This version of the form is not currently in use and is provided for reference only. Download this version of

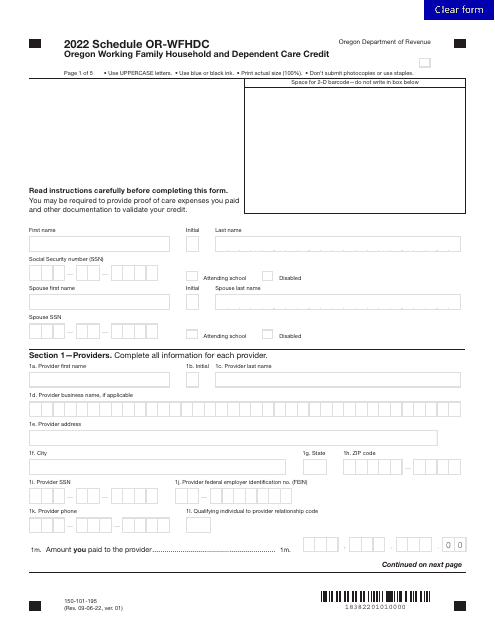

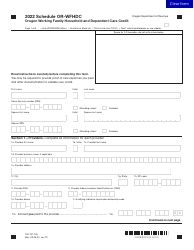

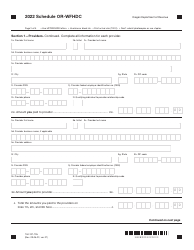

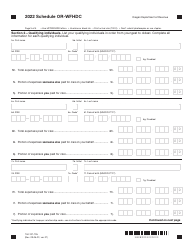

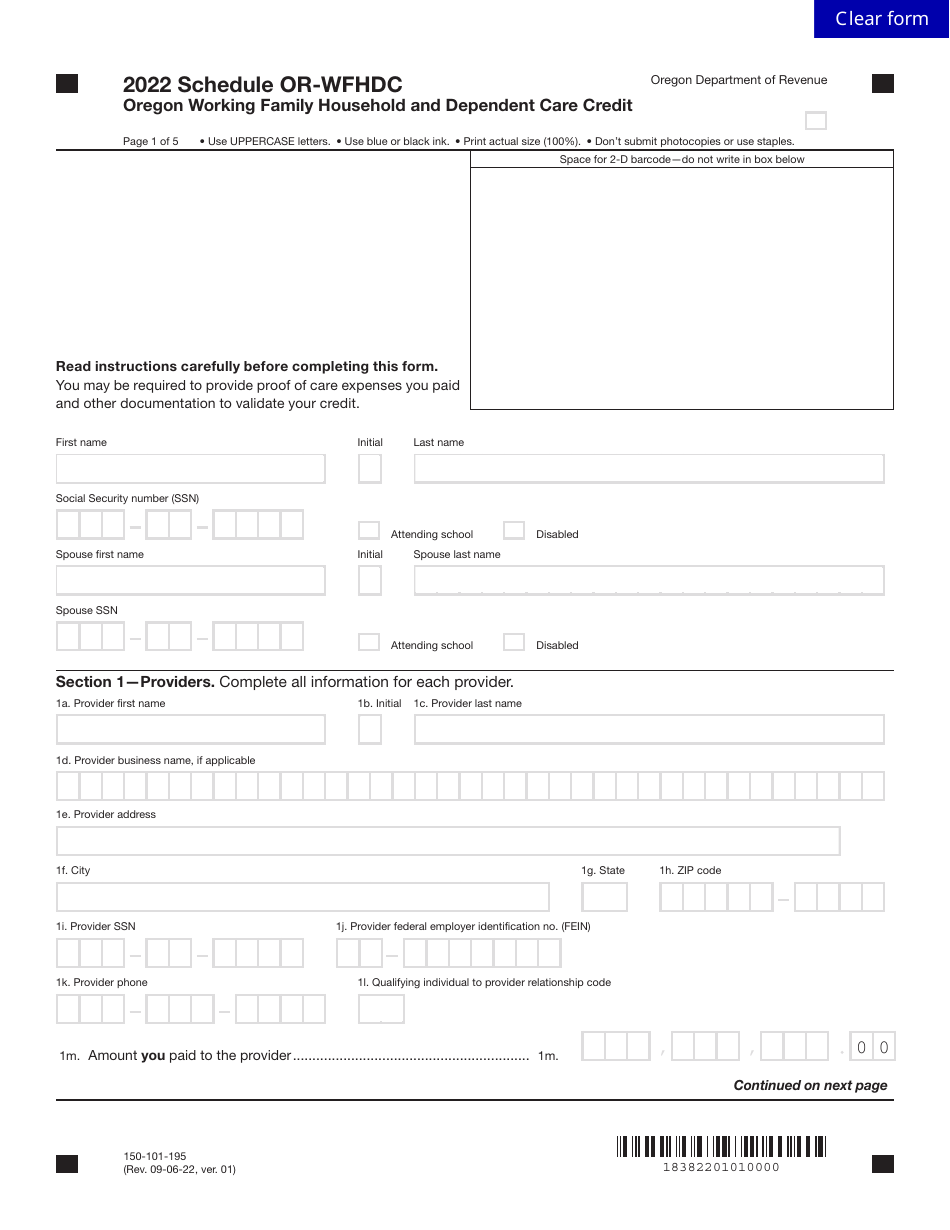

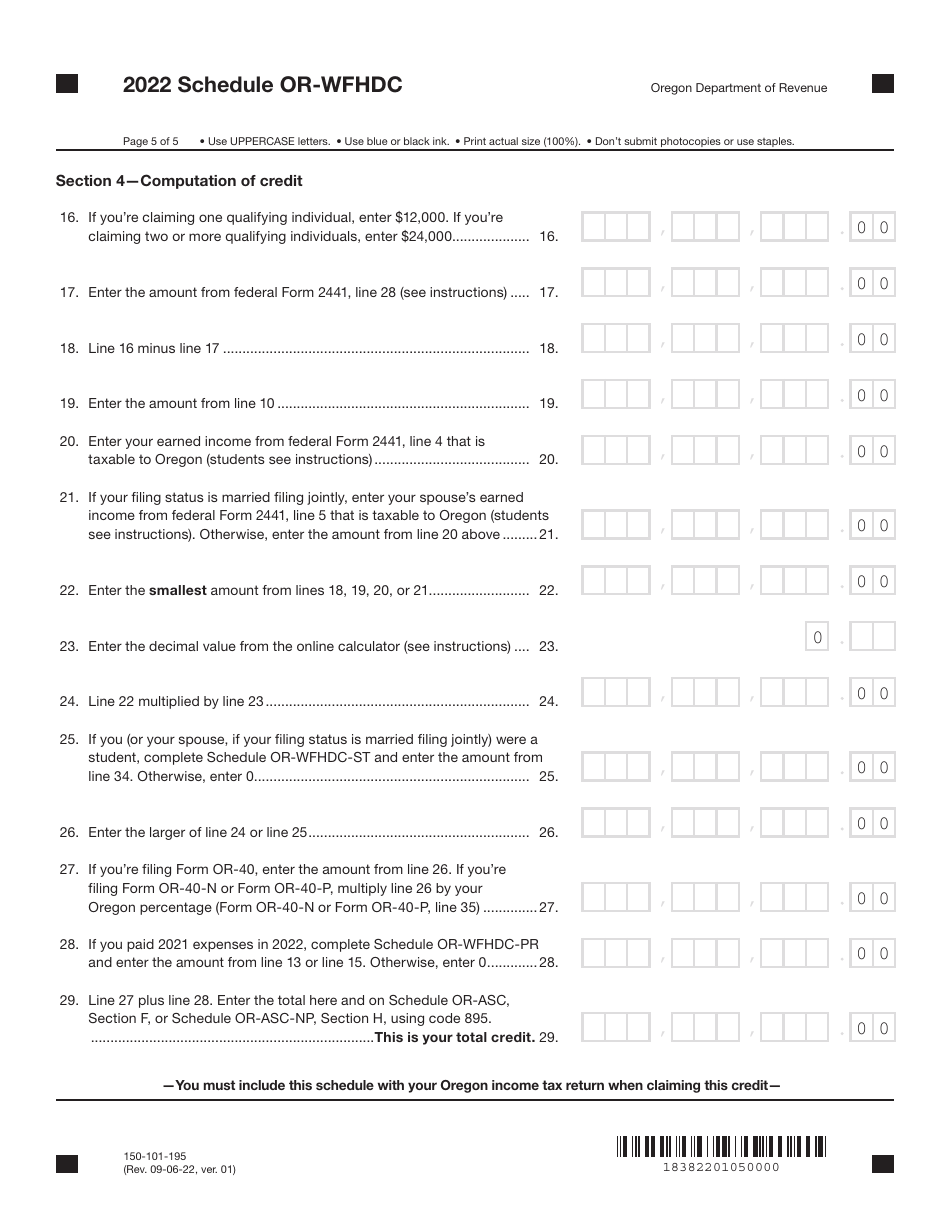

Form 150-101-195 Schedule OR-WFHDC

for the current year.

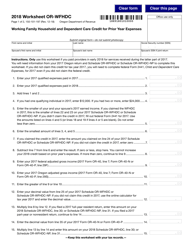

Form 150-101-195 Schedule OR-WFHDC Oregon Working Family Household and Dependent Care Credit - Oregon

What Is Form 150-101-195 Schedule OR-WFHDC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-195?

A: Form 150-101-195 is Schedule OR-WFHDC, which is used to calculate the Oregon Working Family Household and Dependent Care Credit.

Q: What is the purpose of the Oregon Working Family Household and Dependent Care Credit?

A: The purpose of this credit is to provide tax relief to Oregon taxpayers who incur expenses for caring for a dependent that enables them to work.

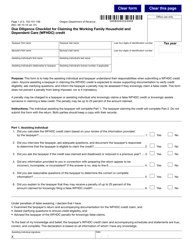

Q: Who is eligible for the Oregon Working Family Household and Dependent Care Credit?

A: To be eligible, you must meet certain requirements, including having earned income, incurring qualifying expenses for household and dependent care, and having a qualified dependent.

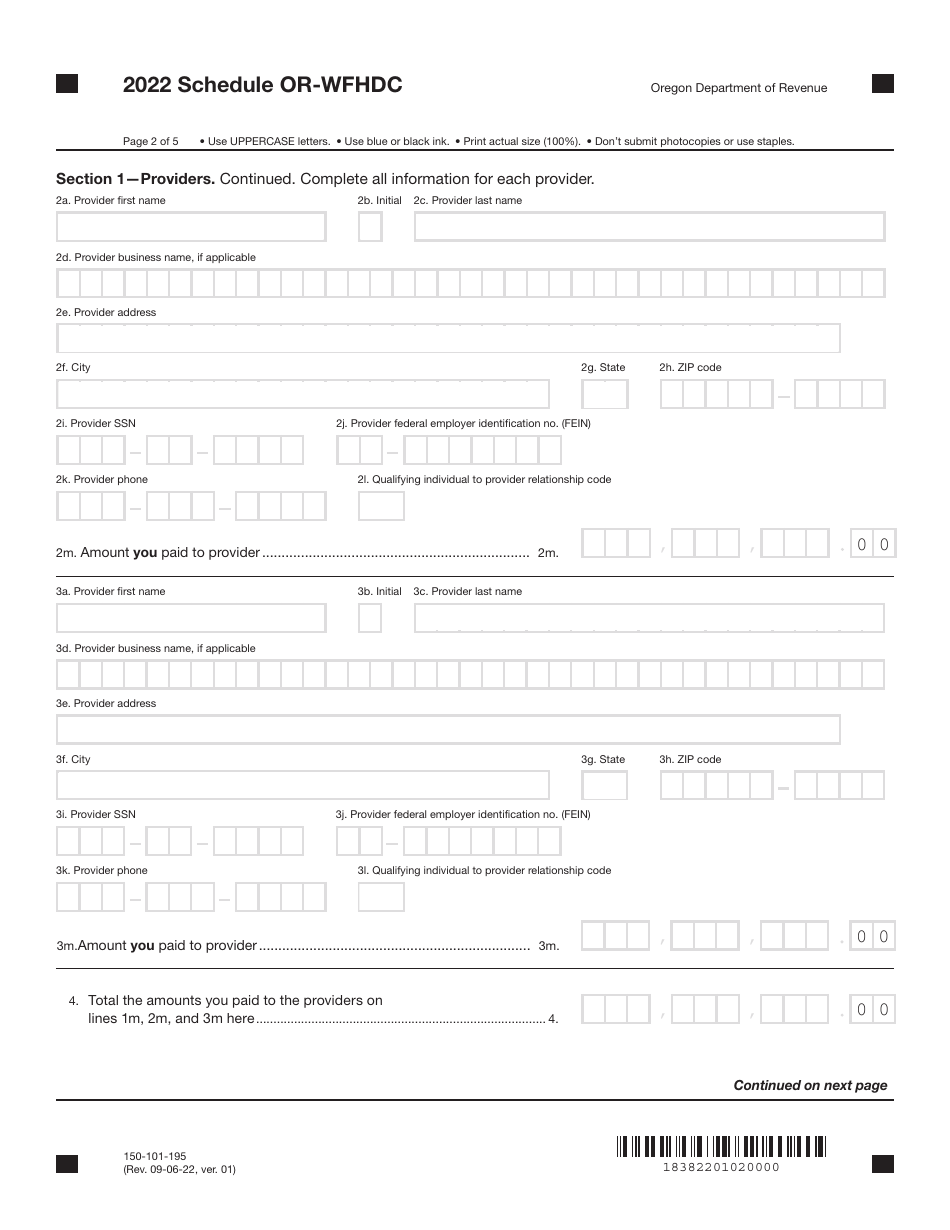

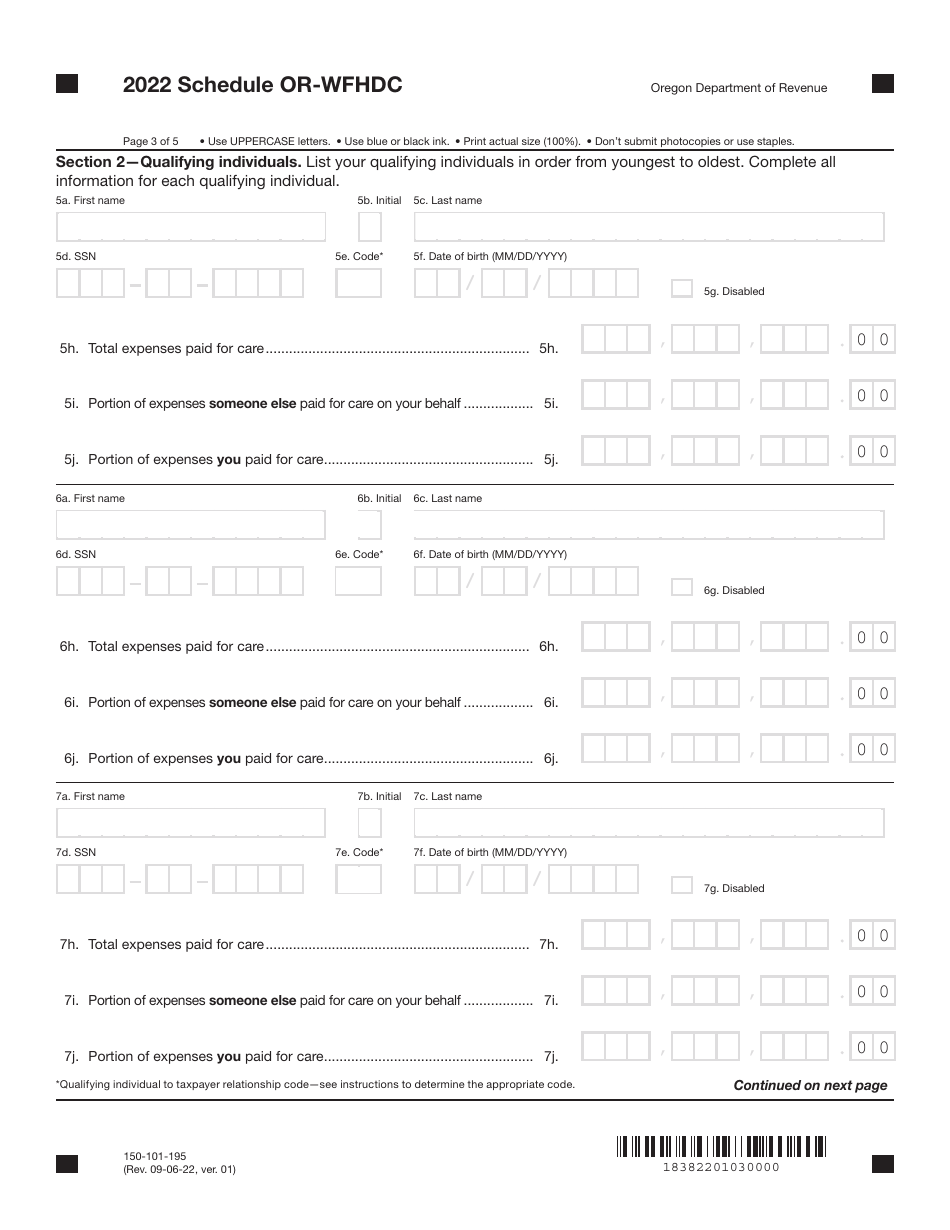

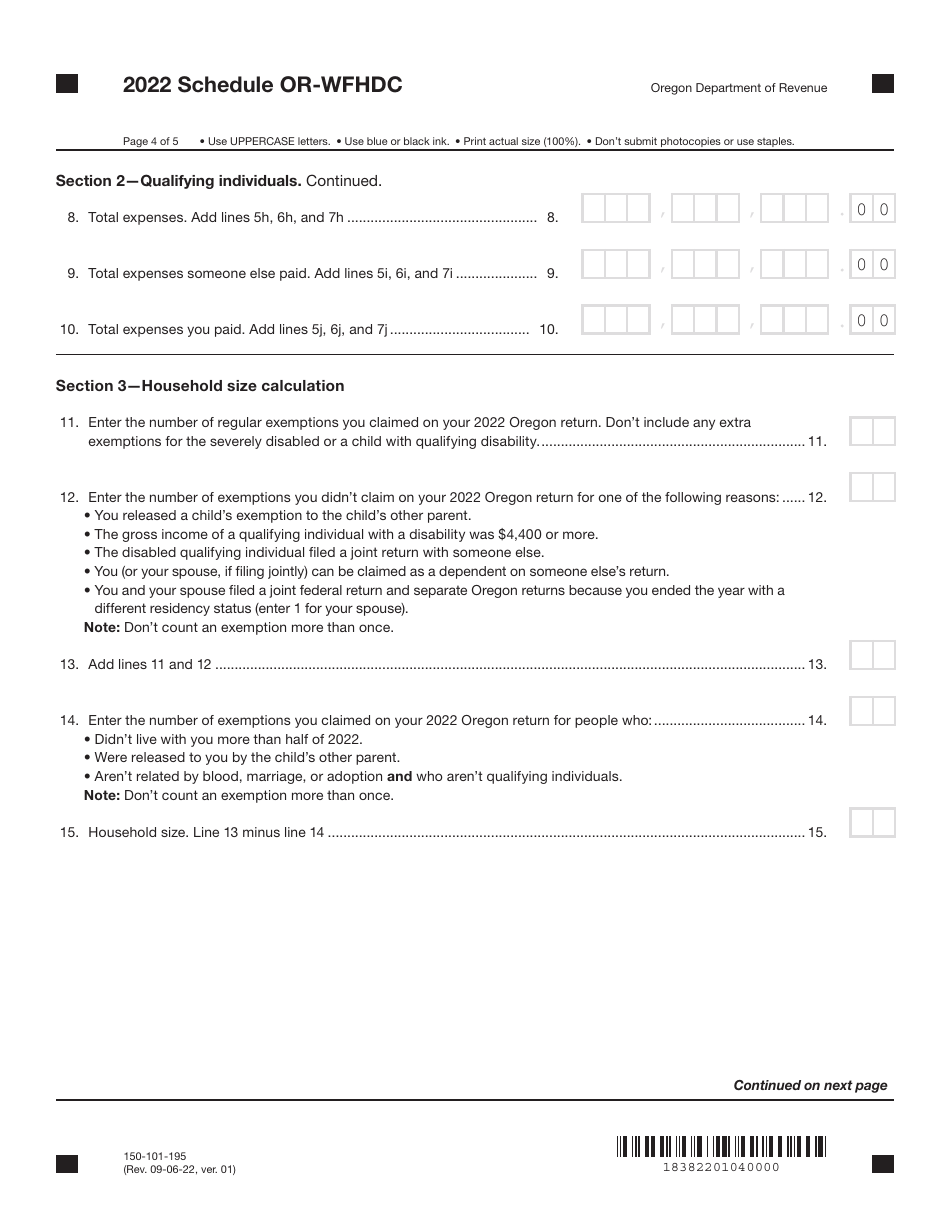

Q: How do I calculate the Oregon Working Family Household and Dependent Care Credit?

A: You can calculate the credit by completing Schedule OR-WFHDC, following the instructions provided.

Form Details:

- Released on September 6, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-195 Schedule OR-WFHDC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.