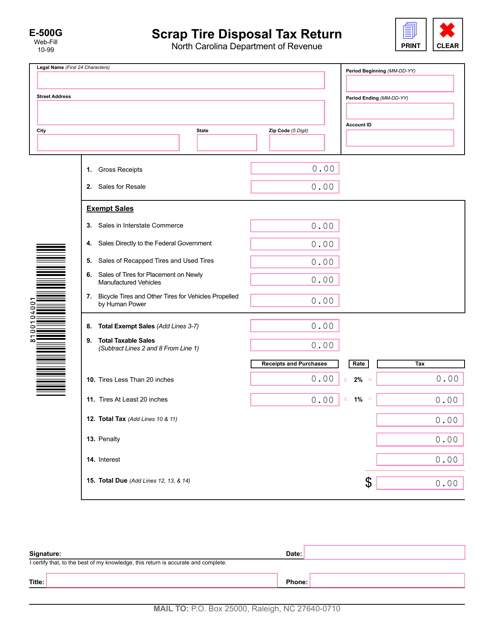

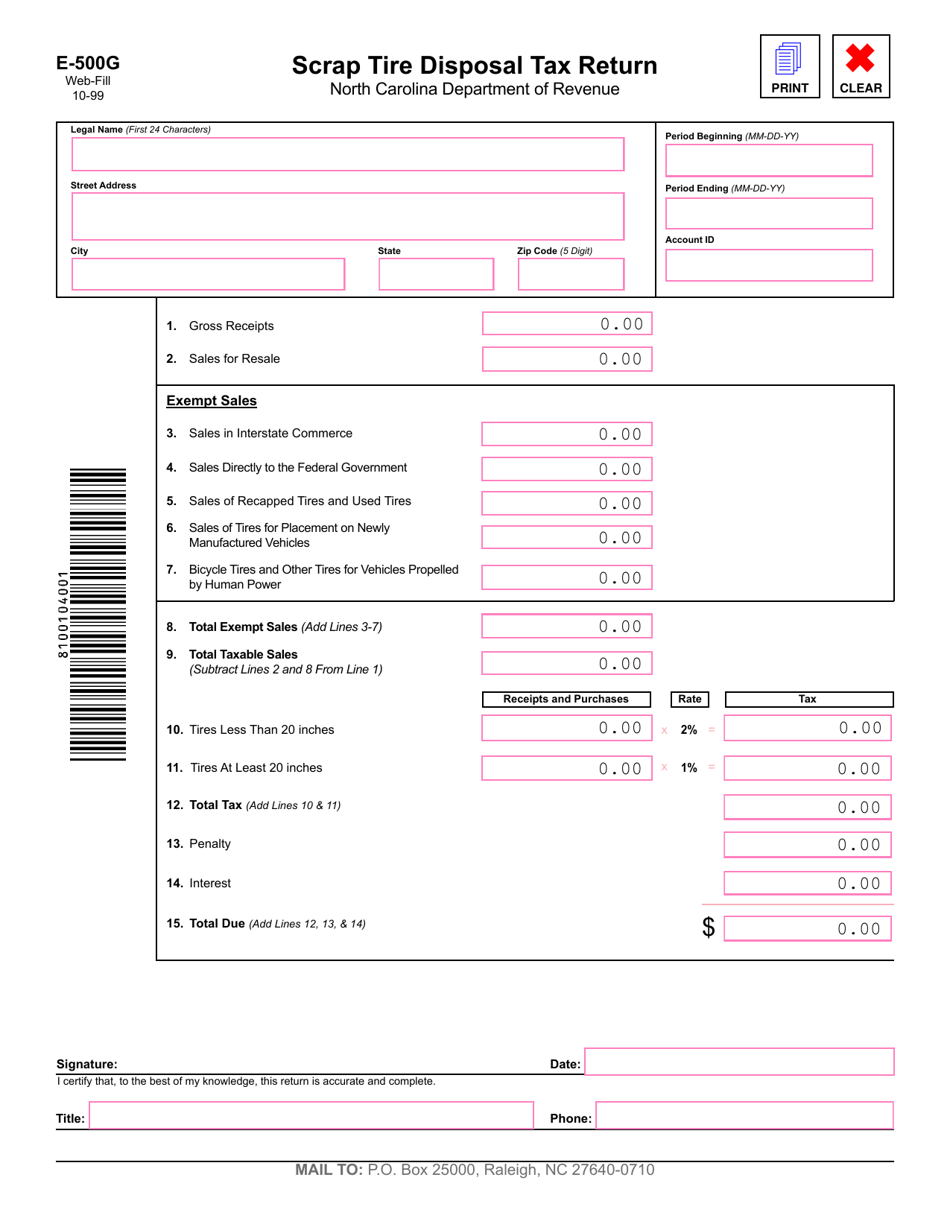

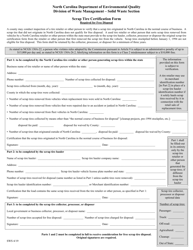

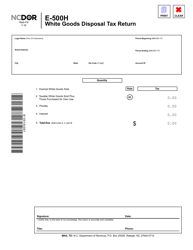

Form E-500G Scrap Tire Disposal Tax Return - North Carolina

What Is Form E-500G?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form E-500G?

A: Form E-500G is the Scrap Tire Disposal Tax Return used in North Carolina.

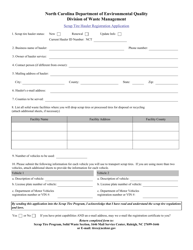

Q: What is the Scrap Tire Disposal Tax?

A: The Scrap Tire Disposal Tax is a tax imposed on the disposal or sale of new tires in North Carolina.

Q: Who needs to file Form E-500G?

A: Any person or business engaged in the sale or disposal of new tires in North Carolina needs to file Form E-500G.

Q: When is Form E-500G due?

A: Form E-500G is due by the 20th day of the month following the end of the reporting period.

Q: What happens if I don't file Form E-500G?

A: If you fail to file Form E-500G or file it late, you may be subject to penalties and interest.

Form Details:

- Released on October 1, 1999;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-500G by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.