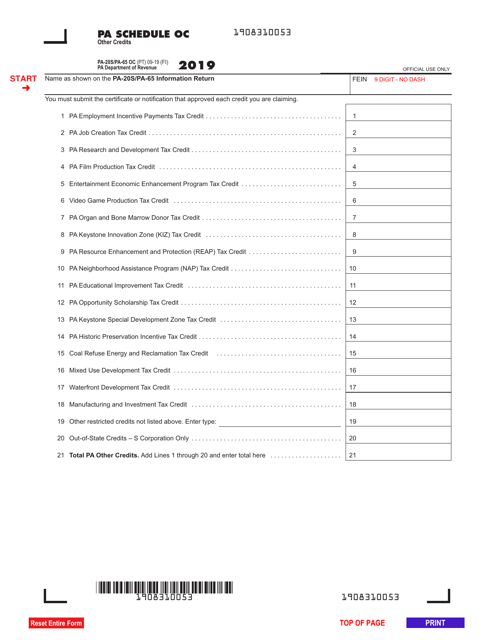

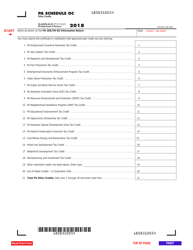

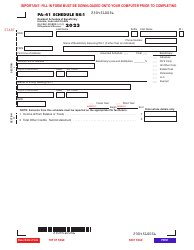

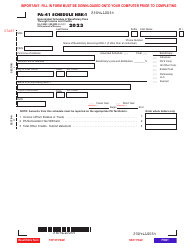

Form PA-20S (PA-65) Schedule OC Other Credits - Pennsylvania

What Is Form PA-20S (PA-65) Schedule OC?

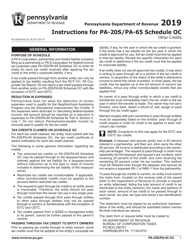

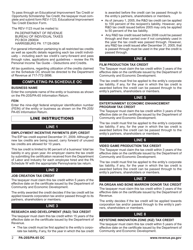

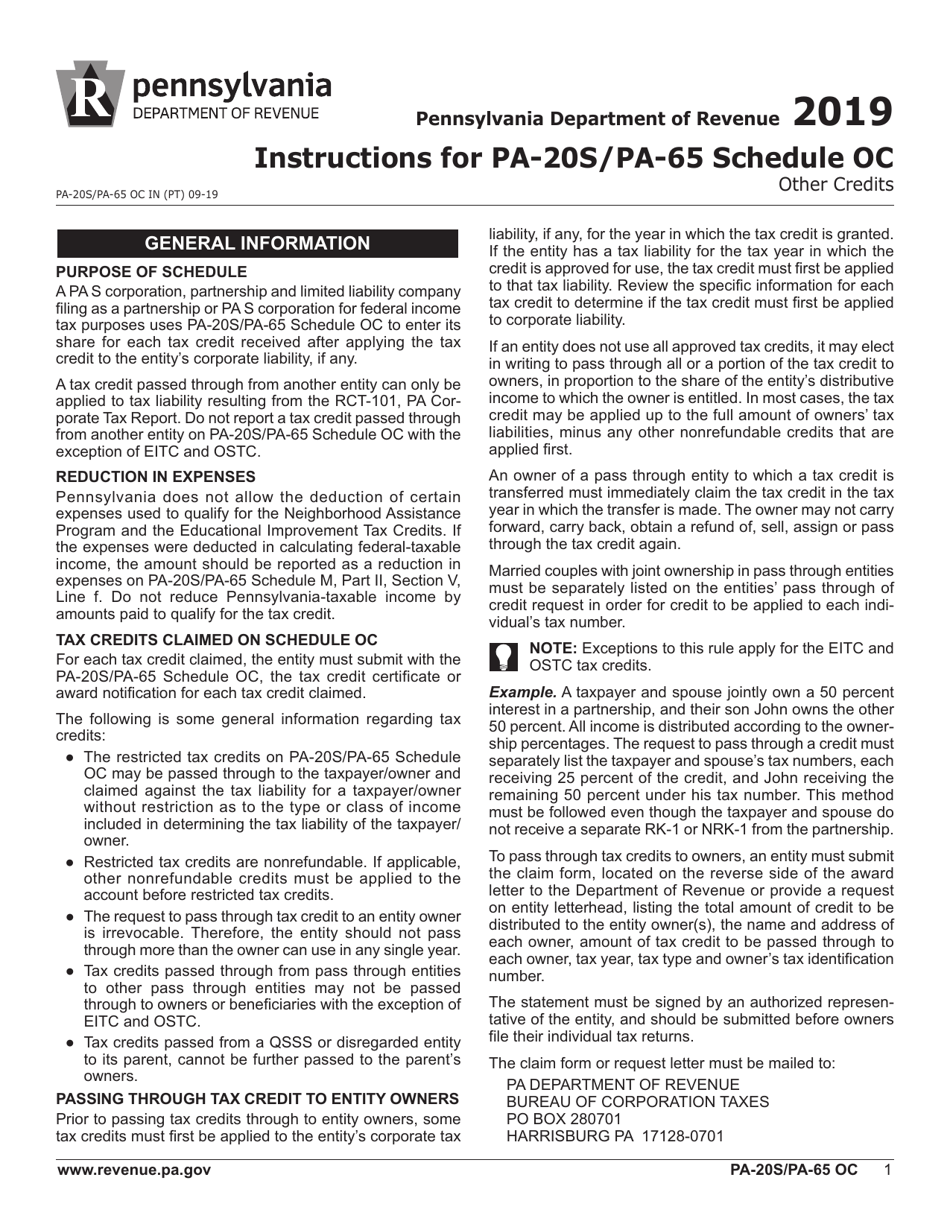

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

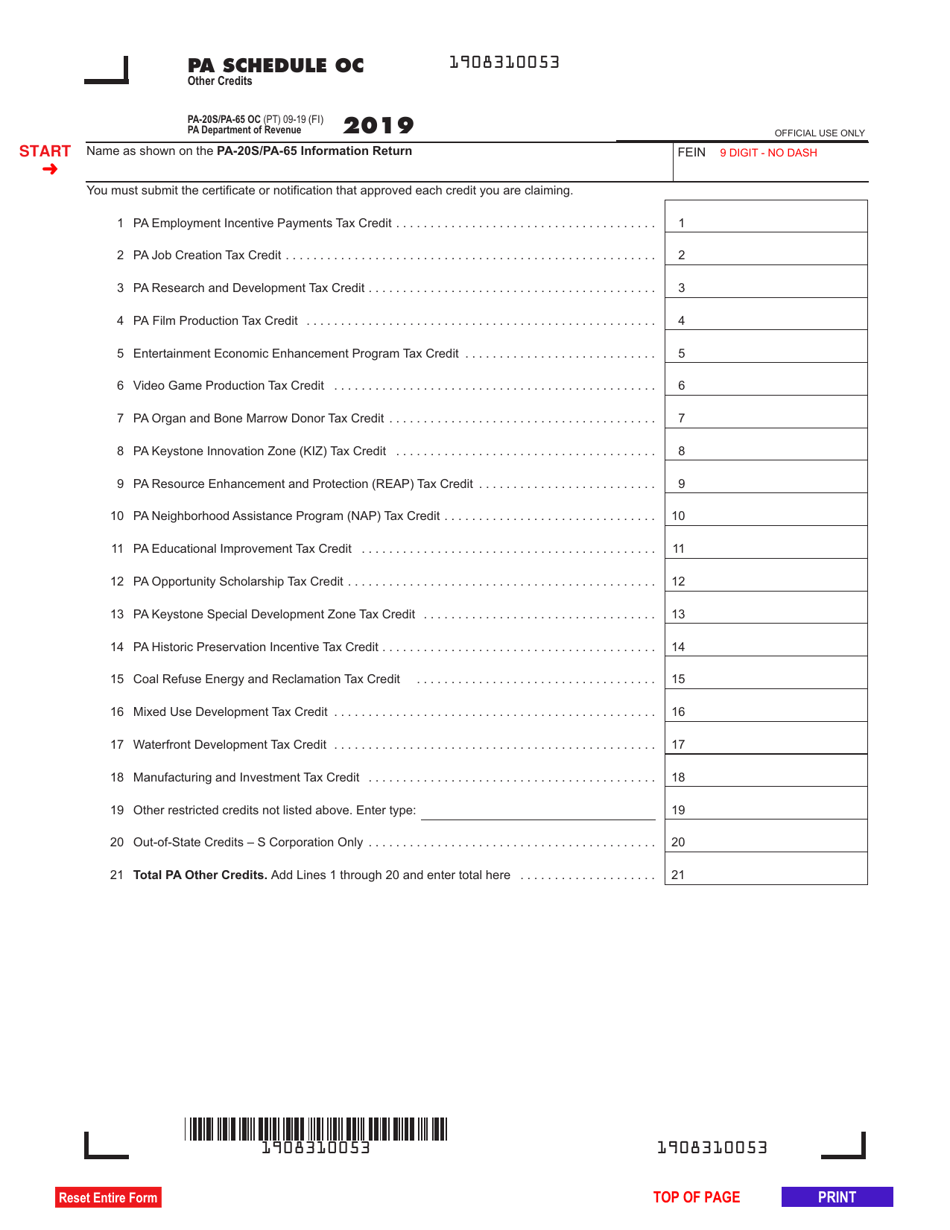

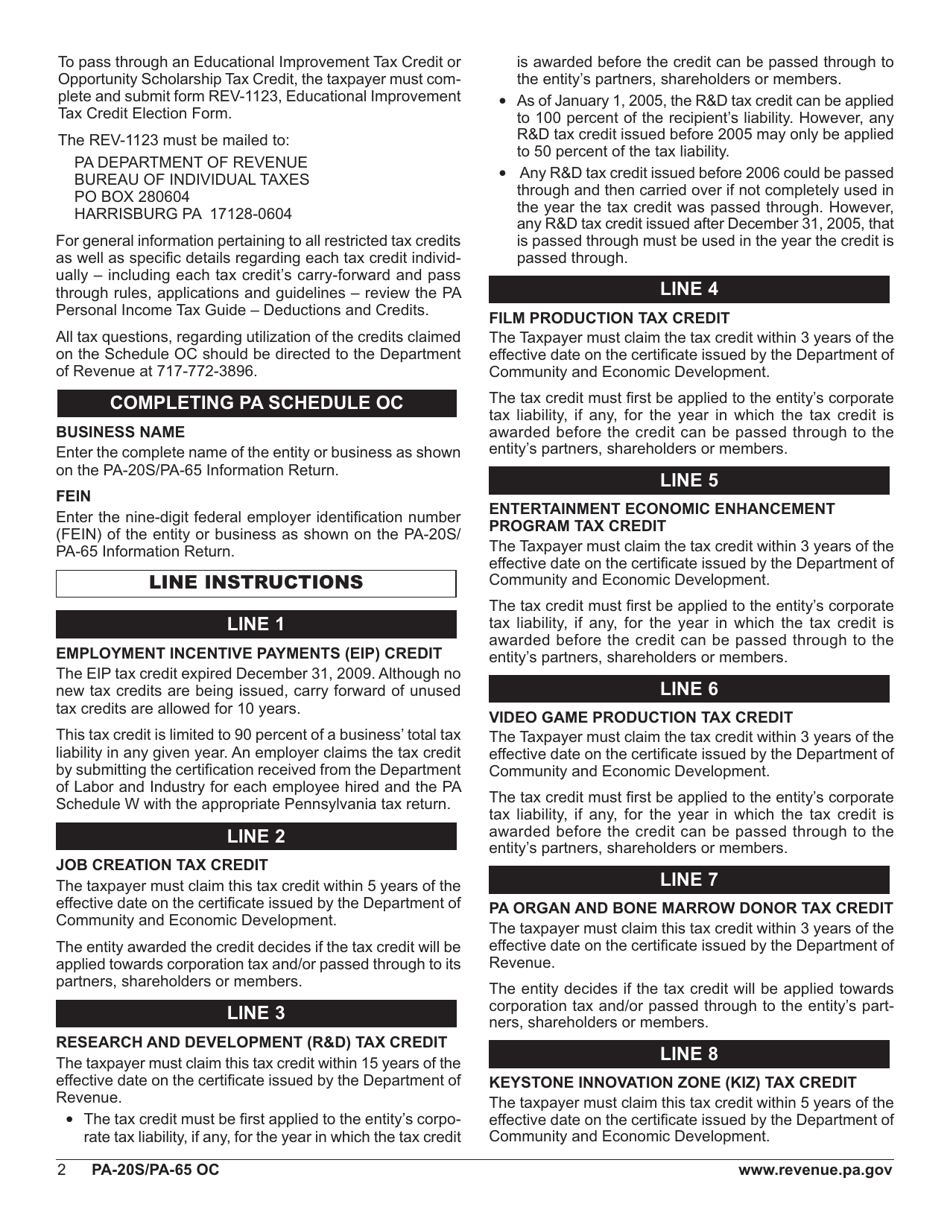

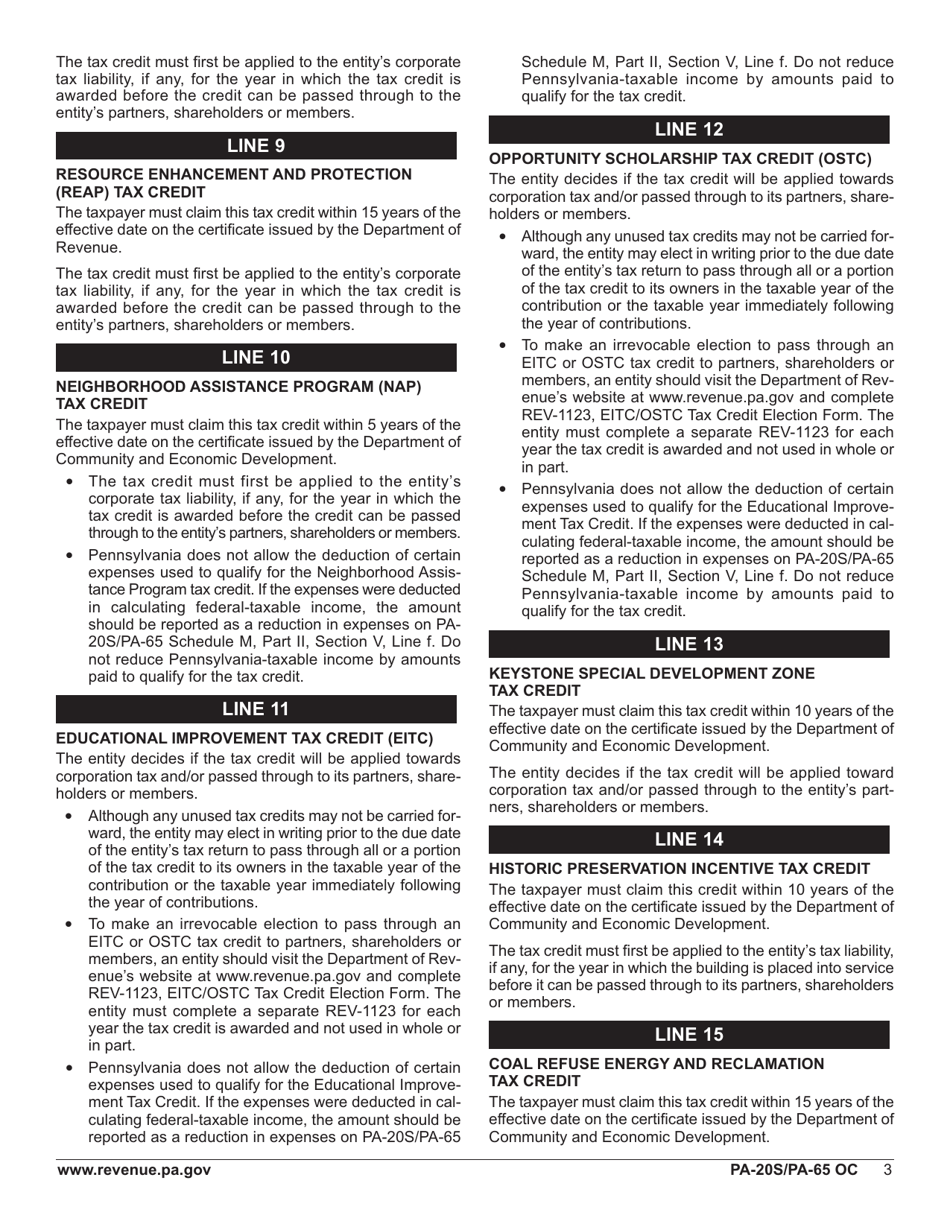

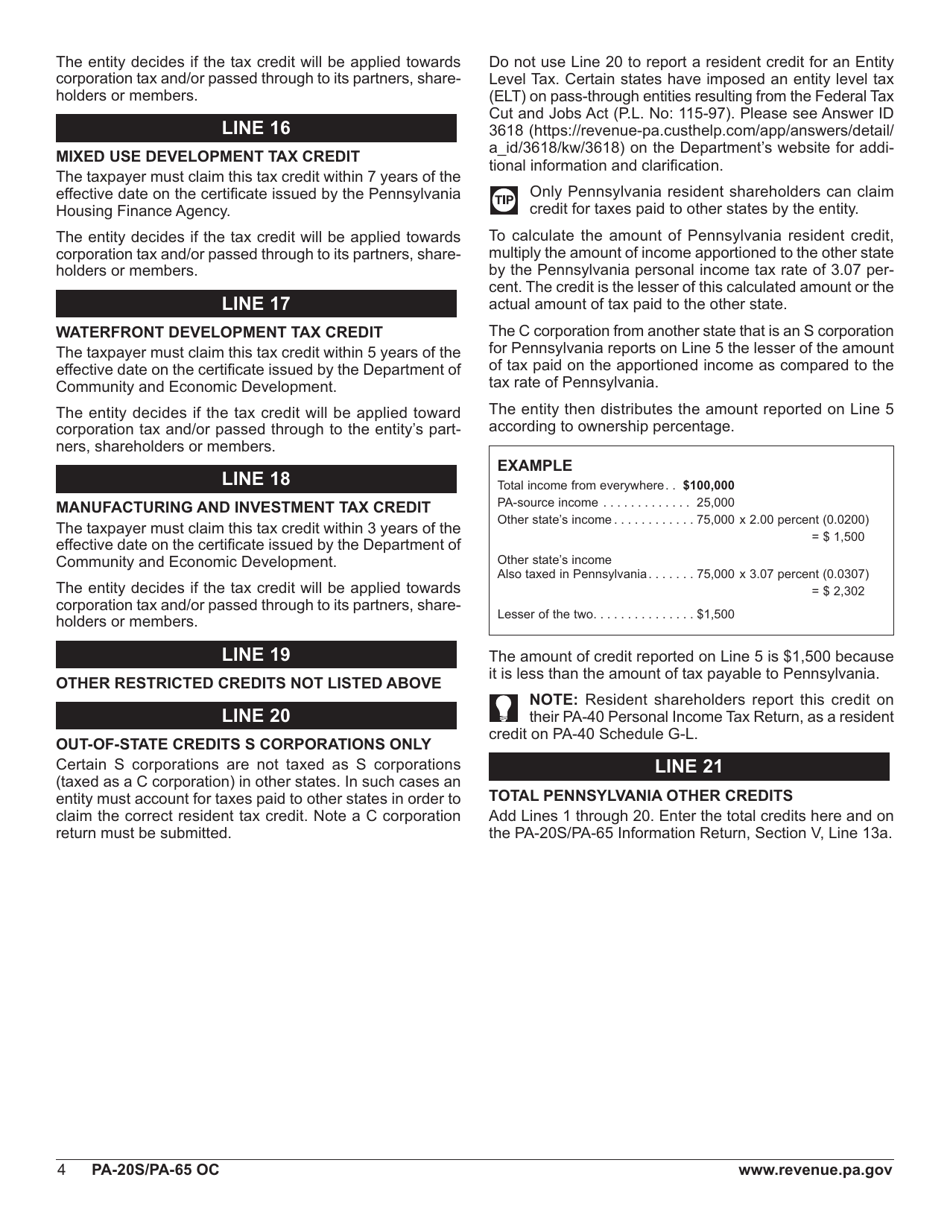

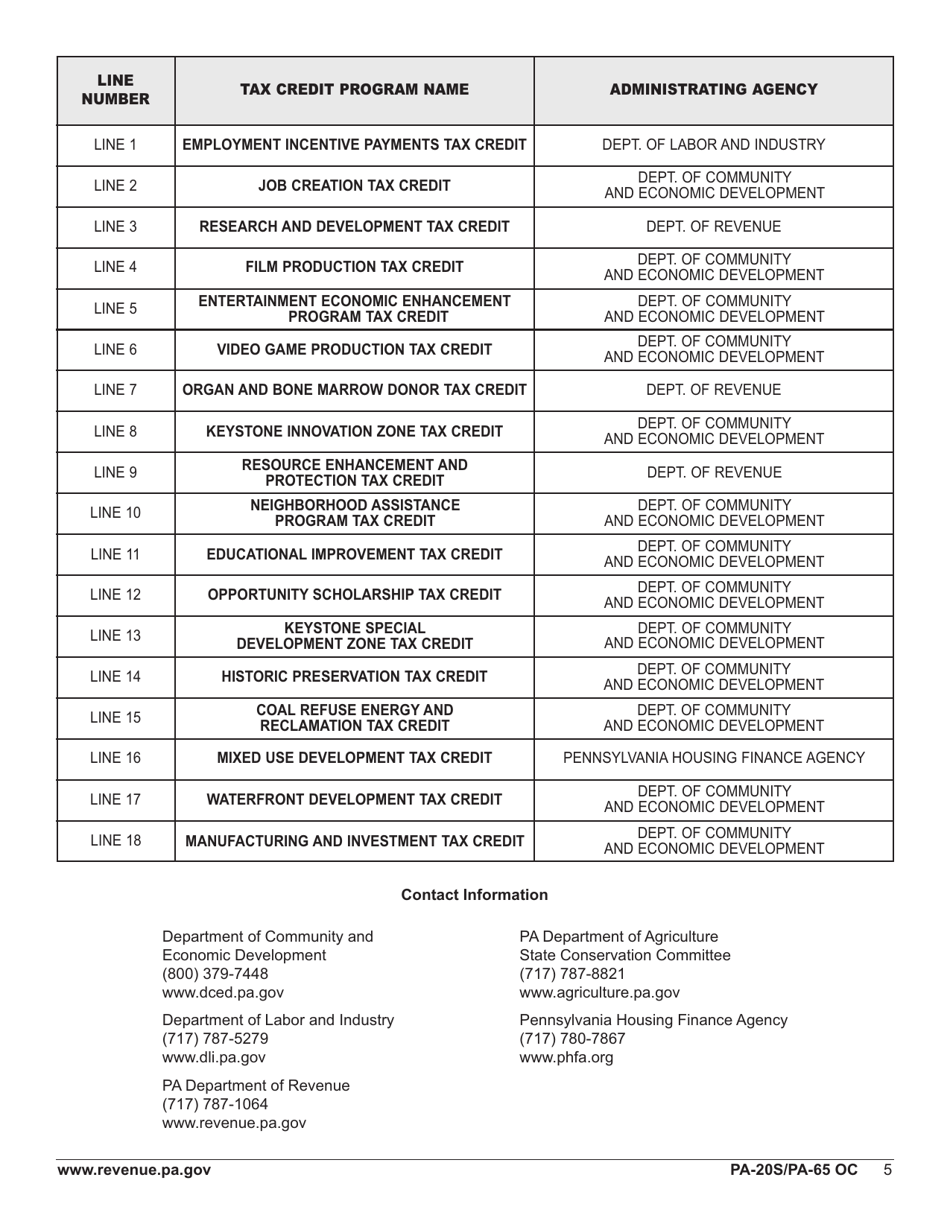

Q: What is Form PA-20S (PA-65) Schedule OC?

A: Form PA-20S (PA-65) Schedule OC is a form used to report other credits for Pennsylvania state tax purposes.

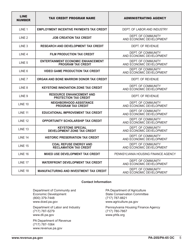

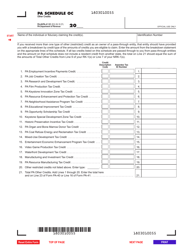

Q: What are other credits on Form PA-20S (PA-65) Schedule OC?

A: Other credits on Form PA-20S (PA-65) Schedule OC include various tax credits that may be available to businesses in Pennsylvania.

Q: Who needs to file Form PA-20S (PA-65) Schedule OC?

A: Businesses that qualify for certain tax credits in Pennsylvania need to file Form PA-20S (PA-65) Schedule OC to claim those credits.

Q: What information do I need to complete Form PA-20S (PA-65) Schedule OC?

A: You will need information about the tax credits you qualify for, including any documentation or supporting evidence required by the Pennsylvania Department of Revenue.

Q: When is the deadline to file Form PA-20S (PA-65) Schedule OC?

A: The deadline to file Form PA-20S (PA-65) Schedule OC corresponds with the deadline for filing your Pennsylvania state tax return, which is typically April 15th.

Q: Are there any penalties for not filing Form PA-20S (PA-65) Schedule OC?

A: If you are eligible for tax credits and do not file Form PA-20S (PA-65) Schedule OC to claim them, you may miss out on potential tax savings.

Q: Can I amend Form PA-20S (PA-65) Schedule OC?

A: Yes, you can amend Form PA-20S (PA-65) Schedule OC if you discover errors or omissions in your original filing. You will need to file an amended return and include the corrected Schedule OC.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65) Schedule OC by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.