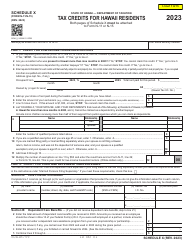

This version of the form is not currently in use and is provided for reference only. Download this version of

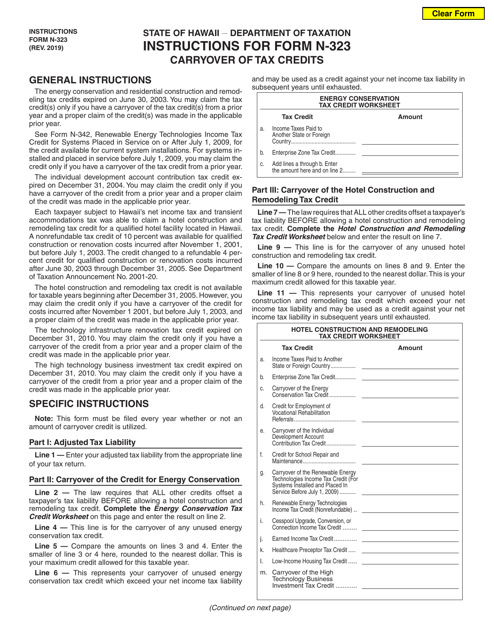

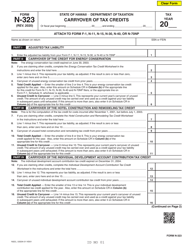

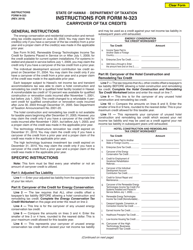

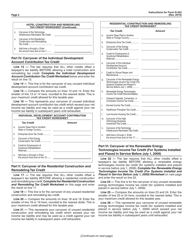

Instructions for Form N-323

for the current year.

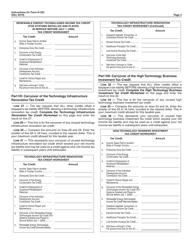

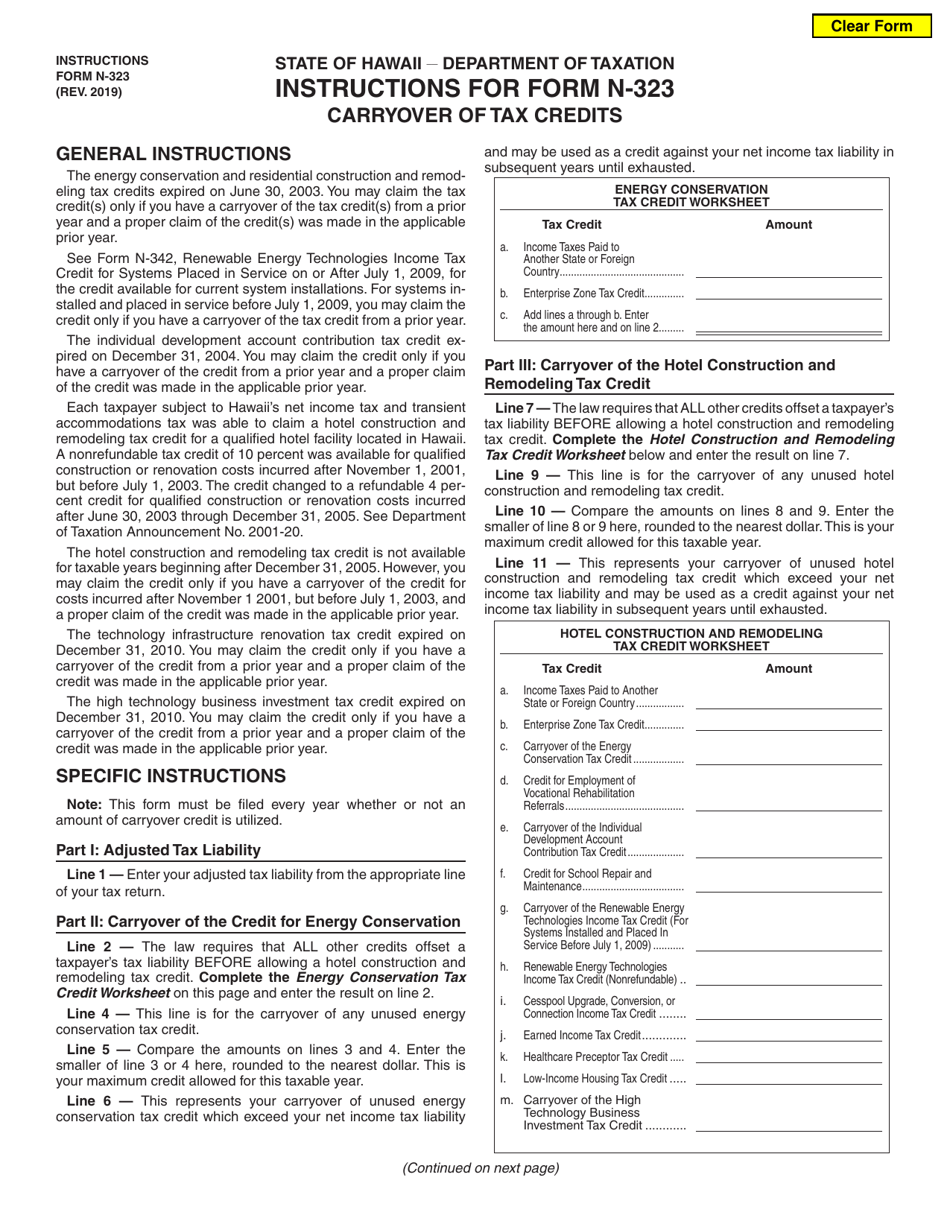

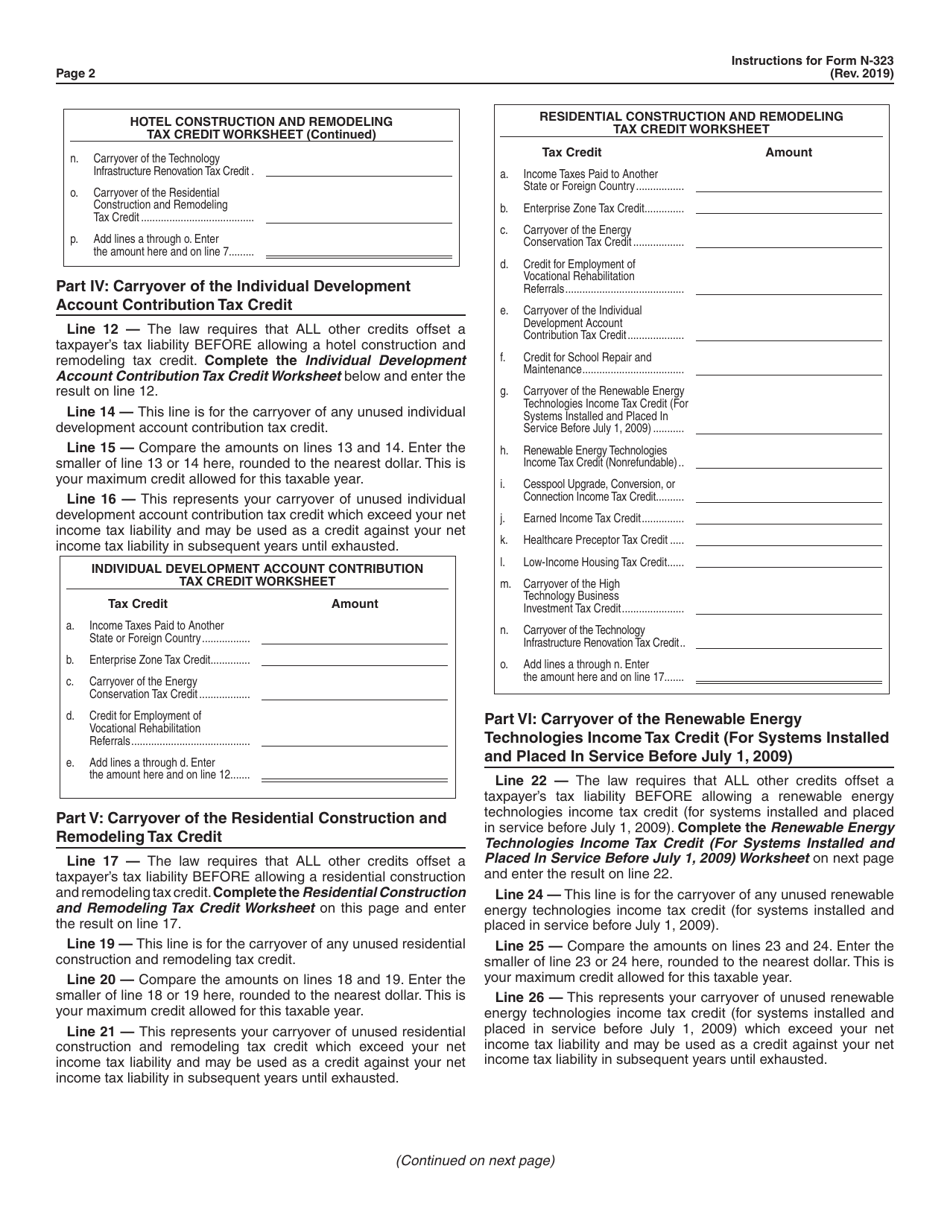

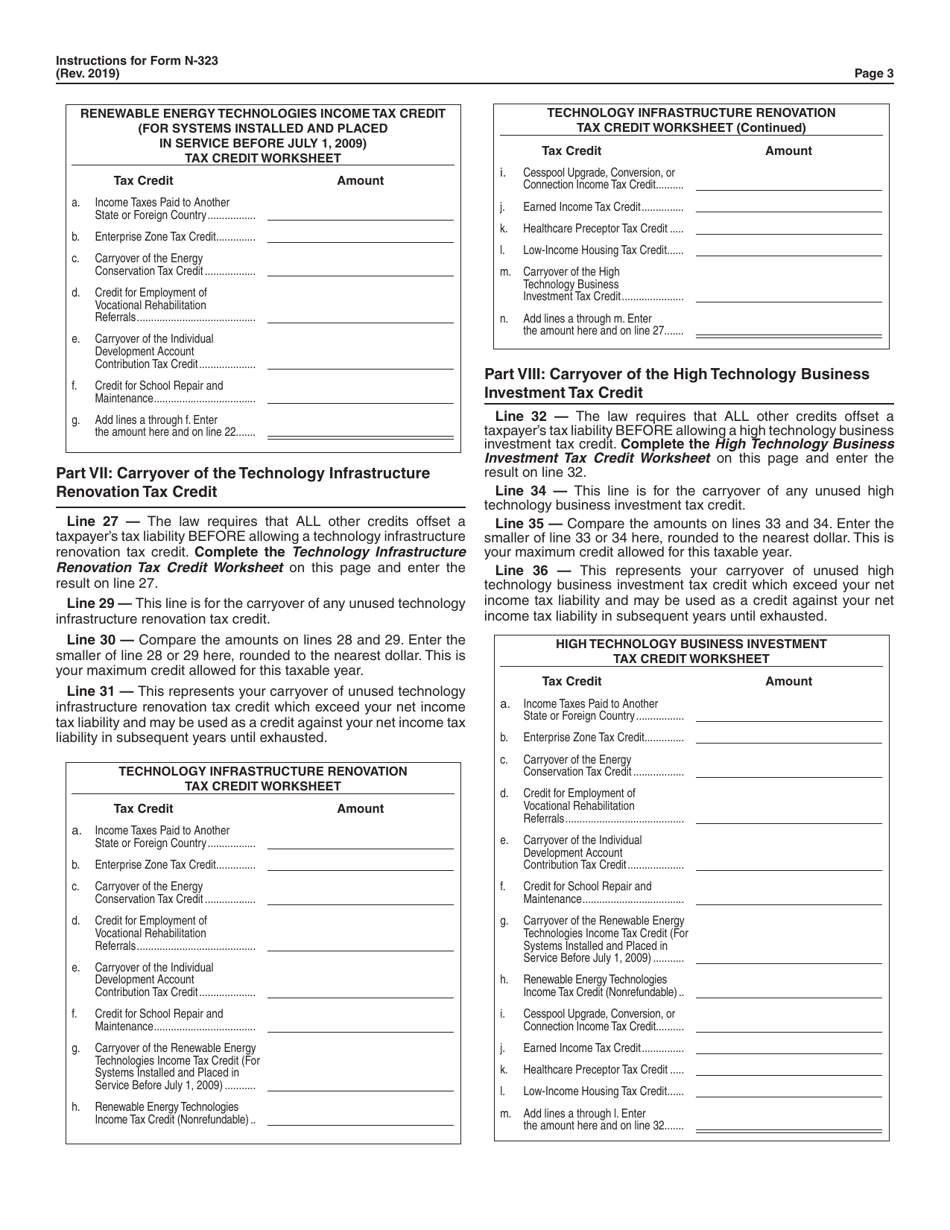

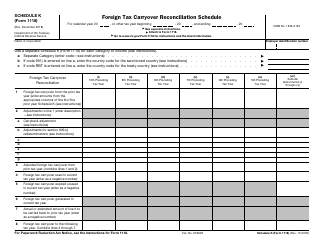

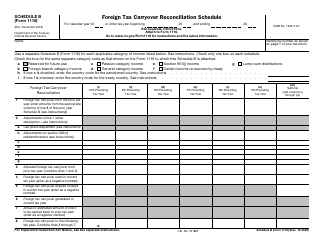

Instructions for Form N-323 Carryover of Tax Credit - Hawaii

This document contains official instructions for Form N-323 , Carryover of Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-323 is available for download through this link.

FAQ

Q: What is Form N-323?

A: Form N-323 is a tax form used in Hawaii to carry over tax credits from a previous year.

Q: Why would someone need to use Form N-323?

A: Someone would need to use Form N-323 if they have unused tax credits from a previous year that they want to apply to their current year's taxes.

Q: What information is required on Form N-323?

A: On Form N-323, you will need to provide your personal information, as well as details about the tax credit you want to carry over.

Q: Can I carry over all types of tax credits using Form N-323?

A: No, not all tax credits are eligible for carryover. Only certain tax credits allowed by law can be carried over.

Q: Is there a deadline for filing Form N-323?

A: Yes, Form N-323 must be filed by the due date of your tax return for the current year.

Q: What happens if I don't use all of my carried-over tax credits?

A: If you have any remaining carried-over tax credits after applying them to your current year's taxes, they may be carried forward to future tax years.

Q: Can I amend my tax return to claim unused carried-over tax credits from a previous year?

A: Yes, if you did not use all of your carried-over tax credits in a previous year, you can amend your tax return to claim them.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.