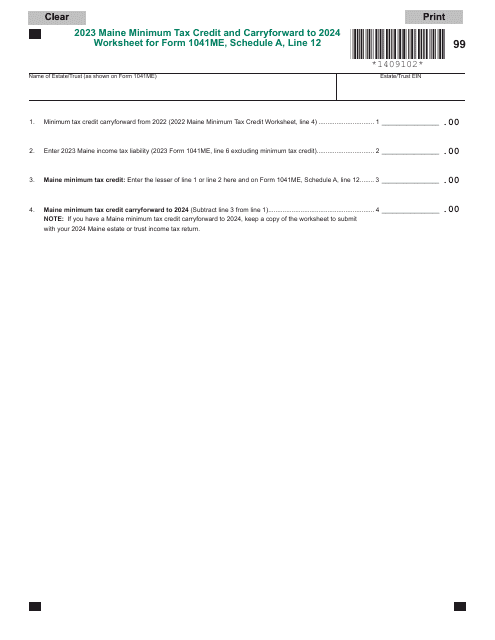

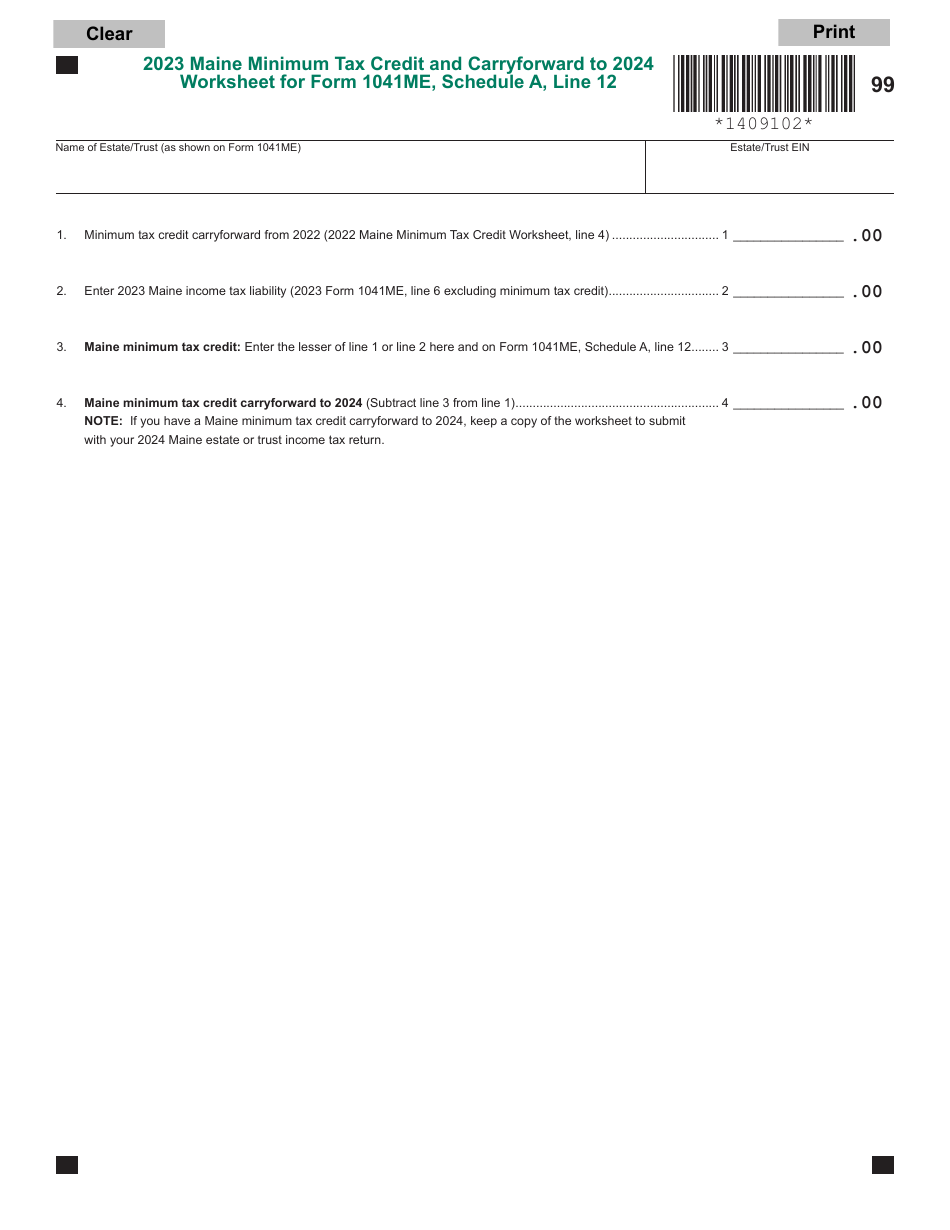

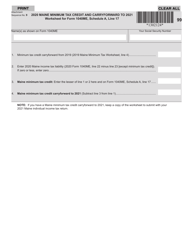

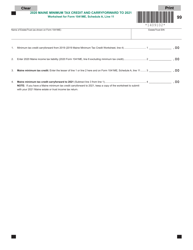

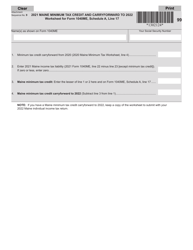

Form 1041ME Schedule A Maine Minimum Tax Credit and Carryforward Worksheet - Maine

What Is Form 1041ME Schedule A?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041ME Schedule A?A: Form 1041ME Schedule A is used by taxpayers in Maine to claim the Maine Minimum Tax Credit and Carryforward.

Q: What is the Maine Minimum Tax Credit?A: The Maine Minimum Tax Credit is a credit that can be taken against the Maine Minimum Tax for individuals, estates, and trusts.

Q: Who can claim the Maine Minimum Tax Credit?A: Individuals, estates, and trusts that paid Maine Minimum Tax can claim the credit.

Q: What is the purpose of Form 1041ME Schedule A?A: Form 1041ME Schedule A is used to calculate the amount of the Maine Minimum Tax Credit and any carryforward that can be used in future tax years.

Q: How do I fill out Form 1041ME Schedule A?A: You will need to provide detailed information about the Maine Minimum Tax paid, as well as any other required information to calculate the credit.

Q: Can I e-file Form 1041ME Schedule A?A: Yes, you can e-file Form 1041ME Schedule A if you are filing your Maine state tax return electronically.

Q: When is the deadline to file Form 1041ME Schedule A?A: The deadline to file Form 1041ME Schedule A is the same as the deadline for filing your Maine state tax return, which is generally April 15th.

Q: Are there any penalties for late filing of Form 1041ME Schedule A?A: Yes, if you file Form 1041ME Schedule A after the deadline without reasonable cause, you may be subject to penalties and interest.

Q: Can I claim the Maine Minimum Tax Credit on my federal tax return?A: No, the Maine Minimum Tax Credit can only be claimed on your Maine state tax return.