This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-41 ES (F)

for the current year.

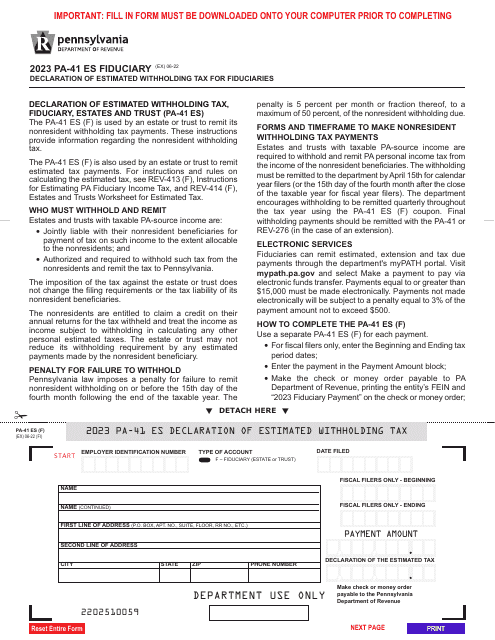

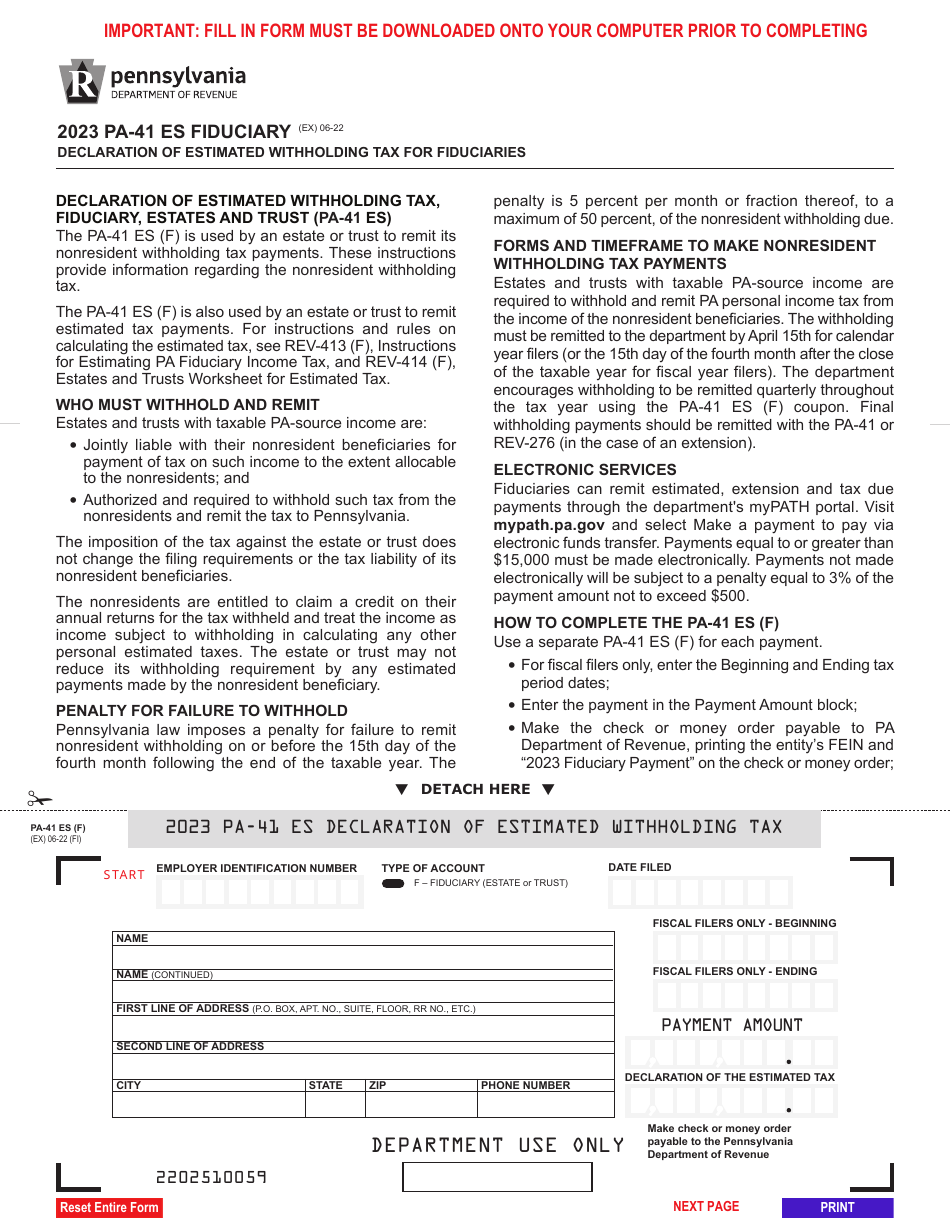

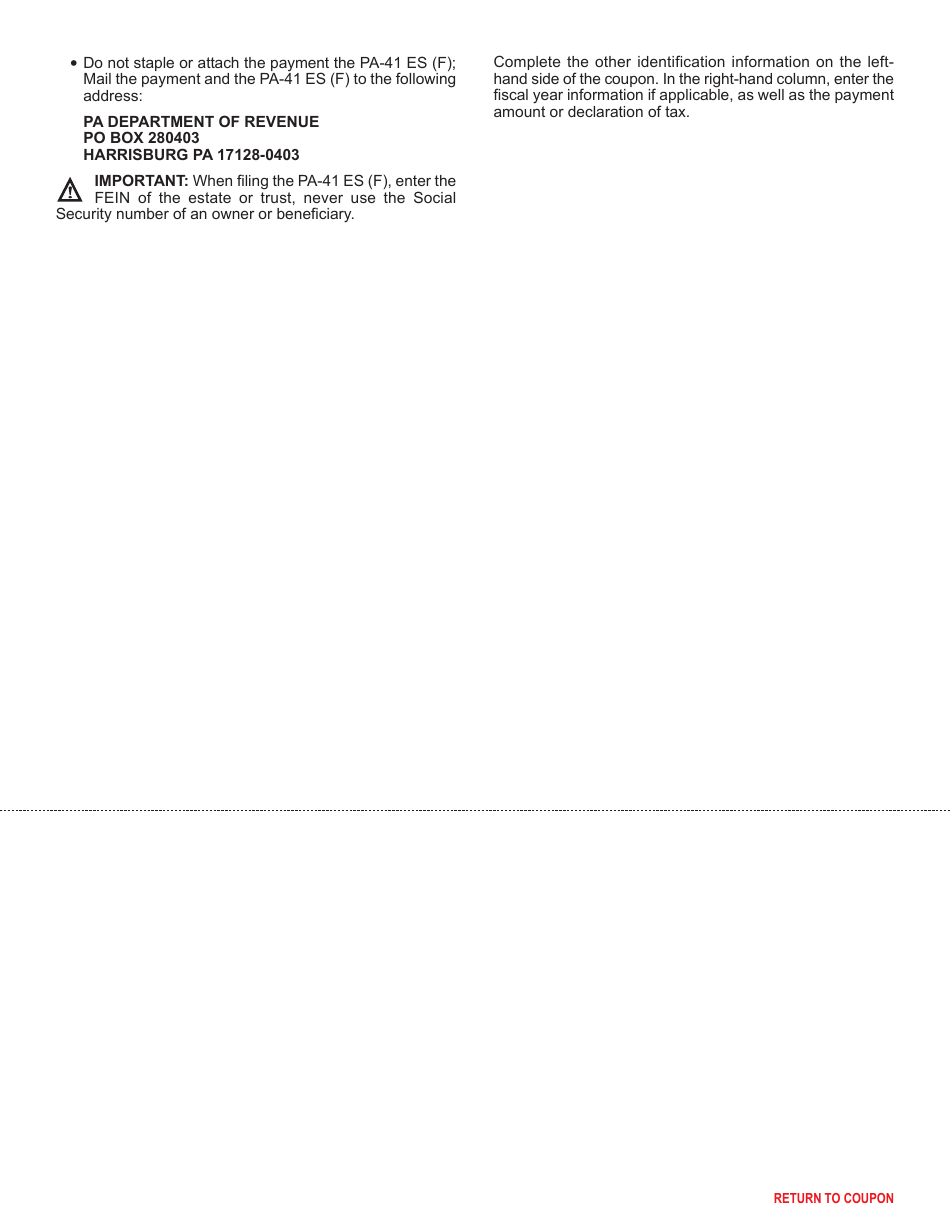

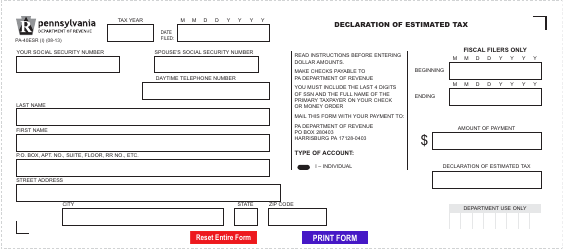

Form PA-41 ES (F) Declaration of Estimated Withholding Tax for Fiduciaries - Pennsylvania

What Is Form PA-41 ES (F)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

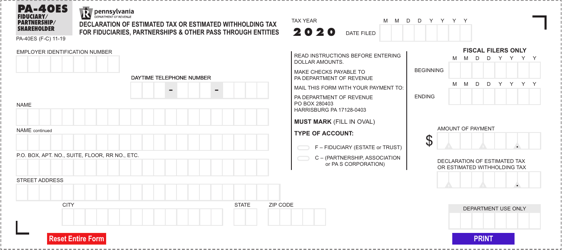

Q: What is Form PA-41 ES (F)?

A: Form PA-41 ES (F) is the Declaration of Estimated Withholding Tax for Fiduciaries in Pennsylvania.

Q: Who needs to file Form PA-41 ES (F)?

A: Fiduciaries in Pennsylvania who are required to withhold income tax from beneficiaries' distributions need to file Form PA-41 ES (F).

Q: What is the purpose of Form PA-41 ES (F)?

A: The purpose of Form PA-41 ES (F) is to report estimated withholding tax amounts for fiduciaries in Pennsylvania.

Q: When is the due date for filing Form PA-41 ES (F)?

A: Form PA-41 ES (F) is due on the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for not filing Form PA-41 ES (F)?

A: Yes, there are penalties for not filing or underpaying the estimated withholding tax. It is important to file the form on time to avoid penalties.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 ES (F) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.