This version of the form is not currently in use and is provided for reference only. Download this version of

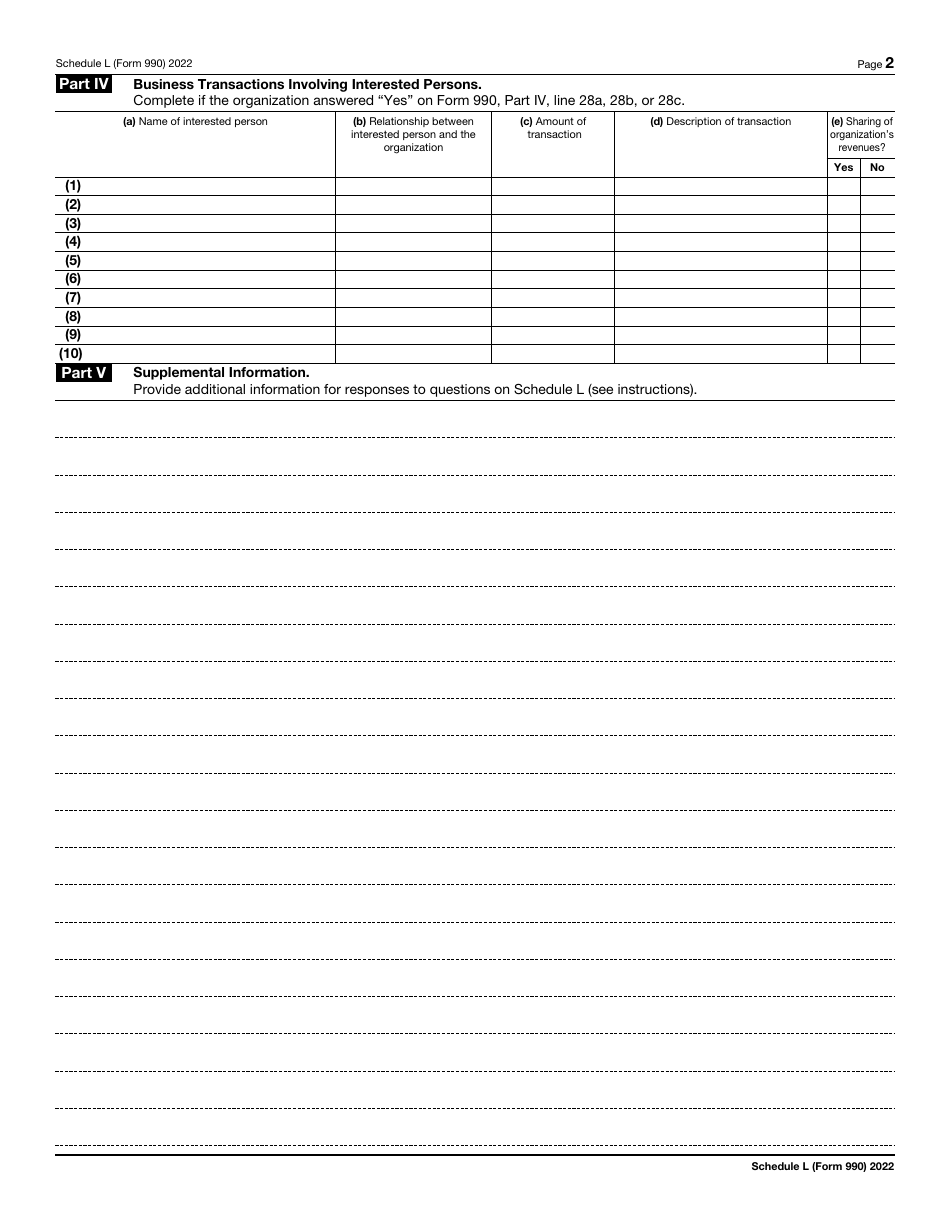

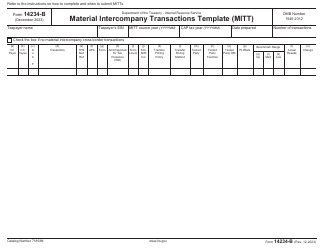

IRS Form 990 Schedule L

for the current year.

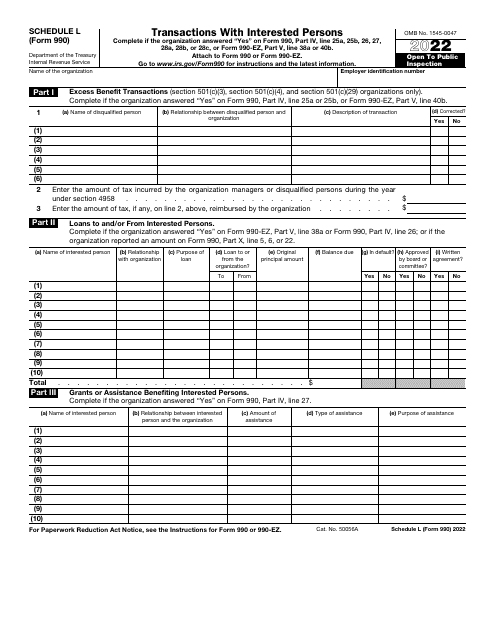

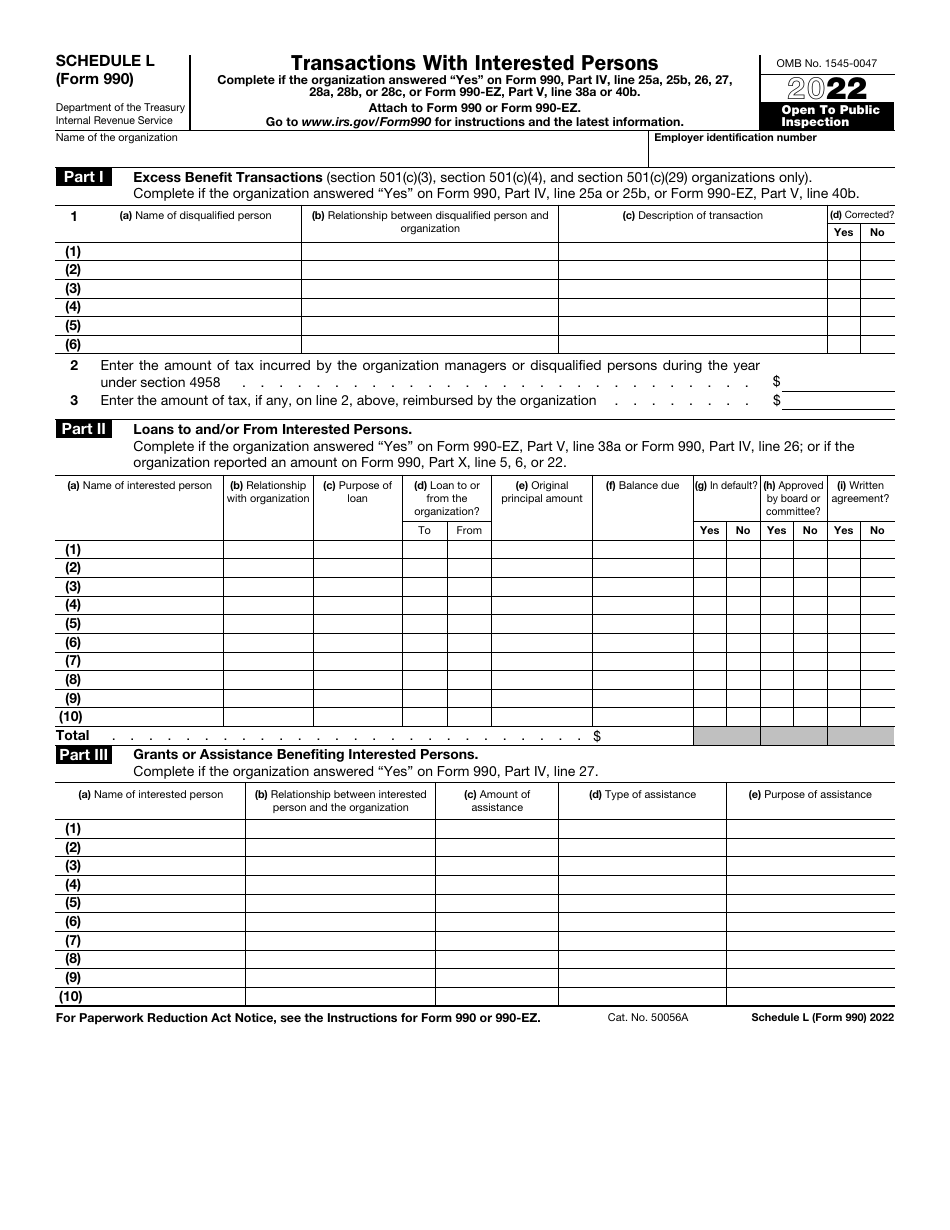

IRS Form 990 Schedule L Transactions With Interested Persons

What Is IRS Form 990 Schedule L?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule L?

A: IRS Form 990 Schedule L is a form that organizations tax-exempt under section 501(c)(3) must file to report certain transactions with interested persons.

Q: Who has to file IRS Form 990 Schedule L?

A: Organizations tax-exempt under section 501(c)(3) must file IRS Form 990 Schedule L.

Q: What are 'transactions with interested persons'?

A: 'Transactions with interested persons' refer to certain financial transactions or arrangements between a tax-exempt organization and individuals who have a close relationship with the organization, such as board members, officers, key employees, or family members.

Q: Why do organizations have to report transactions with interested persons?

A: Organizations have to report transactions with interested persons to ensure transparency and accountability, as these transactions could potentially involve conflicts of interest or improper use of funds.

Q: What information is included in IRS Form 990 Schedule L?

A: IRS Form 990 Schedule L includes information about the nature and amount of transactions with interested persons, as well as the relationship between the parties involved.

Q: When is IRS Form 990 Schedule L due?

A: IRS Form 990 Schedule L is typically due along with the organization's annual Form 990, which is due on the 15th day of the 5th month after the end of the organization's fiscal year.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule L through the link below or browse more documents in our library of IRS Forms.