This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule C

for the current year.

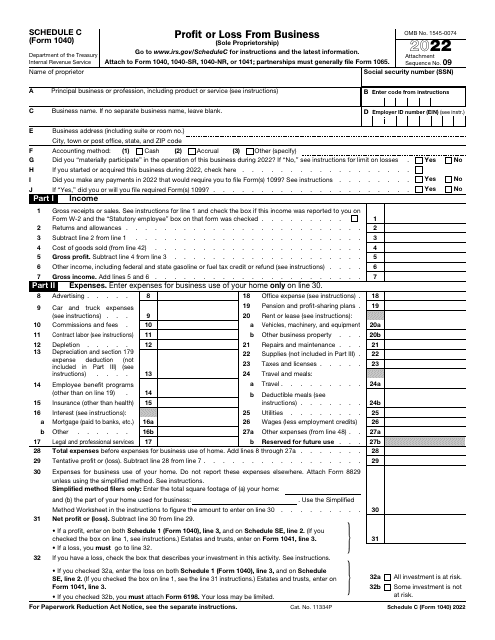

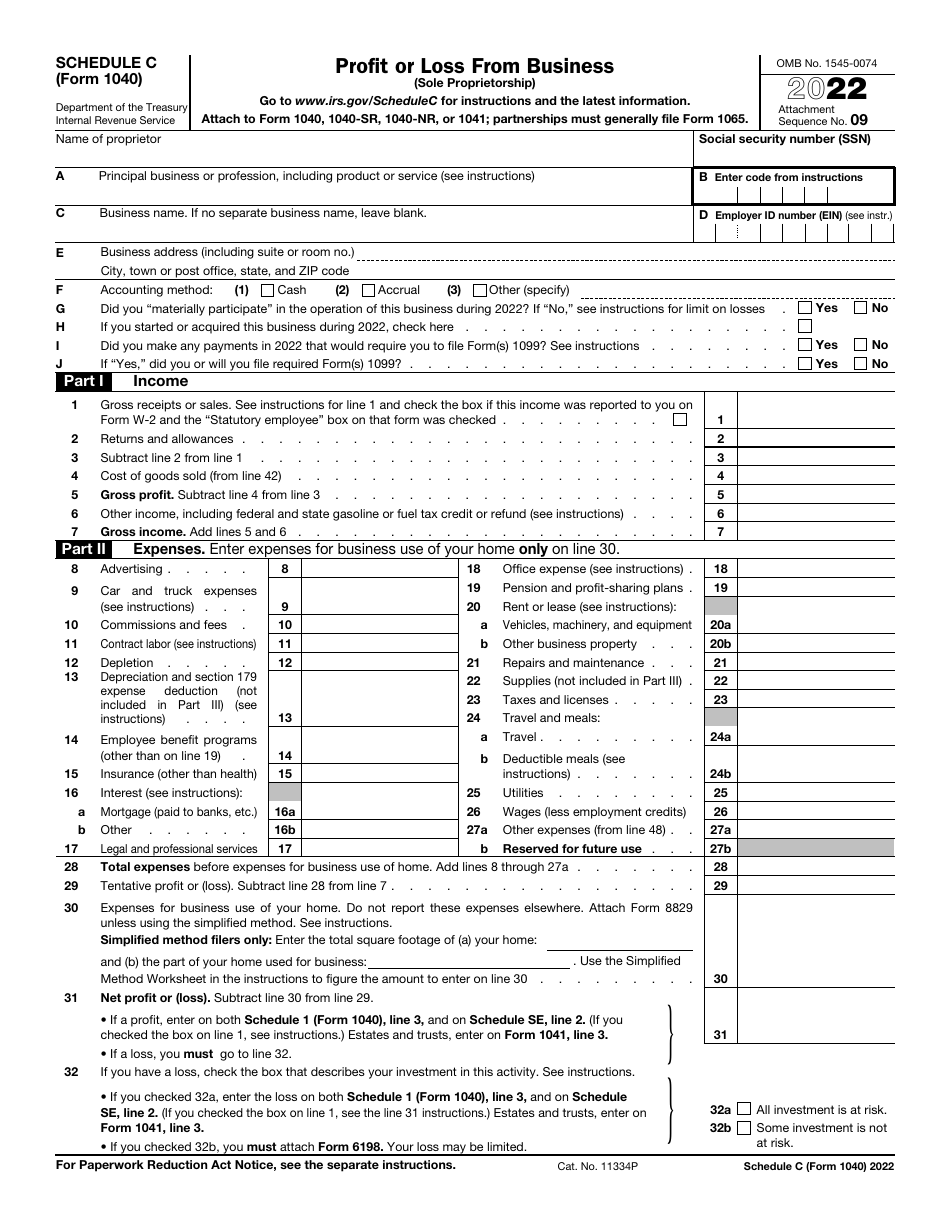

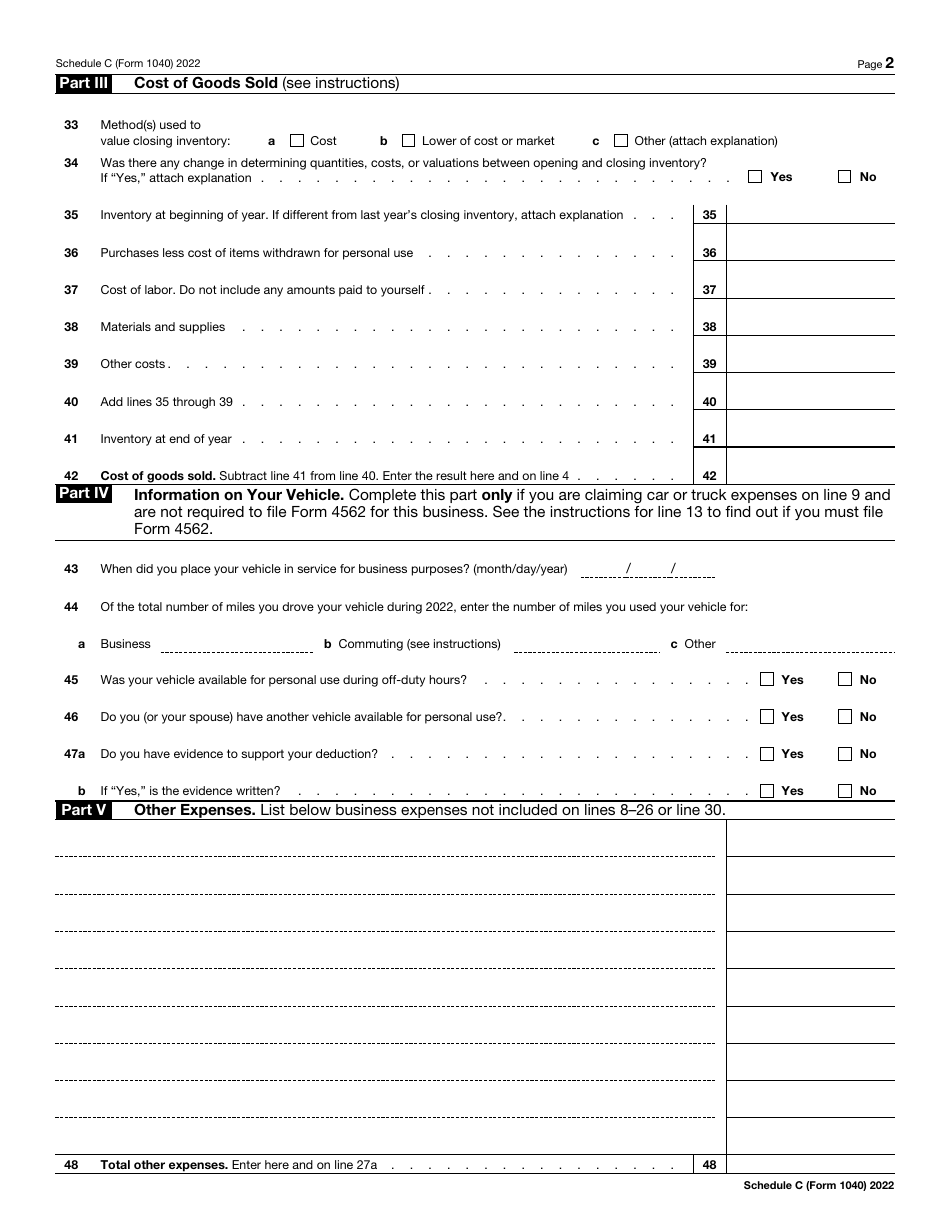

IRS Form 1040 Schedule C Profit or Loss From Business (Sole Proprietorship)

What Is IRS Form 1040 Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule C?

A: IRS Form 1040 Schedule C is a form used to report profit or loss from a sole proprietorship business.

Q: Who needs to file IRS Form 1040 Schedule C?

A: Individuals who are self-employed and operate a sole proprietorship business need to file IRS Form 1040 Schedule C.

Q: What information is required on IRS Form 1040 Schedule C?

A: IRS Form 1040 Schedule C requires information about your business income, expenses, and deductions.

Q: How do I calculate the profit or loss for my business on IRS Form 1040 Schedule C?

A: To calculate the profit or loss for your business on IRS Form 1040 Schedule C, subtract your business expenses from your business income.

Q: When is the deadline to file IRS Form 1040 Schedule C?

A: The deadline to file IRS Form 1040 Schedule C is the same as the deadline to file your annual federal income tax return, which is usually April 15th.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule C through the link below or browse more documents in our library of IRS Forms.