This version of the form is not currently in use and is provided for reference only. Download this version of

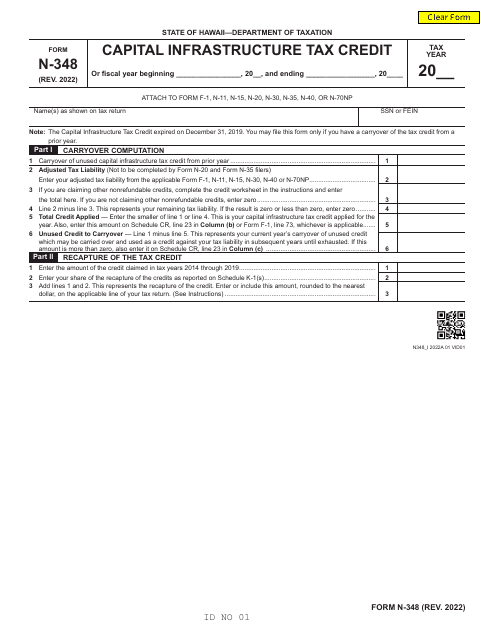

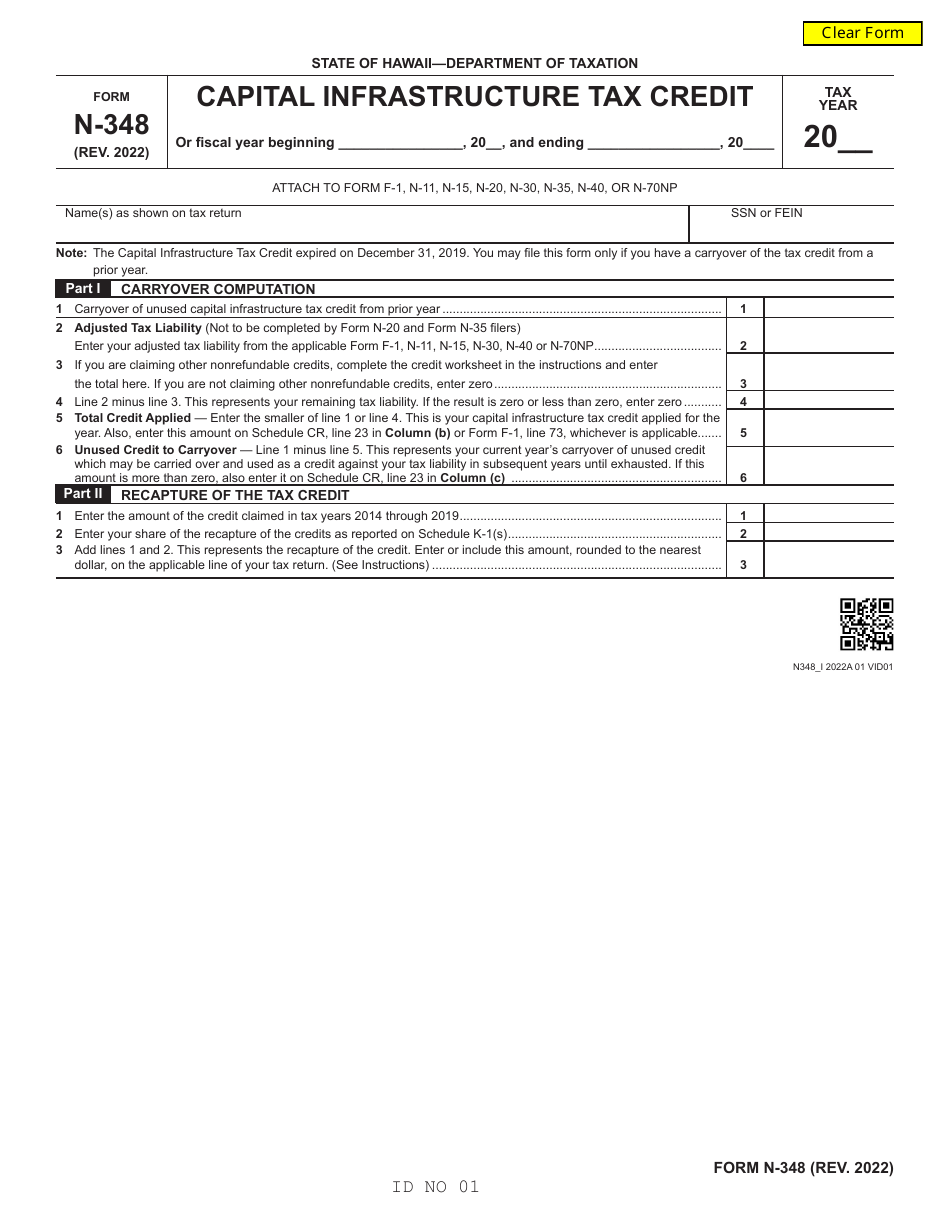

Form N-348

for the current year.

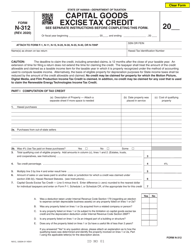

Form N-348 Capital Infrastructure Tax Credit - Hawaii

What Is Form N-348?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-348?

A: Form N-348 is the Capital Infrastructure Tax Credit form specific to the state of Hawaii.

Q: What is the Capital Infrastructure Tax Credit?

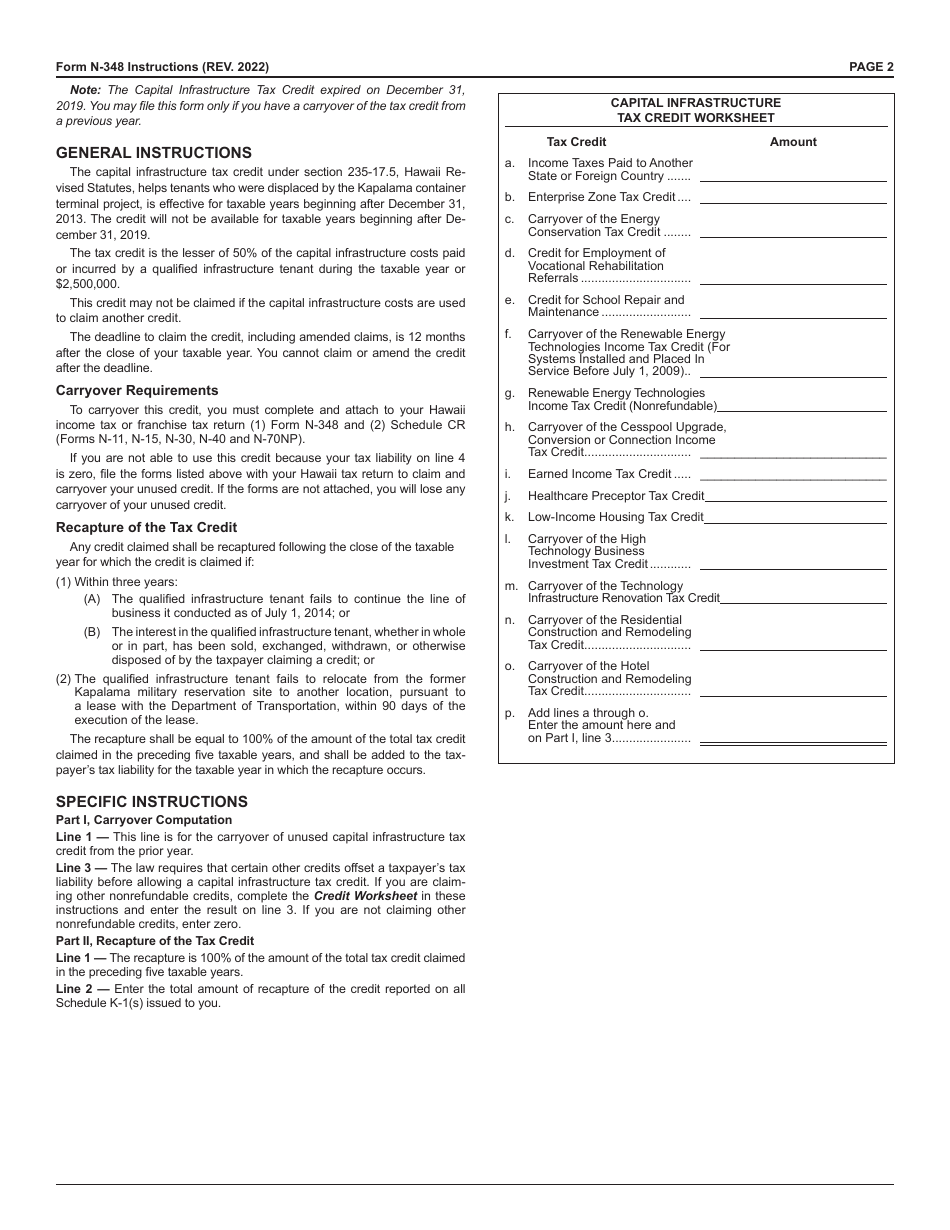

A: The Capital Infrastructure Tax Credit is a tax credit provided by the state of Hawaii for qualifying businesses that make investments in certain types of capital infrastructure.

Q: Who is eligible for the Capital Infrastructure Tax Credit?

A: Businesses in Hawaii that make eligible investments in qualified capital infrastructure projects may be eligible for the tax credit.

Q: What types of investments qualify for the tax credit?

A: Investments in capital infrastructure projects such as roads, bridges, highways, water systems, and energy infrastructure may qualify for the tax credit.

Q: How much is the tax credit?

A: The tax credit amount is based on a percentage of the eligible investment made by the business.

Q: How do I claim the Capital Infrastructure Tax Credit?

A: To claim the tax credit, businesses must complete and file Form N-348 with the Hawaii Department of Taxation.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, businesses must file Form N-348 by the due date of their annual tax return.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are limitations on the amount of the credit, and the tax credit may be subject to recapture if certain conditions are not met.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-348 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.