This version of the form is not currently in use and is provided for reference only. Download this version of

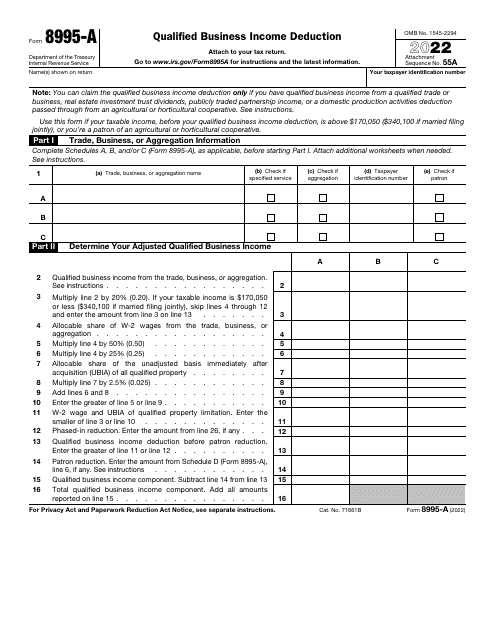

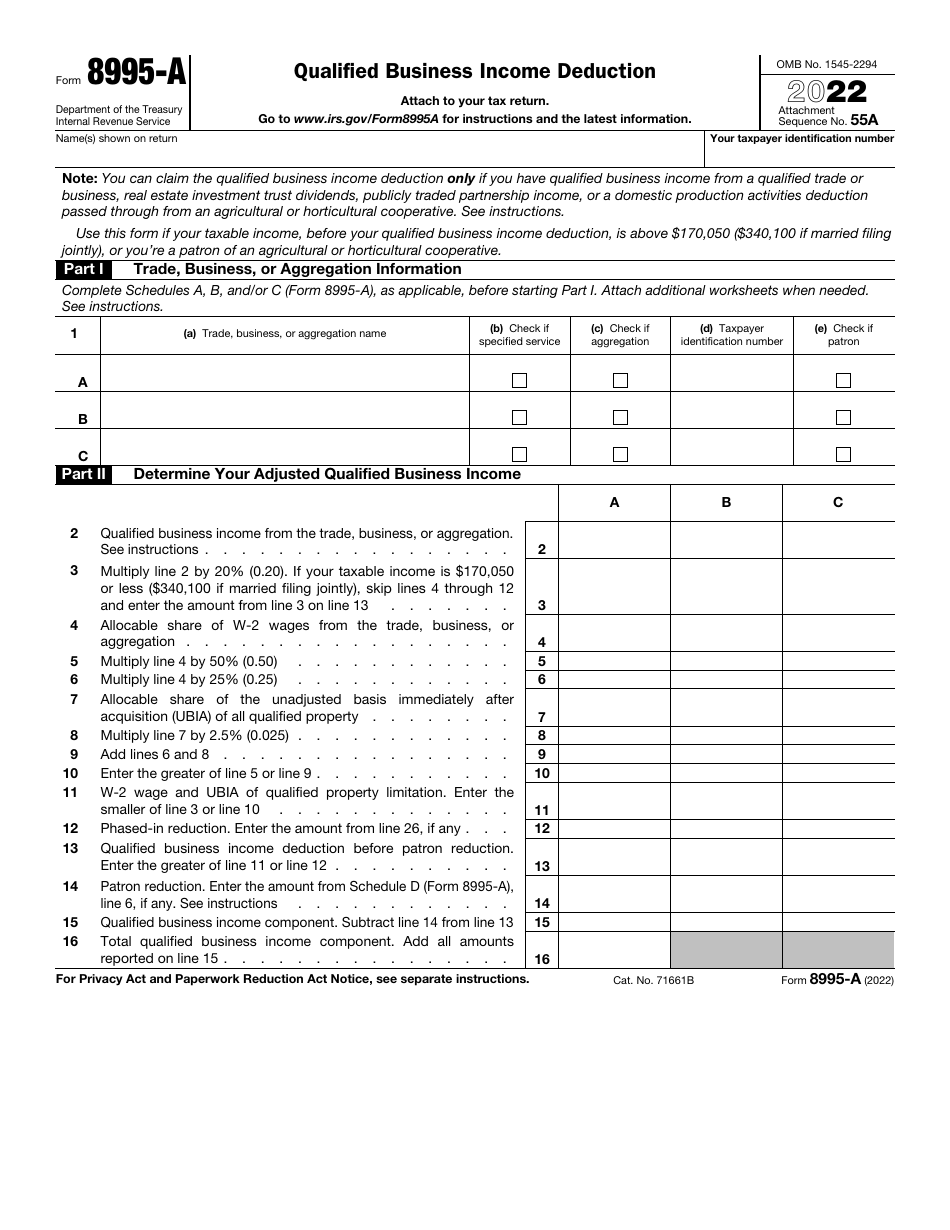

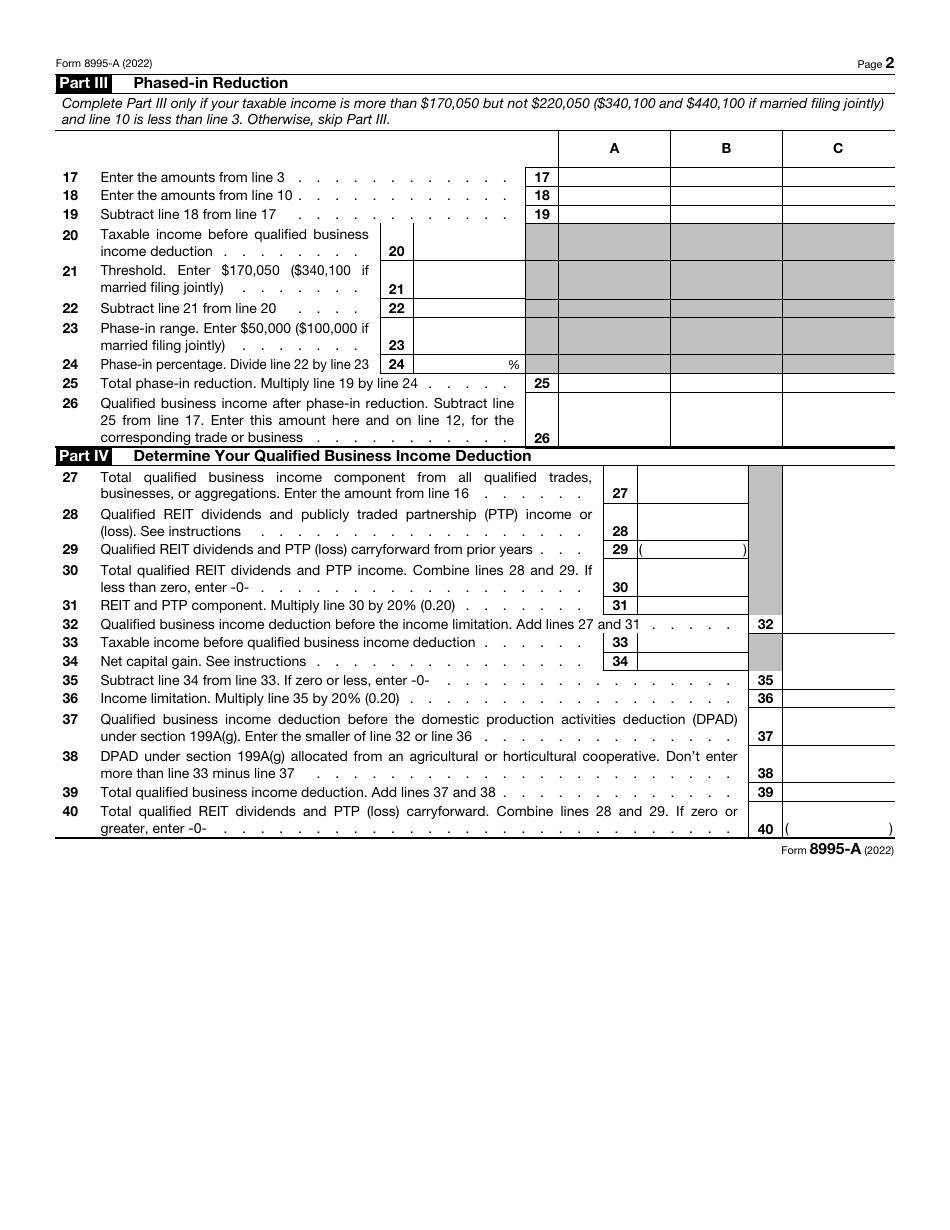

IRS Form 8995-A

for the current year.

IRS Form 8995-A Qualified Business Income Deduction

What Is IRS Form 8995-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a tax form used to calculate the Qualified Business Income Deduction.

Q: What is the Qualified Business Income Deduction?

A: The Qualified Business Income Deduction is a tax deduction that allows eligible individuals to deduct a portion of their qualified business income from their taxable income.

Q: Who is eligible for the Qualified Business Income Deduction?

A: Individuals, trusts, and estates that have qualified business income from a qualified trade or business may be eligible for the deduction.

Q: What is qualified business income?

A: Qualified business income includes income from a qualified trade or business, such as sole proprietorships, partnerships, S corporations, and certain rental activities.

Q: How is the Qualified Business Income Deduction calculated?

A: The deduction is generally calculated as 20% of the taxpayer's qualified business income, subject to certain limitations and phaseouts.

Q: Do I need to file IRS Form 8995-A?

A: You need to file IRS Form 8995-A if you want to claim the Qualified Business Income Deduction or if you are required to do so by the IRS.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A through the link below or browse more documents in our library of IRS Forms.