This version of the form is not currently in use and is provided for reference only. Download this version of

Form 1041ME Schedule A

for the current year.

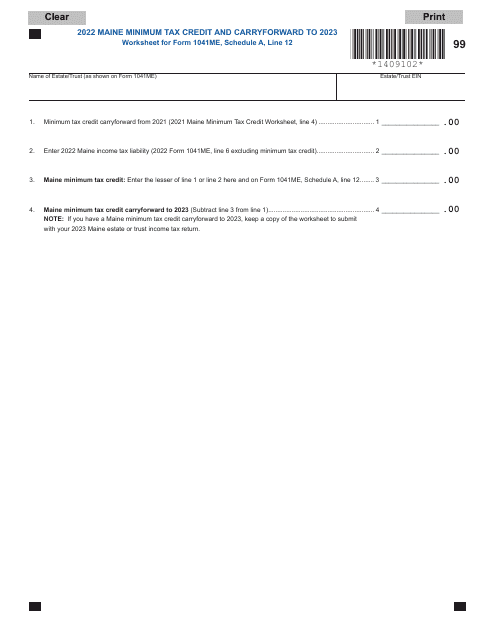

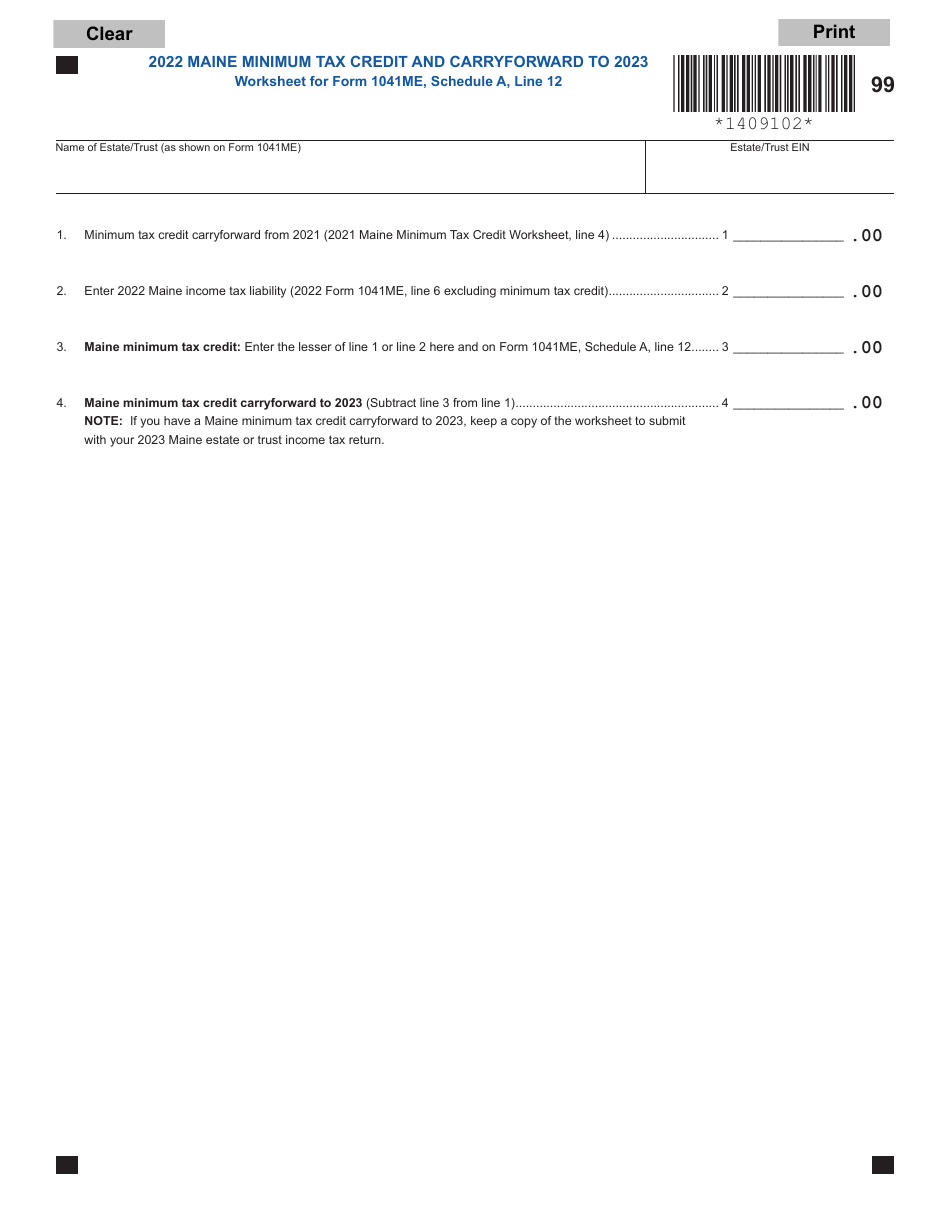

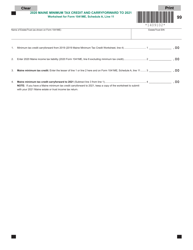

Form 1041ME Schedule A Maine Minimum Tax Credit and Carryforward - Maine

What Is Form 1041ME Schedule A?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041ME Schedule A?

A: Form 1041ME Schedule A is used by taxpayers in Maine to claim the Maine Minimum Tax Credit and Carryforward.

Q: What is the Maine Minimum Tax Credit?

A: The Maine Minimum Tax Credit is a credit that can be taken against the Maine Minimum Tax for individuals, estates, and trusts.

Q: Who can claim the Maine Minimum Tax Credit?

A: Individuals, estates, and trusts that paid Maine Minimum Tax can claim the credit.

Q: What is the purpose of Form 1041ME Schedule A?

A: Form 1041ME Schedule A is used to calculate the amount of the Maine Minimum Tax Credit and any carryforward that can be used in future tax years.

Q: How do I fill out Form 1041ME Schedule A?

A: You will need to provide detailed information about the Maine Minimum Tax paid, as well as any other required information to calculate the credit.

Q: Can I e-file Form 1041ME Schedule A?

A: Yes, you can e-file Form 1041ME Schedule A if you are filing your Maine state tax return electronically.

Q: When is the deadline to file Form 1041ME Schedule A?

A: The deadline to file Form 1041ME Schedule A is the same as the deadline for filing your Maine state tax return, which is generally April 15th.

Q: Are there any penalties for late filing of Form 1041ME Schedule A?

A: Yes, if you file Form 1041ME Schedule A after the deadline without reasonable cause, you may be subject to penalties and interest.

Q: Can I claim the Maine Minimum Tax Credit on my federal tax return?

A: No, the Maine Minimum Tax Credit can only be claimed on your Maine state tax return.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1041ME Schedule A by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.