This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-068 Schedule OR-529

for the current year.

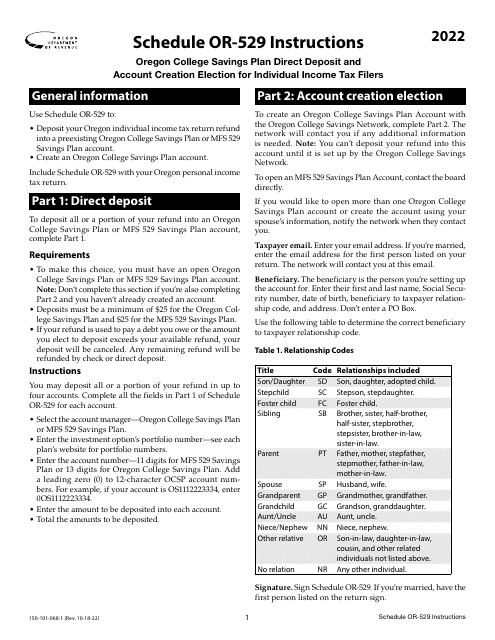

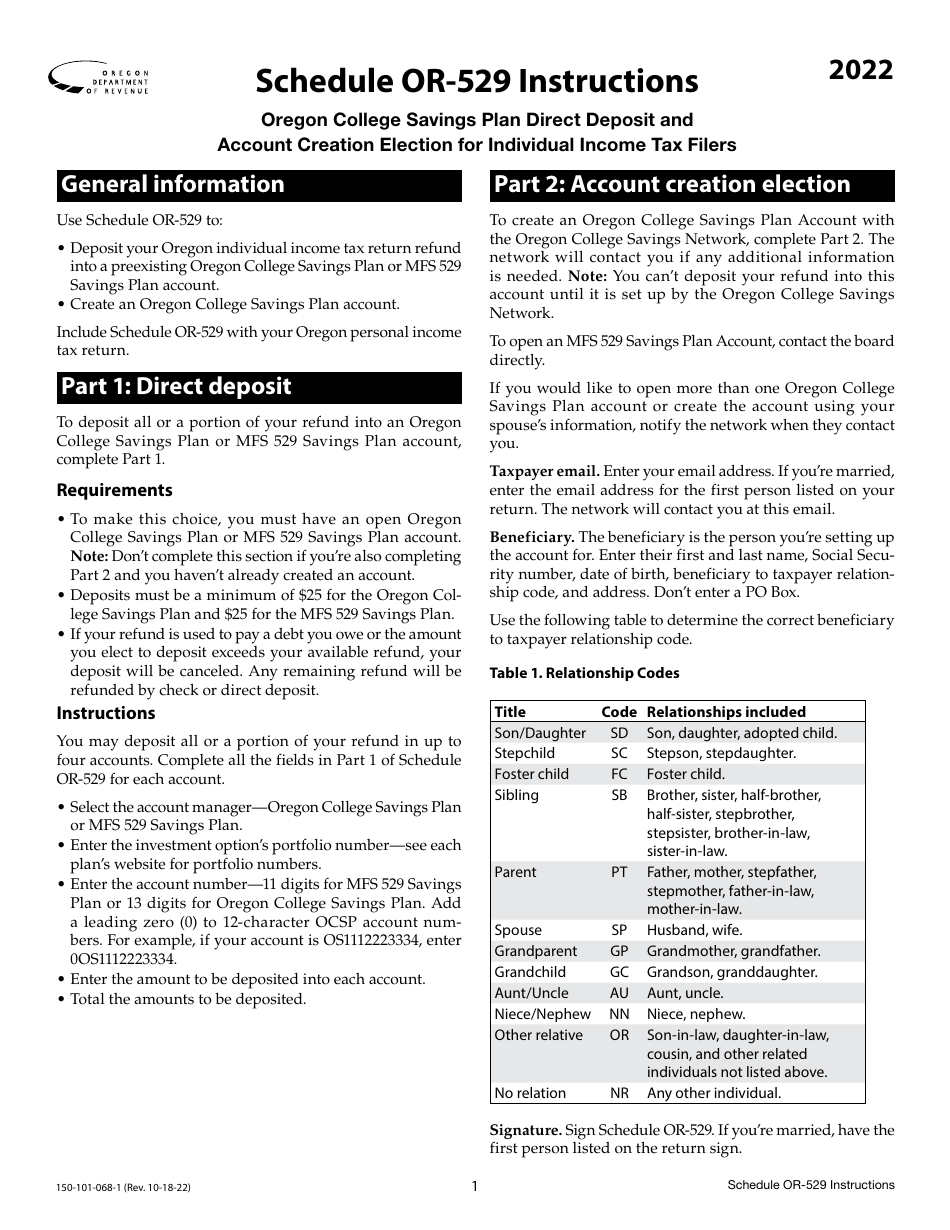

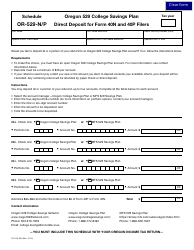

Instructions for Form 150-101-068 Schedule OR-529 Oregon College Savings Plan Direct Deposit and Account Creation Election for Individual Income Tax Filers - Oregon

This document contains official instructions for Form 150-101-068 Schedule OR-529, Oregon Individual Income Tax Filers - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-068 Schedule OR-529 is available for download through this link.

FAQ

Q: What is Form 150-101-068 Schedule OR-529?

A: Form 150-101-068 Schedule OR-529 is a form used by individual income tax filers in Oregon to set up direct deposit and create an account for the Oregon College Savings Plan.

Q: Who needs to use Form 150-101-068 Schedule OR-529?

A: Individual income tax filers in Oregon who want to set up direct deposit and create an account for the Oregon College Savings Plan need to use Form 150-101-068 Schedule OR-529.

Q: What is the purpose of Form 150-101-068 Schedule OR-529?

A: The purpose of Form 150-101-068 Schedule OR-529 is to provide a way for individual income tax filers in Oregon to opt for direct deposit and create an account for the Oregon College Savings Plan.

Q: What information is required on Form 150-101-068 Schedule OR-529?

A: Form 150-101-068 Schedule OR-529 requires information such as the filer's name, SSN, address, and bank account details for direct deposit.

Q: Is Form 150-101-068 Schedule OR-529 mandatory?

A: Form 150-101-068 Schedule OR-529 is not mandatory, but it is recommended for those who want to set up direct deposit and create an account for the Oregon College Savings Plan.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.