This version of the form is not currently in use and is provided for reference only. Download this version of

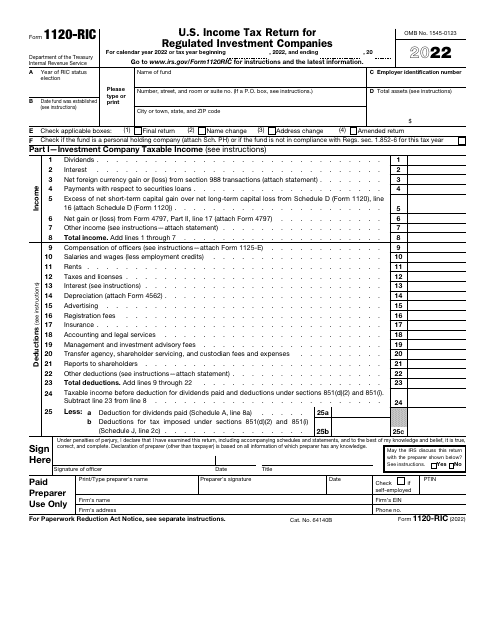

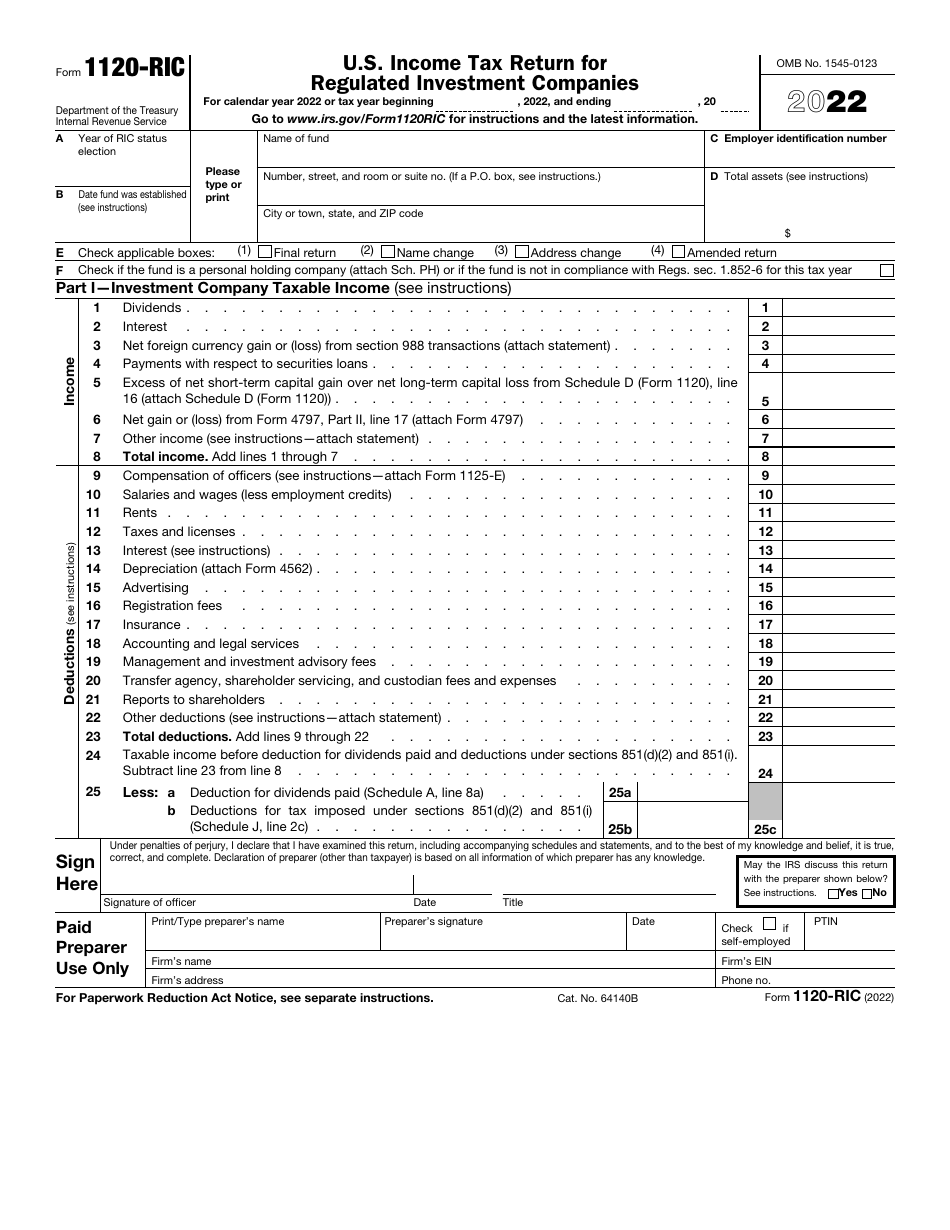

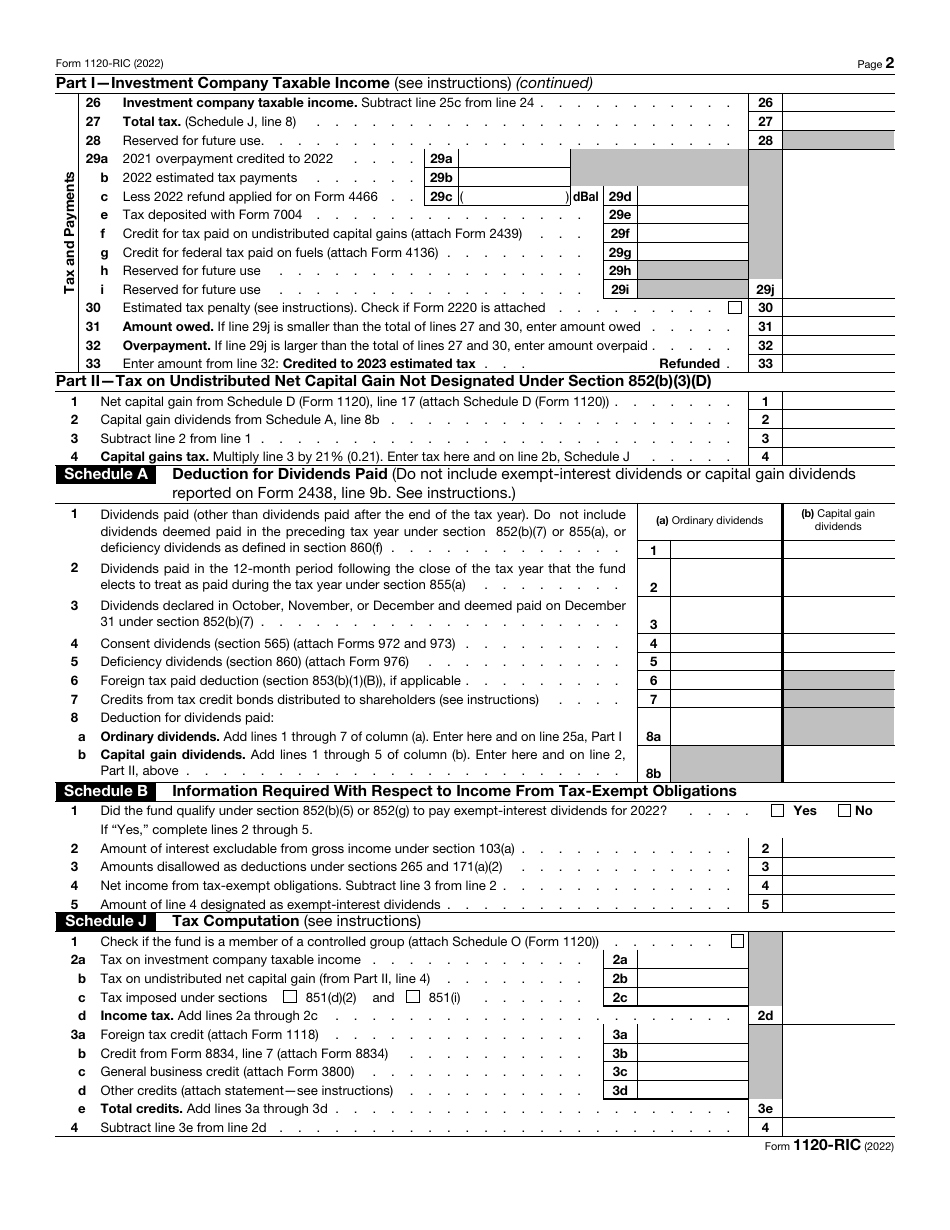

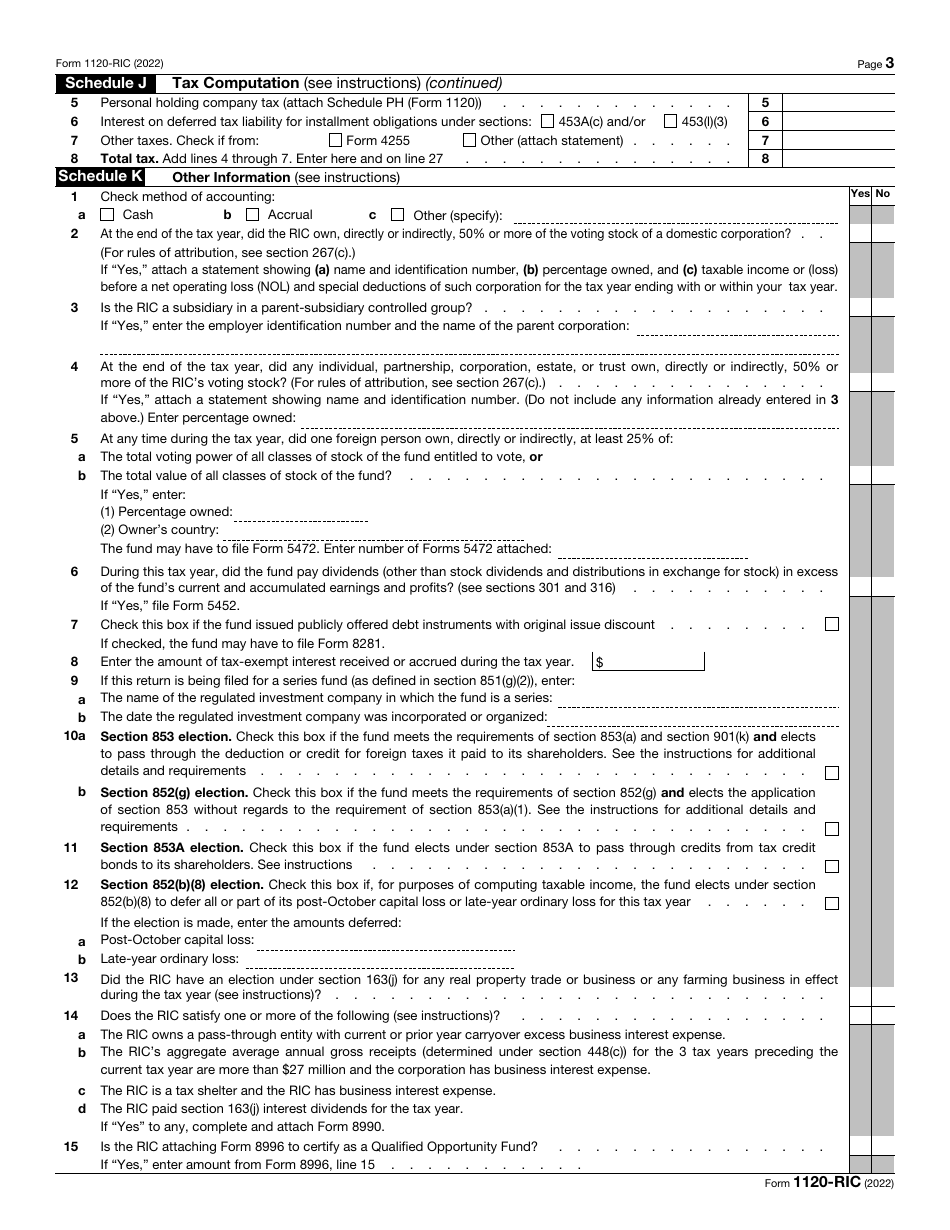

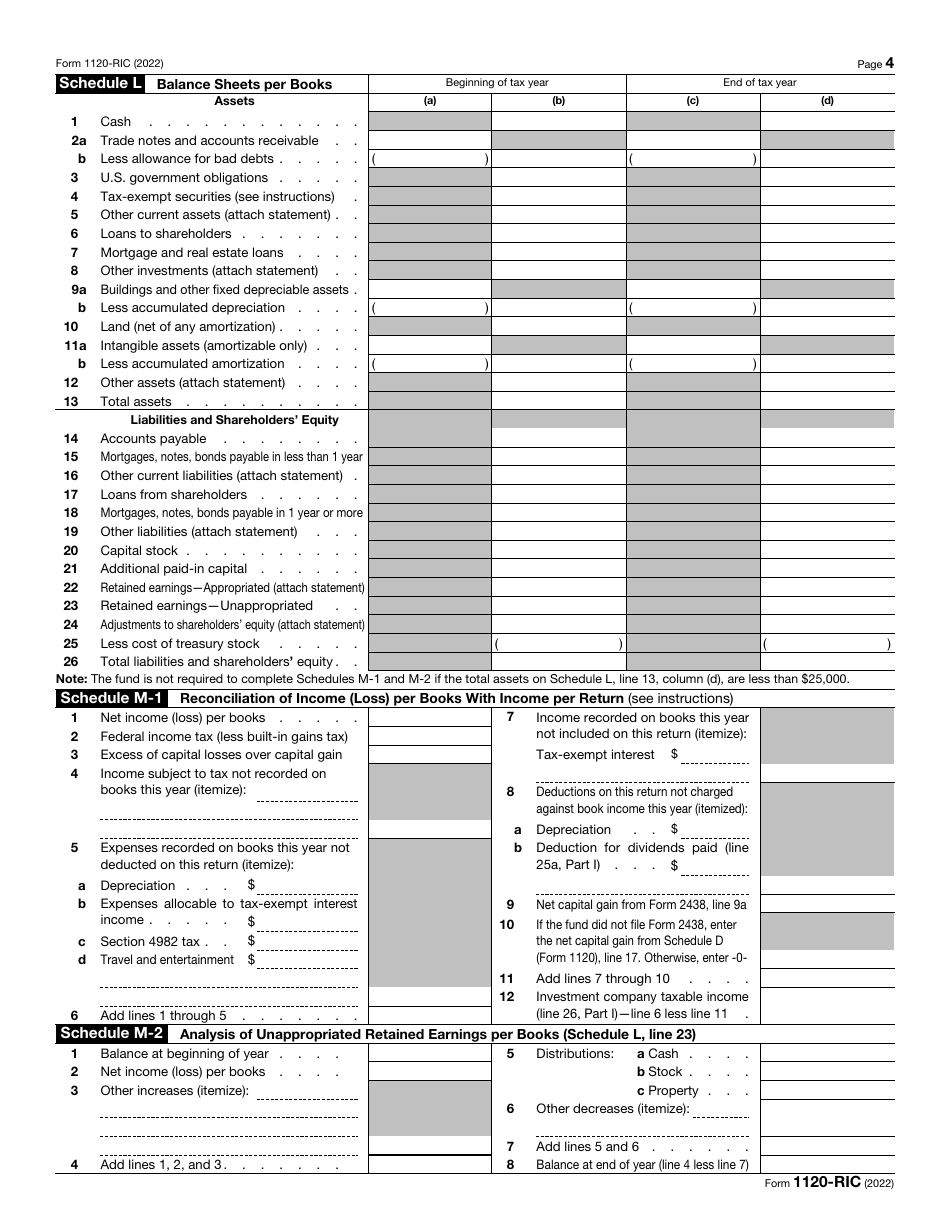

IRS Form 1120-RIC

for the current year.

IRS Form 1120-RIC U.S. Income Tax Return for Regulated Investment Companies

What Is IRS Form 1120-RIC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-RIC?

A: IRS Form 1120-RIC is the U.S. Income Tax Return specifically for Regulated Investment Companies (RICs).

Q: Who needs to file IRS Form 1120-RIC?

A: RICs, which are specific types of investment companies, need to file IRS Form 1120-RIC to report their income and expenses for tax purposes.

Q: What information do I need to complete IRS Form 1120-RIC?

A: You will need to provide details about your RIC's income, deductions, and credits, as well as information about its shareholders and investments.

Q: When is the deadline for filing IRS Form 1120-RIC?

A: The deadline for filing IRS Form 1120-RIC is usually the 15th day of the 3rd month after the end of the RIC's tax year.

Q: Can I file IRS Form 1120-RIC electronically?

A: Yes, you can file IRS Form 1120-RIC electronically using the IRS e-file system.

Q: Are there any penalties for not filing IRS Form 1120-RIC?

A: Yes, failure to file IRS Form 1120-RIC or filing it late can result in penalties and interest charges.

Q: Can I get an extension to file IRS Form 1120-RIC?

A: Yes, you can request an extension to file IRS Form 1120-RIC by filing Form 7004 before the original due date of the return.

Q: Is there a separate version of IRS Form 1120-RIC for Canadian companies?

A: No, IRS Form 1120-RIC is specifically for U.S. Regulated Investment Companies and does not have a separate version for Canadian companies.

Q: Do I need to include financial statements with IRS Form 1120-RIC?

A: In general, you do not need to include financial statements with IRS Form 1120-RIC. However, you may need to provide them upon request by the IRS.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-RIC through the link below or browse more documents in our library of IRS Forms.