This version of the form is not currently in use and is provided for reference only. Download this version of

Form KBR-1040

for the current year.

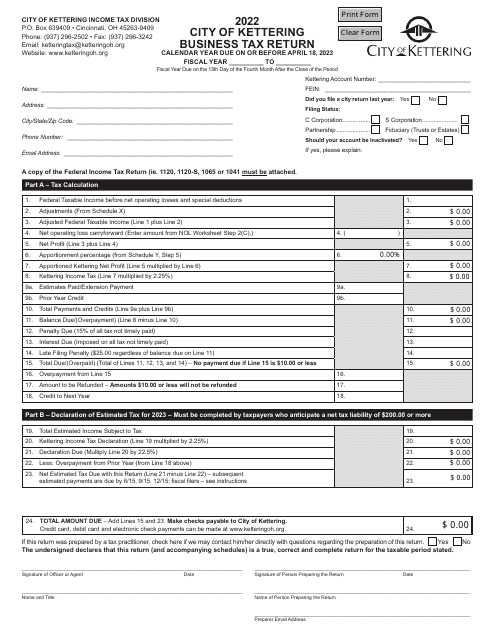

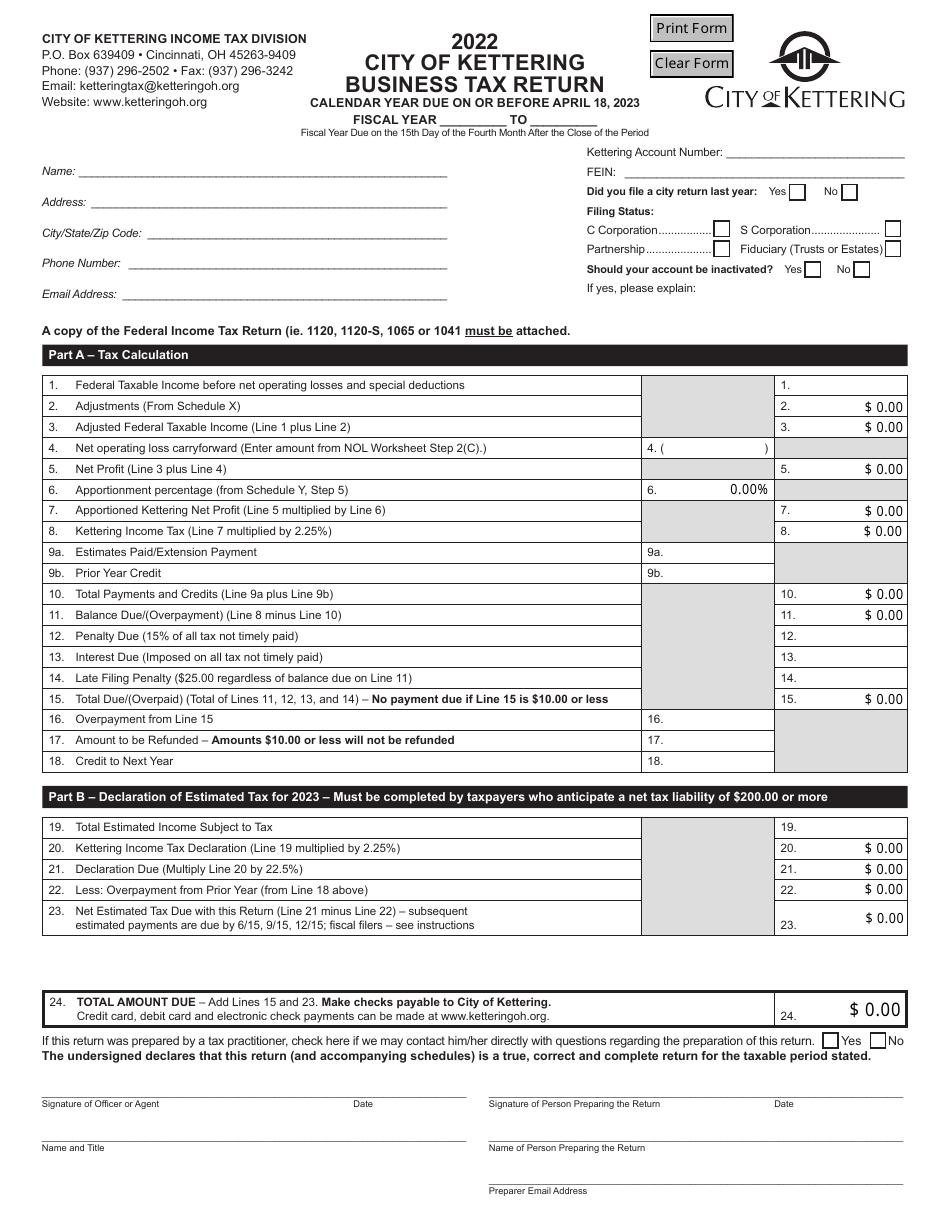

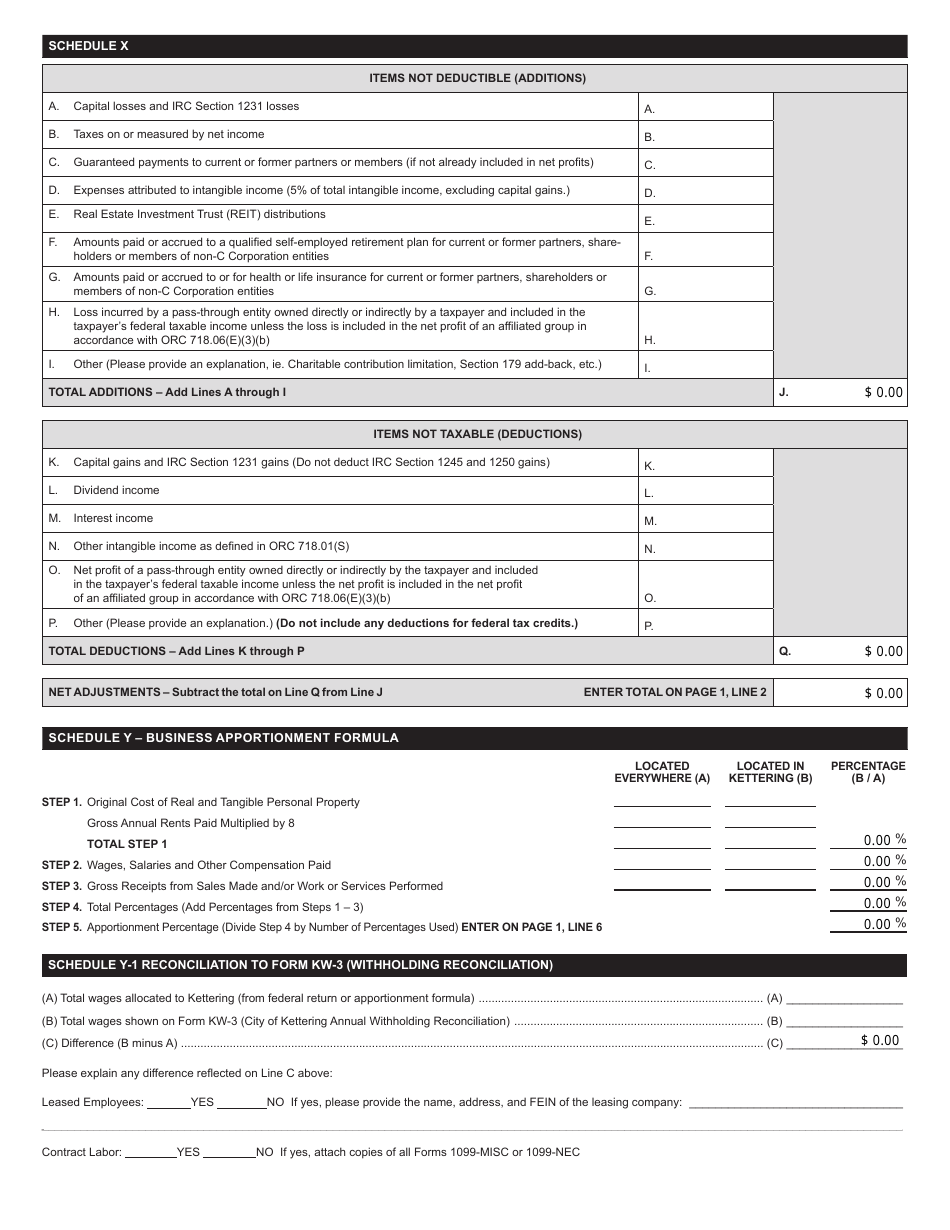

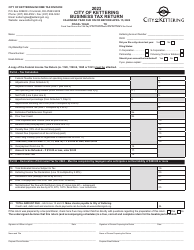

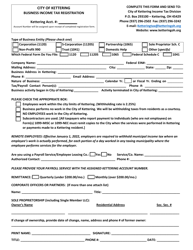

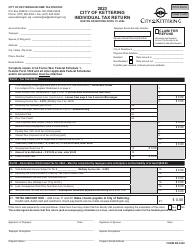

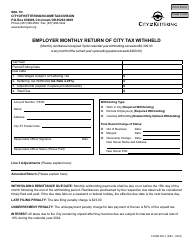

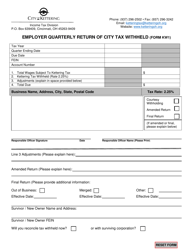

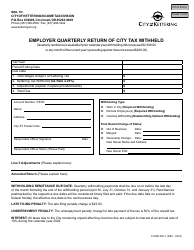

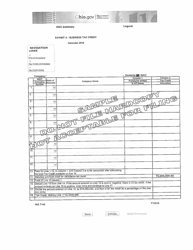

Form KBR-1040 Business Tax Return - City of Kettering, Ohio

What Is Form KBR-1040?

This is a legal form that was released by the Income Tax Division - City of Kettering, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Kettering. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form KBR-1040?

A: Form KBR-1040 is a Business Tax Return specifically for businesses operating in the City of Kettering, Ohio.

Q: Who needs to file Form KBR-1040?

A: Businesses operating in the City of Kettering, Ohio need to file Form KBR-1040.

Q: When is the deadline for filing Form KBR-1040?

A: The deadline for filing Form KBR-1040 varies and should be checked with the City of Kettering, Ohio.

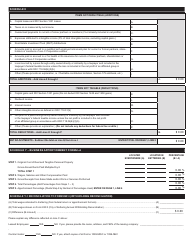

Q: What information is required to complete Form KBR-1040?

A: To complete Form KBR-1040, you will need information about your business income, expenses, and other relevant details.

Q: Is Form KBR-1040 only for businesses or can individuals use it too?

A: Form KBR-1040 is specifically for businesses operating in the City of Kettering, Ohio. Individuals may have different tax forms to use.

Q: What happens if I don't file Form KBR-1040?

A: If you are required to file Form KBR-1040 and fail to do so, you may face penalties or other consequences as determined by the City of Kettering, Ohio.

Form Details:

- The latest edition provided by the Income Tax Division - City of Kettering, Ohio;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KBR-1040 by clicking the link below or browse more documents and templates provided by the Income Tax Division - City of Kettering, Ohio.