This version of the form is not currently in use and is provided for reference only. Download this version of

Form OR-ESTIMATE (150-101-026)

for the current year.

Form OR-ESTIMATE (150-101-026) Estimated Income Tax Instructions - Oregon

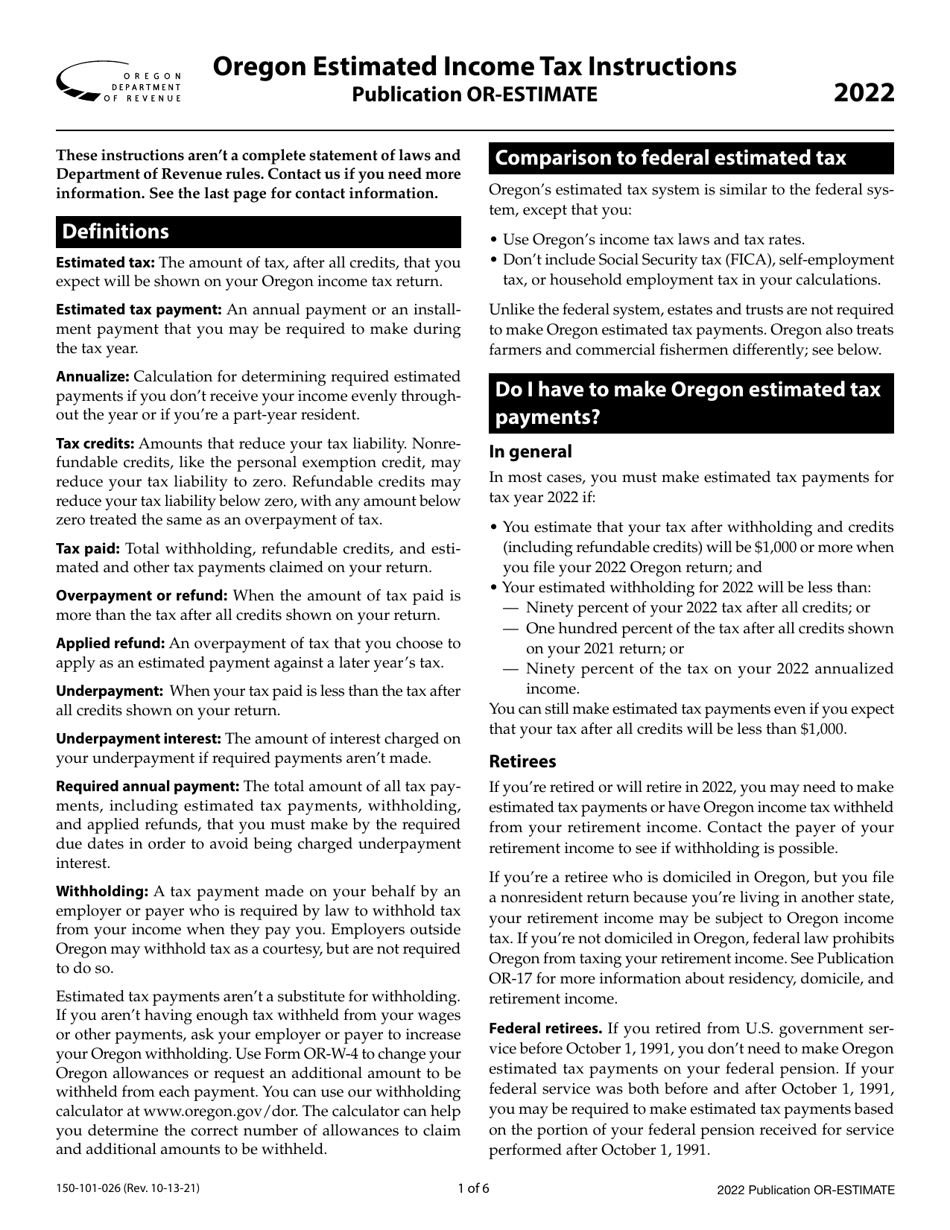

What Is Form OR-ESTIMATE (150-101-026)?

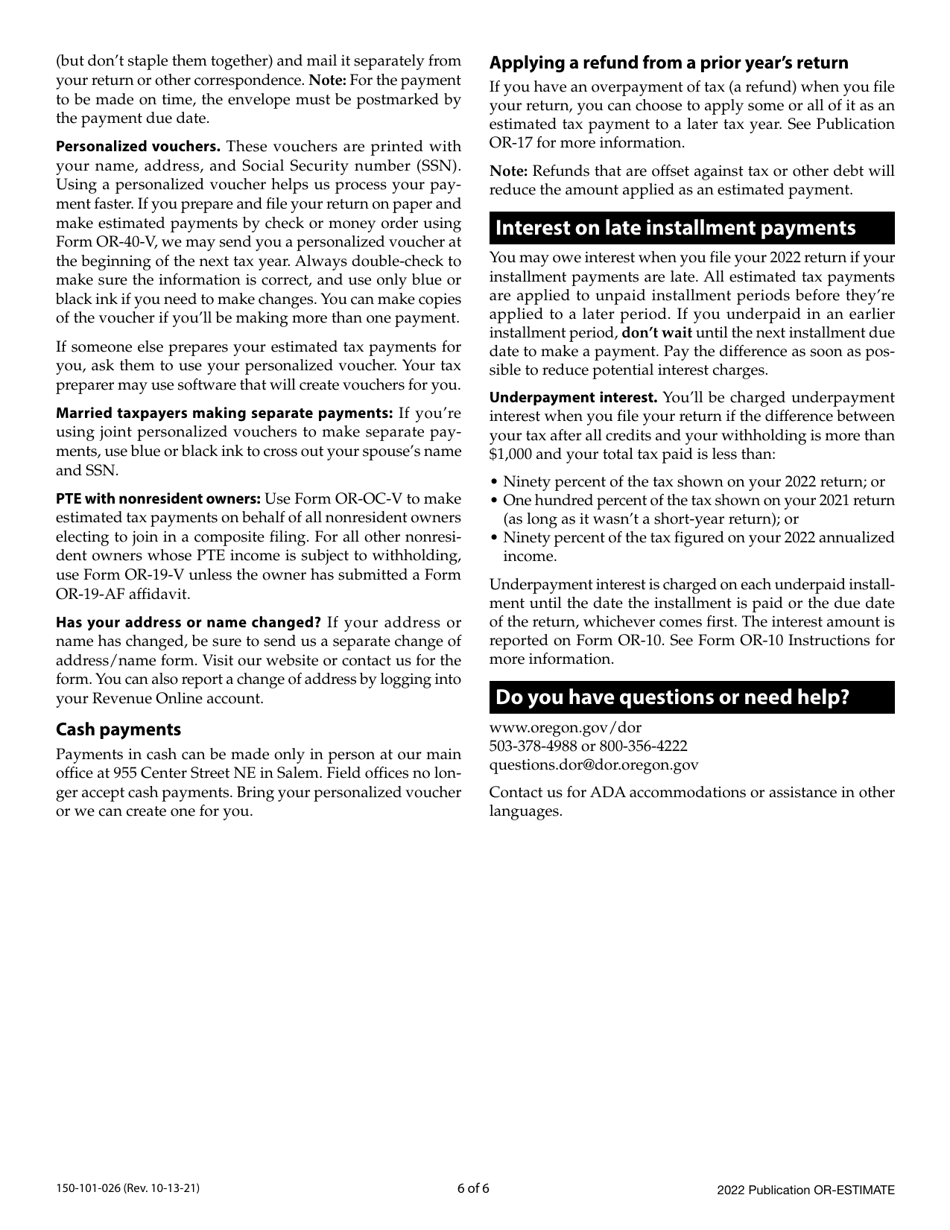

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

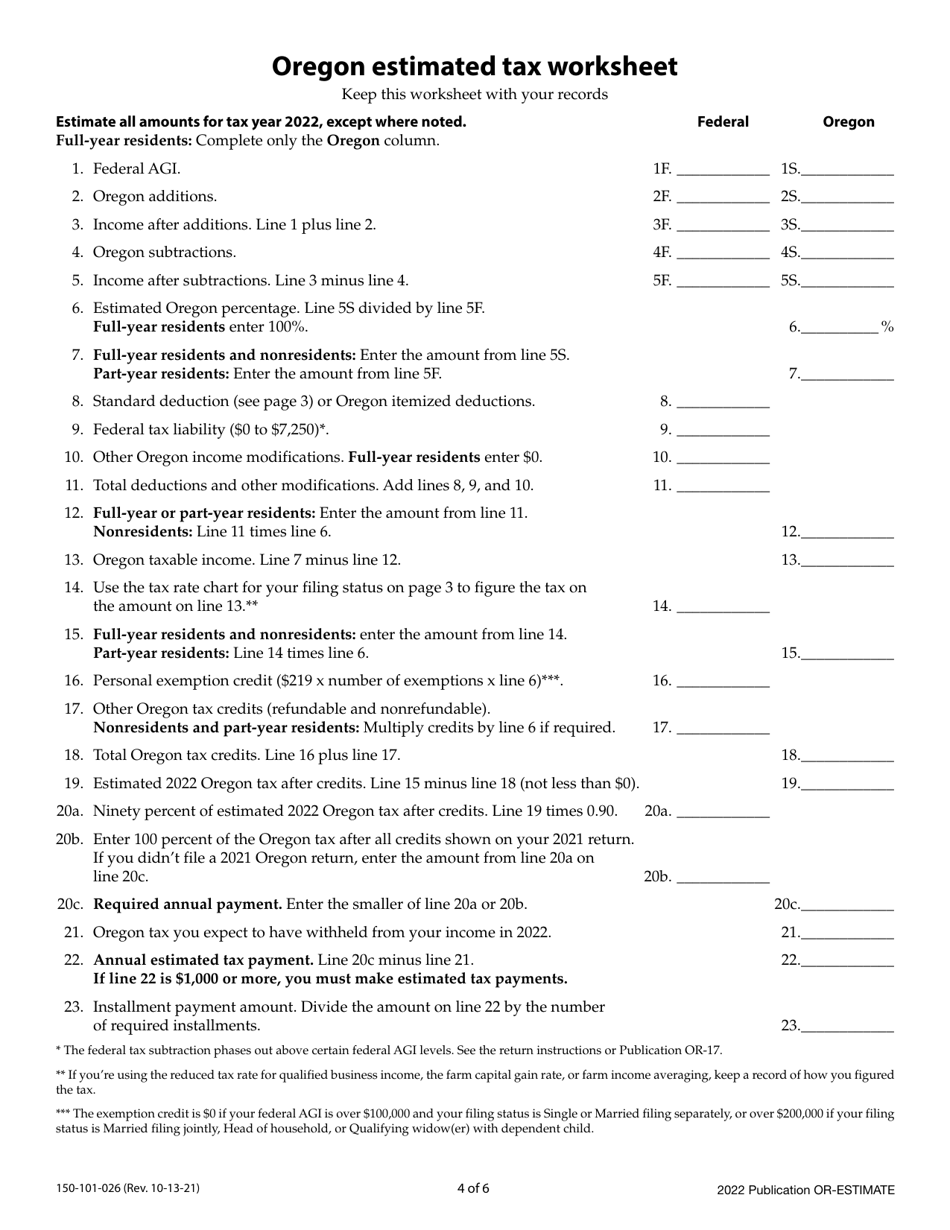

Q: What is Form OR-ESTIMATE (150-101-026)?

A: Form OR-ESTIMATE (150-101-026) is used to estimate and pay your Oregon state income tax.

Q: Who needs to file Form OR-ESTIMATE?

A: You need to file Form OR-ESTIMATE if you expect to owe more than a certain amount in Oregon state income tax.

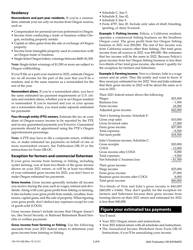

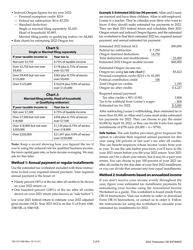

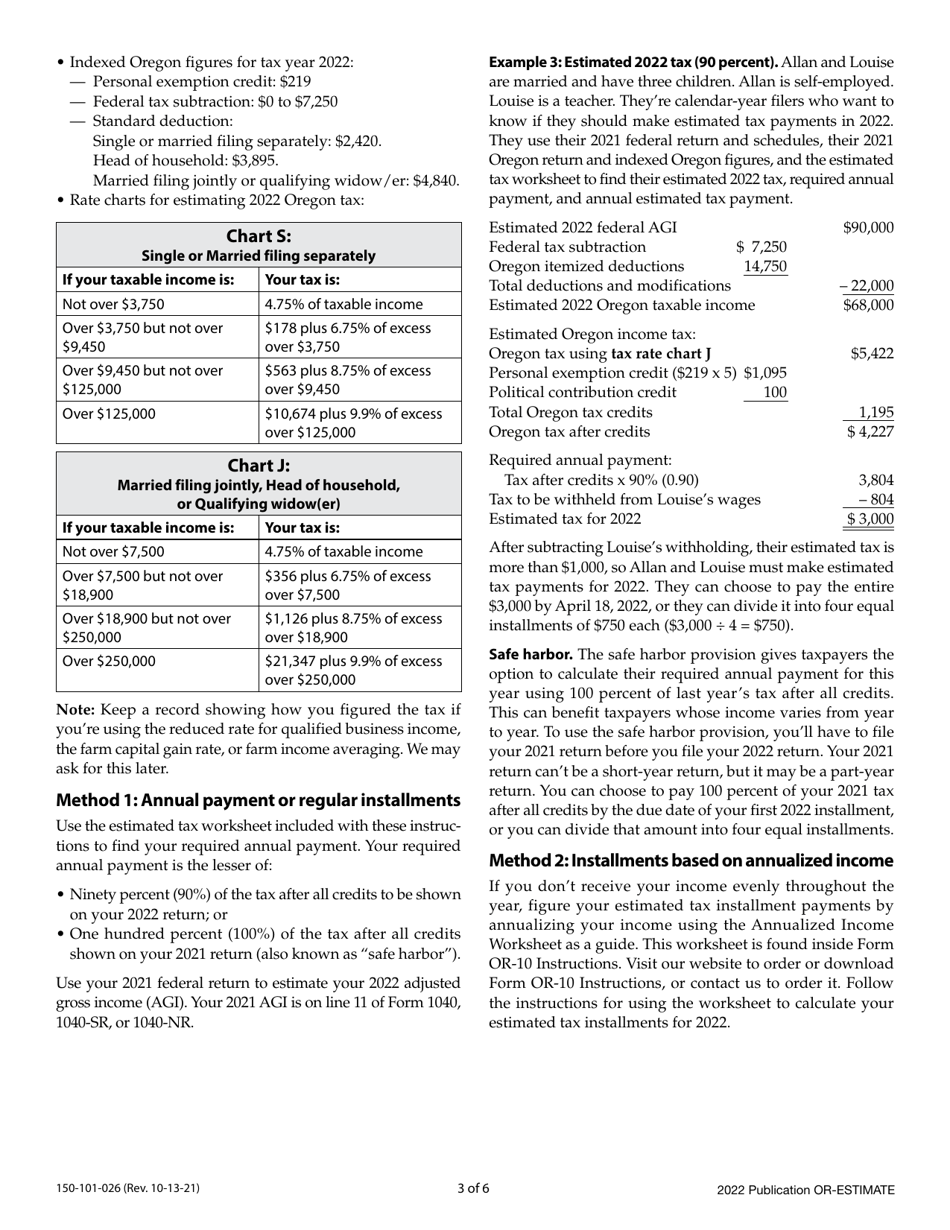

Q: How do I calculate the estimated income tax?

A: You can use the worksheet provided in the instructions to calculate your estimated income tax.

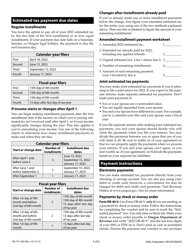

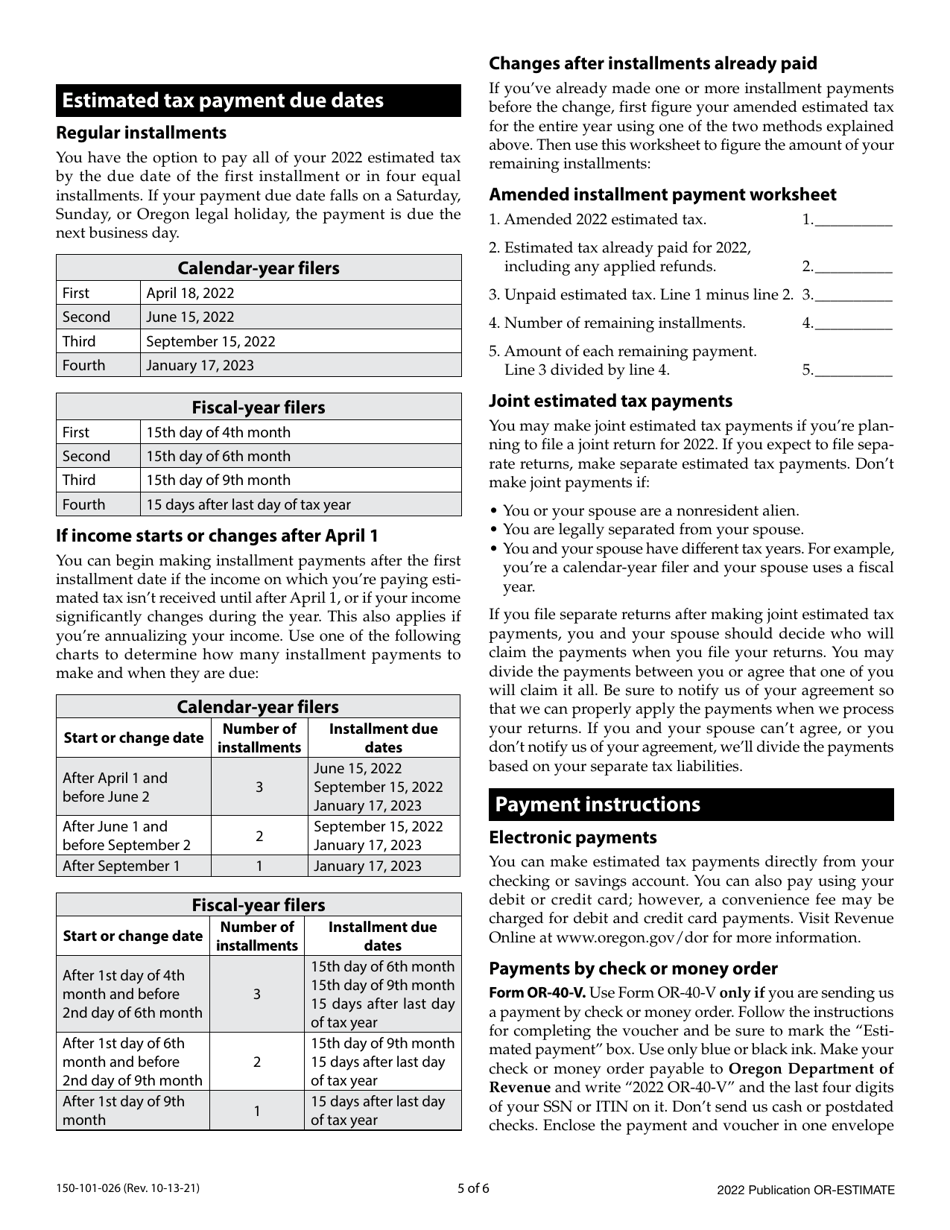

Q: When is the deadline to file Form OR-ESTIMATE?

A: The deadline to file Form OR-ESTIMATE is April 15th or the 15th day of the fourth month following the end of your tax year, whichever comes later.

Form Details:

- Released on October 13, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OR-ESTIMATE (150-101-026) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.