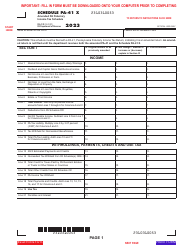

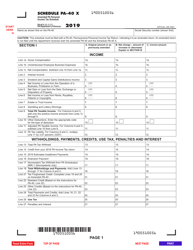

This version of the form is not currently in use and is provided for reference only. Download this version of

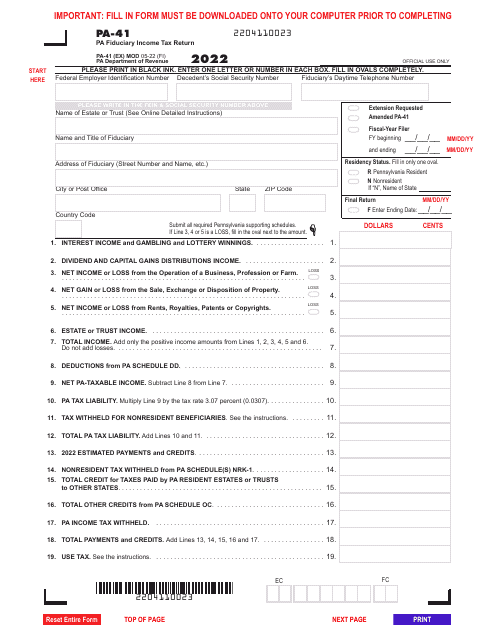

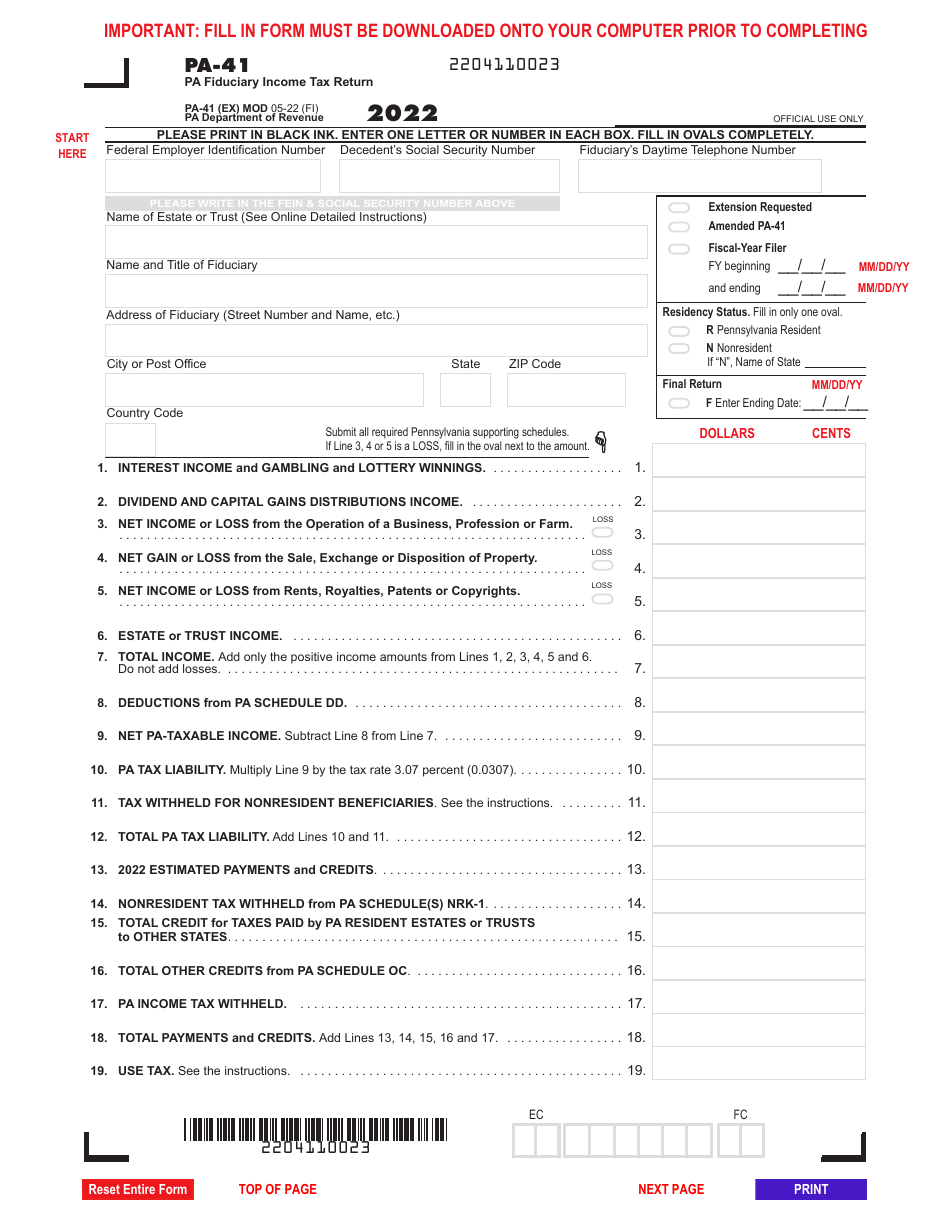

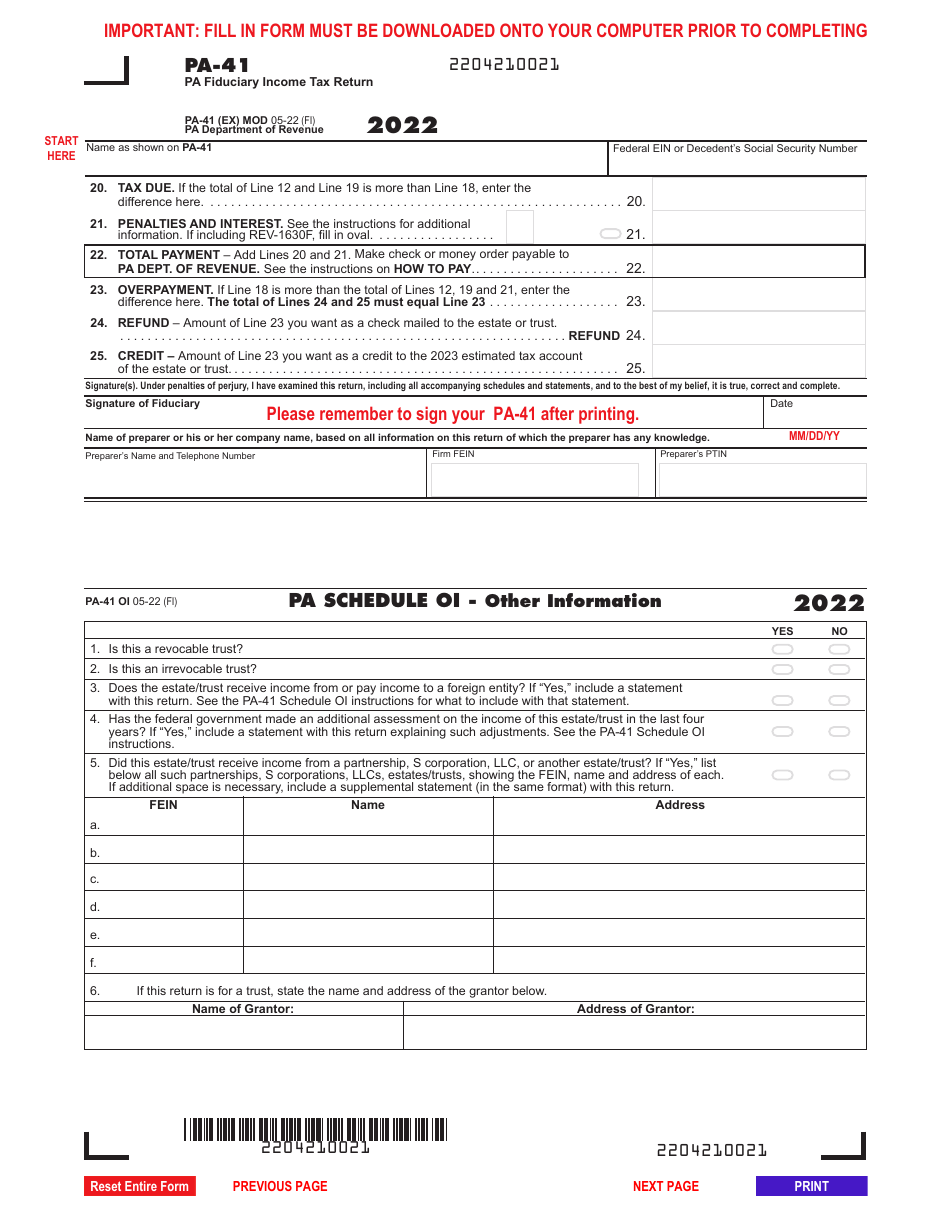

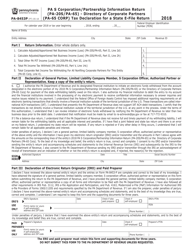

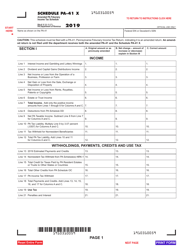

Form PA-41

for the current year.

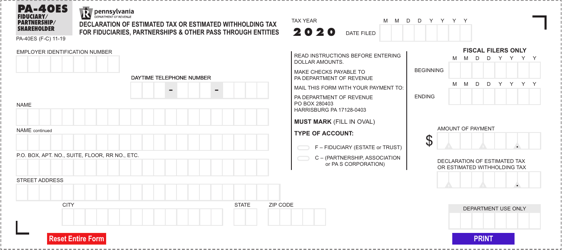

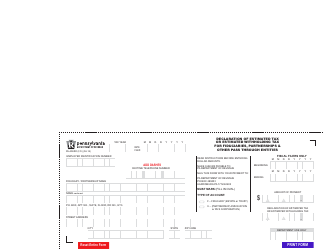

Form PA-41 Pa Fiduciary Income Tax Return - Pennsylvania

What Is Form PA-41?

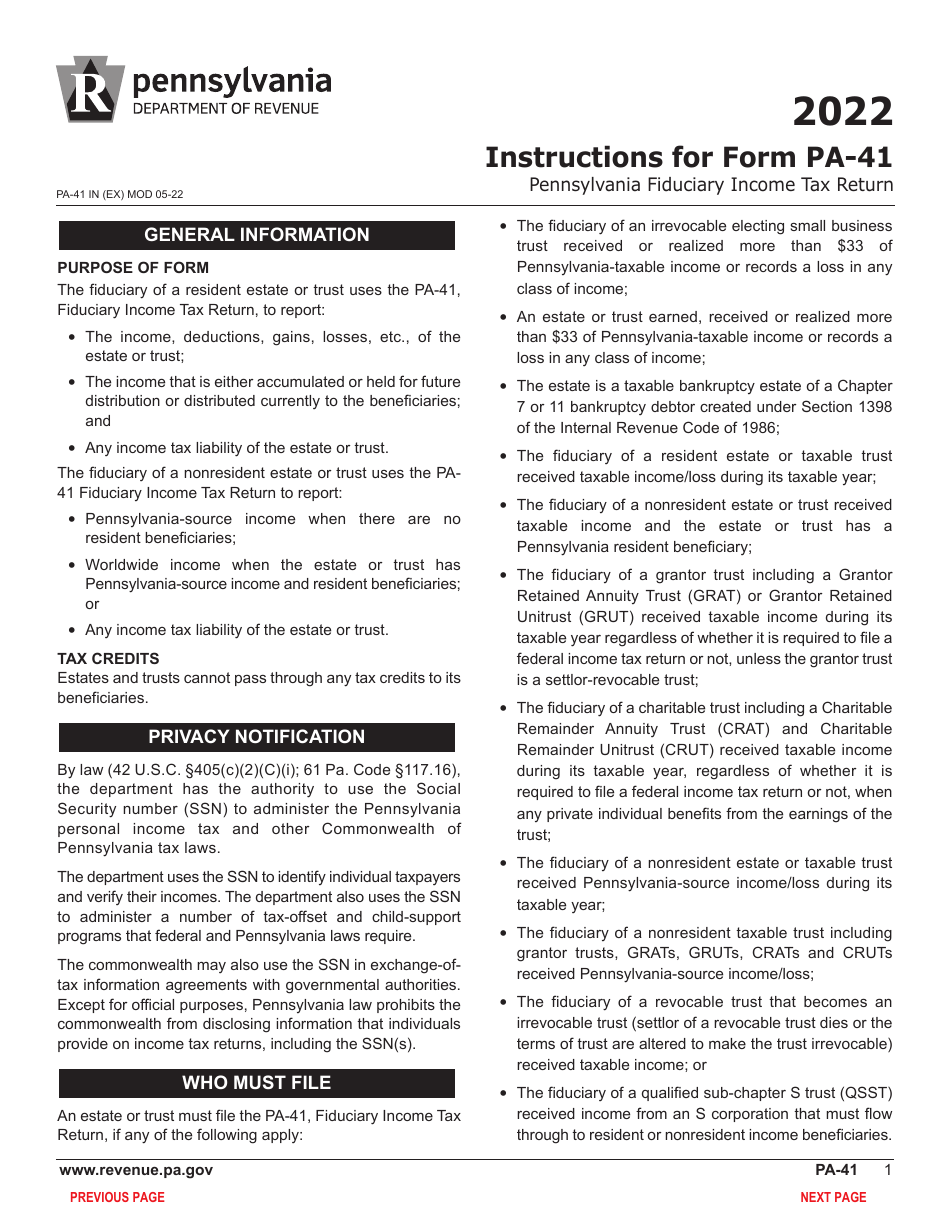

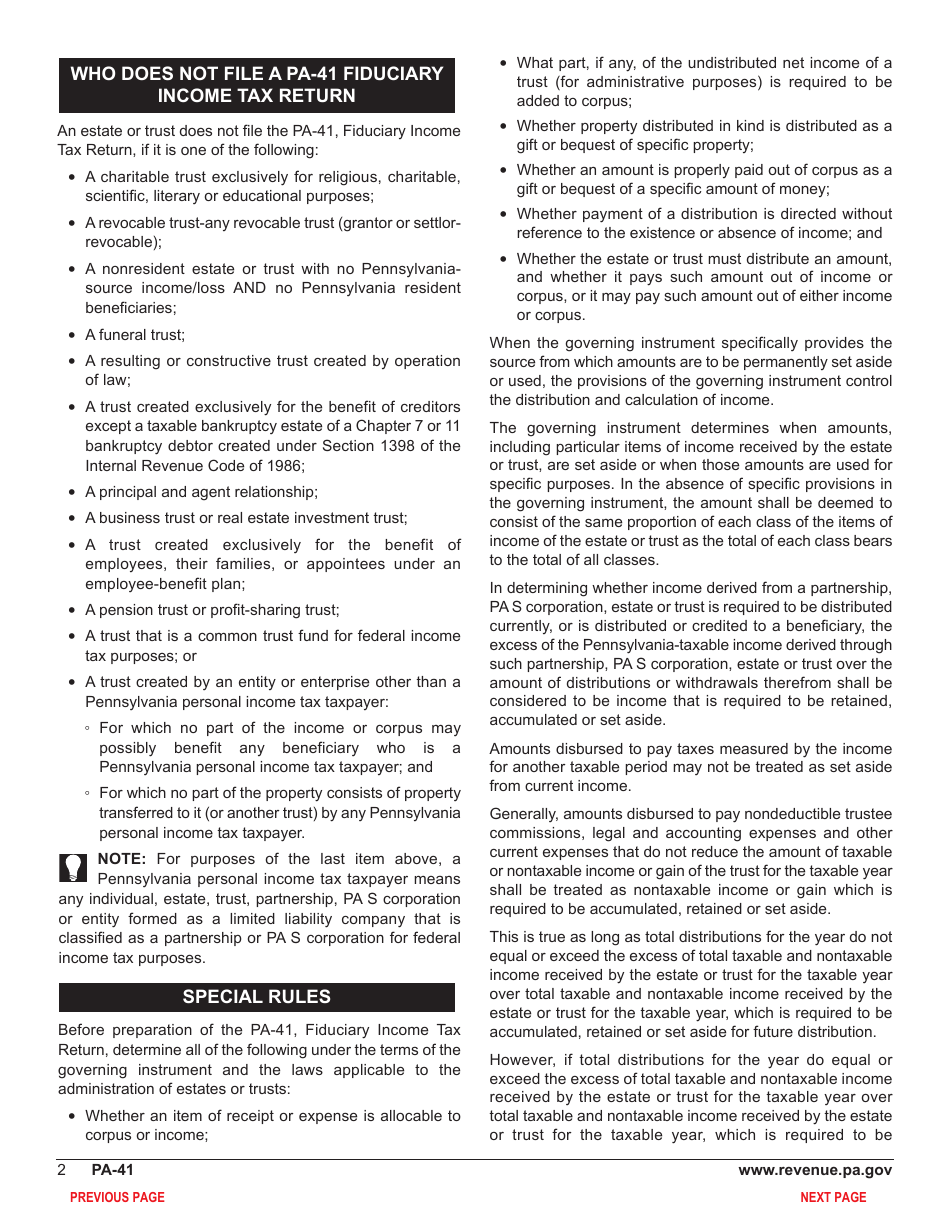

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PA-41?

A: Form PA-41 is the Pennsylvania Fiduciary Income Tax Return.

Q: What is a fiduciary?

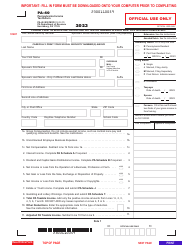

A: A fiduciary is a person or entity responsible for managing and distributing income or assets on behalf of others.

Q: Who should file Form PA-41?

A: Anyone who is a fiduciary for an estate or trust in Pennsylvania should file Form PA-41.

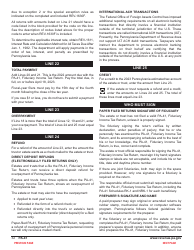

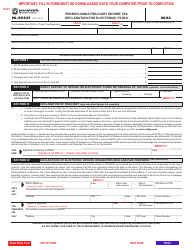

Q: When is Form PA-41 due?

A: The due date for Form PA-41 is the same as the federal due date for Form 1041, which is the 15th day of the 4th month following the close of the tax year.

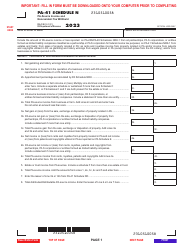

Q: What information do I need to complete Form PA-41?

A: You will need information about the estate or trust, including income and expenses, as well as any beneficiaries.

Q: Are there any special instructions for filing Form PA-41?

A: Yes, there are specific instructions provided by the Pennsylvania Department of Revenue that you should follow when completing Form PA-41.

Q: What if I need an extension to file Form PA-41?

A: You can request an extension to file Form PA-41 by filing Form REV-276, Application for Extension of Time to File.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.