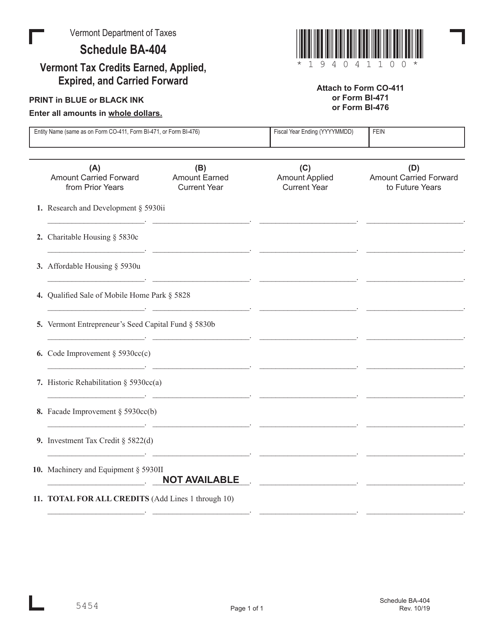

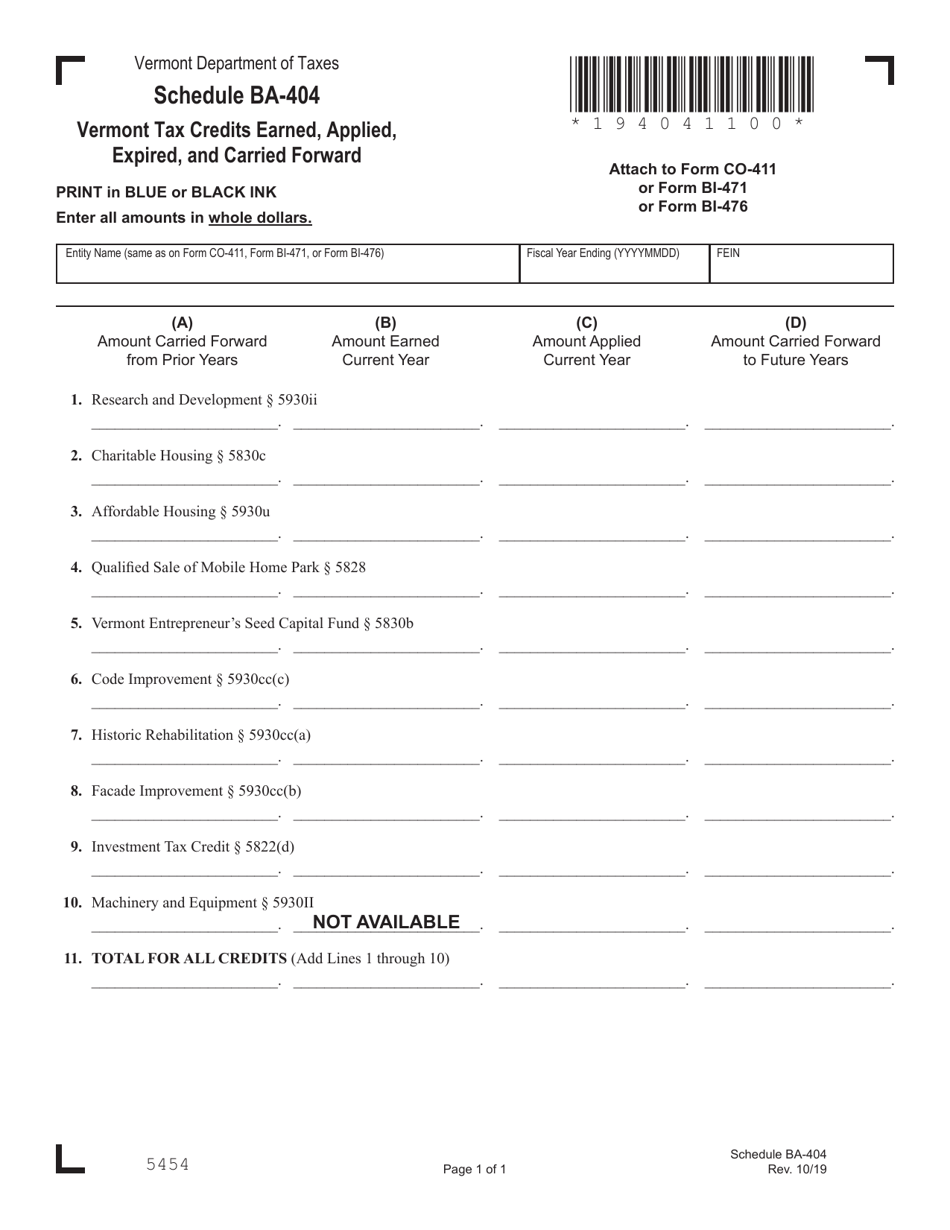

Form CO-411 (BI-471; BI-476) Schedule BA-404 Vermont Tax Credits Earned, Applied, Expired, and Carried Forward - Vermont

What Is Form CO-411 (BI-471; BI-476) Schedule BA-404?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont.The document is a supplement to Form CO-411, Form BI-471, and Form BI-476. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CO-411 (BI-471; BI-476)?

A: Form CO-411 (BI-471; BI-476) is a schedule used in Vermont to report tax credits earned, applied, expired, and carried forward.

Q: What does Schedule BA-404 refer to?

A: Schedule BA-404 refers to the Vermont tax credits earned, applied, expired, and carried forward.

Q: What information does Form CO-411 (BI-471; BI-476) require?

A: Form CO-411 (BI-471; BI-476) requires information about the tax credits earned, applied, expired, and carried forward.

Q: Why is Form CO-411 (BI-471; BI-476) important?

A: Form CO-411 (BI-471; BI-476) is important because it allows individuals to report and track their Vermont tax credits.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CO-411 (BI-471; BI-476) Schedule BA-404 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.