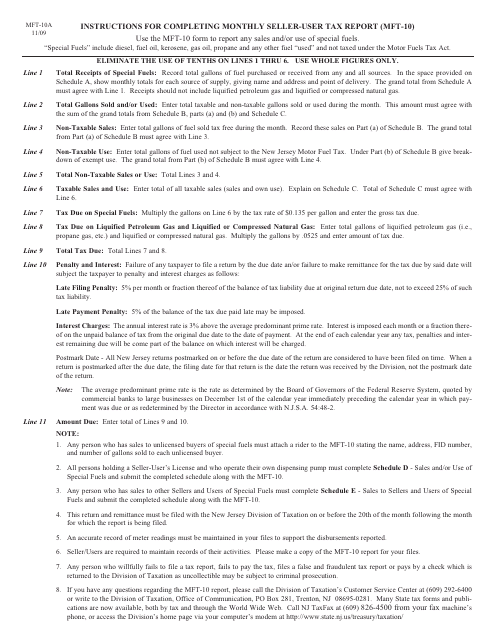

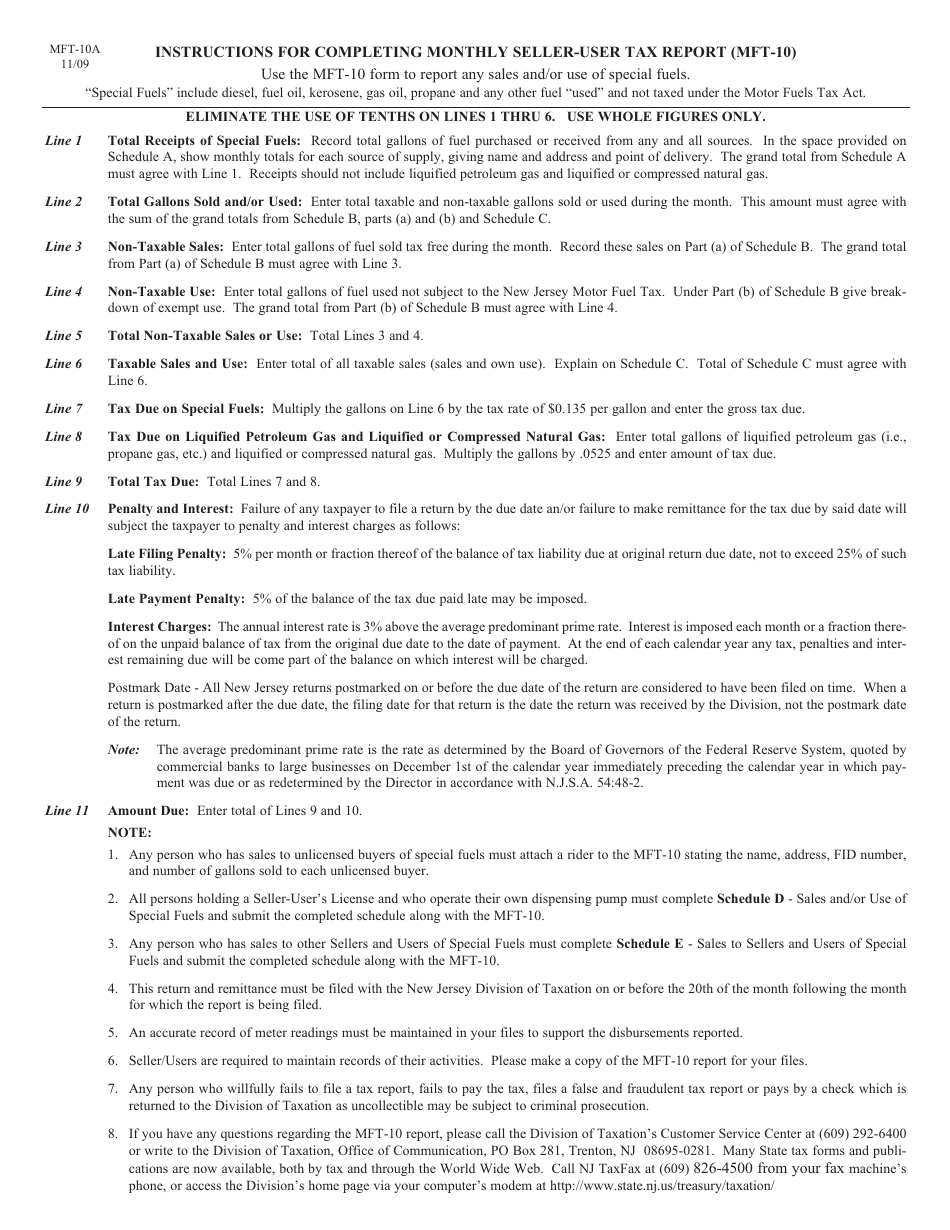

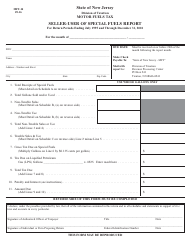

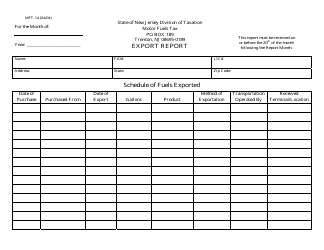

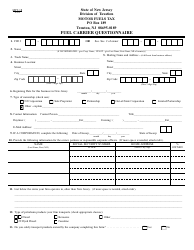

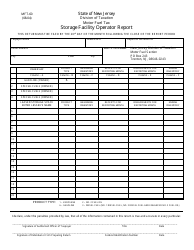

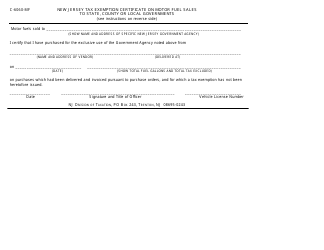

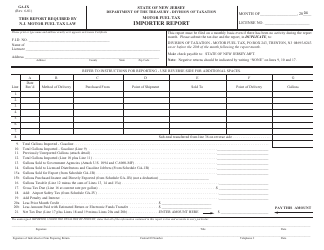

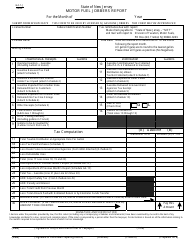

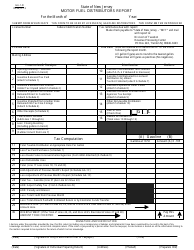

Instructions for Form MFT-10 Seller-User of Special Fuels Tax Report - New Jersey

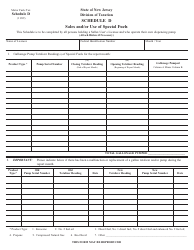

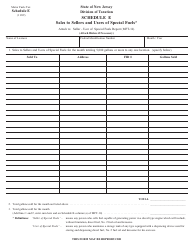

This document contains official instructions for Form MFT-10 , Seller-User of Special Fuels Tax Report - a form released and collected by the New Jersey Department of the Treasury. An up-to-date fillable Form MFT-10 Schedule D is available for download through this link.

FAQ

Q: What is Form MFT-10?

A: Form MFT-10 is the Seller-User of Special Fuels Tax Report in New Jersey.

Q: Who needs to file Form MFT-10?

A: Anyone who sells or uses special fuels in New Jersey needs to file Form MFT-10.

Q: What are special fuels?

A: Special fuels include diesel fuel, kerosene, and any other combustible liquid used to propel a motor vehicle or operate certain equipment.

Q: How often do I need to file Form MFT-10?

A: Form MFT-10 must be filed on a quarterly basis.

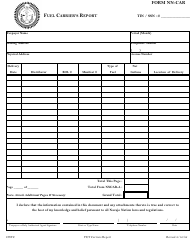

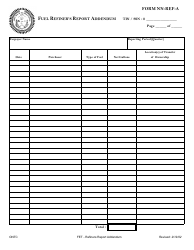

Q: What information do I need to include on Form MFT-10?

A: You need to report the total gallons of special fuels purchased or received, the total gallons used or sold, and any exempt gallons.

Q: Are there any exemptions to the special fuels tax?

A: Yes, there are certain exemptions for specific uses, such as agricultural use or government use.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.