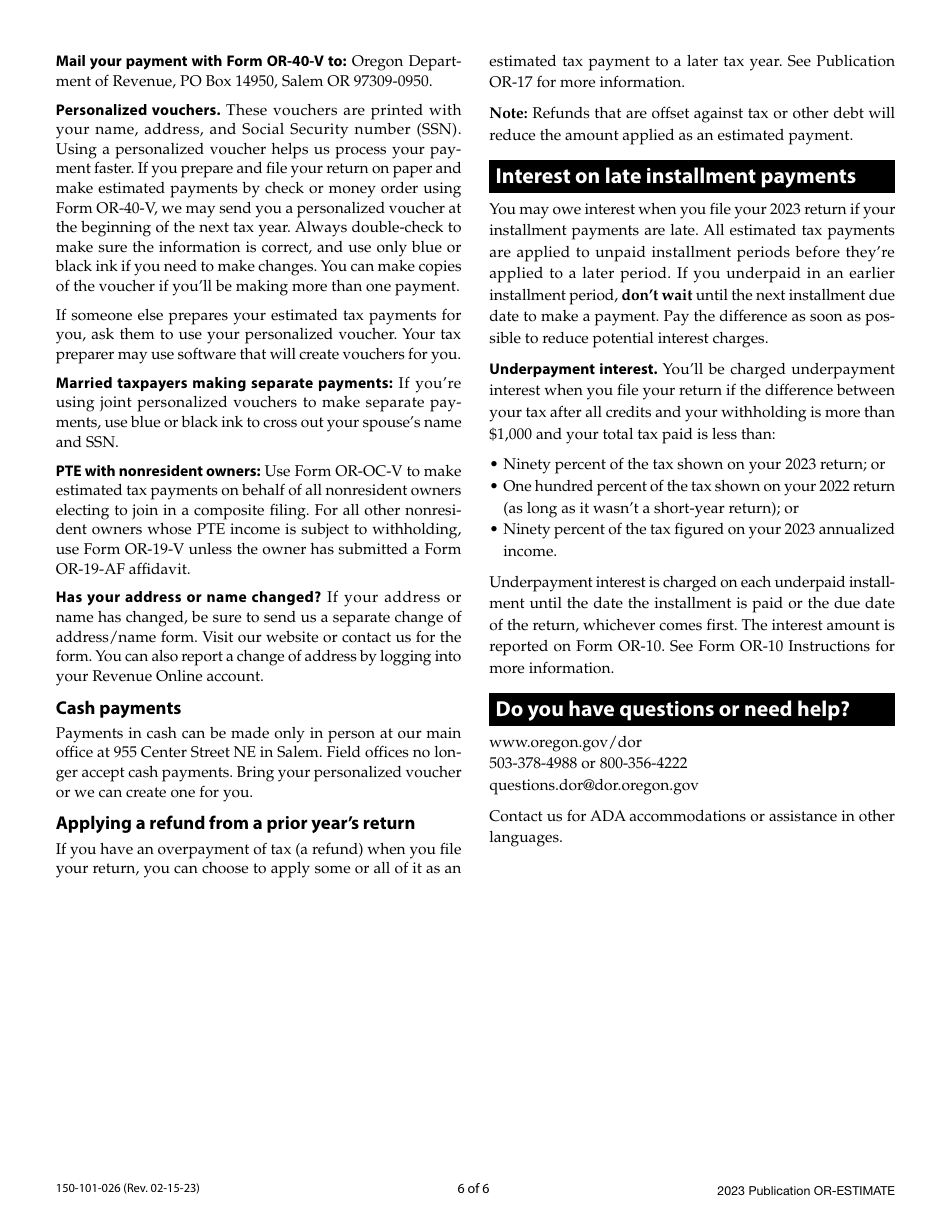

Q: Are there any penalties for not filing Form OR-ESTIMATE?

A: Yes, there may be penalties for not filing or underestimating your Oregon estimated income tax payments.

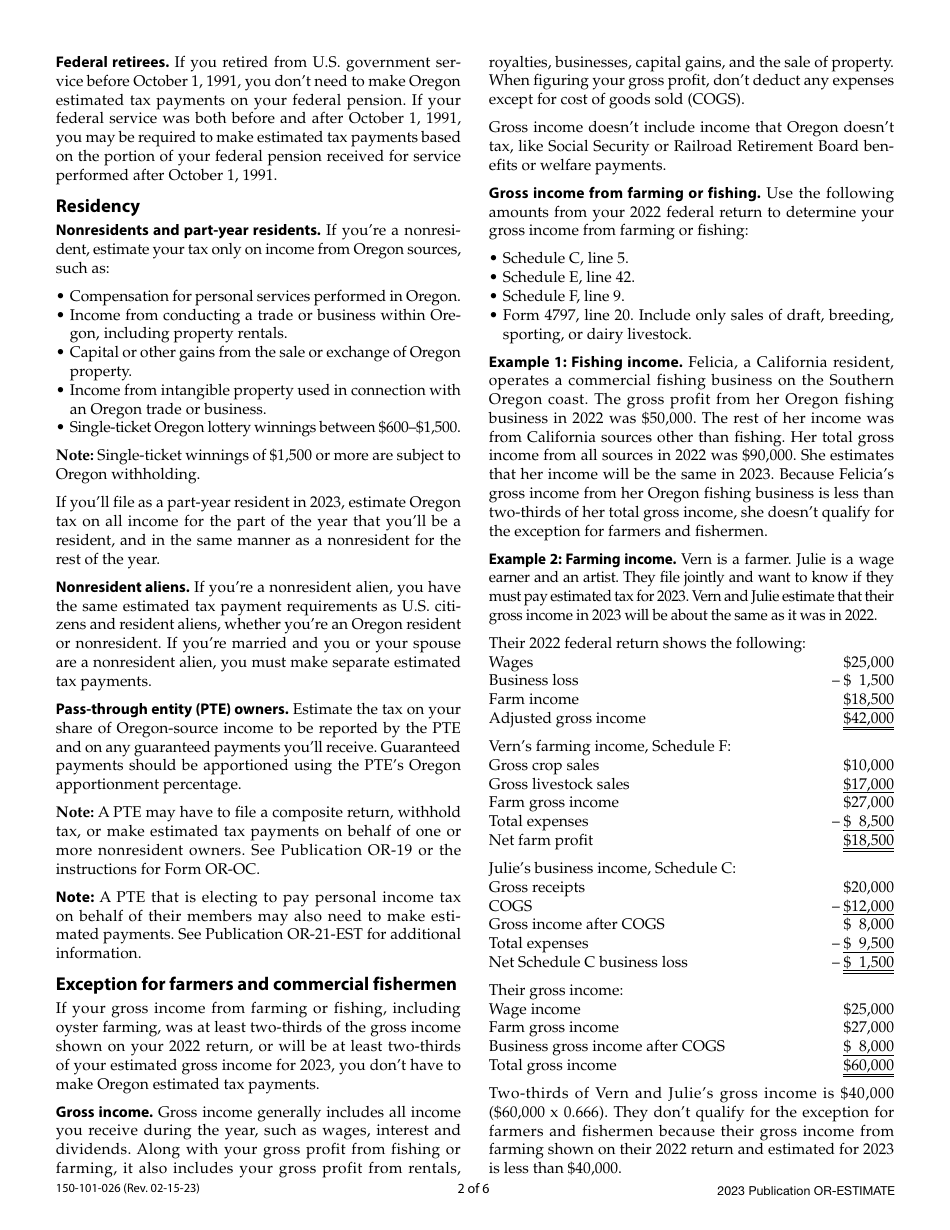

Q: Are there any exceptions to filing Form OR-ESTIMATE?

A: Some individuals may be exempt from filing Form OR-ESTIMATE. Refer to the instructions or consult a tax professional for more information.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose an older version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.