This version of the form is not currently in use and is provided for reference only. Download this version of

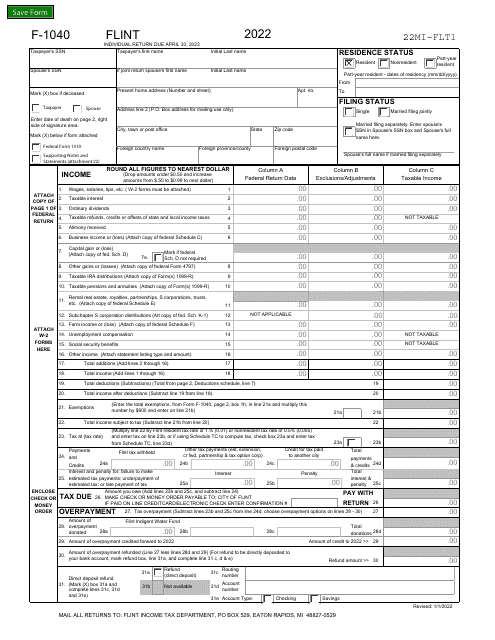

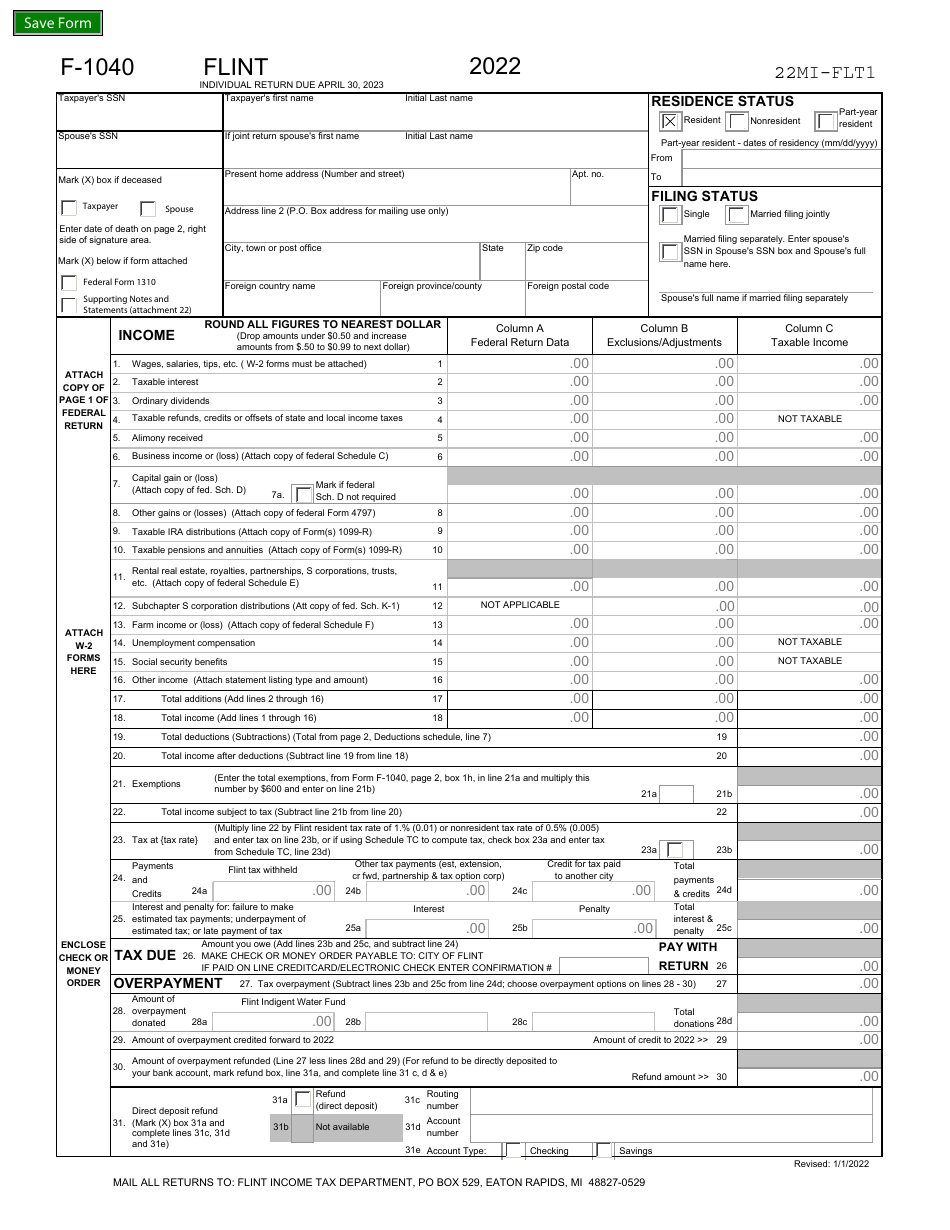

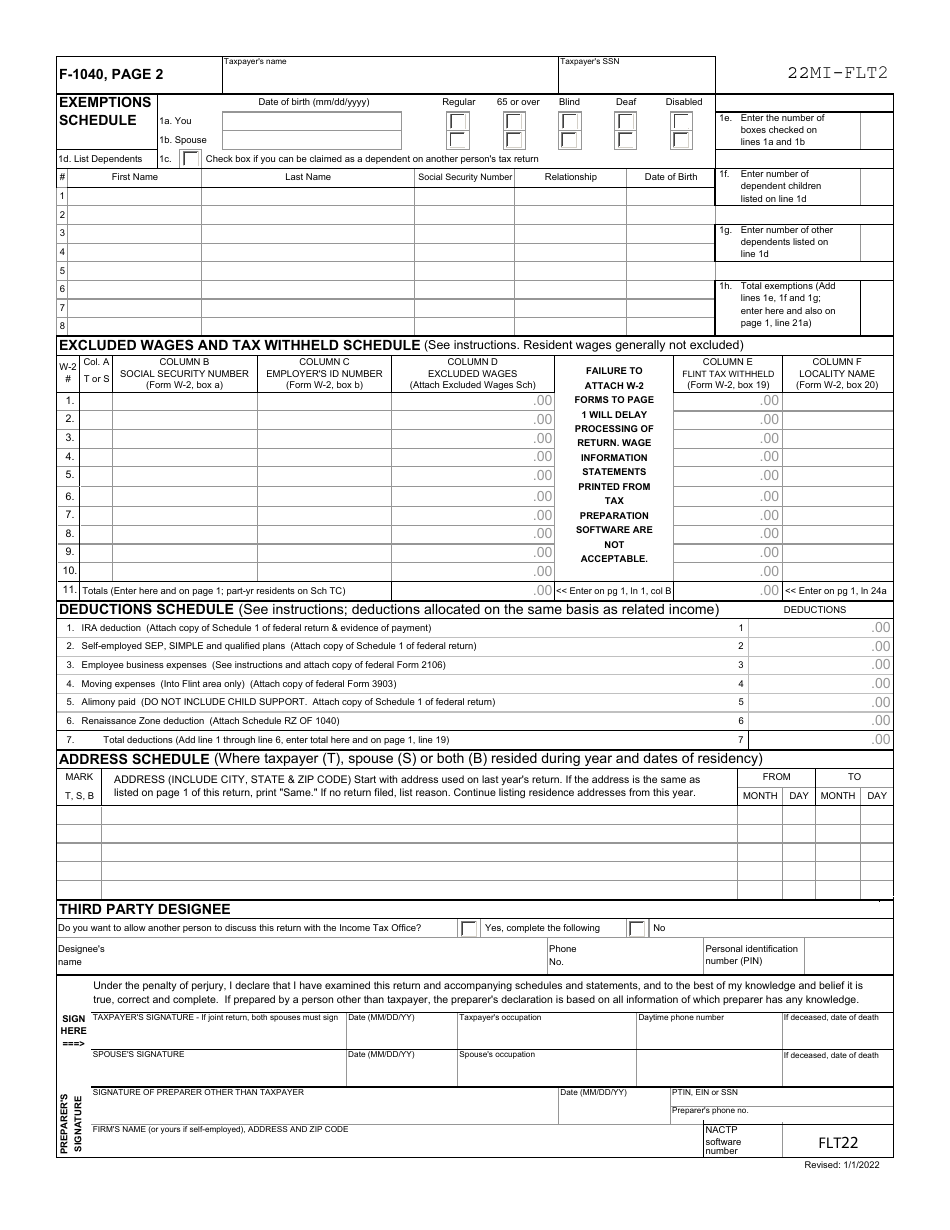

Form F-1040

for the current year.

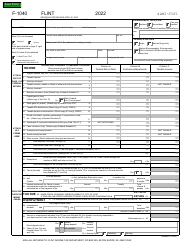

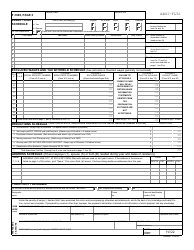

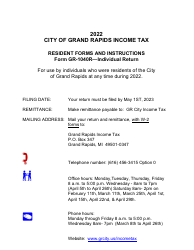

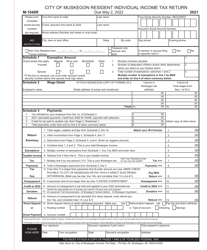

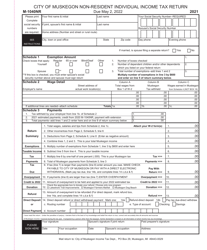

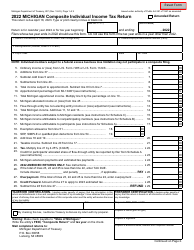

Form F-1040 Individual Income Tax Return - City of Flint, Michigan

What Is Form F-1040?

This is a legal form that was released by the Income Tax Department - City of Flint, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Flint. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form F-1040?

A: Form F-1040 is the Individual Income Tax Return form for US residents.

Q: Why is there a specific mention of City of Flint, Michigan?

A: The specific mention of City of Flint, Michigan may be relevant to the document due to specific tax requirements or considerations for residents of Flint.

Q: Who needs to file Form F-1040?

A: US residents who meet certain income and filing status requirements need to file Form F-1040 to report their income and calculate their tax liability.

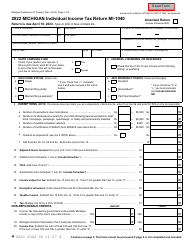

Q: What should be reported on Form F-1040?

A: Form F-1040 is used to report various types of income, deductions, and credits to determine the taxpayer's overall tax liability.

Q: Is Form F-1040 specific to residents of Flint, Michigan?

A: No, Form F-1040 is a general form used by all US residents to report their income and calculate their tax liability. The mention of City of Flint, Michigan may indicate specific tax considerations for residents of Flint.

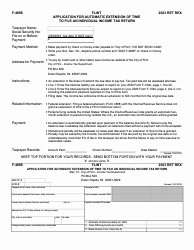

Q: What other forms may be required in addition to Form F-1040?

A: Depending on the individual's financial situation, additional forms such as Schedule A (Itemized Deductions) or Schedule C (Profit or Loss from Business) may be required to be filed along with Form F-1040.

Q: Are there any specific tax incentives or credits for residents of Flint, Michigan?

A: There may be specific tax incentives or credits available to residents of Flint, Michigan. It is recommended to consult with a tax professional or refer to the official IRS guidelines for more information.

Q: When is the deadline to file Form F-1040?

A: The deadline to file Form F-1040 is typically on or around April 15th of each year. However, this deadline can be extended in certain circumstances or if the taxpayer files for an extension.

Q: What happens if I don't file Form F-1040?

A: Failure to file Form F-1040 and pay any taxes owed by the deadline may result in penalties and interest charges imposed by the IRS.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Income Tax Department - City of Flint, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-1040 by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Flint, Michigan.