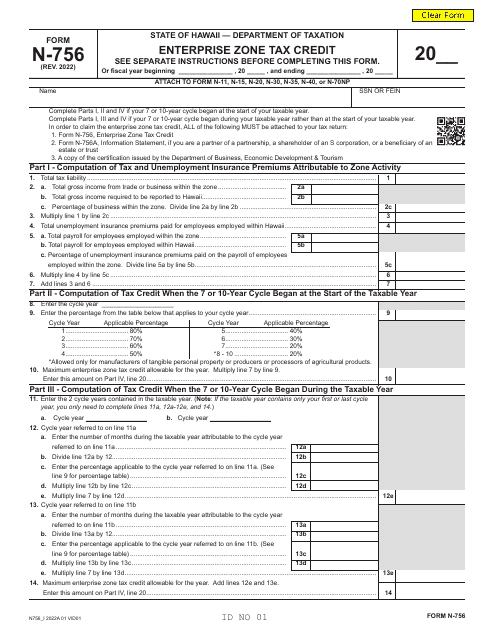

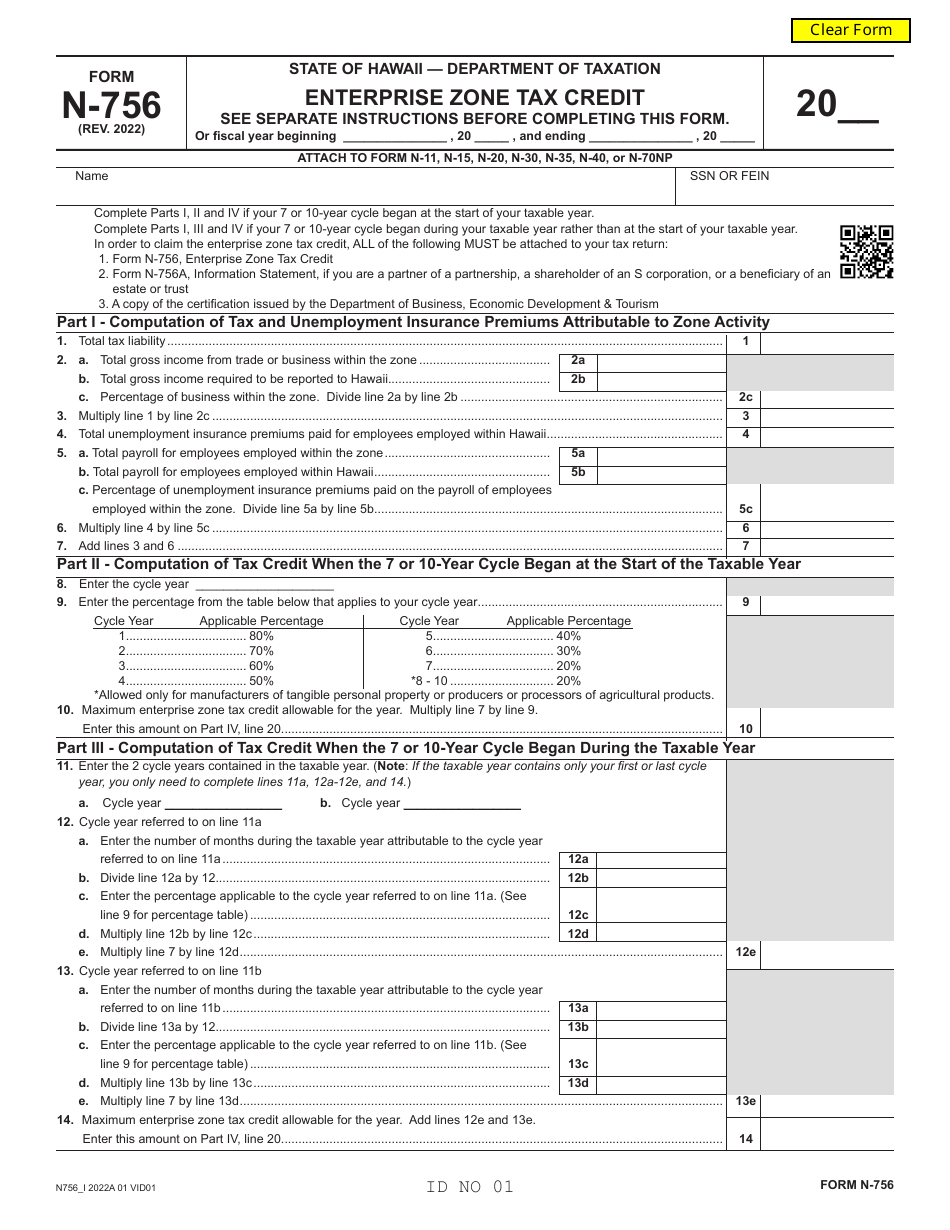

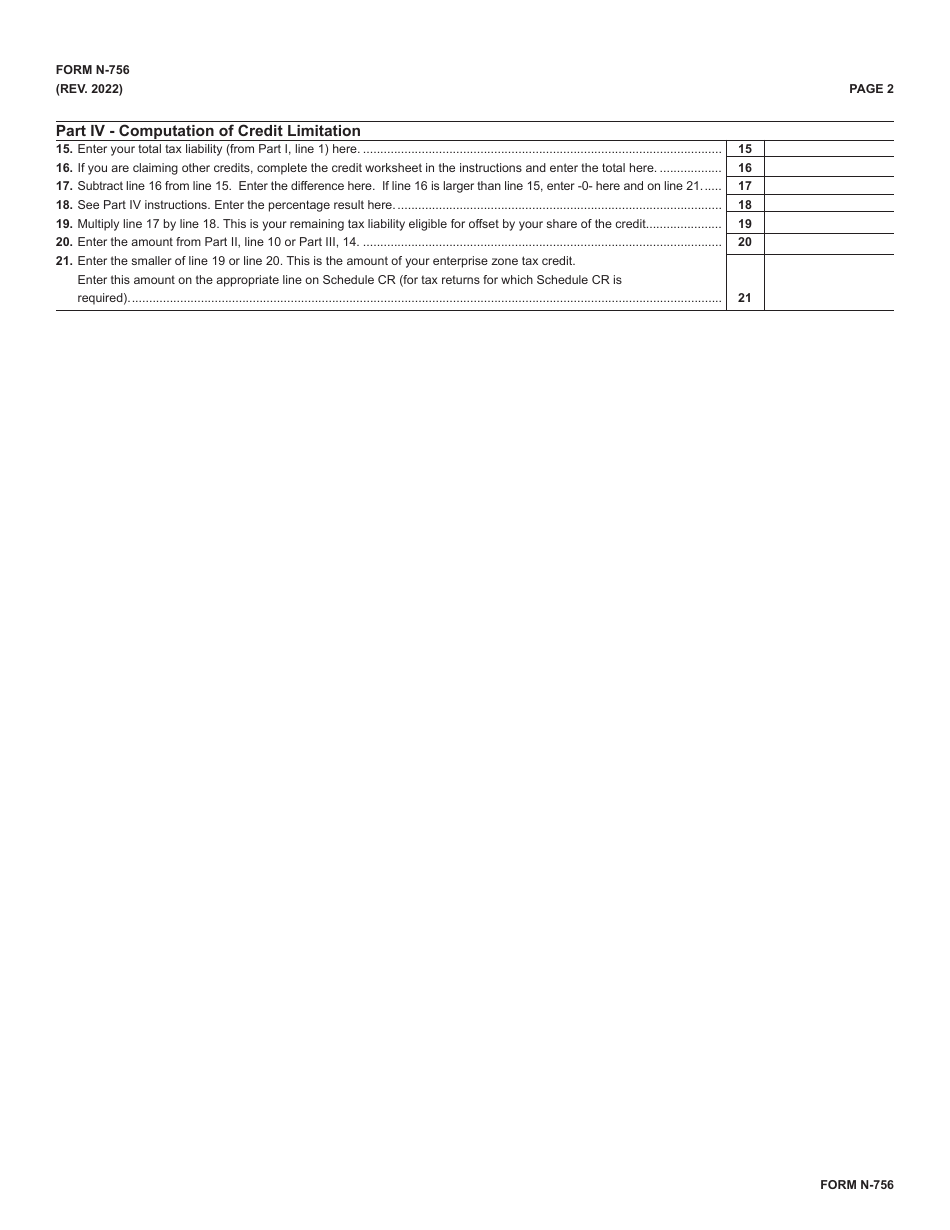

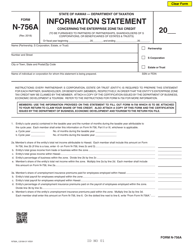

Form N-756 Enterprise Zone Tax Credit - Hawaii

What Is Form N-756?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-756?

A: Form N-756 is a tax form for claiming the Enterprise ZoneTax Credit in Hawaii.

Q: What is the Enterprise Zone Tax Credit?

A: The Enterprise Zone Tax Credit is a credit available to businesses operating in designated enterprise zones in Hawaii.

Q: Who is eligible to claim the Enterprise Zone Tax Credit?

A: Businesses that meet certain criteria and operate within designated enterprise zones in Hawaii are eligible to claim this credit.

Q: How do I qualify for the Enterprise Zone Tax Credit?

A: To qualify, your business must meet specific requirements such as job creation, capital investment, and location within an enterprise zone.

Q: What expenses can be claimed under the Enterprise Zone Tax Credit?

A: Expenses related to job creation, employee training, and capital investments made within an enterprise zone can be claimed under this credit.

Q: How do I file Form N-756?

A: You can file Form N-756 by completing the form and submitting it along with any necessary supporting documents to the Hawaii Department of Taxation.

Q: What is the deadline for filing Form N-756?

A: The deadline for filing Form N-756 is the same as the deadline for filing your Hawaii state tax return, which is typically April 20th.

Q: Are there any limitations or restrictions on the Enterprise Zone Tax Credit?

A: Yes, there are certain limitations and restrictions on this credit, such as annual caps and specific guidelines regarding eligible expenses.

Q: Can I claim the Enterprise Zone Tax Credit if I operate a home-based business?

A: In general, home-based businesses are not eligible for the Enterprise Zone Tax Credit unless they meet certain criteria and are located within an enterprise zone.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-756 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.