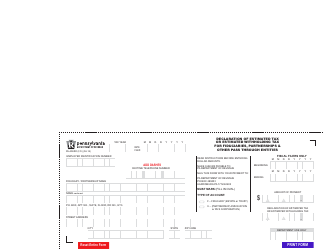

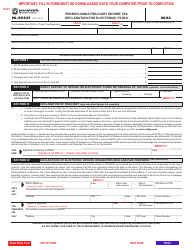

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form REV-414 (F), PA-41 ES (F)

for the current year.

Instructions for Form REV-414 (F), PA-41 ES (F) - Pennsylvania

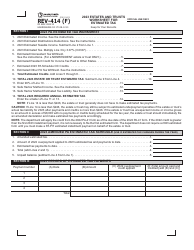

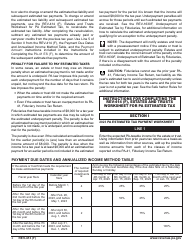

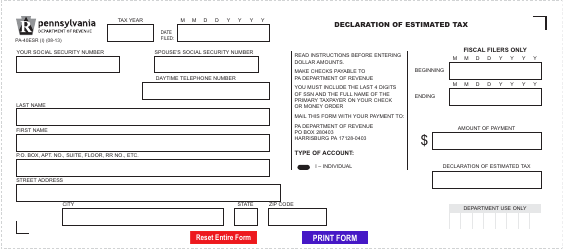

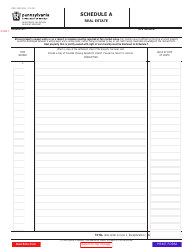

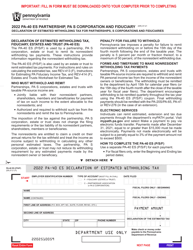

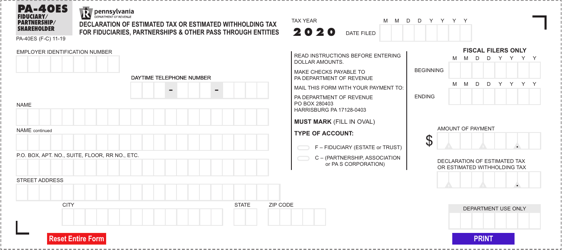

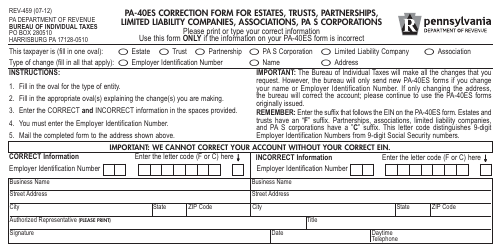

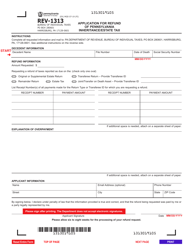

This document contains official instructions for Form REV-414 (F) , and Form PA-41 ES (F) . Both forms are released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-414 (F) is available for download through this link. The latest available Form PA-41 ES (F) can be downloaded through this link.

FAQ

Q: What is Form REV-414 (F)?

A: Form REV-414 (F) is a declaration of estimated personal income tax.

Q: What is PA-41 ES (F)?

A: PA-41 ES (F) is a declaration of estimated personal income tax for farmers.

Q: Who needs to file Form REV-414 (F)?

A: Individuals who need to make quarterly estimated tax payments in Pennsylvania.

Q: Who needs to file PA-41 ES (F)?

A: Farmers who need to make quarterly estimated tax payments in Pennsylvania.

Q: How often do I need to file Form REV-414 (F)?

A: Form REV-414 (F) should be filed quarterly.

Q: How often do I need to file PA-41 ES (F)?

A: PA-41 ES (F) should be filed quarterly.

Q: What is the purpose of Form REV-414 (F)?

A: The purpose of Form REV-414 (F) is to report and pay estimated personal income tax.

Q: What is the purpose of PA-41 ES (F)?

A: The purpose of PA-41 ES (F) is to report and pay estimated personal income tax for farmers.

Instruction Details:

- This 7-page document is available for download in PDF;

- Might not be applicable for the current year. Choose an older version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.