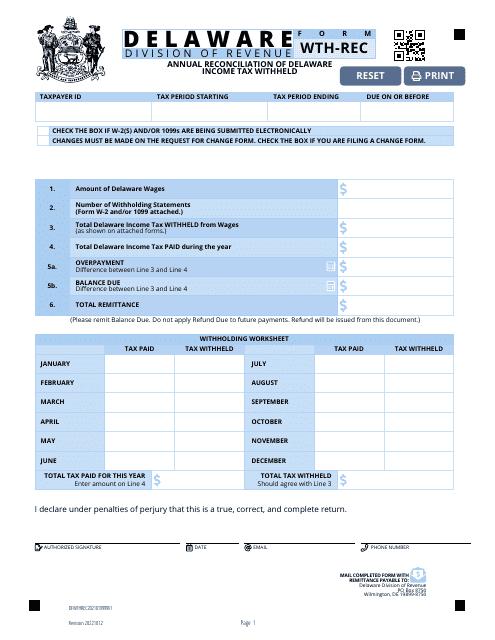

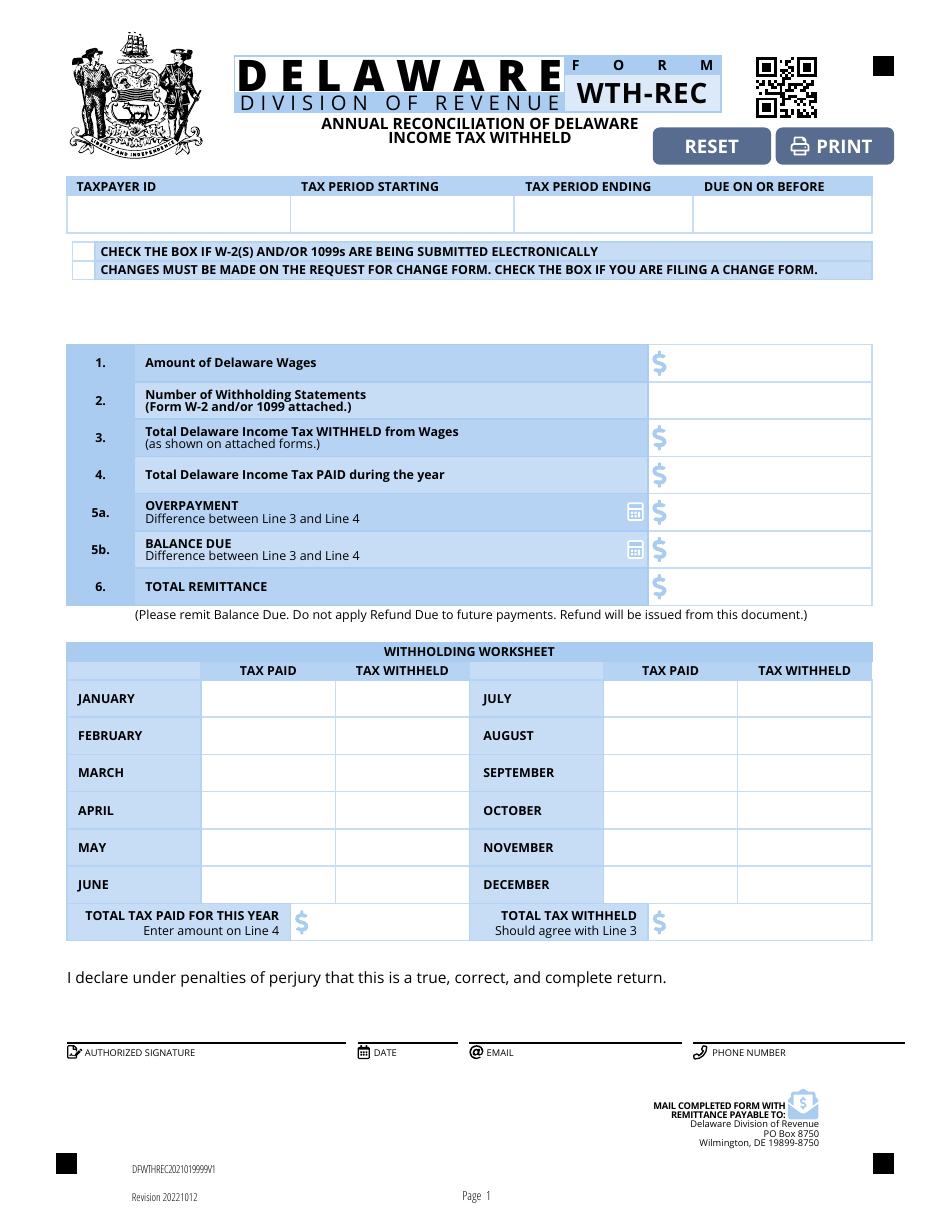

Form WTH-REC Annual Reconciliation of Delaware Income Tax Withheld - Delaware

What Is Form WTH-REC?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form WTH-REC?

A: Form WTH-REC is the Annual Reconciliation of Delaware Income Tax Withheld.

Q: Who needs to file Form WTH-REC?

A: Employers who withhold Delaware income tax from their employees' wages need to file Form WTH-REC.

Q: What is the purpose of filing Form WTH-REC?

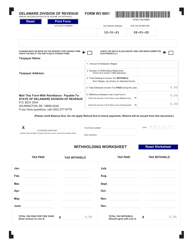

A: The purpose of filing Form WTH-REC is to reconcile the amount of Delaware income tax withheld from employees' wages and the total amount of Delaware income tax deposits made.

Q: When is Form WTH-REC due?

A: Form WTH-REC is due on or before February 20th of the year following the tax year.

Q: Is Form WTH-REC only for employers?

A: Yes, Form WTH-REC is specifically for employers who withhold Delaware income tax from their employees' wages.

Form Details:

- Released on October 12, 2022;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WTH-REC by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.