This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form KBR-1040

for the current year.

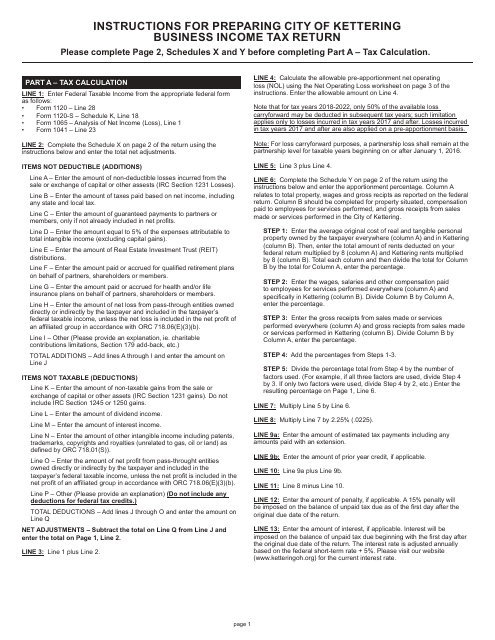

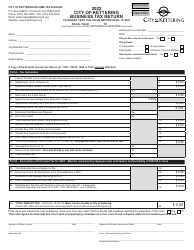

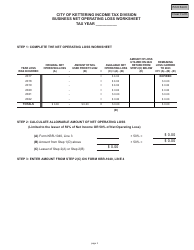

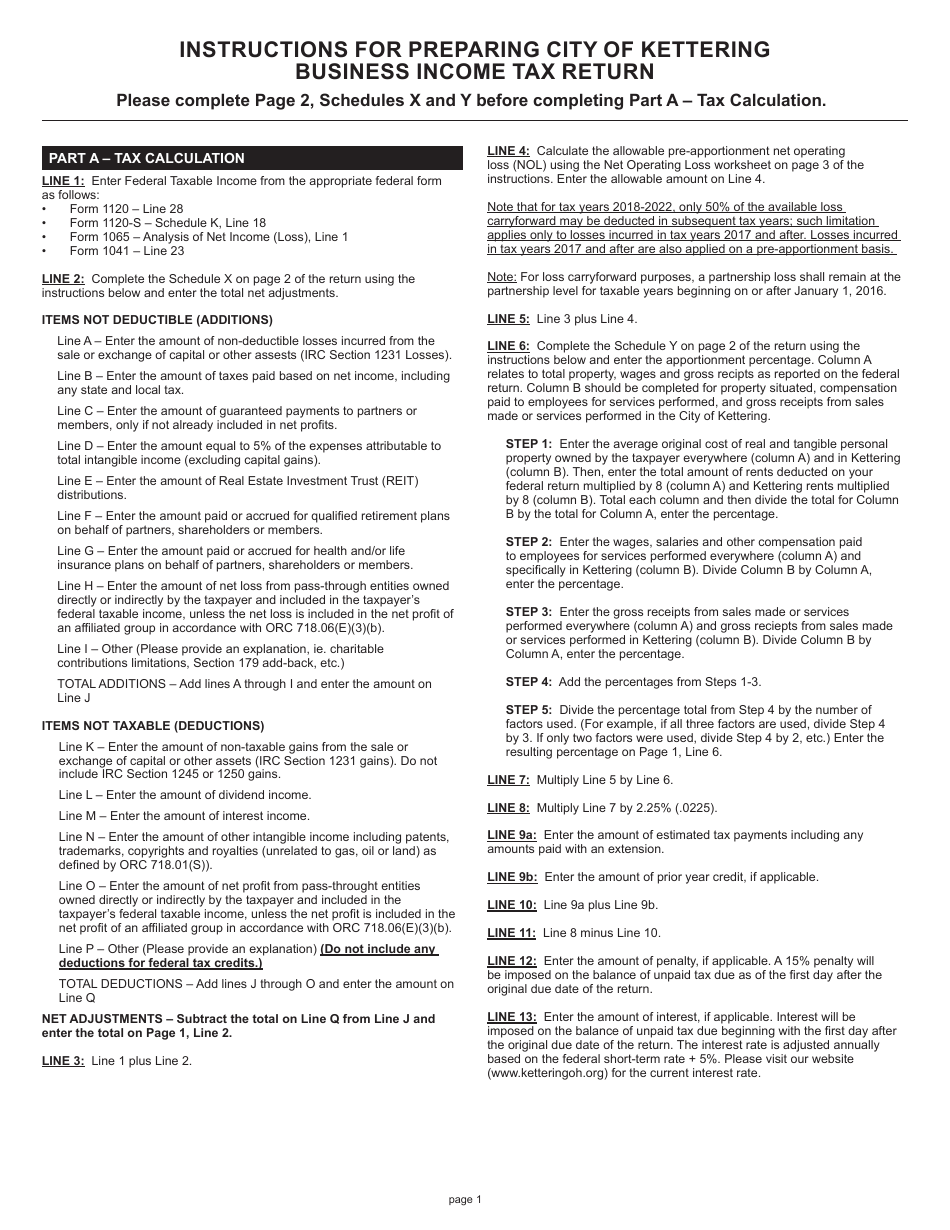

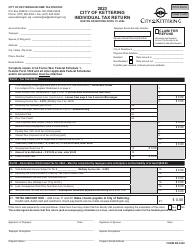

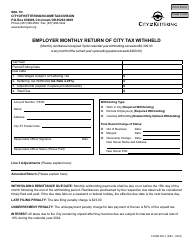

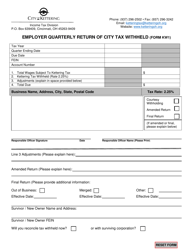

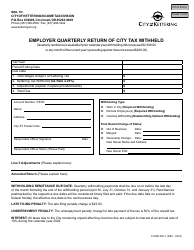

Instructions for Form KBR-1040 Business Tax Return - City of Kettering, Ohio

This document contains official instructions for Form KBR-1040 , Business Tax Return - a form released and collected by the Income Tax Division - City of Kettering, Ohio. An up-to-date fillable Form KBR-1040 is available for download through this link.

FAQ

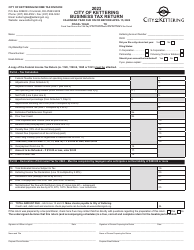

Q: What is Form KBR-1040?

A: Form KBR-1040 is a business tax return for the City of Kettering, Ohio.

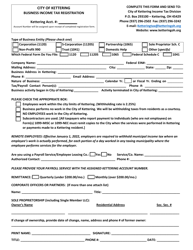

Q: Who needs to file Form KBR-1040?

A: Businesses operating in the City of Kettering, Ohio need to file Form KBR-1040.

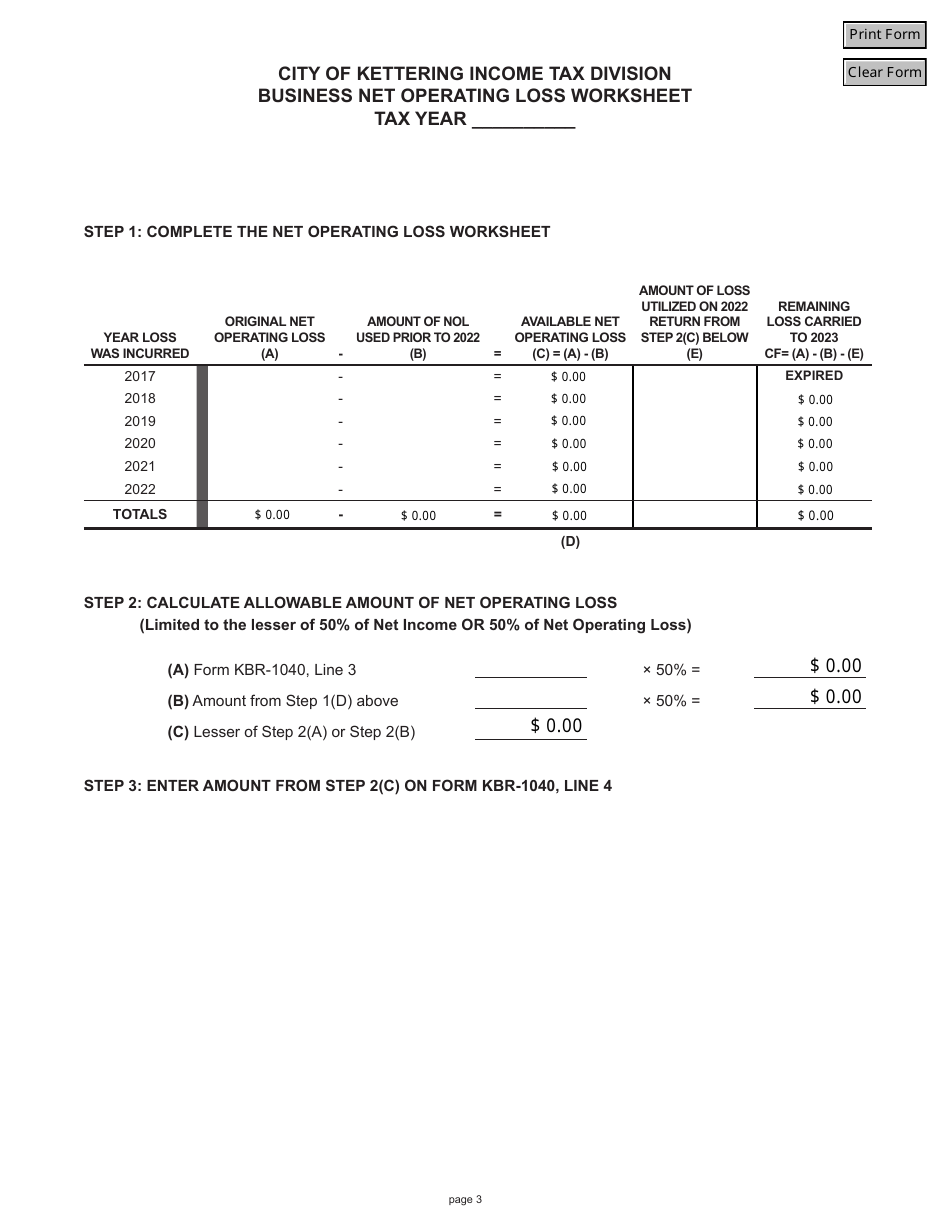

Q: What information is required on Form KBR-1040?

A: Form KBR-1040 requires businesses to provide information about their income, expenses, and deductions.

Q: When is the deadline to file Form KBR-1040?

A: The deadline to file Form KBR-1040 is typically April 15th, the same as the federal income tax deadline.

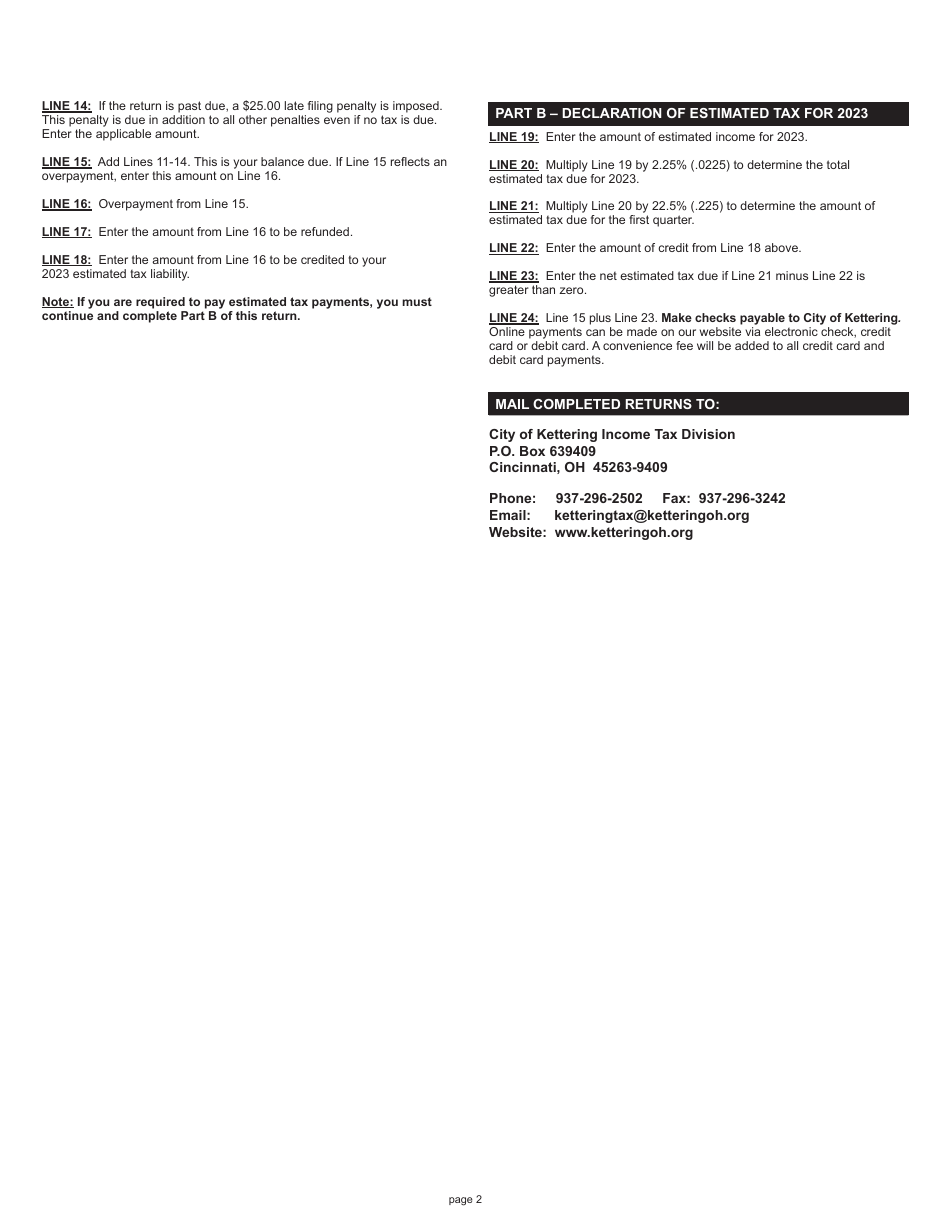

Q: Are there any penalties for late filing of Form KBR-1040?

A: Yes, there may be penalties for late filing of Form KBR-1040, so it's important to file on time.

Q: Can Form KBR-1040 be filed electronically?

A: Yes, businesses can file Form KBR-1040 electronically if they prefer.

Q: Is there a fee to file Form KBR-1040?

A: There may be a fee to file Form KBR-1040, depending on the specific requirements of the City of Kettering, Ohio.

Q: What if I have questions or need assistance with Form KBR-1040?

A: If you have questions or need assistance with Form KBR-1040, you can contact the City of Kettering, Ohio's tax office for help.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Division - City of Kettering, Ohio.