This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule L

for the current year.

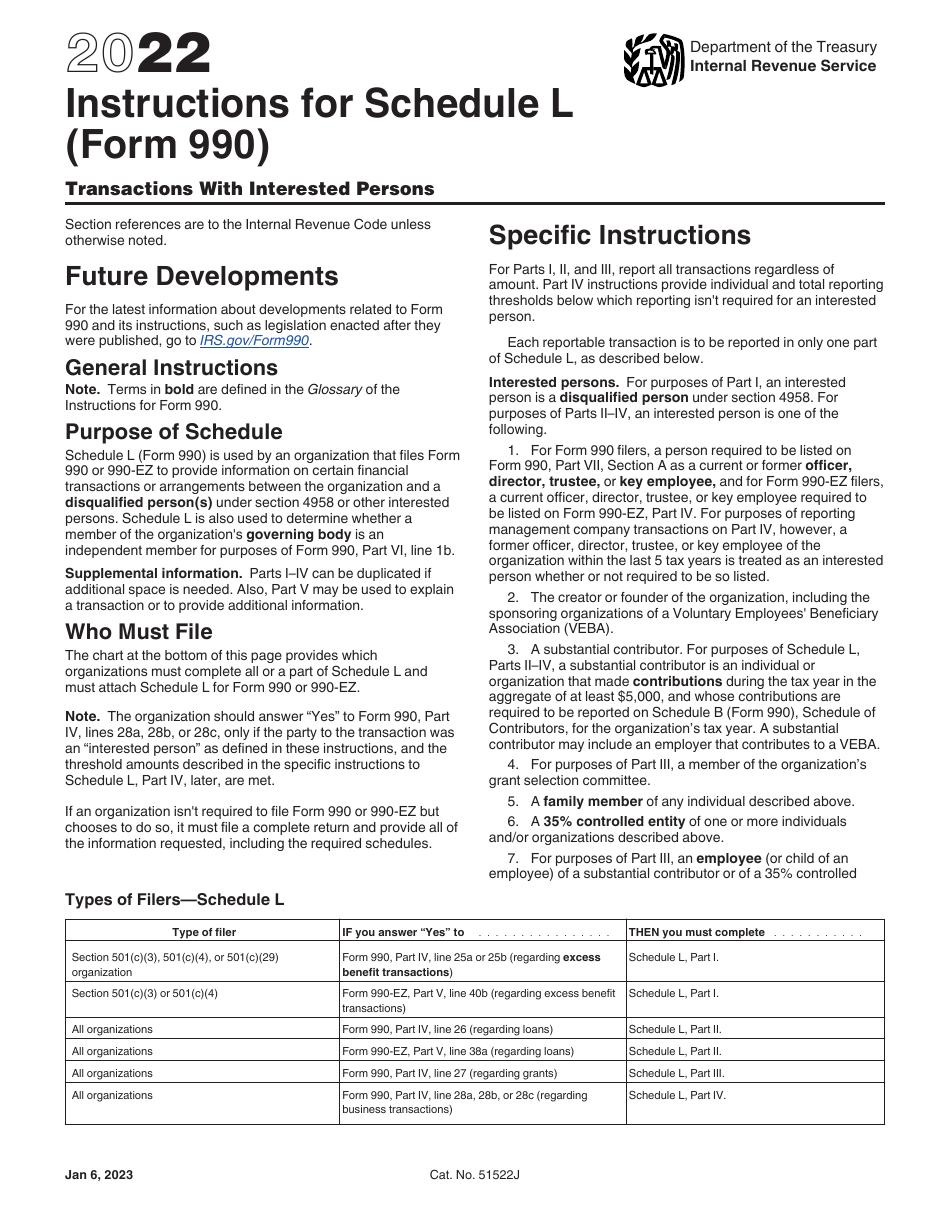

Instructions for IRS Form 990 Schedule L Transactions With Interested Persons

This document contains official instructions for IRS Form 990 Schedule L, Transactions With Interested Persons - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule L is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule L?

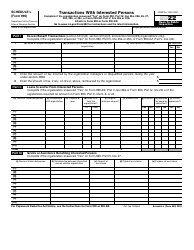

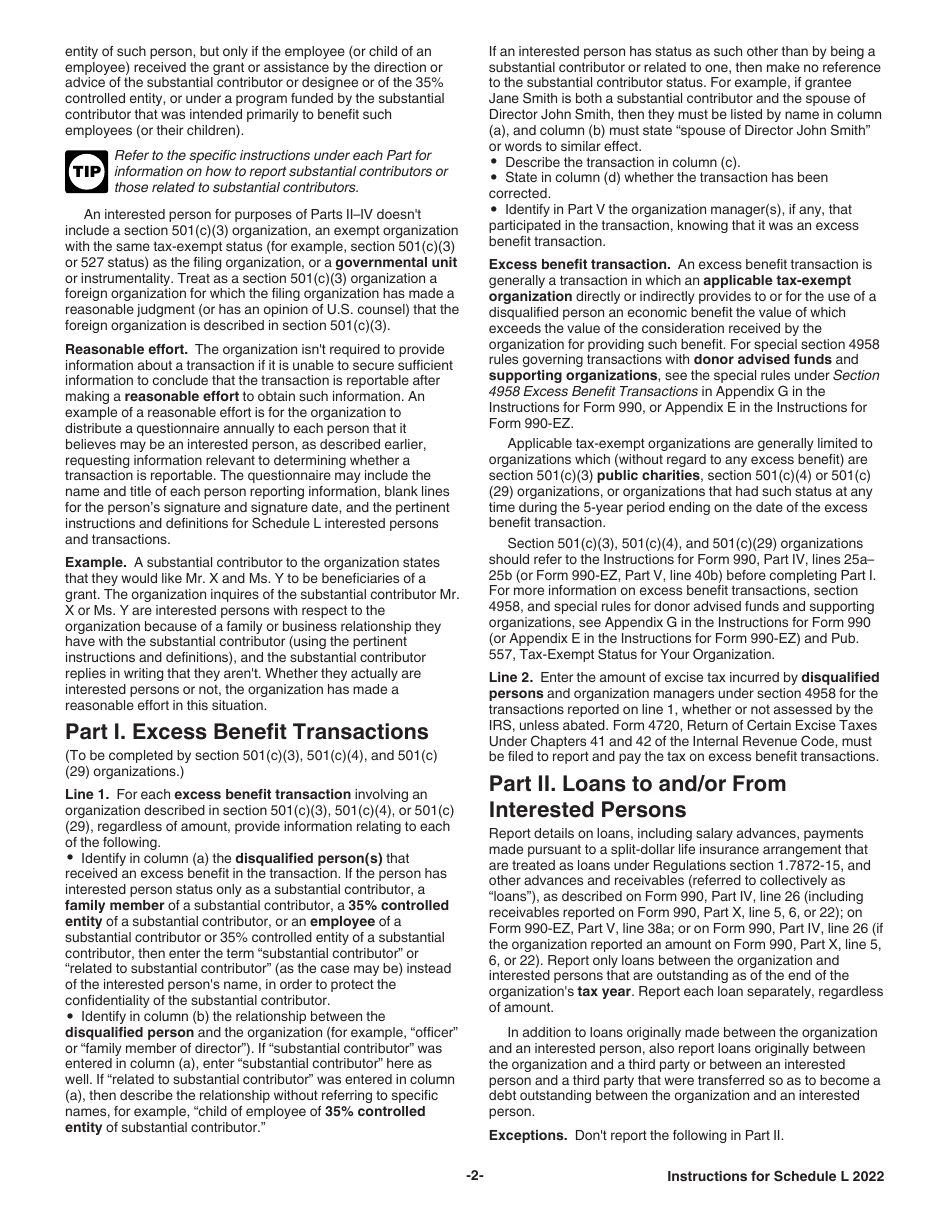

A: IRS Form 990 Schedule L is a form used by tax-exempt organizations to report transactions with interested persons.

Q: Who should file IRS Form 990 Schedule L?

A: Tax-exempt organizations who have engaged in transactions with interested persons should file IRS Form 990 Schedule L.

Q: What are transactions with interested persons?

A: Transactions with interested persons include any financial transactions between a tax-exempt organization and individuals who have a close relationship with the organization.

Q: What information is required to be reported on IRS Form 990 Schedule L?

A: IRS Form 990 Schedule L requires the organization to provide detailed information about each transaction with an interested person, including the nature of the transaction, the amount involved, and any relationship between the organization and the interested person.

Q: When is IRS Form 990 Schedule L due?

A: IRS Form 990 Schedule L is due at the same time as the organization's annual Form 990, which is typically on the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are there any penalties for not filing IRS Form 990 Schedule L?

A: Yes, failure to file IRS Form 990 Schedule L or providing incomplete or inaccurate information can result in penalties imposed by the IRS.

Q: Can I e-file IRS Form 990 Schedule L?

A: Yes, tax-exempt organizations can e-file IRS Form 990 Schedule L using the IRS's Modernized e-File system (MeF).

Q: Can IRS Form 990 Schedule L be amended?

A: Yes, if the organization discovers errors or omissions on IRS Form 990 Schedule L after filing, they can file an amended return to correct the information.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.