This version of the form is not currently in use and is provided for reference only. Download this version of

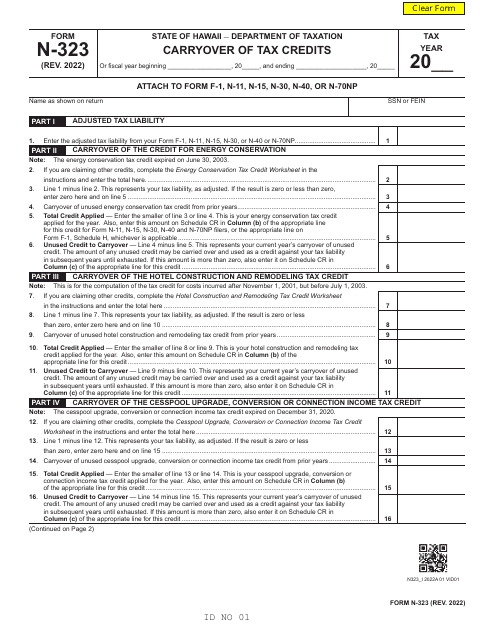

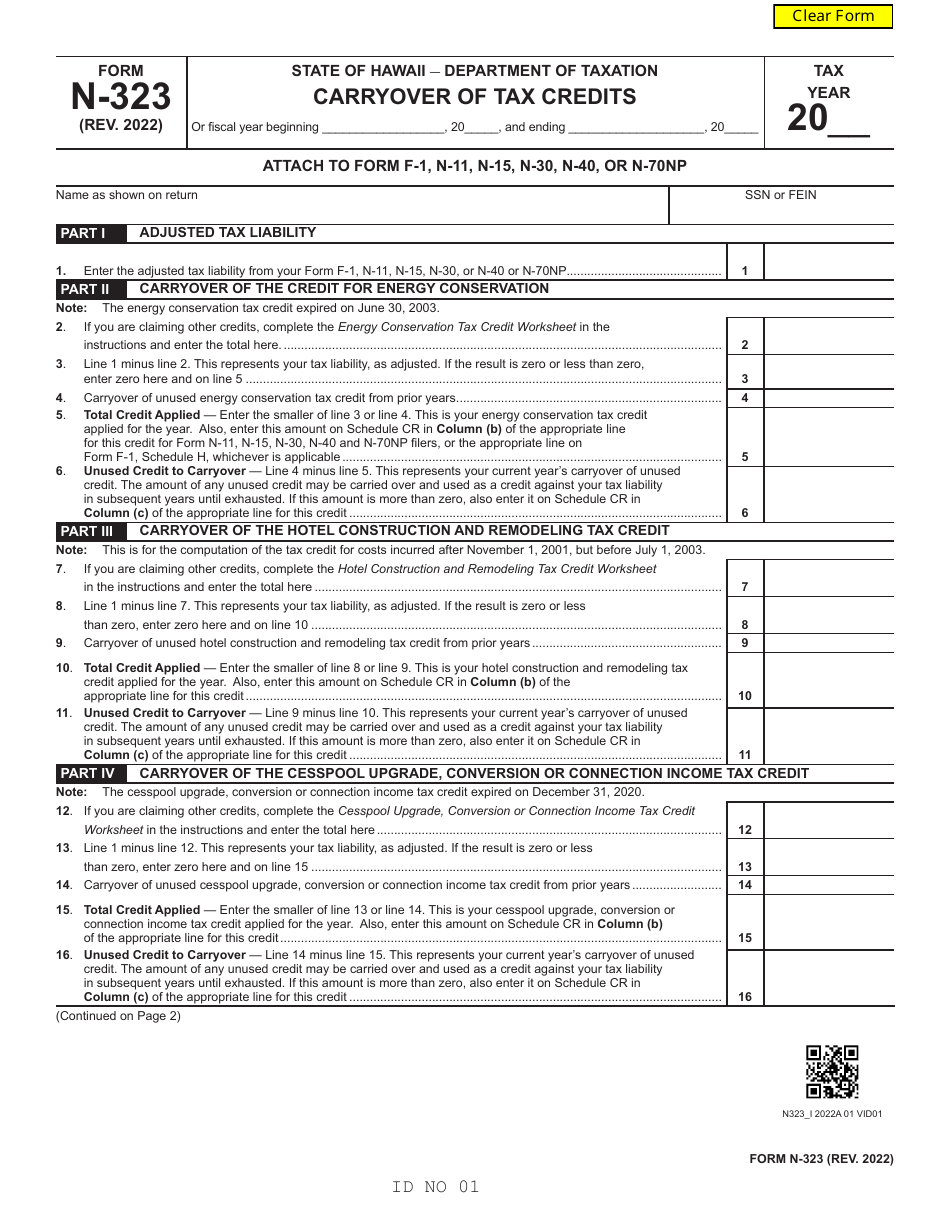

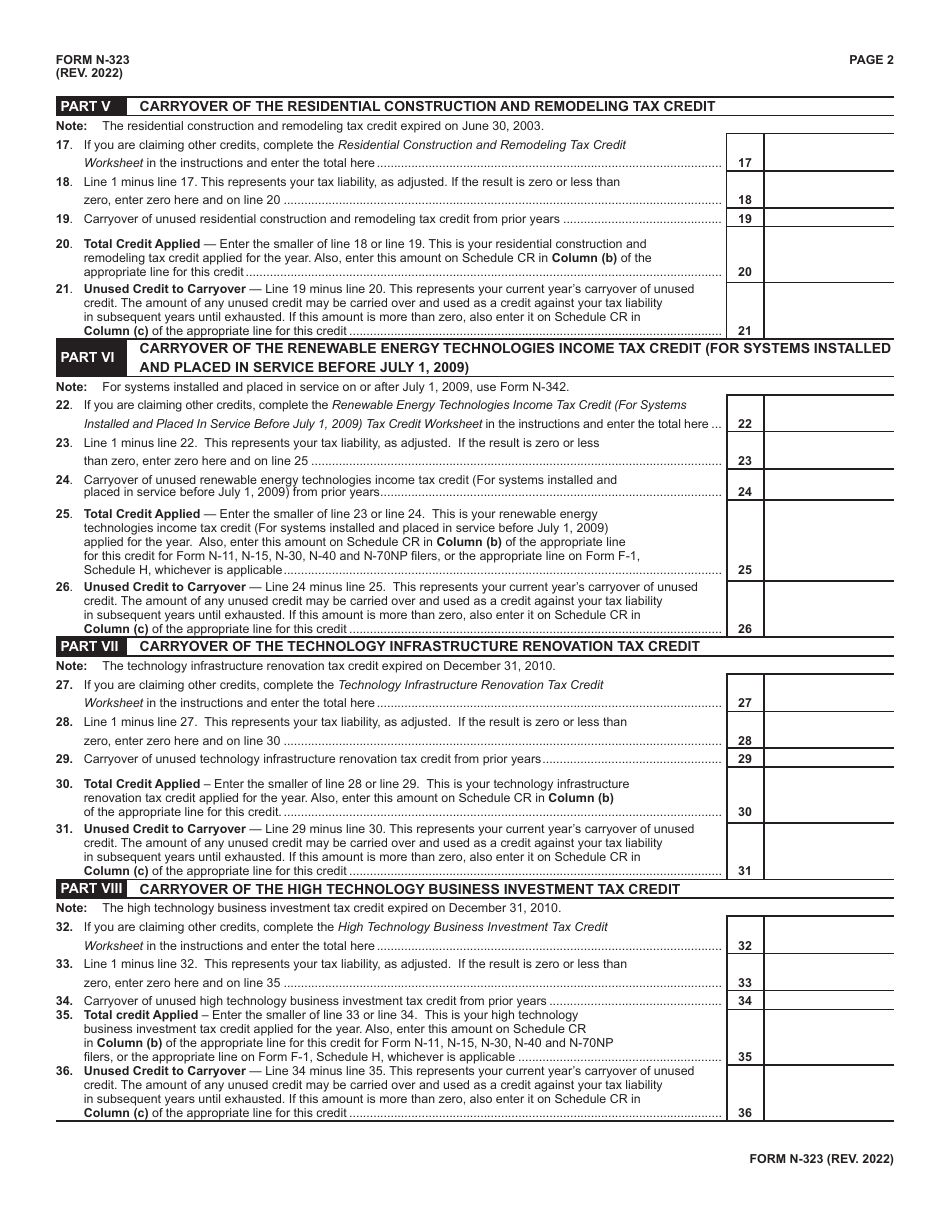

Form N-323

for the current year.

Form N-323 Carryover of Tax Credits - Hawaii

What Is Form N-323?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-323?

A: Form N-323 is a tax form used in Hawaii to carryover tax credits from previous tax years.

Q: What are tax credits?

A: Tax credits are incentives provided by the government that reduce the amount of tax you owe.

Q: Why would I need to carryover tax credits?

A: If you have unused tax credits from a previous year, you can carry them over to offset your tax liability in future years.

Q: Who can use Form N-323?

A: Individuals and businesses in Hawaii who have unused tax credits from a previous year can use Form N-323.

Q: When is the deadline to file Form N-323?

A: The deadline to file Form N-323 is usually the same as the deadline for filing your Hawaii state tax return, which is typically April 20th or the next business day if April 20th falls on a weekend or holiday.

Q: Can I e-file Form N-323?

A: Yes, you can e-file Form N-323 if you are using approved tax software.

Q: What should I do if I have questions about Form N-323?

A: If you have questions about Form N-323 or how to fill it out, you can contact the Hawaii Department of Taxation for assistance.

Q: Can I carryover tax credits to future years indefinitely?

A: No, there are limitations on how long you can carryover tax credits in Hawaii. Check the instructions for Form N-323 or consult a tax professional for more information.

Q: Are there any other requirements for using Form N-323?

A: Yes, you must meet certain eligibility criteria and follow the instructions provided with the form to properly use Form N-323.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-323 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.