This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-195 Schedule OR-WFHDC

for the current year.

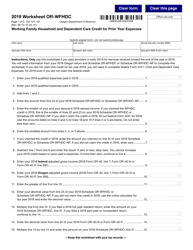

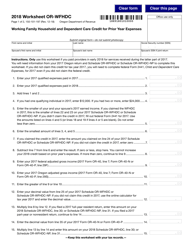

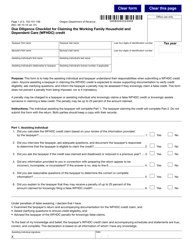

Instructions for Form 150-101-195 Schedule OR-WFHDC Oregon Working Family Household and Dependent Care Credit - Oregon

This document contains official instructions for Form 150-101-195 Schedule OR-WFHDC, Oregon Dependent Care Credit - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-195 Schedule OR-WFHDC is available for download through this link.

FAQ

Q: What is Form 150-101-195?

A: Form 150-101-195 is the Schedule OR-WFHDC used to claim the Oregon Working Family Household and Dependent Care Credit.

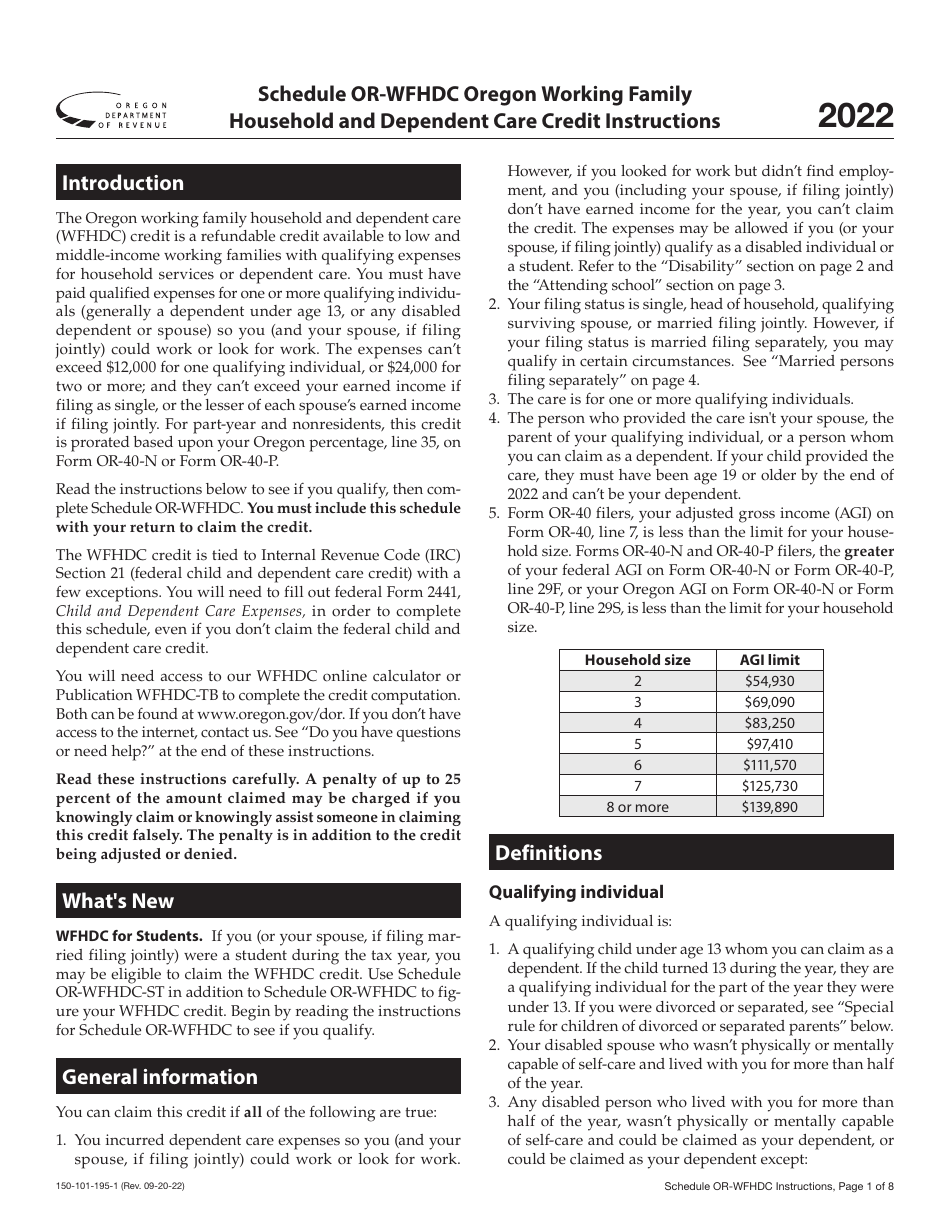

Q: What is the Oregon Working Family Household and Dependent Care Credit?

A: The Oregon Working Family Household and Dependent Care Credit is a tax credit that allows eligible taxpayers to claim a portion of their qualifying child and dependent care expenses.

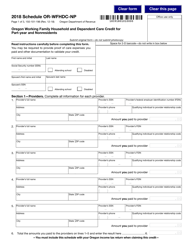

Q: Who is eligible to claim the Oregon Working Family Household and Dependent Care Credit?

A: To be eligible for the credit, you must meet certain income and residency requirements and have incurred qualifying child and dependent care expenses.

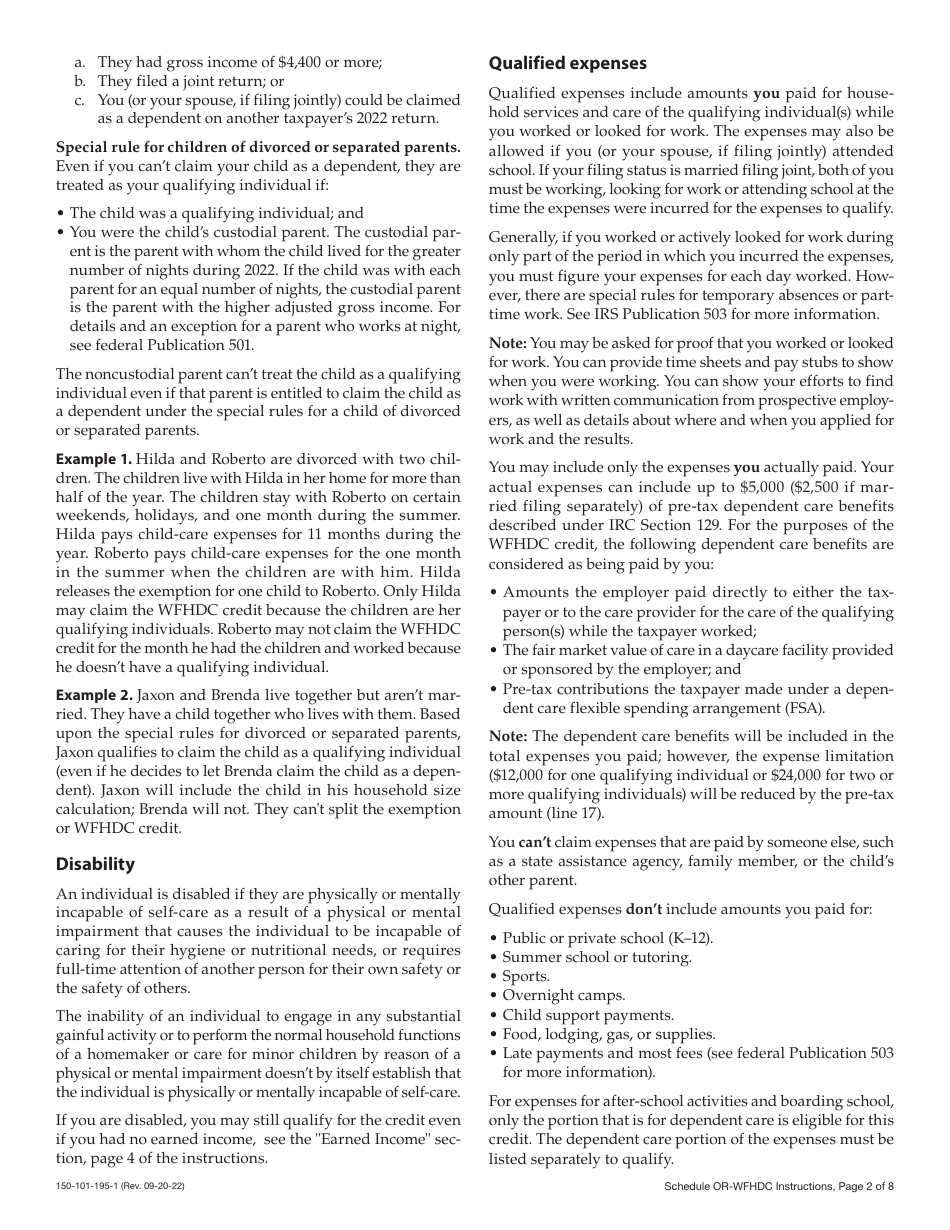

Q: What expenses qualify for the credit?

A: Qualifying expenses include costs associated with the care of a child or dependent that enable you to work, search for work, or attend school.

Q: How do I claim the Oregon Working Family Household and Dependent Care Credit?

A: You need to complete Form 150-101-195 Schedule OR-WFHDC and include it with your Oregon state tax return.

Q: Is there a deadline to file for the Oregon Working Family Household and Dependent Care Credit?

A: Yes, you must file your Oregon state tax return and claim the credit by the extended due date, which is generally April 15th or the 15th day of the 4th month following the close of your tax year, whichever is later.

Q: Can I claim the credit if I have a dependent with special needs?

A: Yes, if you have a dependent with special needs and incurred qualifying expenses related to their care, you may be eligible for an increased credit amount.

Q: Are there any limitations on the credit?

A: Yes, the credit is subject to income limits and may be reduced or eliminated based on your income, filing status, and the number of dependents you have.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.