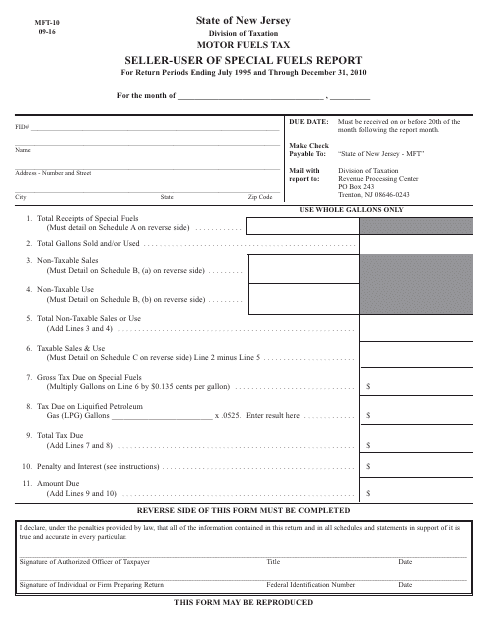

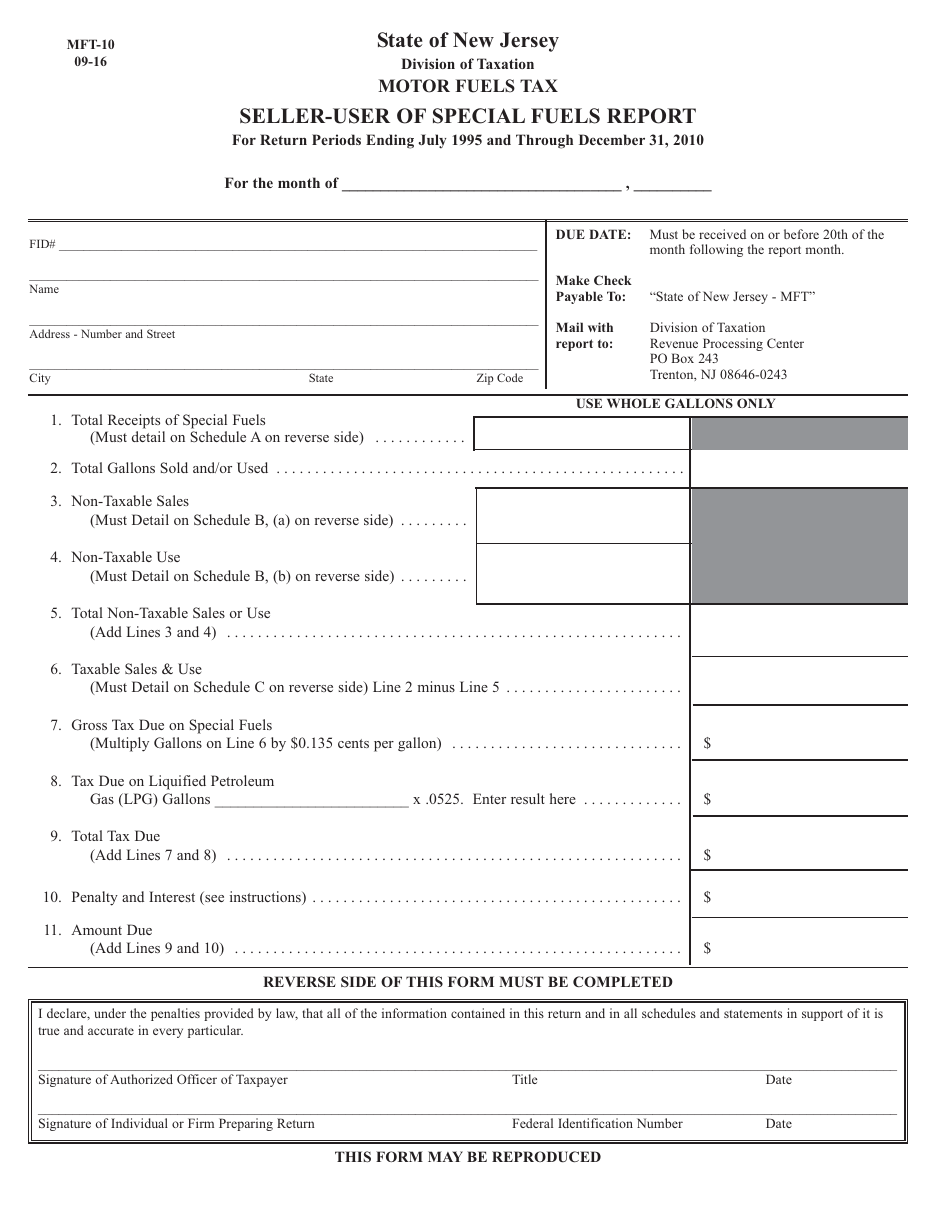

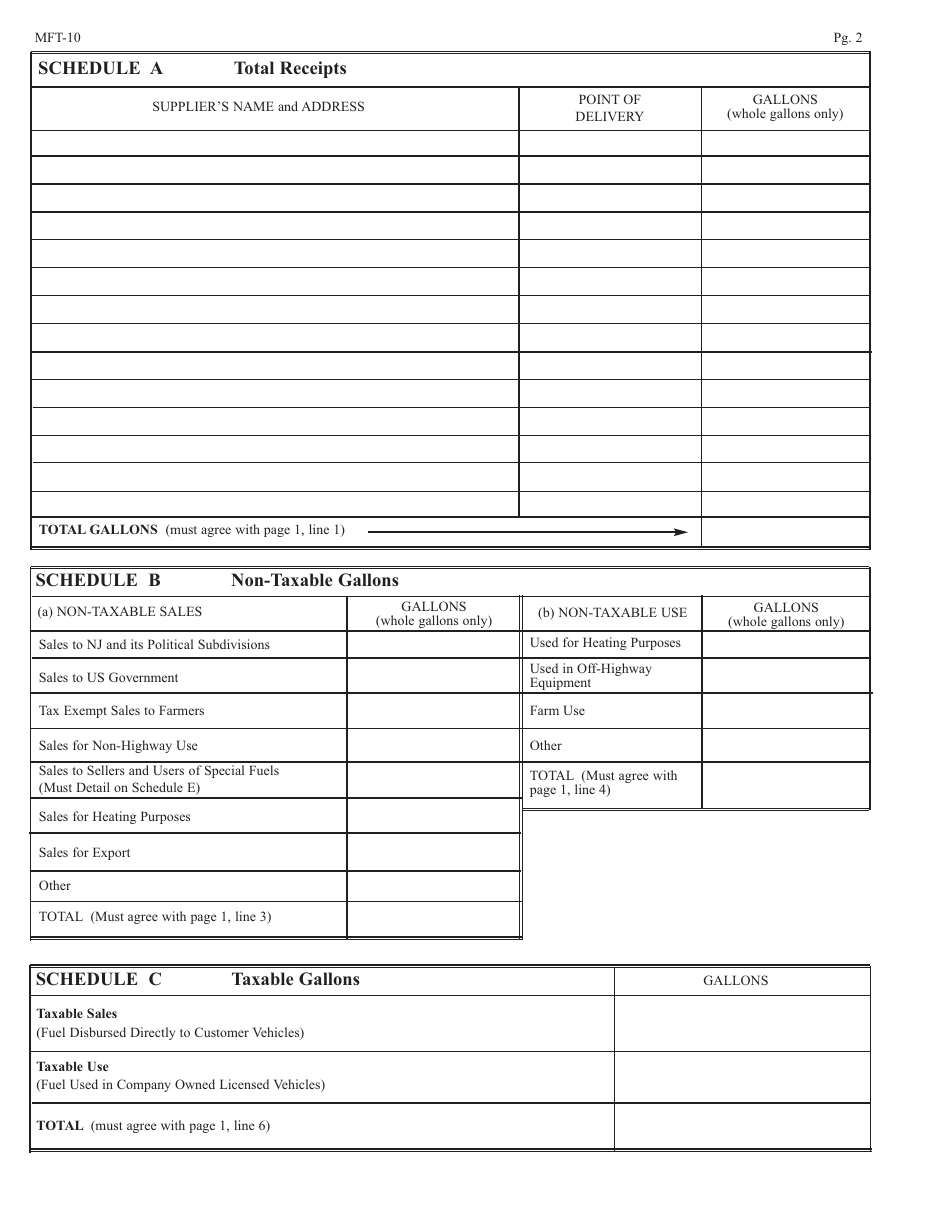

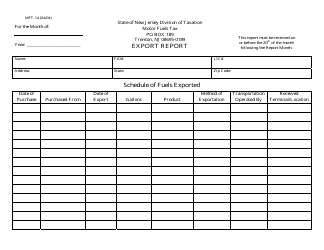

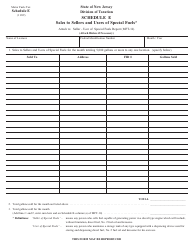

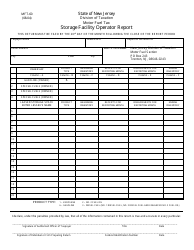

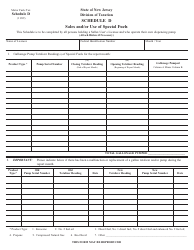

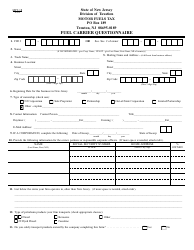

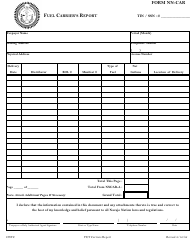

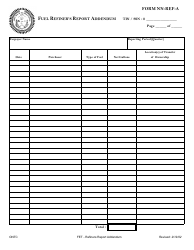

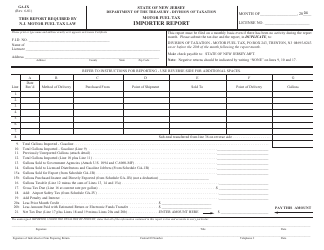

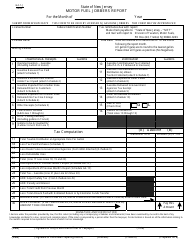

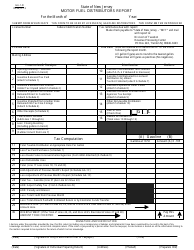

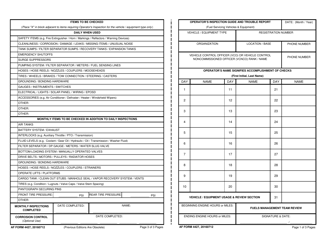

Form MFT-10 Seller-User of Special Fuels Report - New Jersey

What Is Form MFT-10?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MFT-10?

A: Form MFT-10 is the Seller-User of Special Fuels Report in New Jersey.

Q: What is the purpose of Form MFT-10?

A: The purpose of Form MFT-10 is to report special fuel usage and pay the associated tax.

Q: Who needs to file Form MFT-10?

A: Any seller or user of special fuels in New Jersey needs to file Form MFT-10.

Q: What are special fuels?

A: Special fuels include diesel fuel, kerosene, and other similar fuels used in motor vehicles.

Q: When is Form MFT-10 due?

A: Form MFT-10 is due on a quarterly basis, with specific due dates provided by the state.

Q: Are there penalties for late filing or non-filing?

A: Yes, there are penalties for late filing or non-filing of Form MFT-10, including potential interest charges and additional penalties.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MFT-10 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.