This version of the form is not currently in use and is provided for reference only. Download this version of

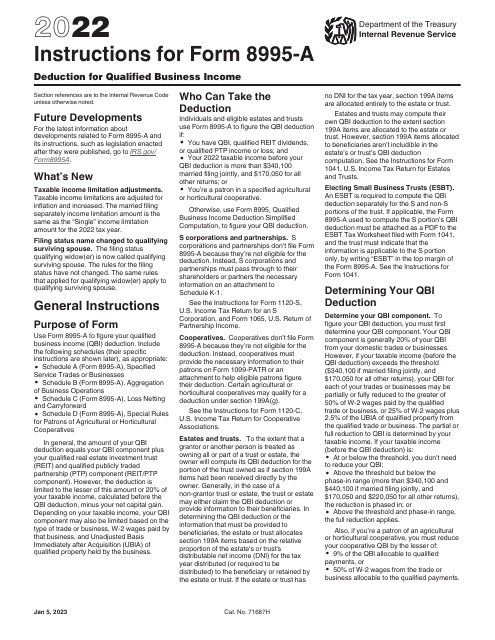

Instructions for IRS Form 8995-A

for the current year.

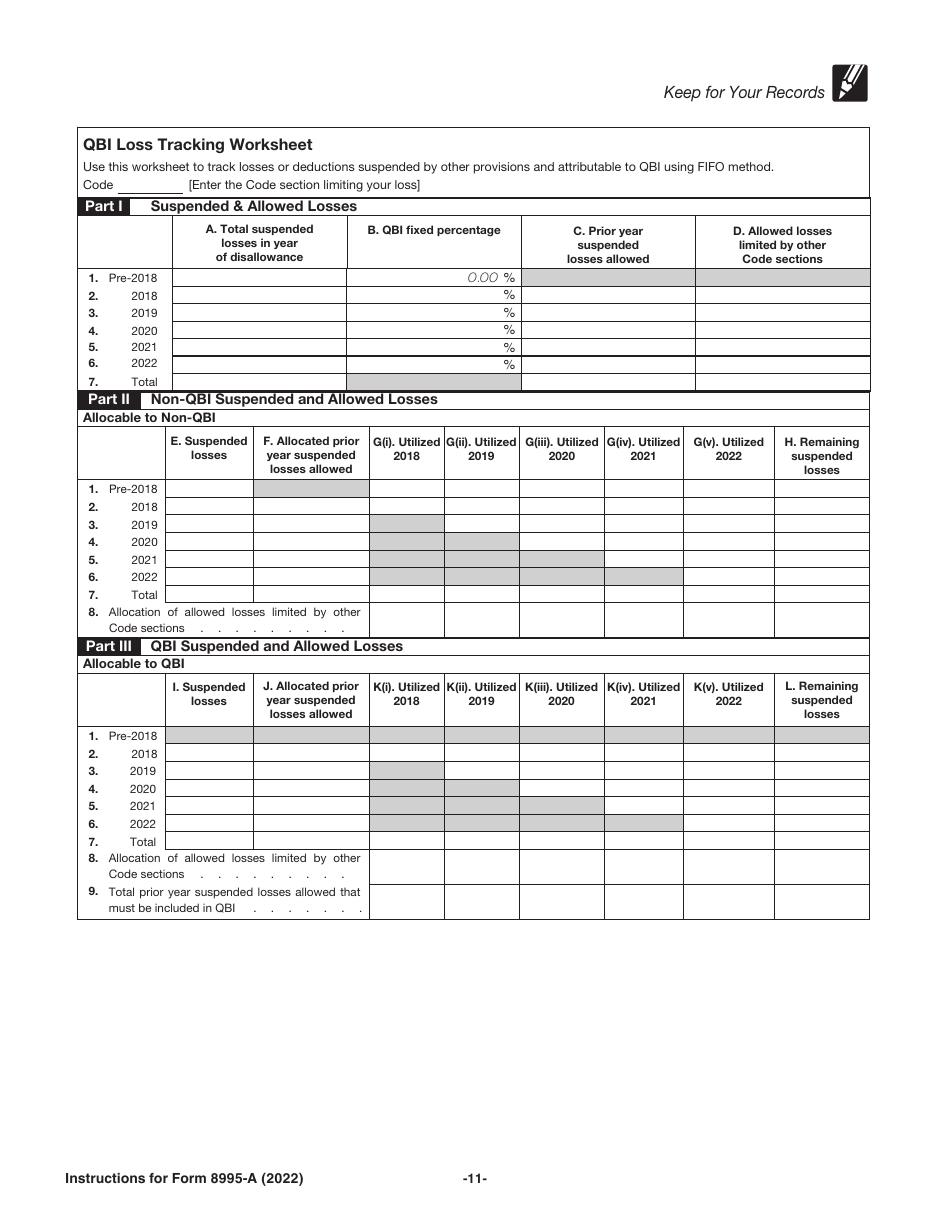

Instructions for IRS Form 8995-A Deduction for Qualified Business Income

This document contains official instructions for IRS Form 8995-A , Deduction for Qualified Business Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8995-A is available for download through this link.

FAQ

Q: What is IRS Form 8995-A?

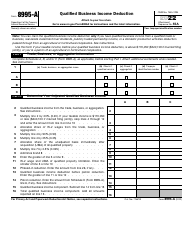

A: IRS Form 8995-A is used to claim the Deduction for Qualified Business Income.

Q: What is the Deduction for Qualified Business Income?

A: The Deduction for Qualified Business Income allows eligible businesses to deduct up to 20% of their qualified business income.

Q: Who is eligible for the Deduction for Qualified Business Income?

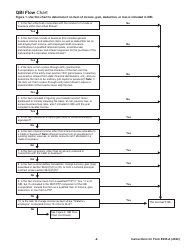

A: Individuals, estates, and trusts that have qualified business income from a partnership, S corporation, or sole proprietorship may be eligible for the deduction.

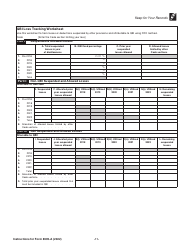

Q: How do I fill out Form 8995-A?

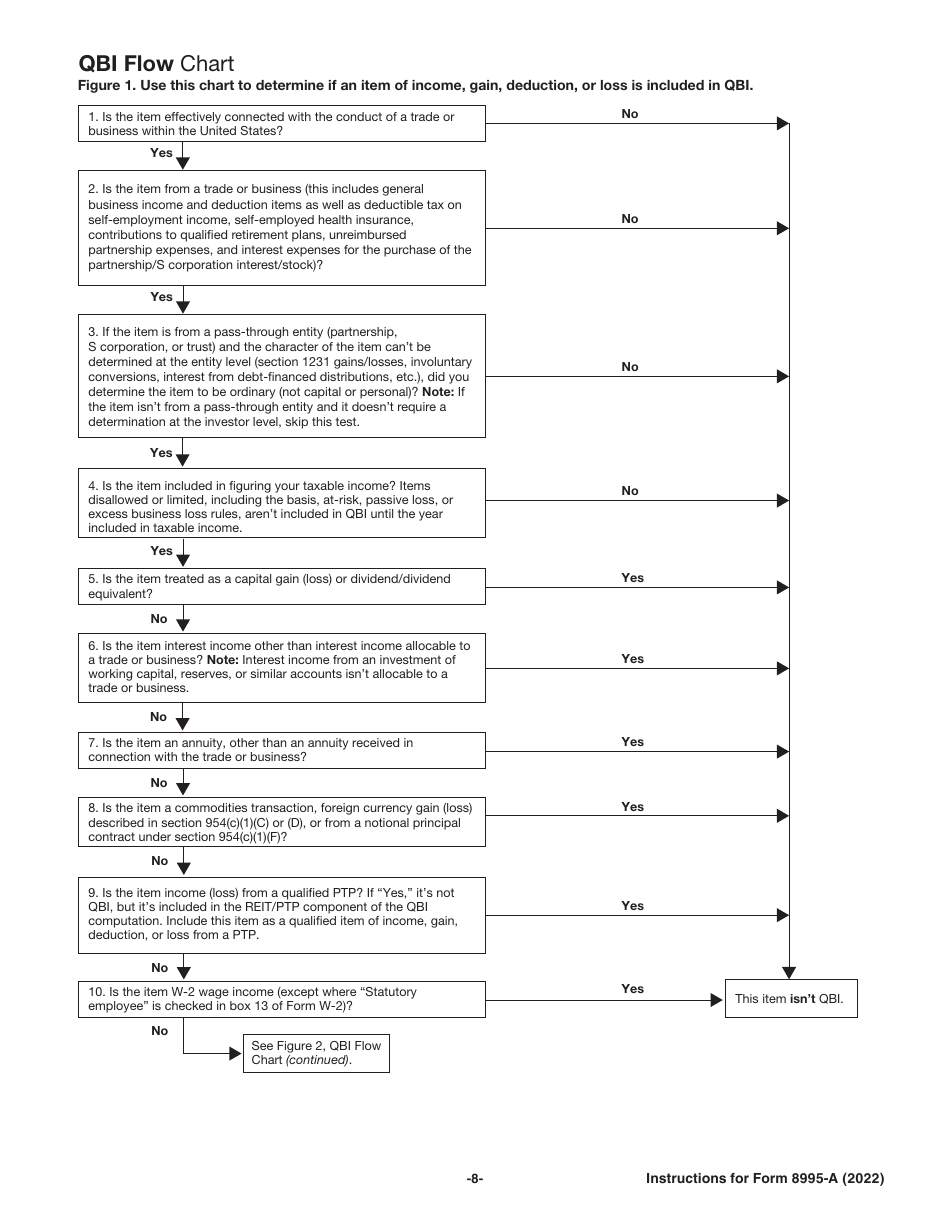

A: Form 8995-A instructions provide guidance on how to fill out the form. You will need to input information about your qualified business income and calculate your deduction.

Q: What is the deadline for filing Form 8995-A?

A: The deadline for filing Form 8995-A is typically April 15th, unless an extension has been granted.

Q: Are there any limitations on the Deduction for Qualified Business Income?

A: Yes, there are limitations based on income, type of business, and other factors. The instructions for Form 8995-A provide more information on these limitations.

Q: Can I e-file Form 8995-A?

A: Yes, Form 8995-A can be e-filed using authorized tax software or through a tax professional.

Instruction Details:

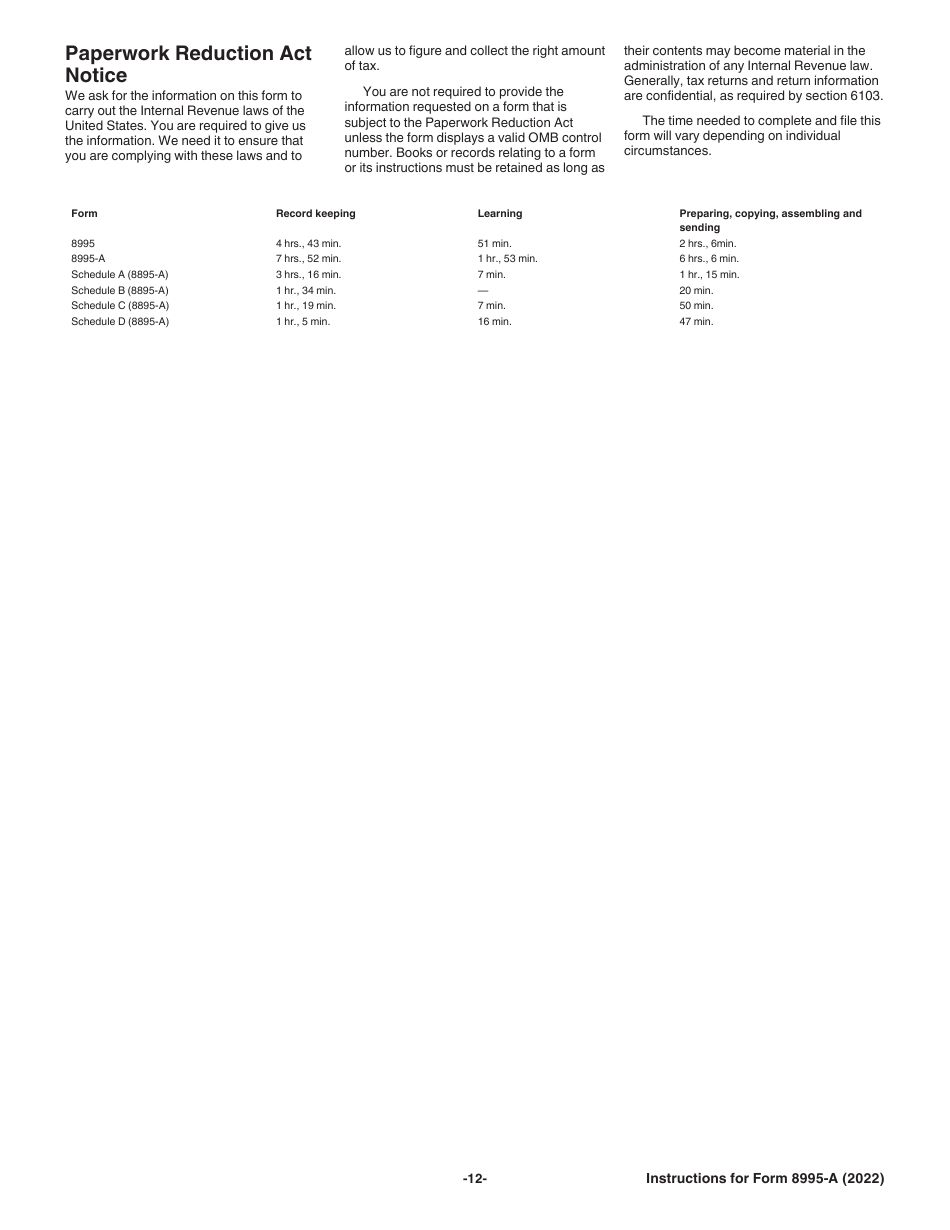

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.