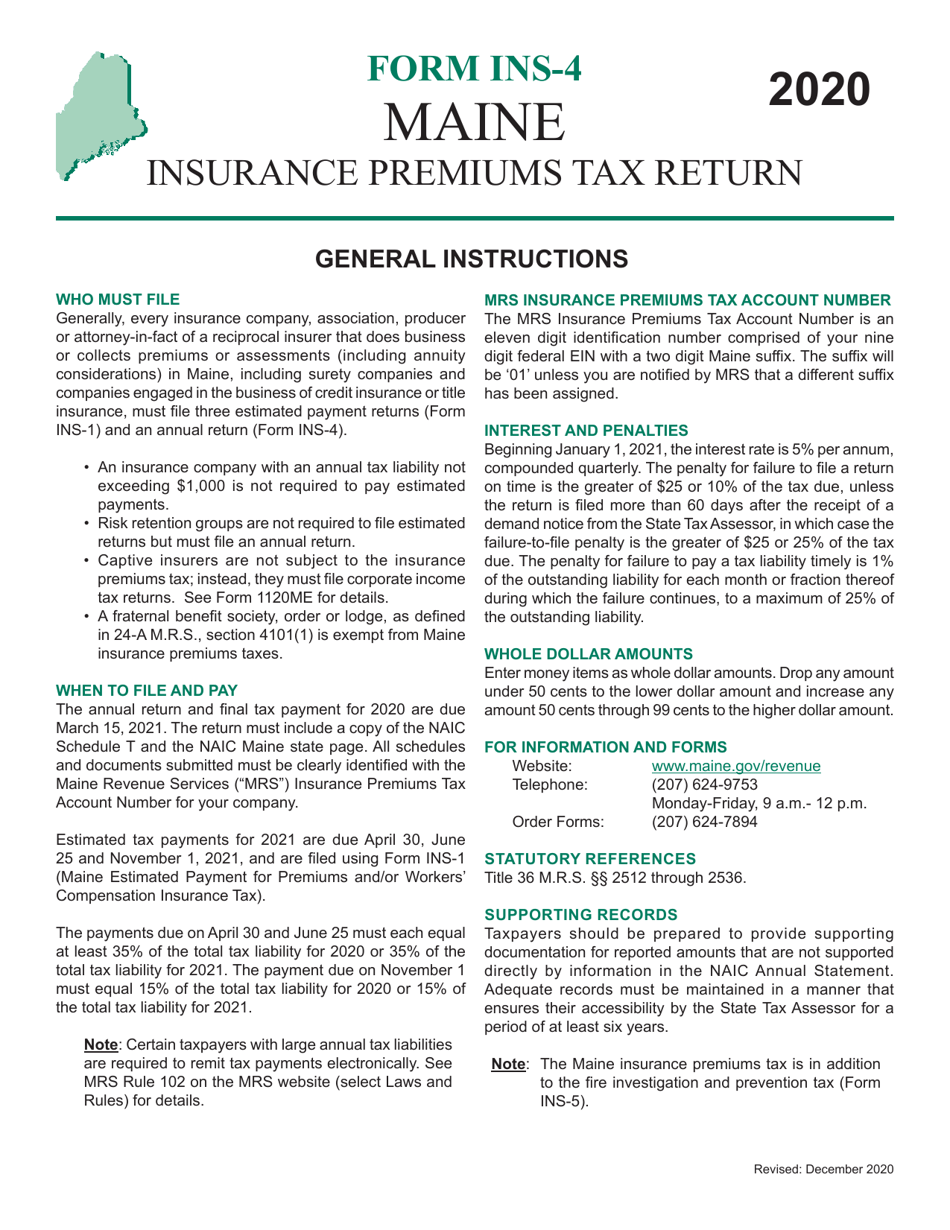

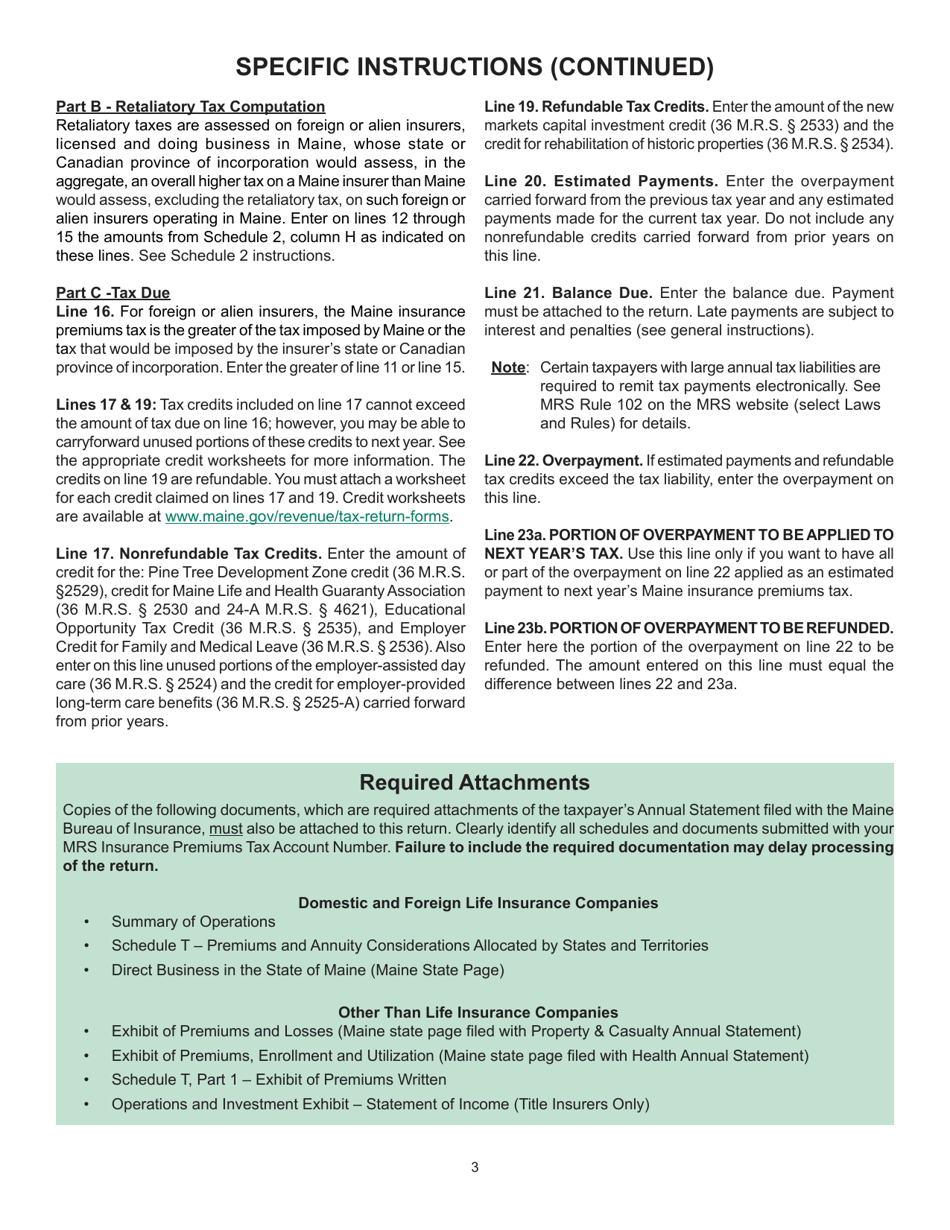

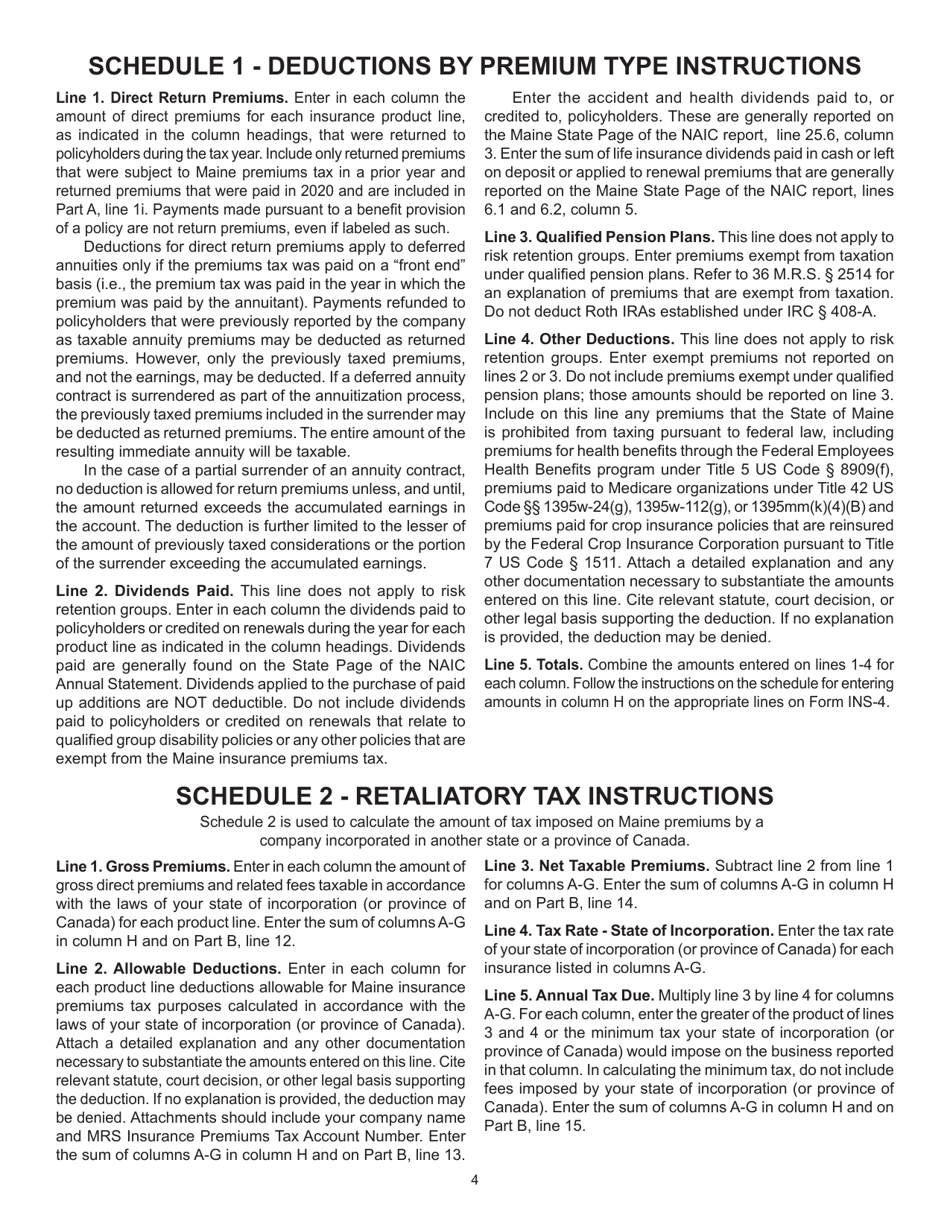

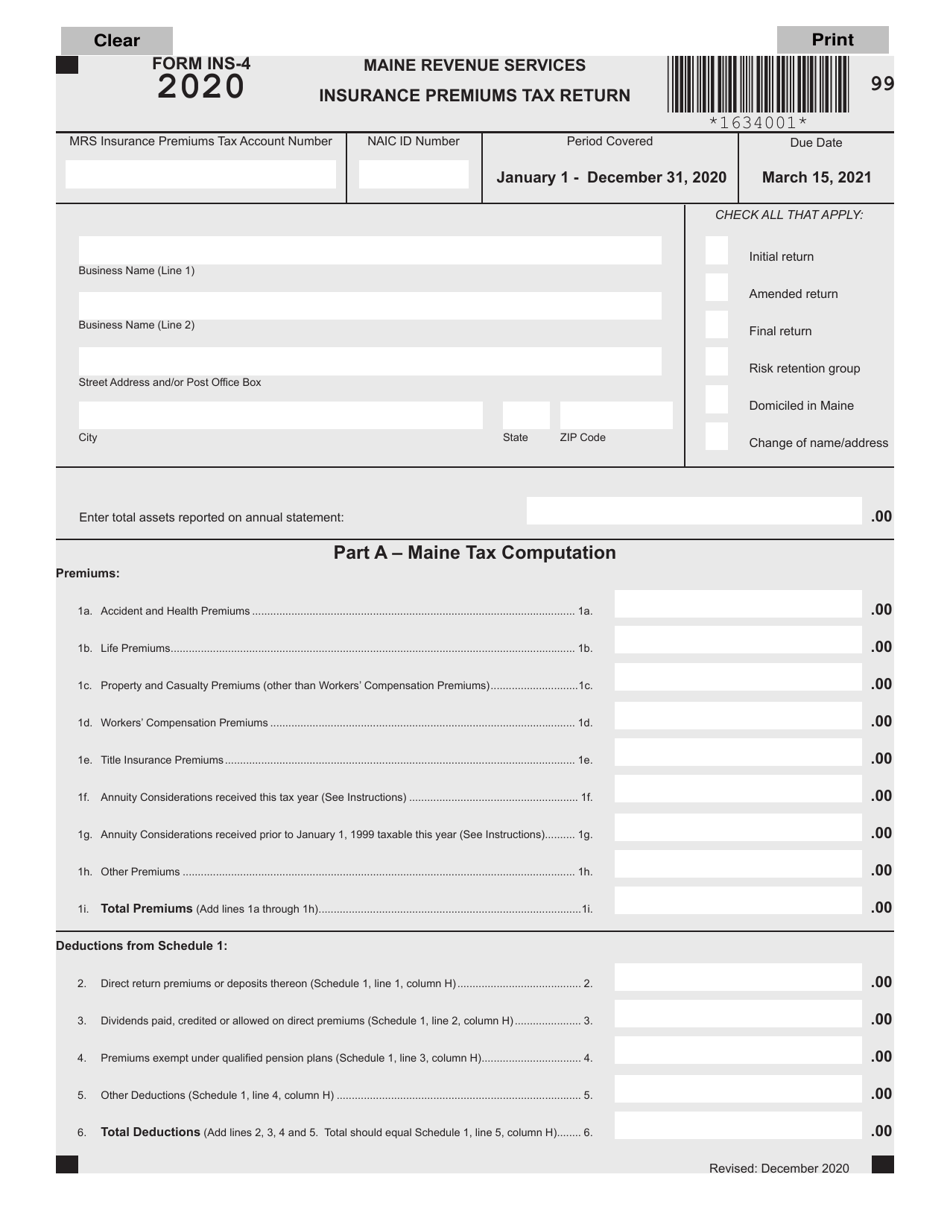

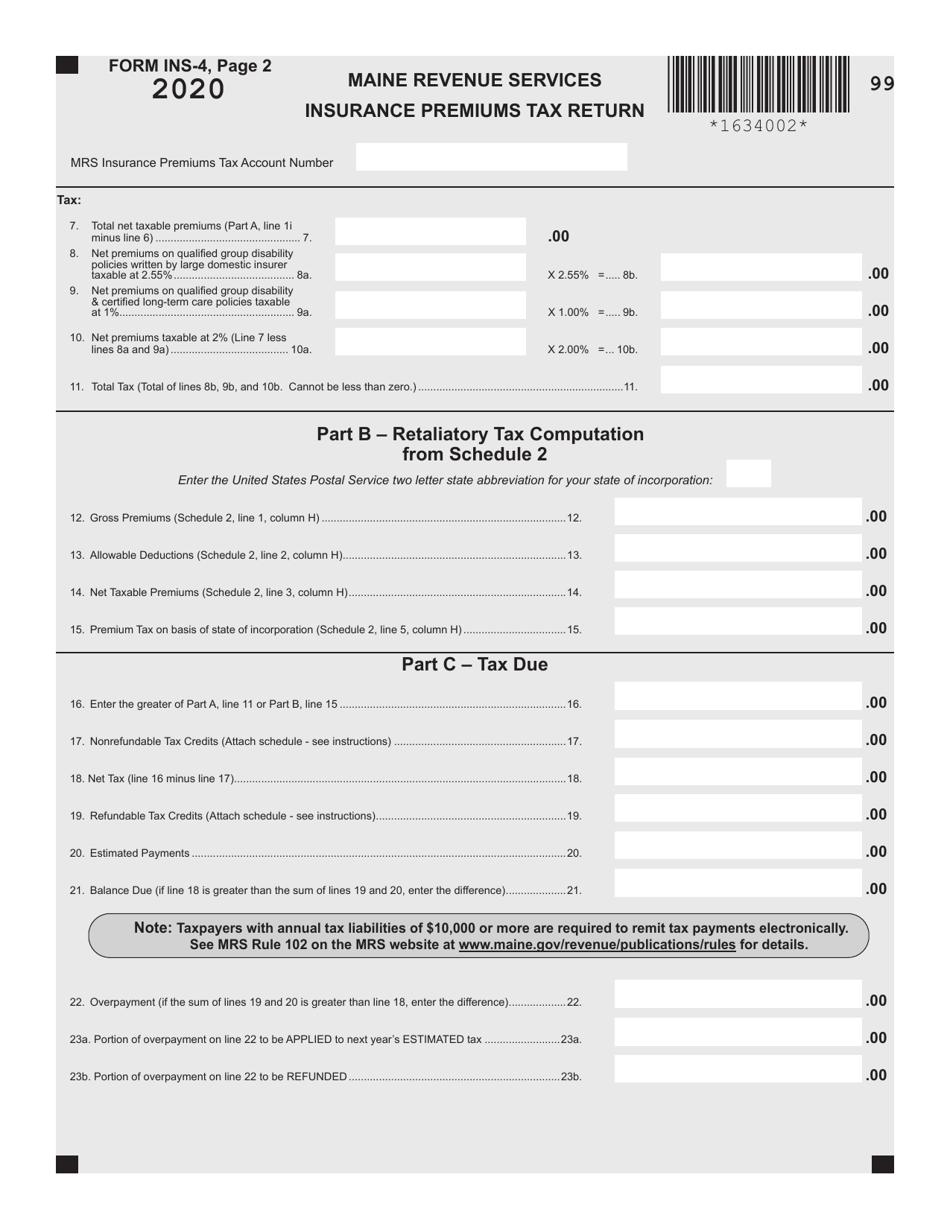

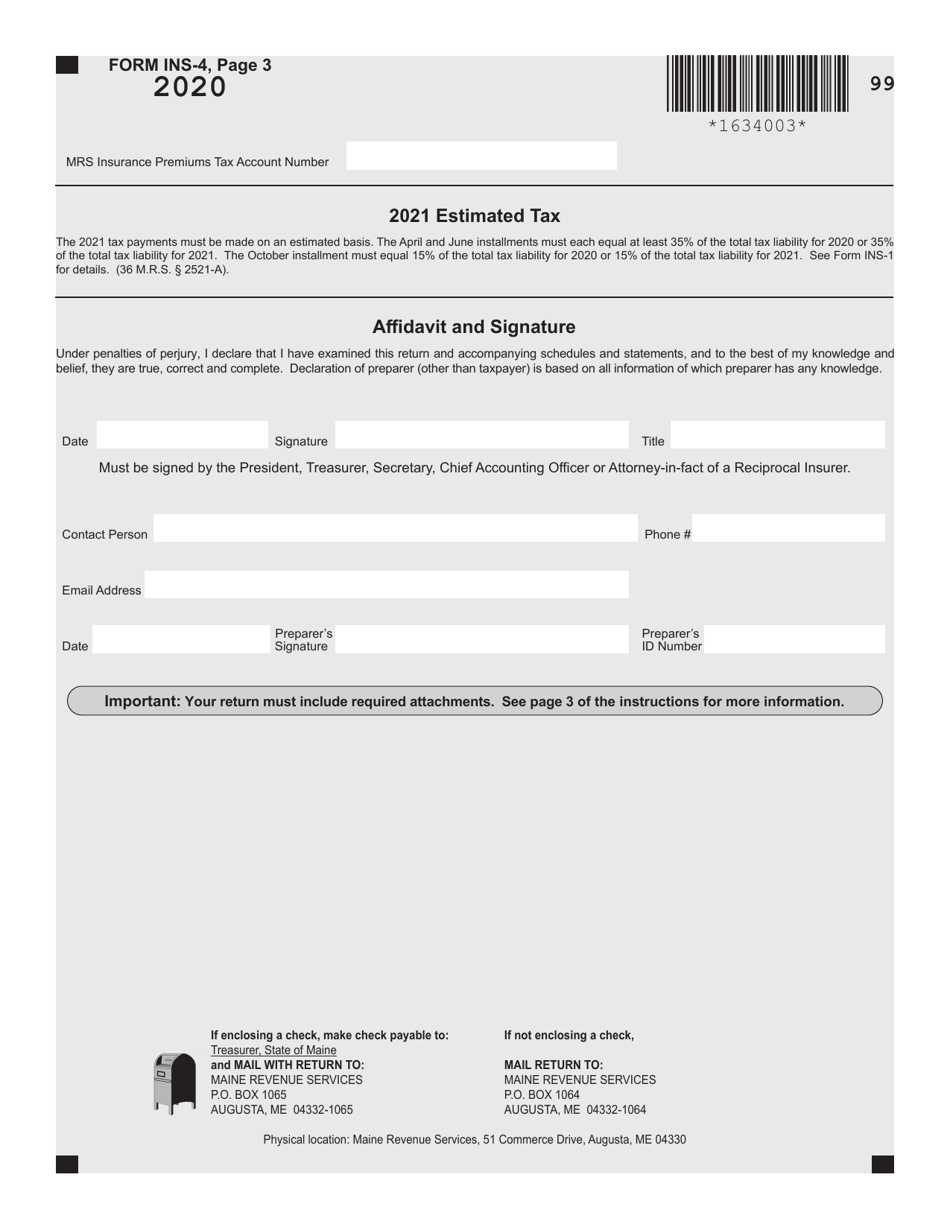

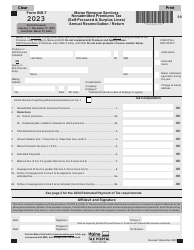

Form INS-4 Insurance Premiums Tax Return - Maine

What Is Form INS-4?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INS-4?

A: Form INS-4 is the Insurance Premiums Tax Return for the state of Maine.

Q: Who needs to file Form INS-4?

A: All insurance companies authorized to conduct business in Maine are required to file Form INS-4.

Q: When is Form INS-4 due?

A: Form INS-4 is due on or before March 1st of each year.

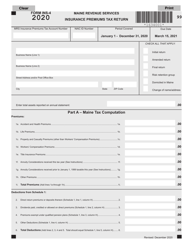

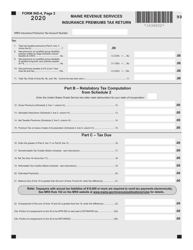

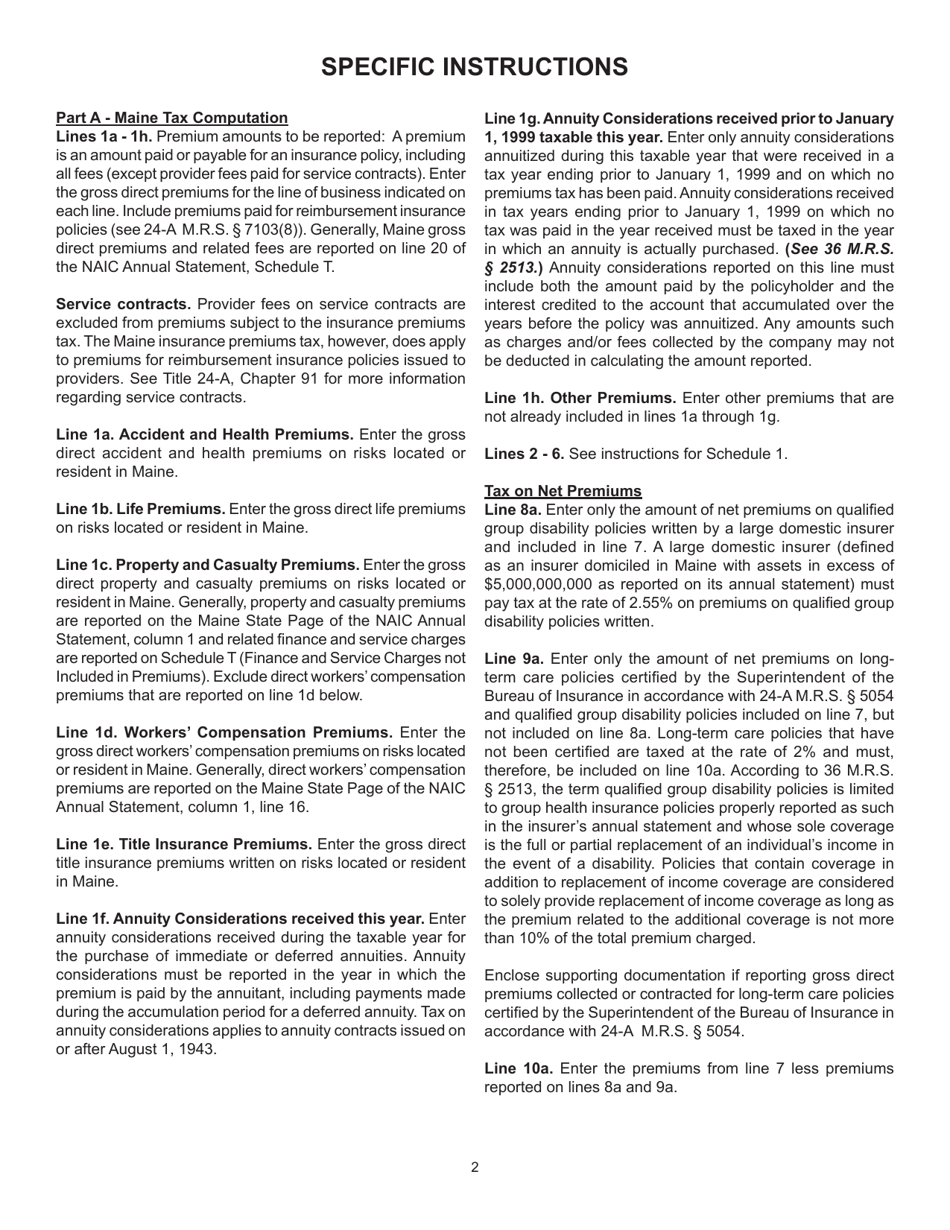

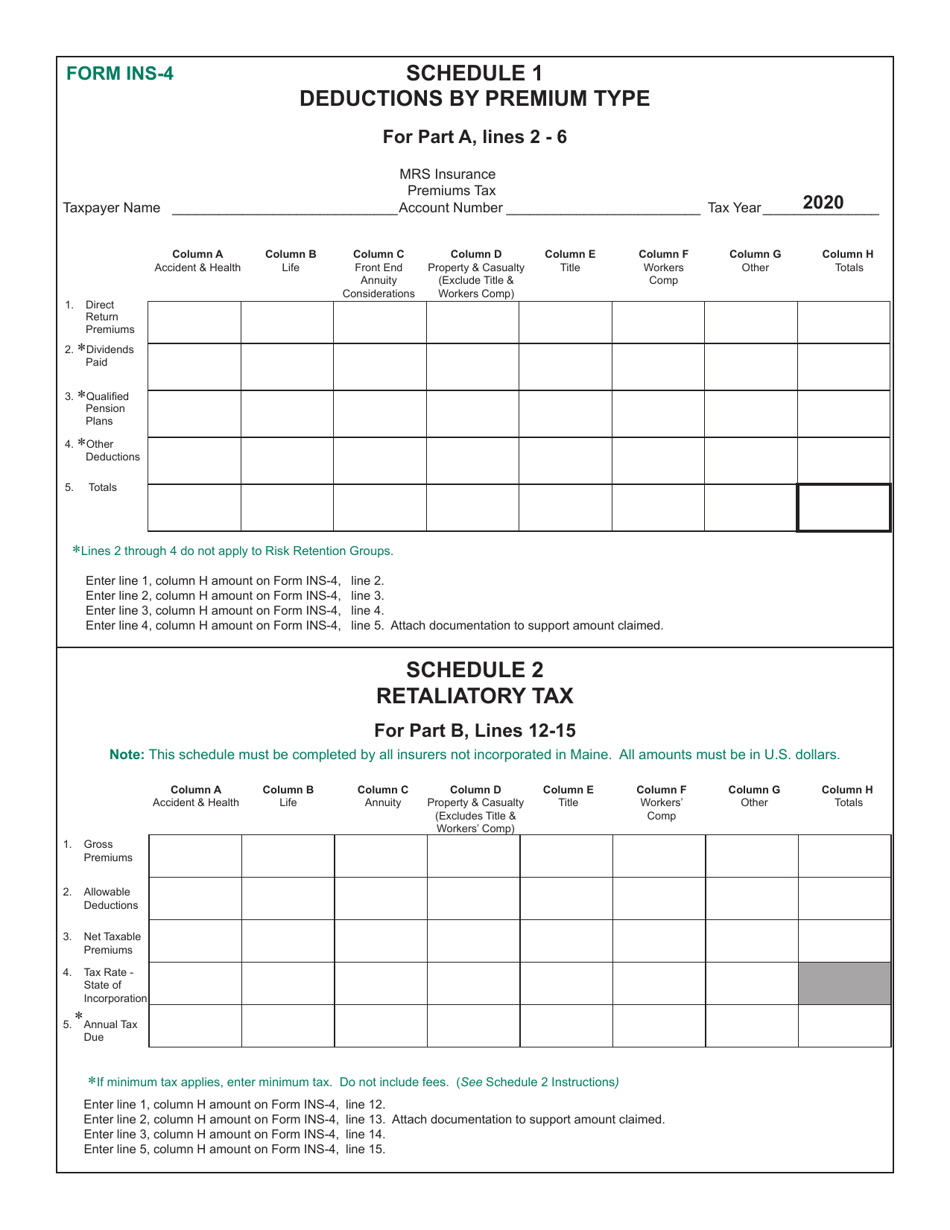

Q: What information do I need to complete Form INS-4?

A: You will need to provide details about your insurance company's premium income and deductibles.

Q: Are there any penalties for late filing of Form INS-4?

A: Yes, there are penalties for late filing of Form INS-4. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INS-4 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.