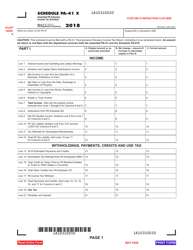

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form PA-41 Schedule OI

for the current year.

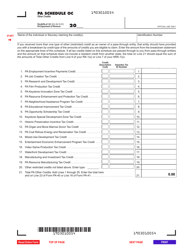

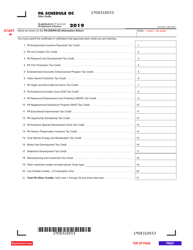

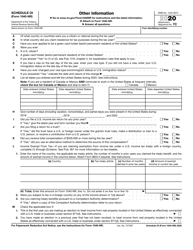

Instructions for Form PA-41 Schedule OI Other Information - Pennsylvania

This document contains official instructions for Form PA-41 Schedule OI, Other Information - a form released and collected by the Pennsylvania Department of Revenue.

FAQ

Q: What is Form PA-41 Schedule OI?

A: Form PA-41 Schedule OI is a supplemental form used in Pennsylvania for providing additional information related to your income tax return.

Q: When should I use Form PA-41 Schedule OI?

A: You should use Form PA-41 Schedule OI when you need to provide additional information that is not covered by other schedules or forms.

Q: What kind of information should I include on Form PA-41 Schedule OI?

A: You should include any additional details or explanations that are necessary to provide a clear and accurate representation of your income tax situation.

Q: Do I need to submit Form PA-41 Schedule OI along with my income tax return?

A: Yes, if you have any applicable information to report, you should submit Form PA-41 Schedule OI along with your income tax return.

Q: Are there any specific instructions for completing Form PA-41 Schedule OI?

A: Yes, you should carefully follow the instructions provided on the form to ensure that you provide the required information correctly.

Q: Can I attach additional pages to Form PA-41 Schedule OI if I need more space?

A: Yes, you can attach additional pages to Form PA-41 Schedule OI if you need more space to provide the required information.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.