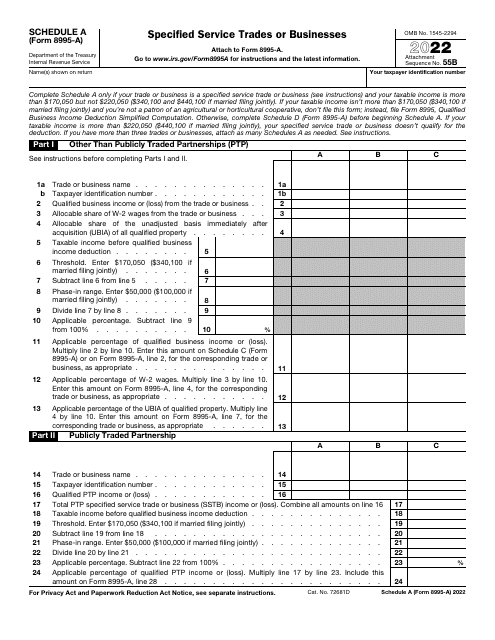

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8995-A Schedule A

for the current year.

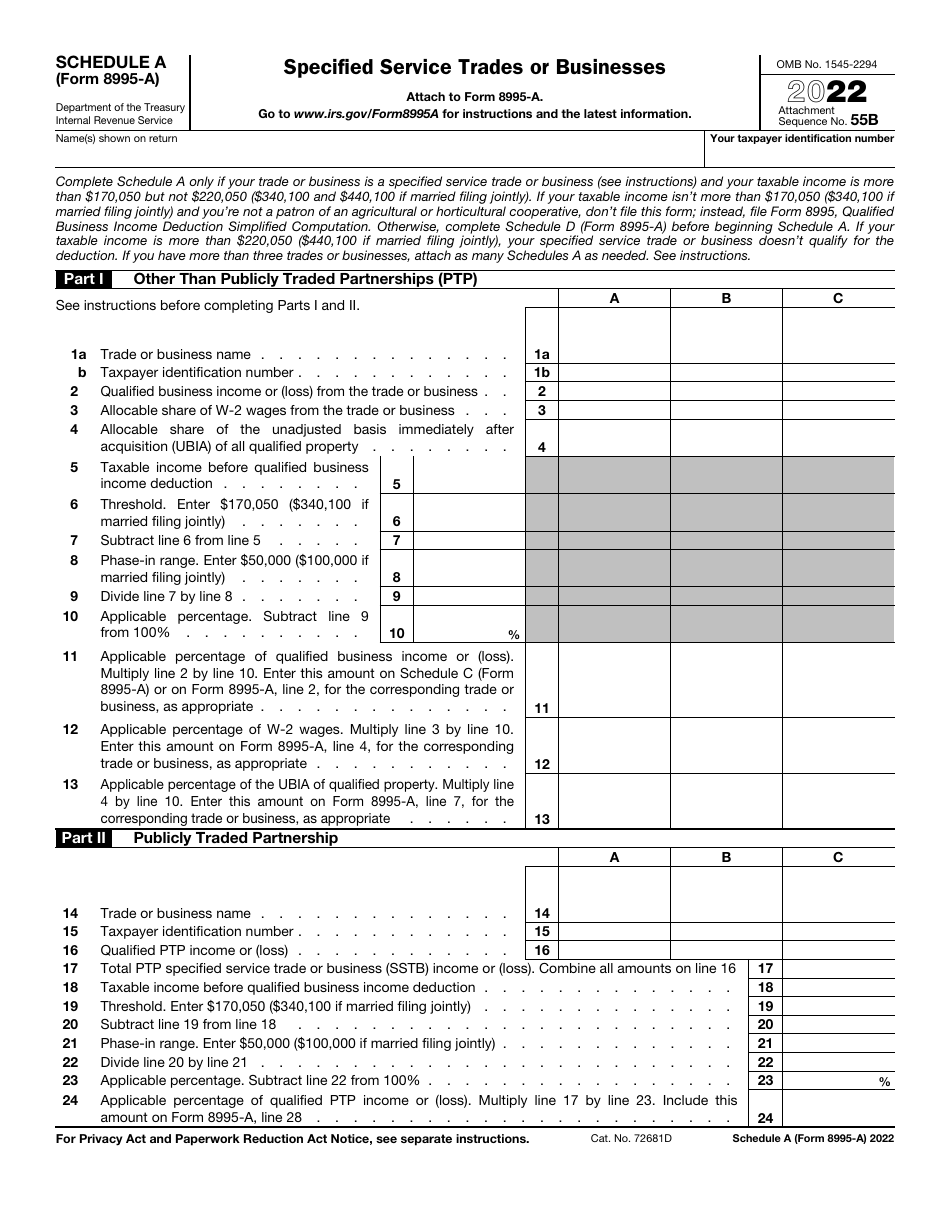

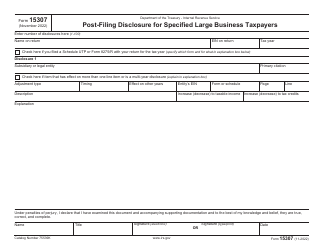

IRS Form 8995-A Schedule A Specified Service Trades or Businesses

What Is IRS Form 8995-A Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8995-A, Qualified Business Income Deduction. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A, Schedule A is used to report income from specified service trades or businesses (SSTBs).

Q: What are specified service trades or businesses?

A: Specified service trades or businesses (SSTBs) are certain professional service businesses that are subject to special rules under the tax law.

Q: Who needs to file Form 8995-A?

A: Taxpayers who have income from specified service trades or businesses (SSTBs) need to file Form 8995-A to report their income and determine the deduction they are eligible for.

Q: What information is required on Form 8995-A?

A: Form 8995-A requires taxpayers to provide detailed information about their specified service trades or businesses, including the income earned and the type of services provided.

Q: What is the purpose of Schedule A?

A: Schedule A is used to calculate the allowable deduction for qualified business income from specified service trades or businesses (SSTBs).

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A Schedule A through the link below or browse more documents in our library of IRS Forms.