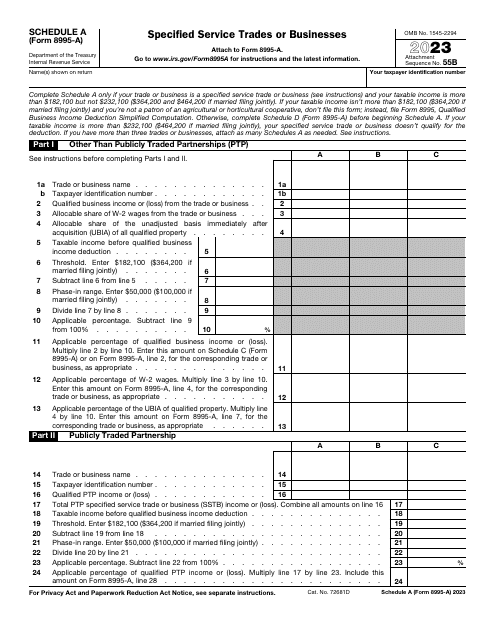

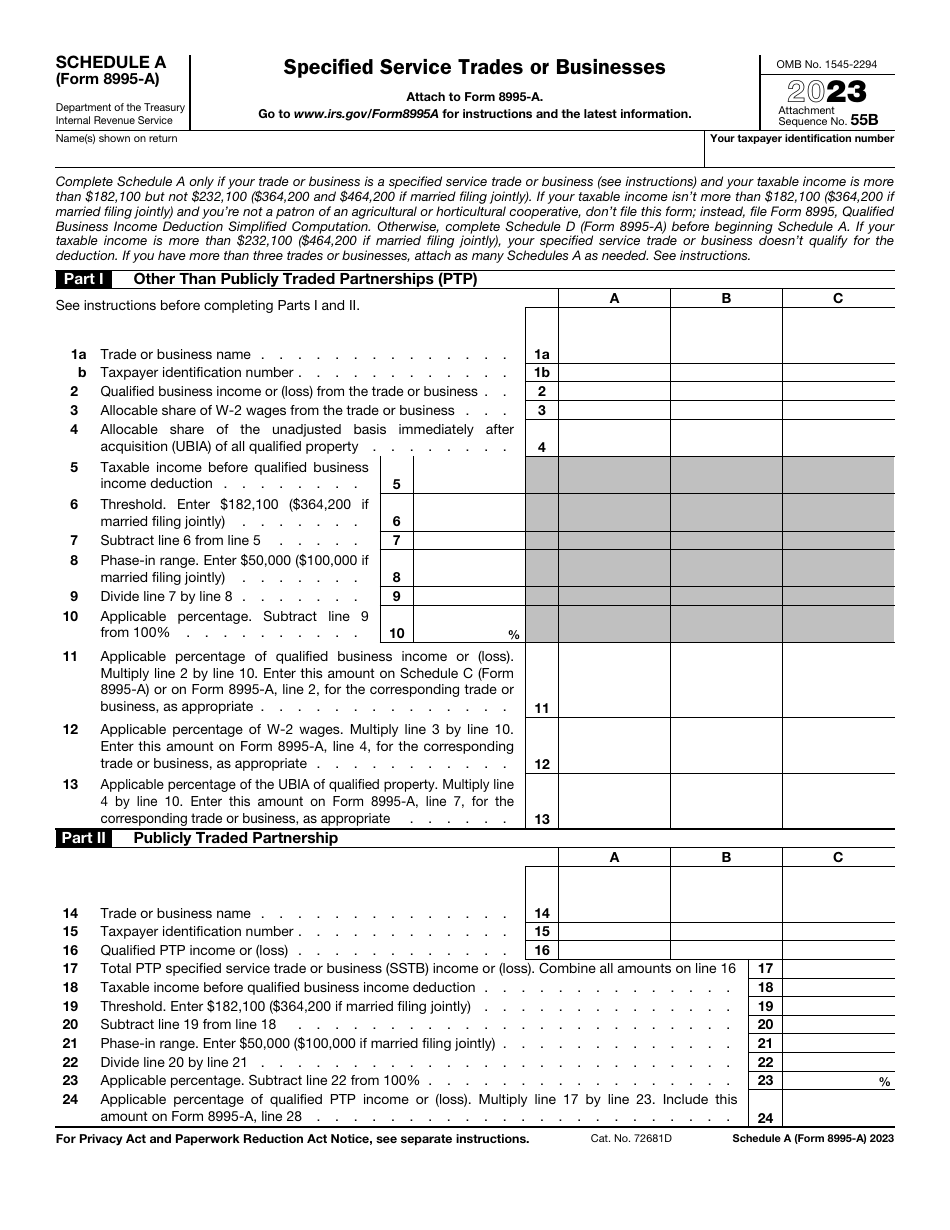

IRS Form 8995-A Schedule A Specified Service Trades or Businesses

What Is IRS Form 8995-A Schedule A?

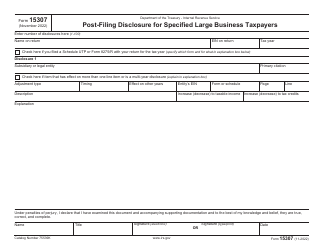

IRS Form 8995-A Schedule A, Specified Service Trades or Businesses , is a supplementary instrument used by taxpayers in order to claim a business deduction after reporting your business income. It is obligatory to submit this schedule alongside IRS Form 8995-A, Qualified Business Income Deduction, if your entity qualifies for such a deduction due to the services you provide in the field of law, health, consulting, performing arts, and several other areas. Additionally, your income has to be higher than $170.050 and lower than $220.050 to allow you to file your claim in the first place.

This schedule was issued by the Internal Revenue Service (IRS) on 2023 - older editions of the form are now obsolete. An IRS Form 8995-A Schedule A fillable version can be found through the link below.

Indicate the name you write on your regular income statement and add your taxpayer identification number. The form is separated into two parts - fill out the second one if you are submitting paperwork on behalf of a publicly traded partnership; in all other cases, you are required to complete the first section of the document. Make sure you meet the thresholds established by the fiscal authorities, specify the amount of your business income or loss, and follow the formulas listed in the schedule whether you are filing the papers alone or with your spouse. After you are done with computations, replicate the numbers on the Form 8995-A.