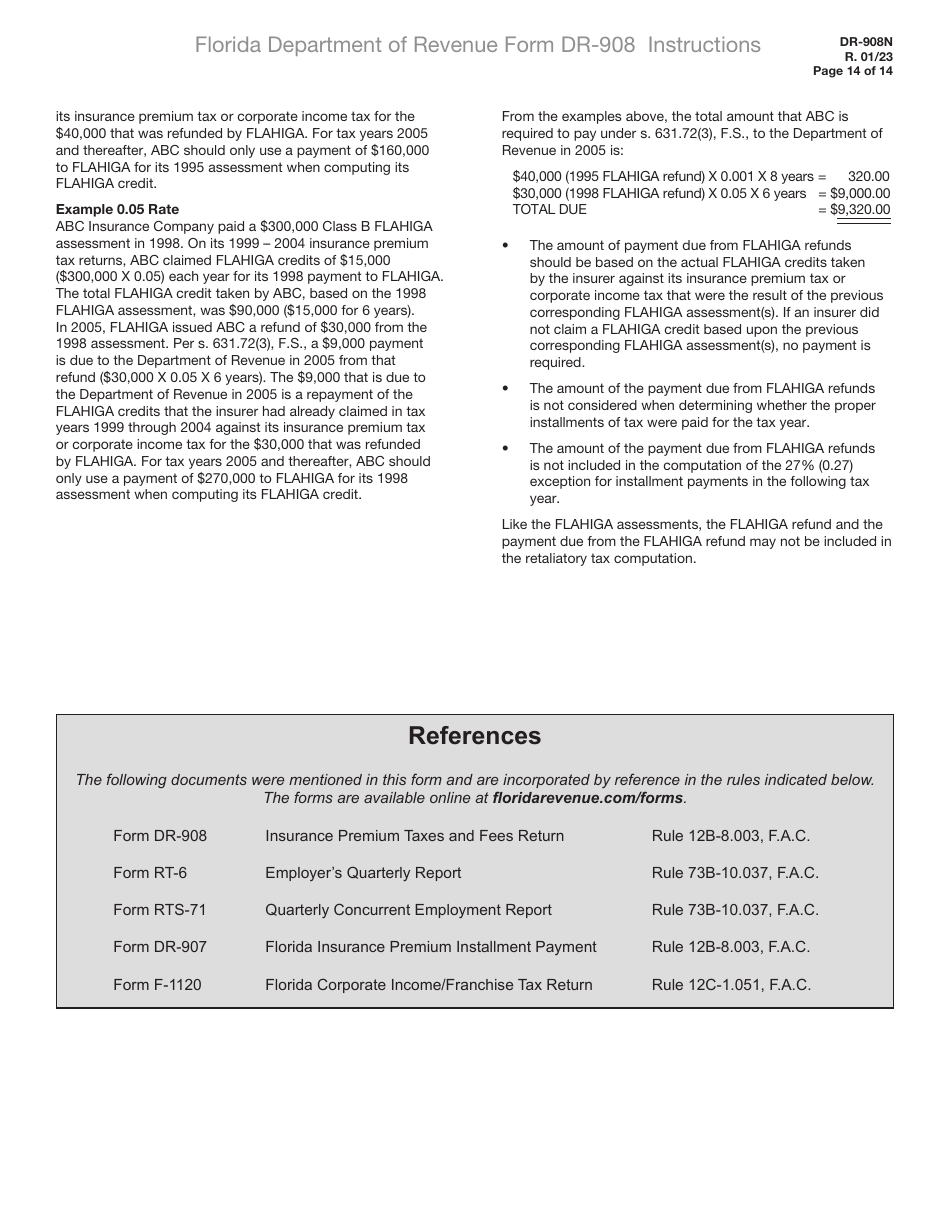

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form DR-908

for the current year.

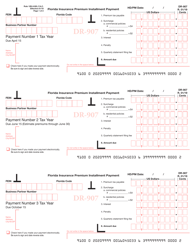

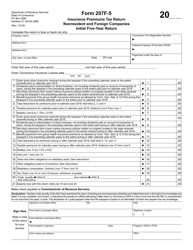

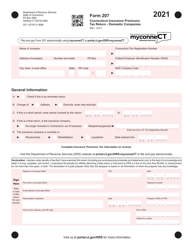

Instructions for Form DR-908 Insurance Premium Taxes and Fees Return - Florida

This document contains official instructions for Form DR-908 , Insurance Premium Taxes and Fees Return - a form released and collected by the Florida Department of Revenue.

FAQ

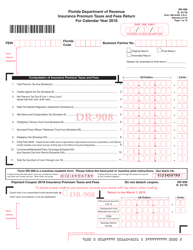

Q: What is Form DR-908?

A: Form DR-908 is the Insurance Premium Taxes and Fees Return that needs to be filed in Florida.

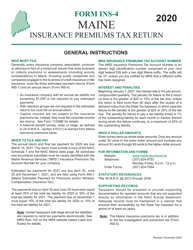

Q: Who needs to file Form DR-908?

A: Insurance companies, including health maintenance organizations (HMOs), risk retention groups (RRGs), and self-insurers need to file Form DR-908.

Q: What is the purpose of Form DR-908?

A: Form DR-908 is used to report and pay insurance premium taxes and fees in Florida.

Q: When is Form DR-908 due?

A: Form DR-908 is due on or before March 1st each year.

Q: Are there any late filing penalties for Form DR-908?

A: Yes, late filing can result in penalties, including interest charges on unpaid taxes and fees.

Q: What information do I need to complete Form DR-908?

A: You will need to provide details of premium taxes and fees collected, gross premiums written, and other relevant financial information.

Q: Is there any additional documentation required with Form DR-908?

A: Yes, you may need to attach supporting schedules and documentation, depending on your insurance business activities.

Q: Can Form DR-908 be filed electronically?

A: Yes, you can file Form DR-908 electronically through the Florida Department of Revenue's e-Services portal.

Q: What happens after I file Form DR-908?

A: Once you file Form DR-908, you will receive a confirmation of receipt. The department may also conduct audits and send notices if they need additional information or if any discrepancies are found.

Instruction Details:

- This 14-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Florida Department of Revenue.