This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule C

for the current year.

Instructions for IRS Form 1040 Schedule C Profit or Loss From Business

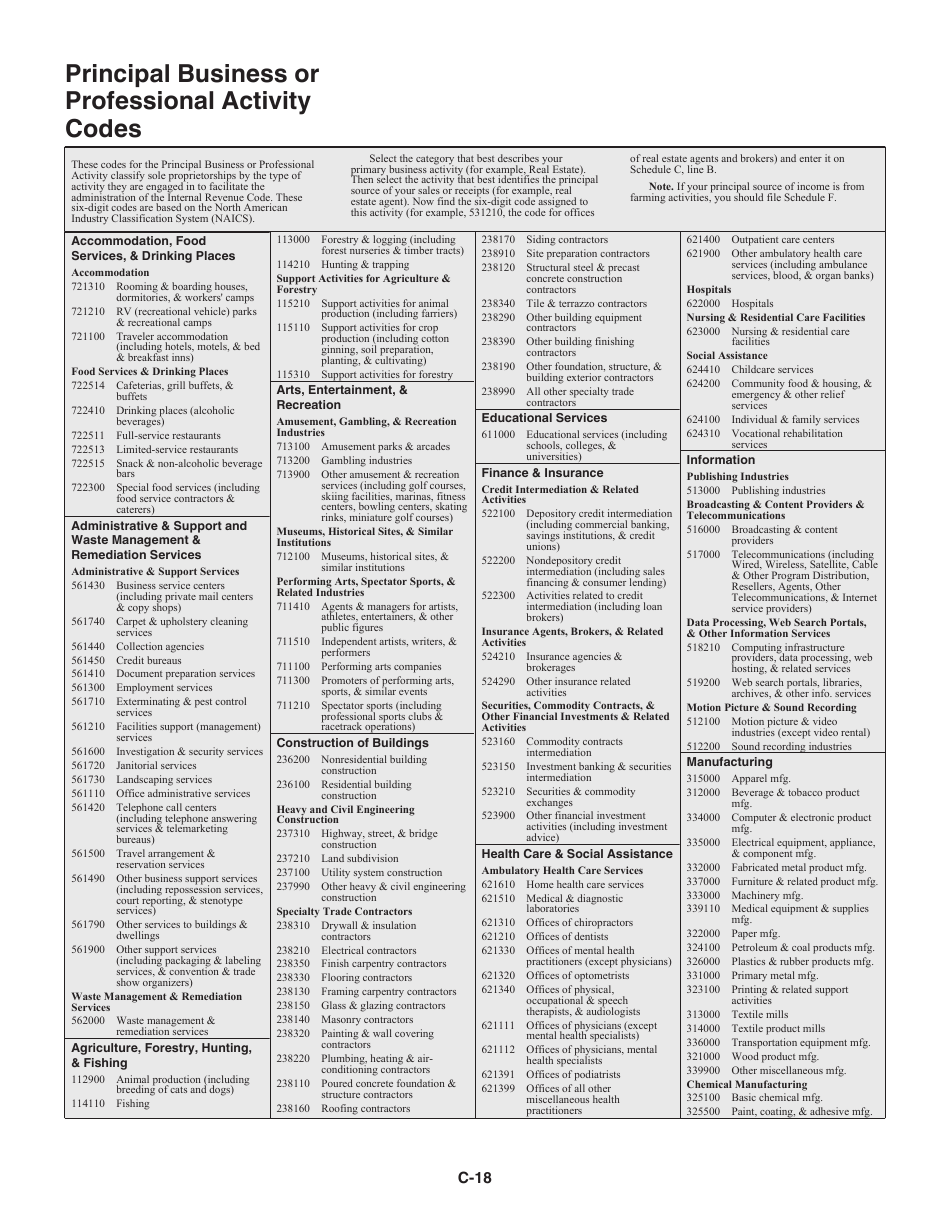

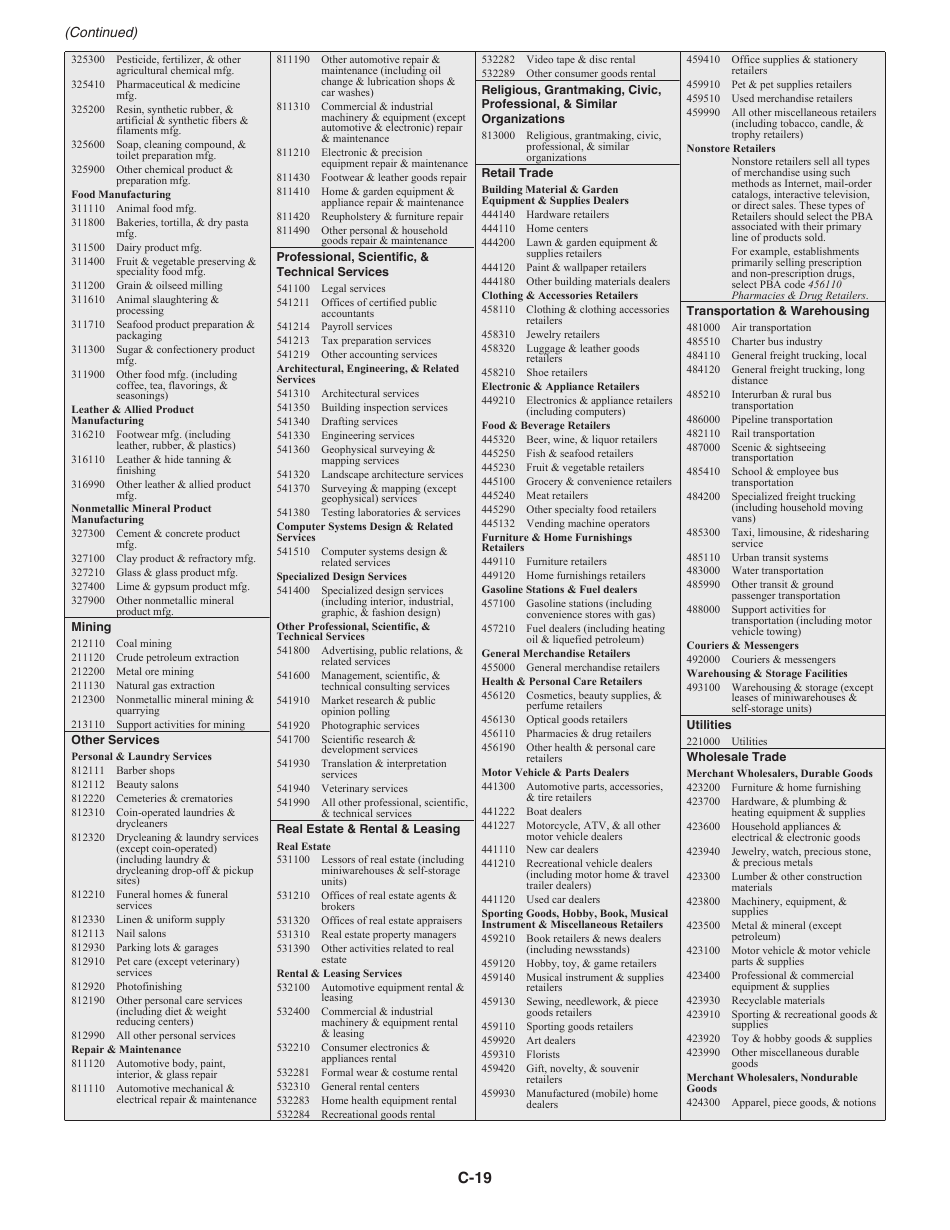

This document contains official instructions for IRS Form 1040 Schedule C, Profit or Loss From Business - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule C?

A: IRS Form 1040 Schedule C is a tax form used by self-employed individuals to report their profit or loss from their business.

Q: Who needs to file IRS Form 1040 Schedule C?

A: Self-employed individuals who have a business or a profession that they operate as a sole proprietorship need to file IRS Form 1040 Schedule C.

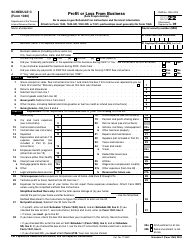

Q: What information is required to complete IRS Form 1040 Schedule C?

A: To complete IRS Form 1040 Schedule C, you will need to provide information about your business income, expenses, deductions, and any other relevant financial information related to your business.

Q: How do I calculate my profit or loss on IRS Form 1040 Schedule C?

A: To calculate your profit or loss on IRS Form 1040 Schedule C, you subtract your total business expenses from your total business income.

Q: When is the deadline to file IRS Form 1040 Schedule C?

A: The deadline to file IRS Form 1040 Schedule C is usually April 15th of the following year. However, the deadline may vary in certain situations, so it's best to check with the IRS or a tax professional for the most up-to-date information.

Instruction Details:

- This 20-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.