This version of the form is not currently in use and is provided for reference only. Download this version of

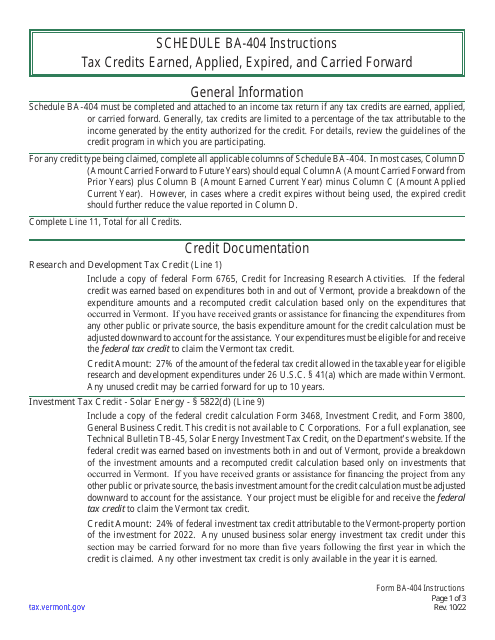

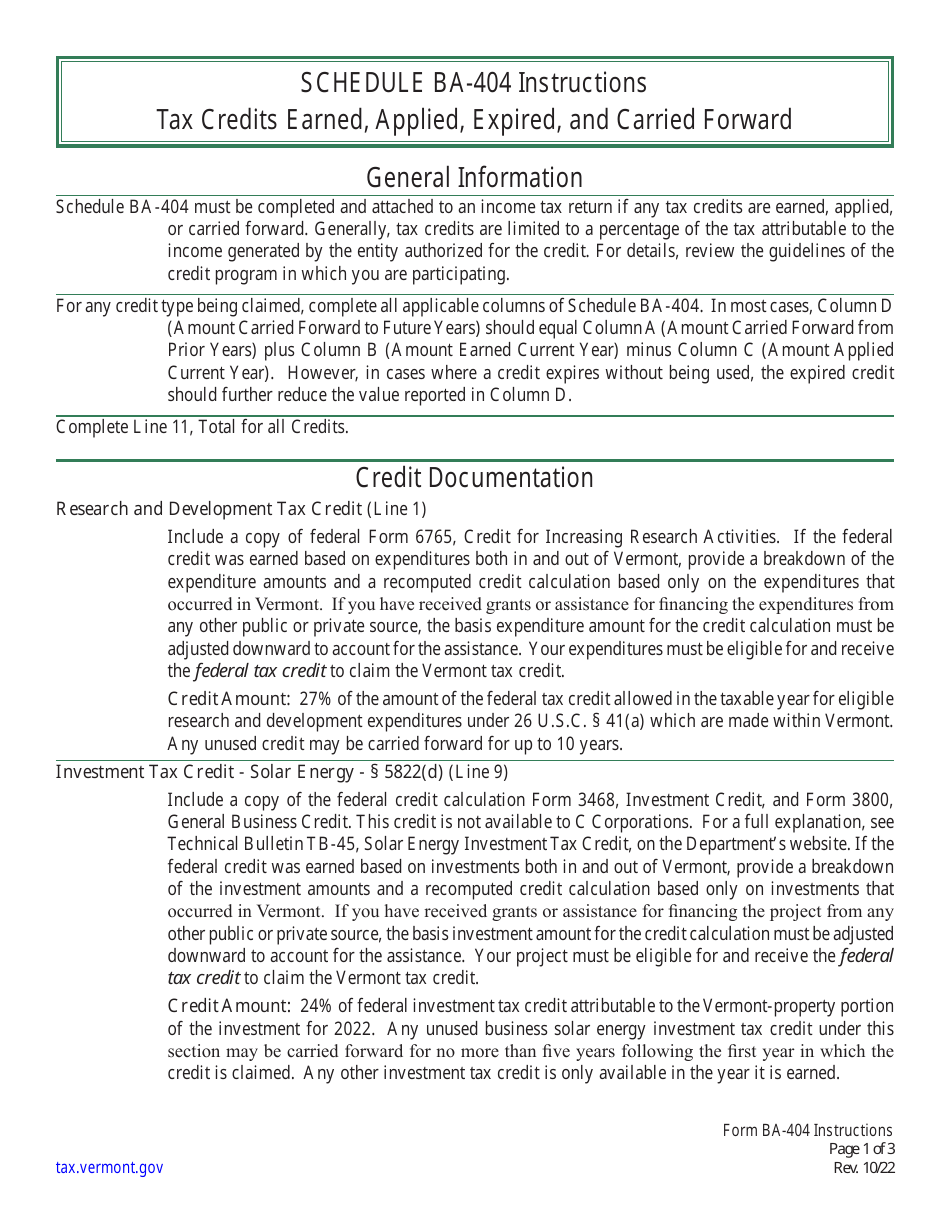

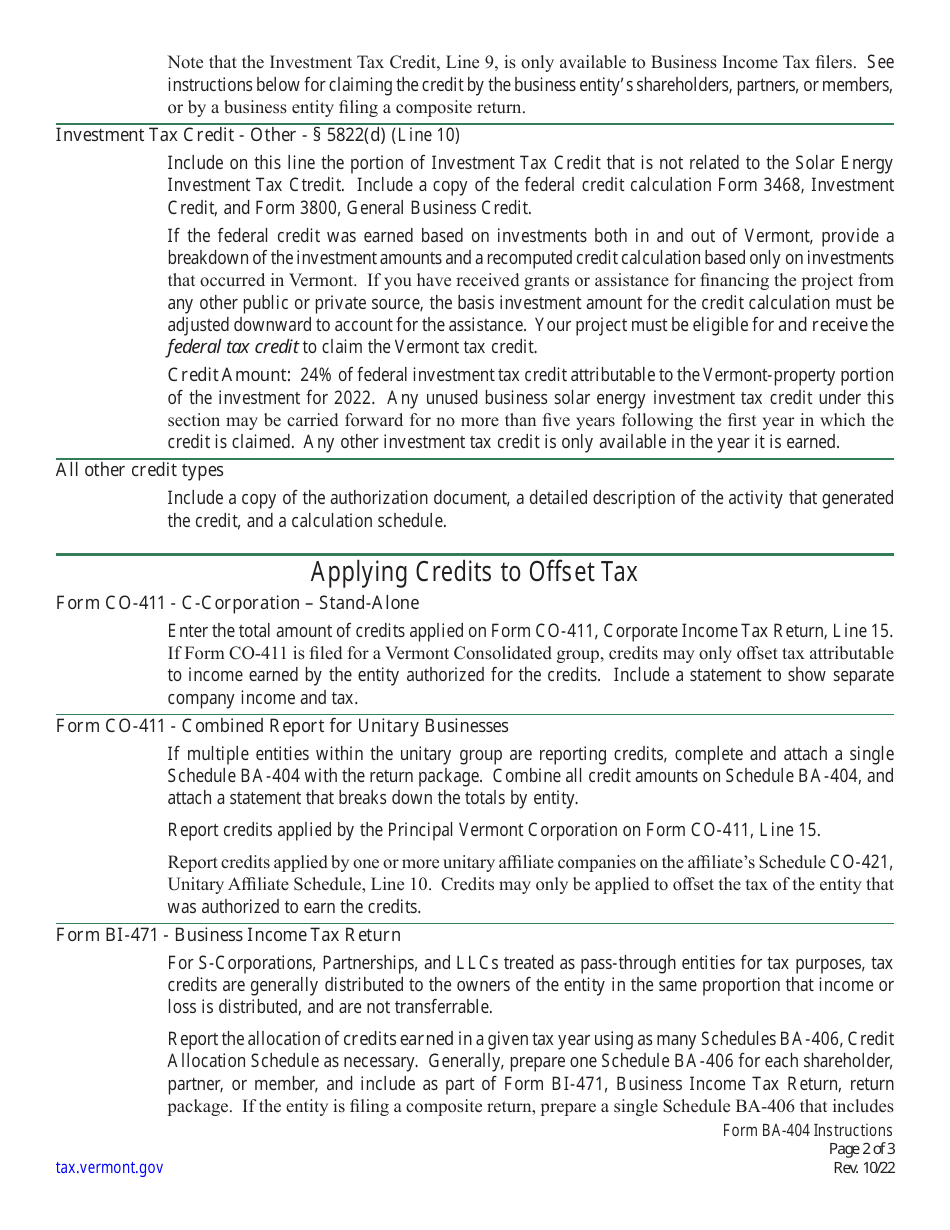

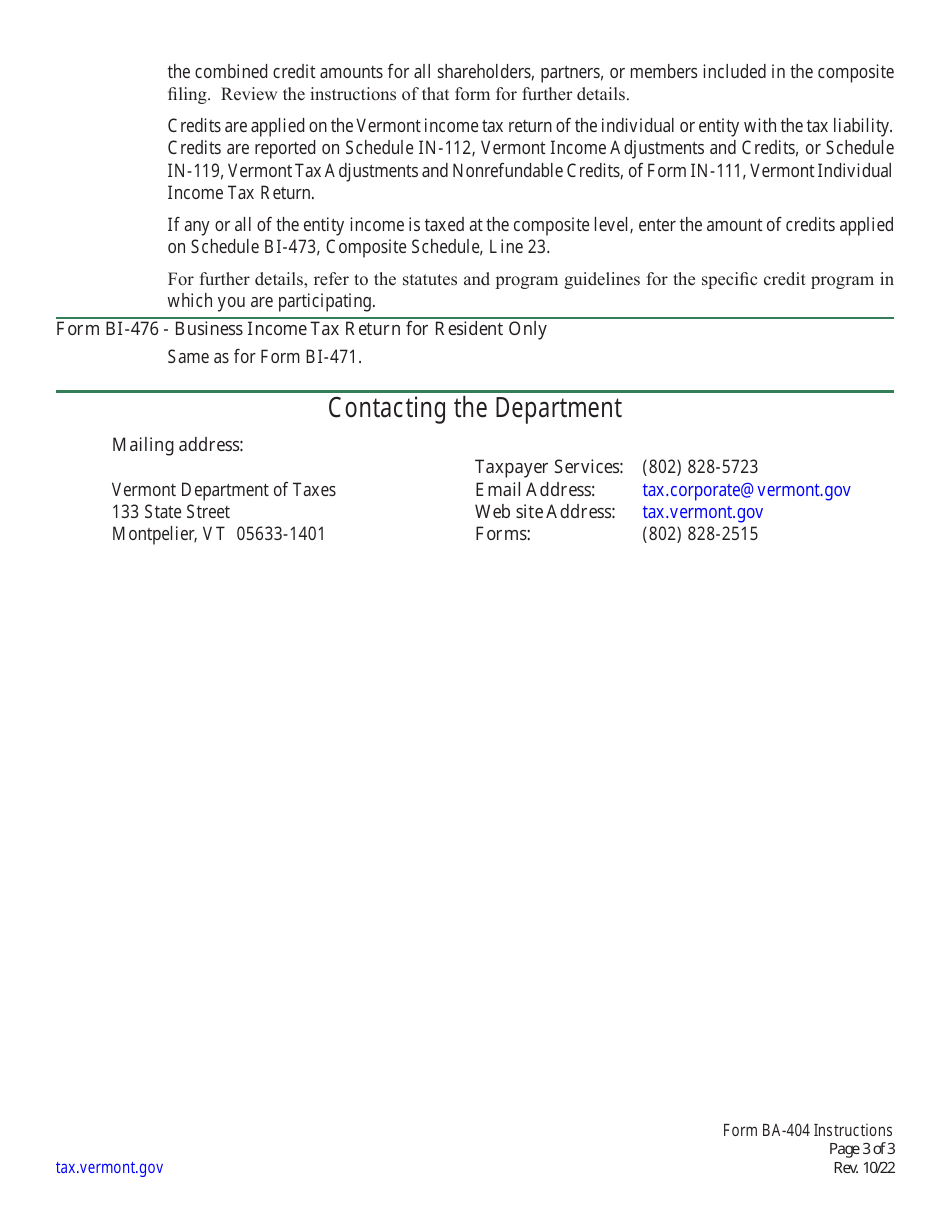

Instructions for Schedule BA-404

for the current year.

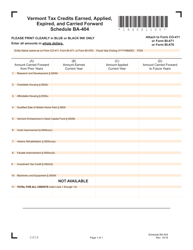

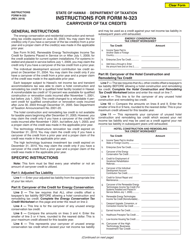

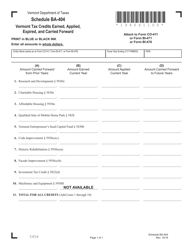

Instructions for Schedule BA-404 Tax Credits Earned, Applied, Expired, and Carried Forward - Vermont

This document contains official instructions for Schedule BA-404 , Tax Credits Earned, Applied, Expired, and Carried Forward - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule BA-404?

A: Schedule BA-404 is a tax form in Vermont that tracks tax credits earned, applied, expired, and carried forward.

Q: What does Schedule BA-404 track?

A: Schedule BA-404 tracks tax credits earned, applied, expired and carried forward.

Q: Who needs to fill out Schedule BA-404?

A: Individuals or businesses in Vermont who have earned tax credits and want to apply, expire, or carry them forward must fill out Schedule BA-404.

Q: How does Schedule BA-404 work?

A: Schedule BA-404 allows taxpayers to report and keep track of tax credits that they have earned and either applied to reduce their tax liability, expired unused, or carried forward to future tax years.

Q: What is the purpose of Schedule BA-404?

A: The purpose of Schedule BA-404 is to provide a record of tax credits earned, applied, expired, and carried forward in Vermont.

Q: When is Schedule BA-404 due?

A: The due date for Schedule BA-404 varies depending on the tax year and individual circumstances. It is generally due around the same time as the Vermont state tax return.

Q: Are there any penalties for not filling out Schedule BA-404?

A: There may be penalties for not accurately reporting tax credits on Schedule BA-404, such as underpayment penalties or delays in processing the tax return.

Q: Can I carry forward tax credits to future years?

A: Yes, you can carry forward tax credits to future years by reporting them on Schedule BA-404.

Q: Can I apply tax credits to reduce my tax liability?

A: Yes, you can apply tax credits earned to reduce your tax liability by reporting them on Schedule BA-404.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.