This version of the form is not currently in use and is provided for reference only. Download this version of

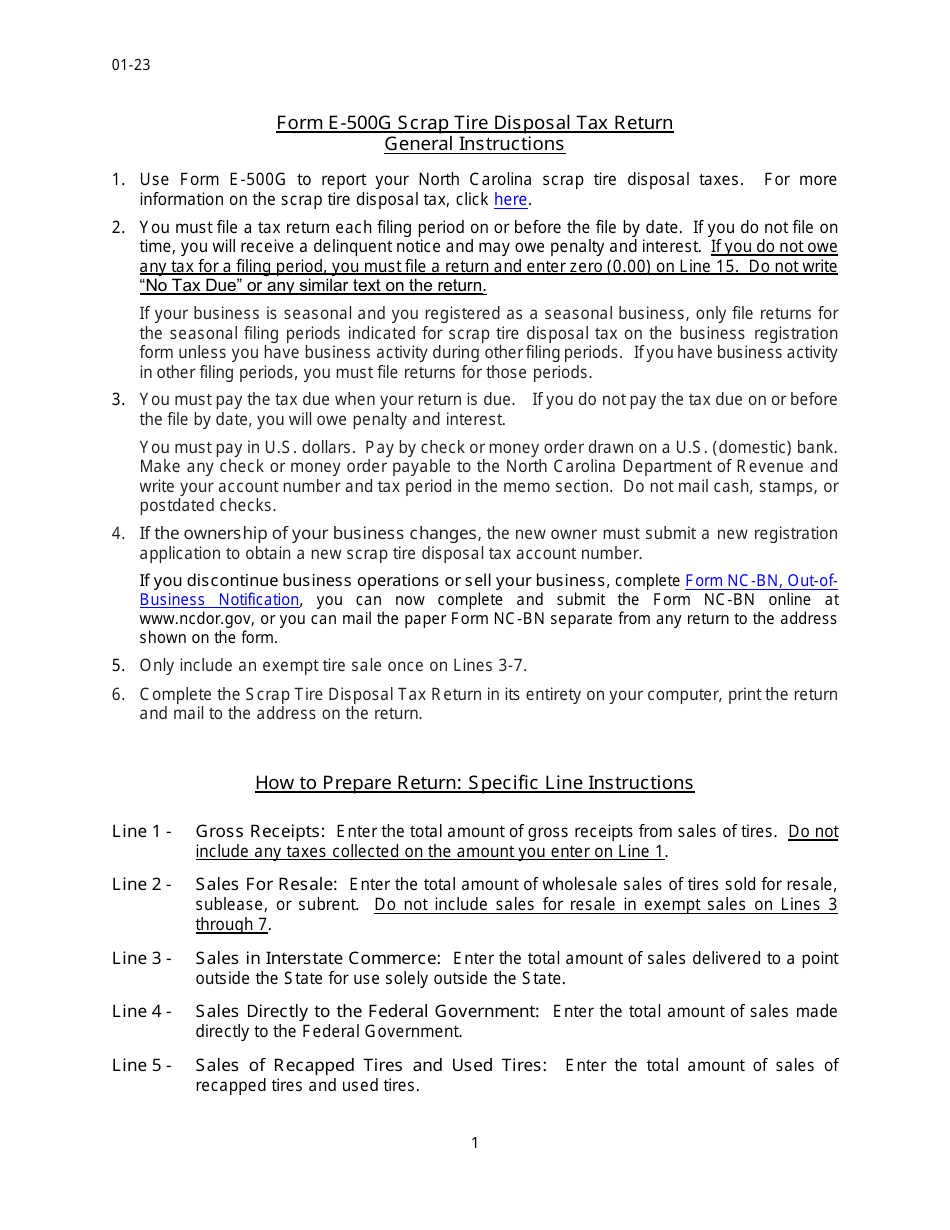

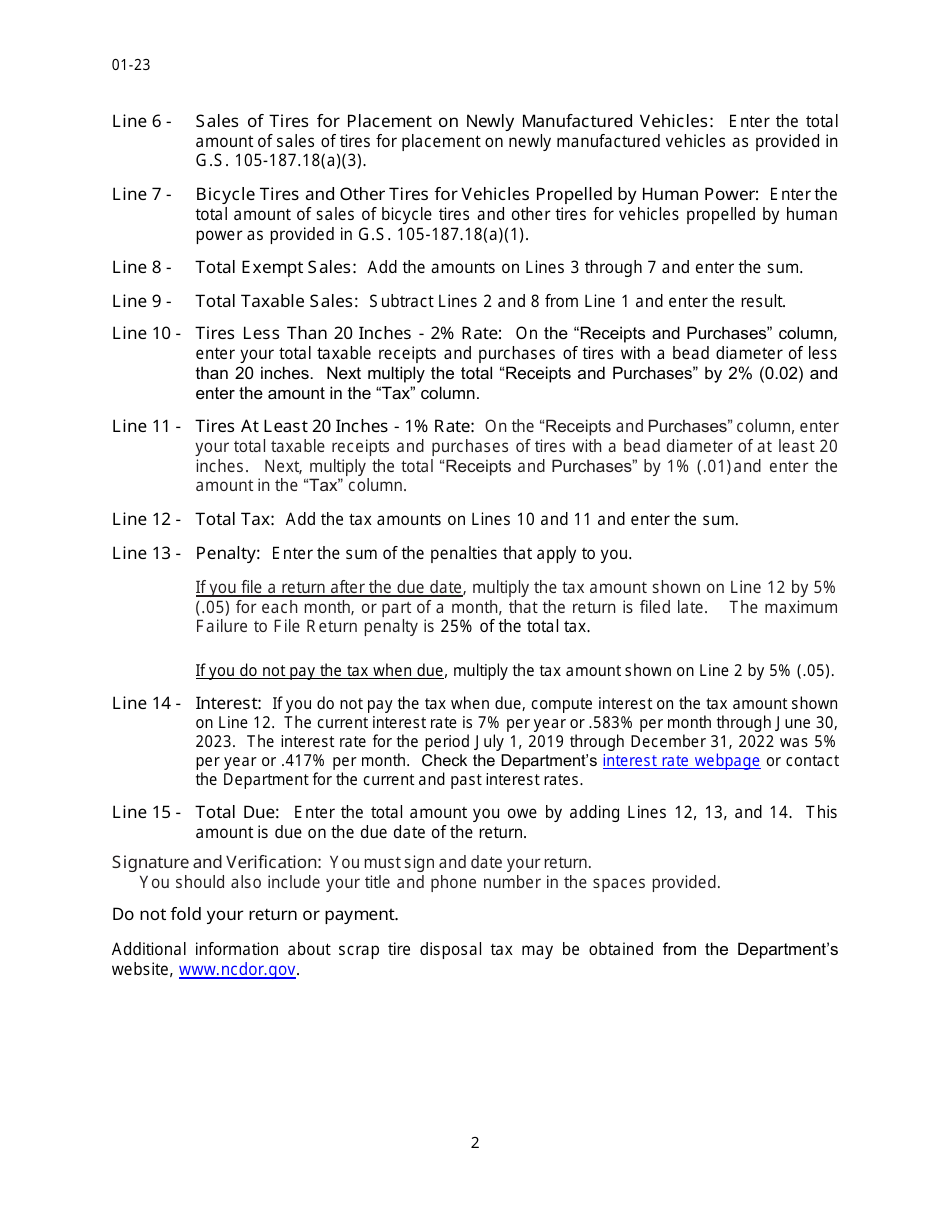

Instructions for Form E-500G

for the current year.

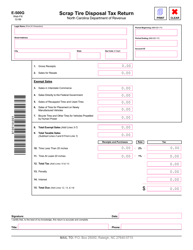

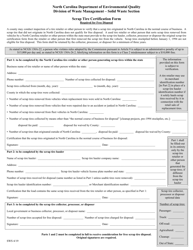

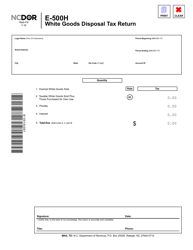

Instructions for Form E-500G Scrap Tire Disposal Tax Return - North Carolina

This document contains official instructions for Form E-500G , Scrap Tire Disposal Tax Return - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form E-500G is available for download through this link.

FAQ

Q: What is Form E-500G?

A: Form E-500G is the Scrap Tire Disposal Tax Return that needs to be filed in North Carolina.

Q: What is the purpose of Form E-500G?

A: The purpose of Form E-500G is to report and pay the Scrap Tire Disposal Tax in North Carolina.

Q: Who needs to file Form E-500G?

A: Any person or business engaged in the business of selling or disposing of tires in North Carolina needs to file Form E-500G.

Q: When should Form E-500G be filed?

A: Form E-500G should be filed on a quarterly basis, on or before the last day of the month following the end of the quarter.

Q: Is there a penalty for late filing of Form E-500G?

A: Yes, there is a penalty for late filing of Form E-500G. The penalty is 5% of the tax due per month or part thereof that the return is late, up to a maximum of 25%.

Q: What is the current tax rate for the Scrap Tire Disposal Tax in North Carolina?

A: The current tax rate for the Scrap Tire Disposal Tax in North Carolina is $2.00 per tire.

Q: Are there any exemptions or deductions available for the Scrap Tire Disposal Tax?

A: No, there are no exemptions or deductions available for the Scrap Tire Disposal Tax in North Carolina.

Q: What happens if I overpay the Scrap Tire Disposal Tax?

A: If you overpay the Scrap Tire Disposal Tax, you can request a refund from the North Carolina Department of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.