This version of the form is not currently in use and is provided for reference only. Download this version of

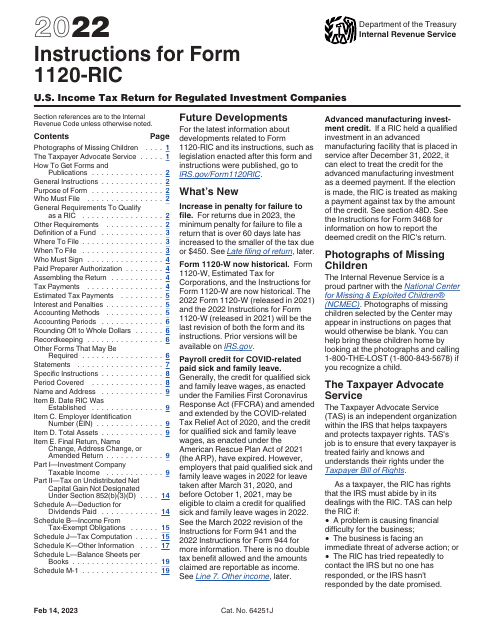

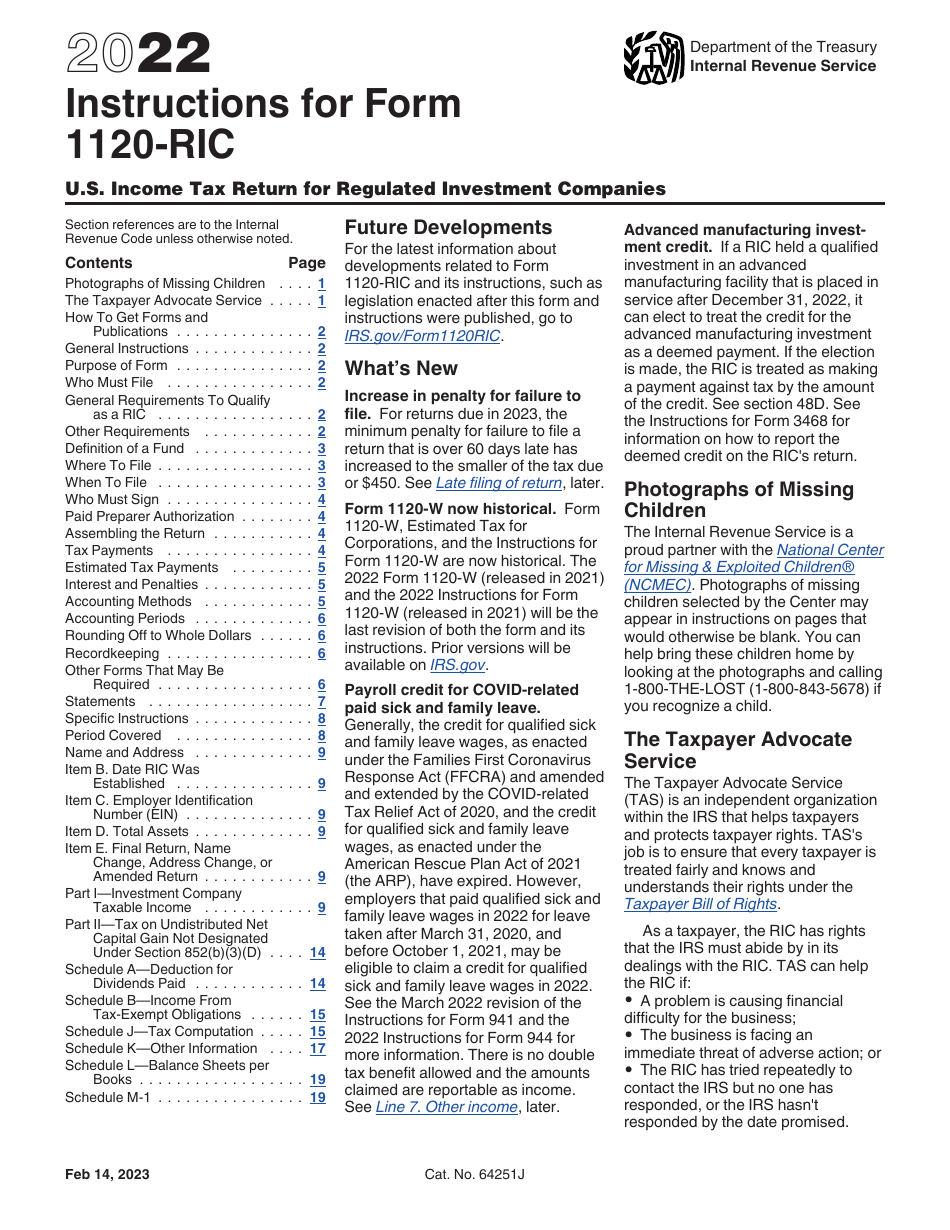

Instructions for IRS Form 1120-RIC

for the current year.

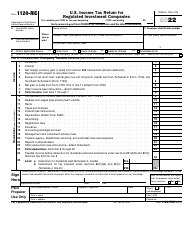

Instructions for IRS Form 1120-RIC U.S. Income Tax Return for Regulated Investment Companies

This document contains official instructions for IRS Form 1120-RIC , U.S. Income Tax Return for Regulated Investment Companies - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-RIC is available for download through this link.

FAQ

Q: What is IRS Form 1120-RIC?

A: IRS Form 1120-RIC is the U.S. Income Tax Return specifically for Regulated Investment Companies (RICs).

Q: Who needs to file IRS Form 1120-RIC?

A: RICs, or Regulated Investment Companies, need to file IRS Form 1120-RIC.

Q: What is the purpose of IRS Form 1120-RIC?

A: The purpose of IRS Form 1120-RIC is to report income, deductions, gains, losses, and other information for a Regulated Investment Company.

Q: When is the deadline to file IRS Form 1120-RIC?

A: The deadline to file IRS Form 1120-RIC is generally the 15th day of the 3rd month following the close of the RIC's tax year.

Q: Can IRS Form 1120-RIC be filed electronically?

A: Yes, IRS Form 1120-RIC can be filed electronically using the IRS e-file system.

Q: Are there any penalties for late filing of IRS Form 1120-RIC?

A: Yes, there may be penalties for late filing of IRS Form 1120-RIC, so it is important to file by the deadline.

Q: Are there any specific requirements for completing IRS Form 1120-RIC?

A: Yes, there are specific requirements for completing IRS Form 1120-RIC, such as providing accurate and detailed information about the RIC's financial activity.

Q: Can I get an extension to file IRS Form 1120-RIC?

A: Yes, you can request an extension to file IRS Form 1120-RIC by filing IRS Form 7004 before the original due date.

Instruction Details:

- This 20-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.