This version of the form is not currently in use and is provided for reference only. Download this version of

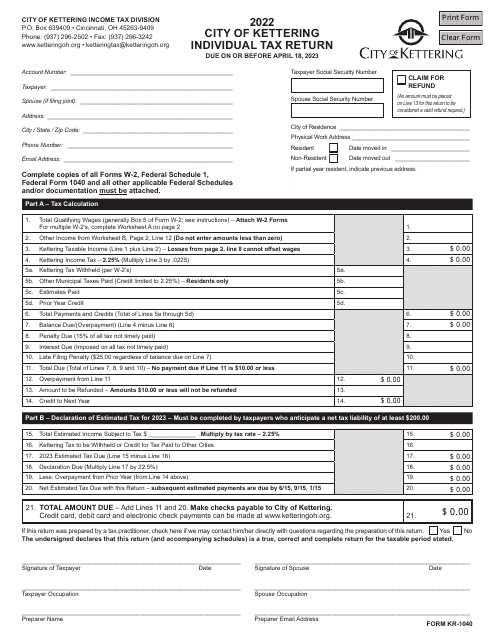

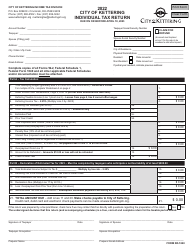

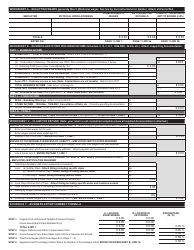

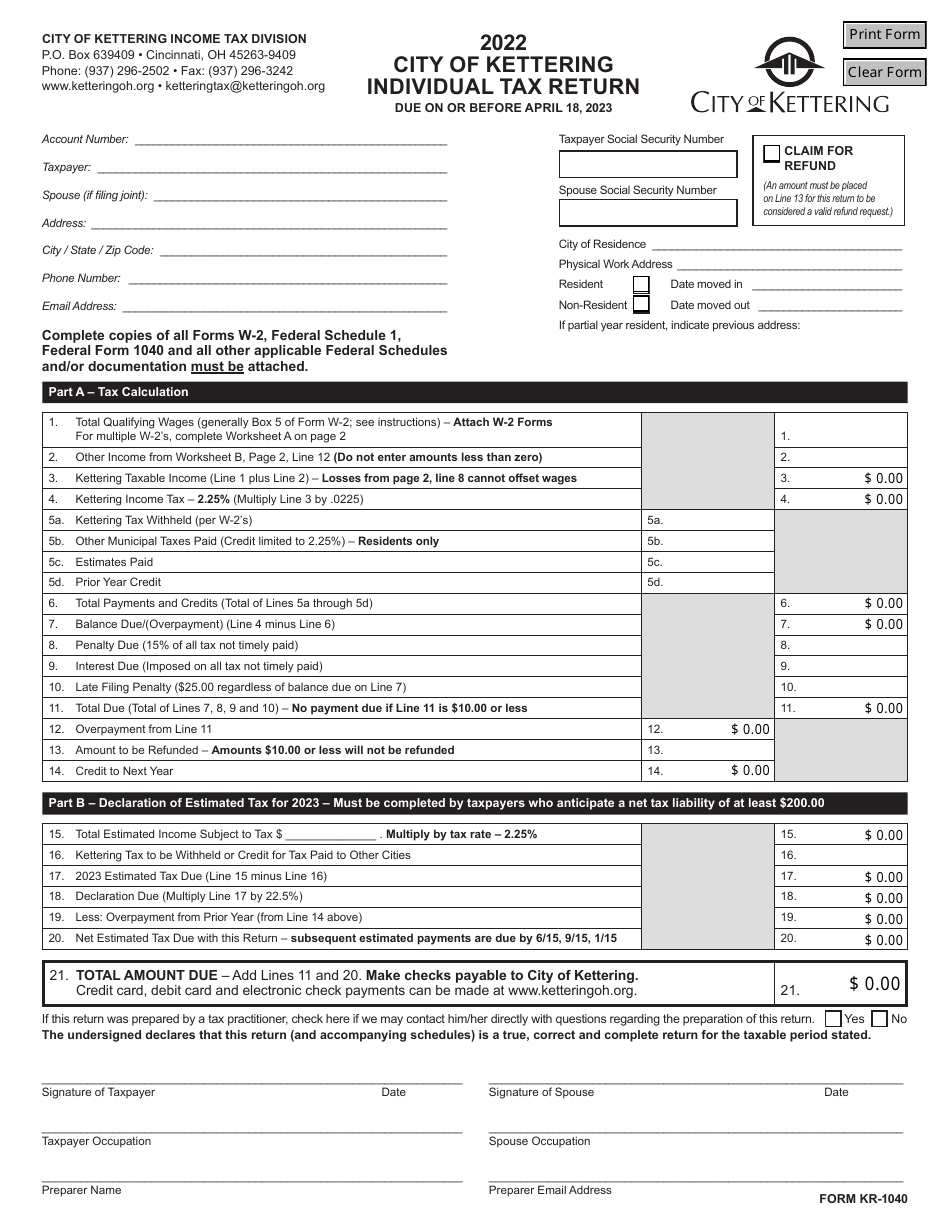

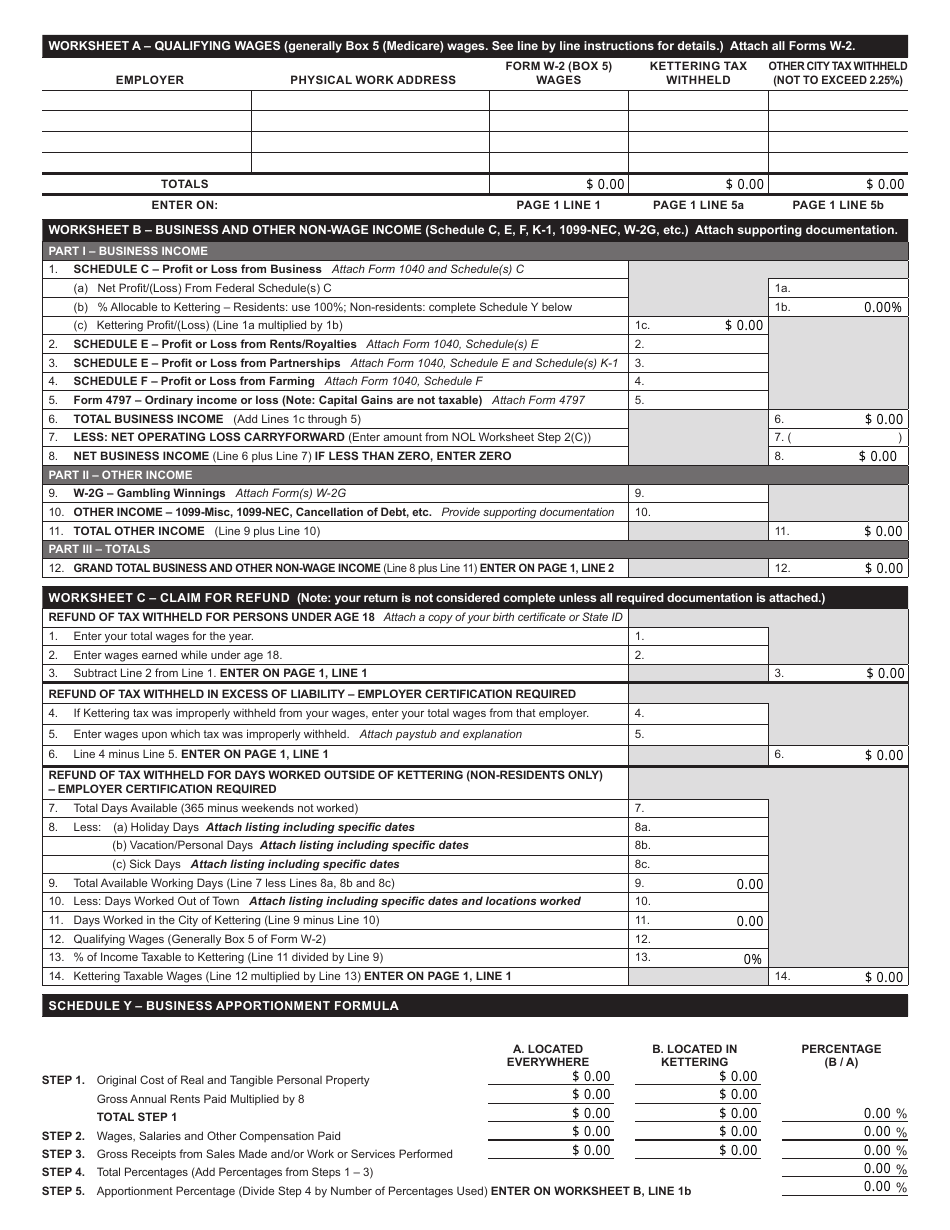

Form KR-1040

for the current year.

Form KR-1040 Individual Income Tax Return - City of Kettering, Ohio

What Is Form KR-1040?

This is a legal form that was released by the Income Tax Division - City of Kettering, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Kettering. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form KR-1040?

A: Form KR-1040 is the Individual Income Tax Return for residents of the City of Kettering, Ohio.

Q: Who is required to file Form KR-1040?

A: Residents of the City of Kettering, Ohio who have taxable income are required to file Form KR-1040.

Q: What is the purpose of Form KR-1040?

A: The purpose of Form KR-1040 is to report and pay income tax to the City of Kettering, Ohio.

Q: What information do I need to complete Form KR-1040?

A: You will need information about your income, deductions, and credits to complete Form KR-1040.

Q: When is the deadline to file Form KR-1040?

A: The deadline to file Form KR-1040 is typically April 15th of the following year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing. It is important to file your Form KR-1040 by the deadline to avoid penalties.

Q: Is there an electronic filing option for Form KR-1040?

A: Yes, you can file Form KR-1040 electronically through the City of Kettering, Ohio's electronic filing system.

Q: Do I need to include payment with my Form KR-1040?

A: Yes, if you owe taxes, you will need to include payment with your Form KR-1040.

Q: What if I need help with completing Form KR-1040?

A: If you need help with completing Form KR-1040, you can seek assistance from a tax professional or the local tax office in Kettering, Ohio.

Form Details:

- The latest edition provided by the Income Tax Division - City of Kettering, Ohio;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KR-1040 by clicking the link below or browse more documents and templates provided by the Income Tax Division - City of Kettering, Ohio.