This version of the form is not currently in use and is provided for reference only. Download this version of

Form 150-101-068 Schedule OR-529

for the current year.

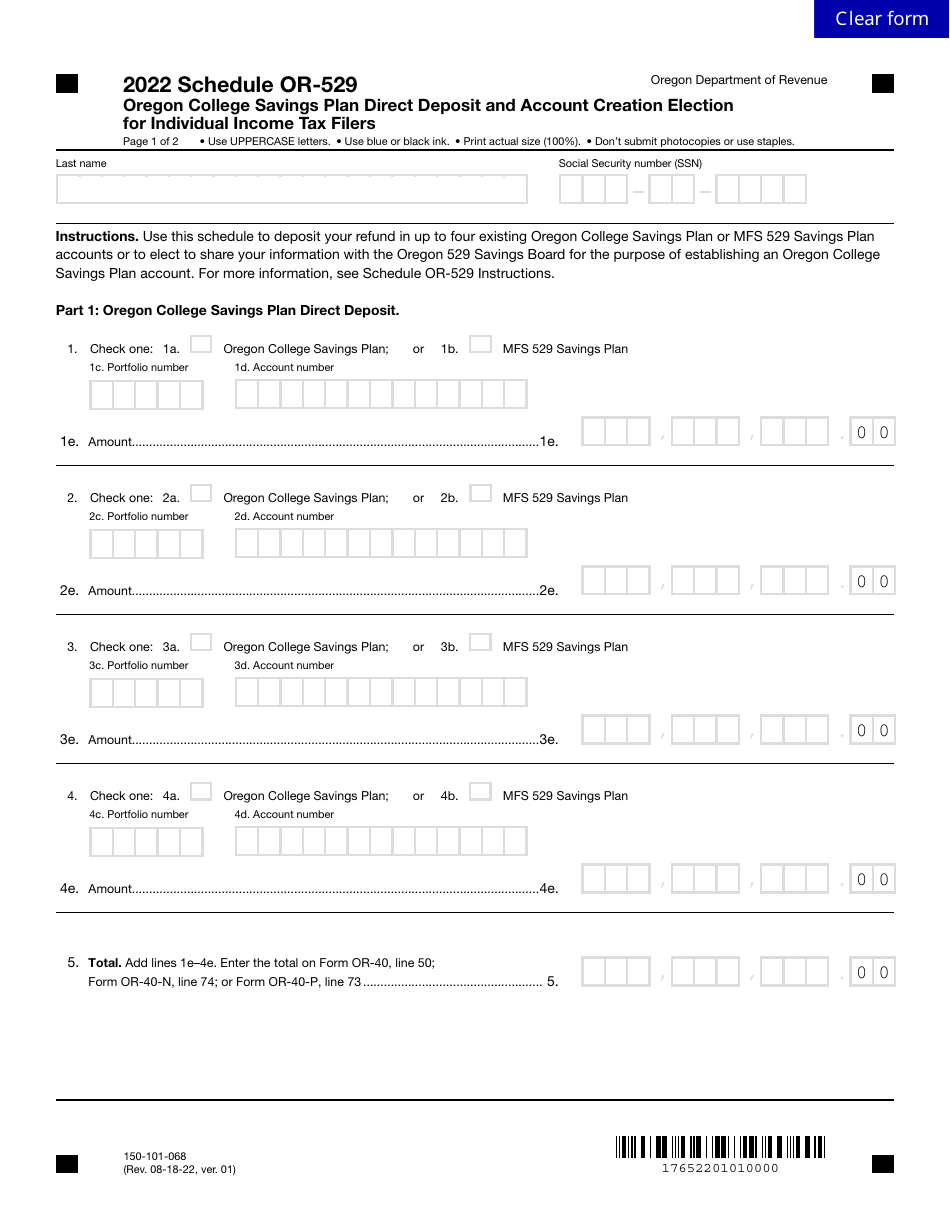

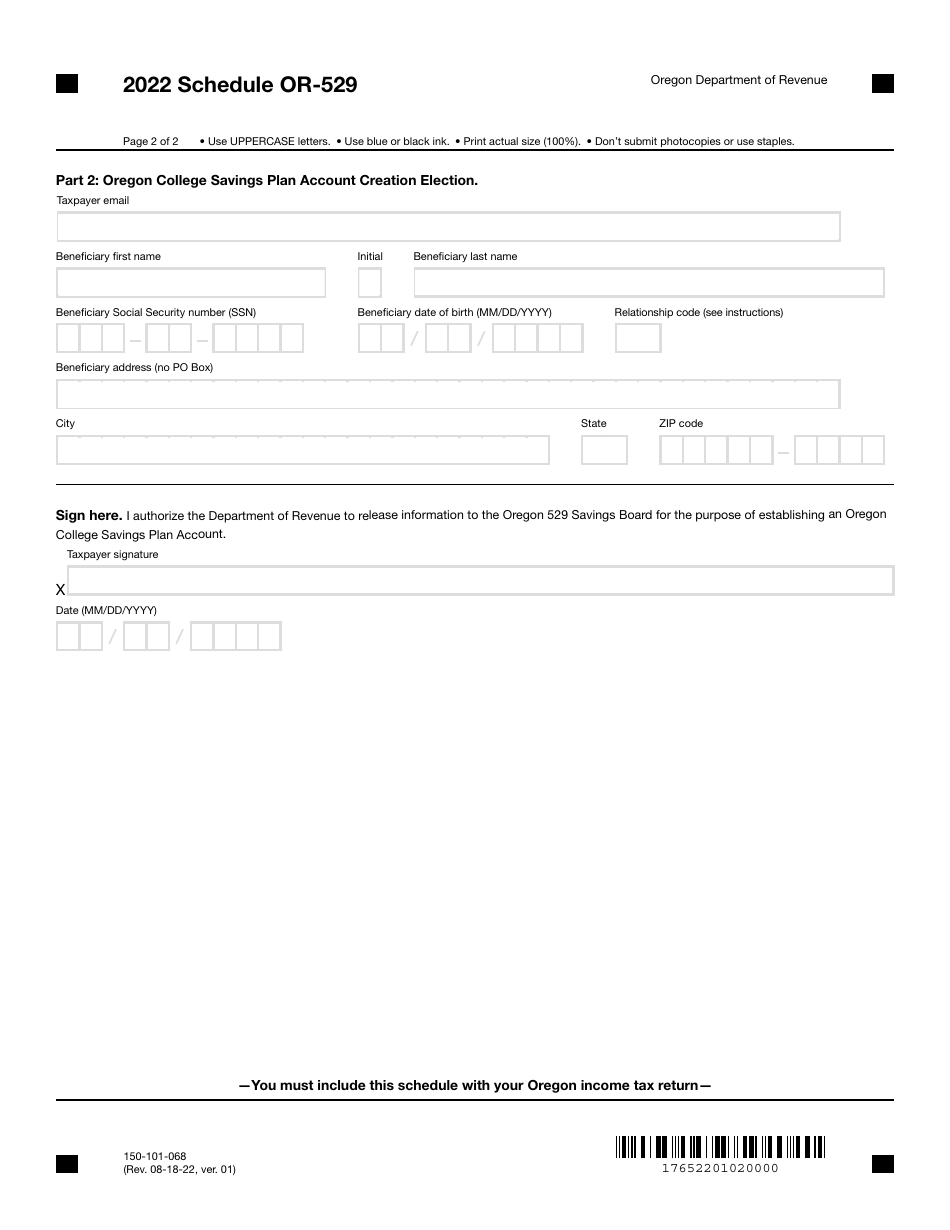

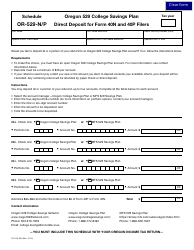

Form 150-101-068 Schedule OR-529 Oregon College Savings Plan Direct Deposit and Account Creation Election for Individual Income Tax Filers - Oregon

What Is Form 150-101-068 Schedule OR-529?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-068?

A: Form 150-101-068 is a schedule for Oregon College Savings Plan Direct Deposit and Account Creation Election for Individual Income Tax Filers in Oregon.

Q: What is Oregon College Savings Plan?

A: Oregon College Savings Plan is a savings plan designed to help individuals save for future education expenses.

Q: What is the purpose of Form 150-101-068?

A: The purpose of Form 150-101-068 is to allow taxpayers to set up direct deposit for their Oregon College Savings Plan account and to create a new account if they do not have one already.

Q: Who needs to use Form 150-101-068?

A: Individual income tax filers in Oregon who want to set up direct deposit for their Oregon College Savings Plan account or create a new account need to use Form 150-101-068.

Q: Are there any fees associated with the Oregon College Savings Plan?

A: Yes, there are fees associated with the Oregon College Savings Plan. These fees include management fees, enrollment fees, and investment expenses. It is important to review the plan's fees before opening an account.

Q: Can I change my direct deposit information for my Oregon College Savings Plan account?

A: Yes, you can change your direct deposit information for your Oregon College Savings Plan account. You will need to complete Form 150-101-068 to make the necessary changes.

Q: Can I create multiple Oregon College Savings Plan accounts?

A: Yes, you can create multiple Oregon College Savings Plan accounts if needed. Each account will have its own unique direct deposit information.

Q: What other options are available for saving for education expenses in Oregon?

A: In addition to the Oregon College Savings Plan, there are other options available for saving for education expenses in Oregon, such as the Oregon ABLE Savings Plan and the federal 529 College Savings Plan.

Q: Is the Oregon College Savings Plan tax-deductible?

A: Contributions to the Oregon College Savings Plan may be deductible from Oregon taxable income, subject to certain limitations. It is recommended to consult a tax advisor for more information on tax deductions.

Form Details:

- Released on August 18, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-068 Schedule OR-529 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.